Table of Contents

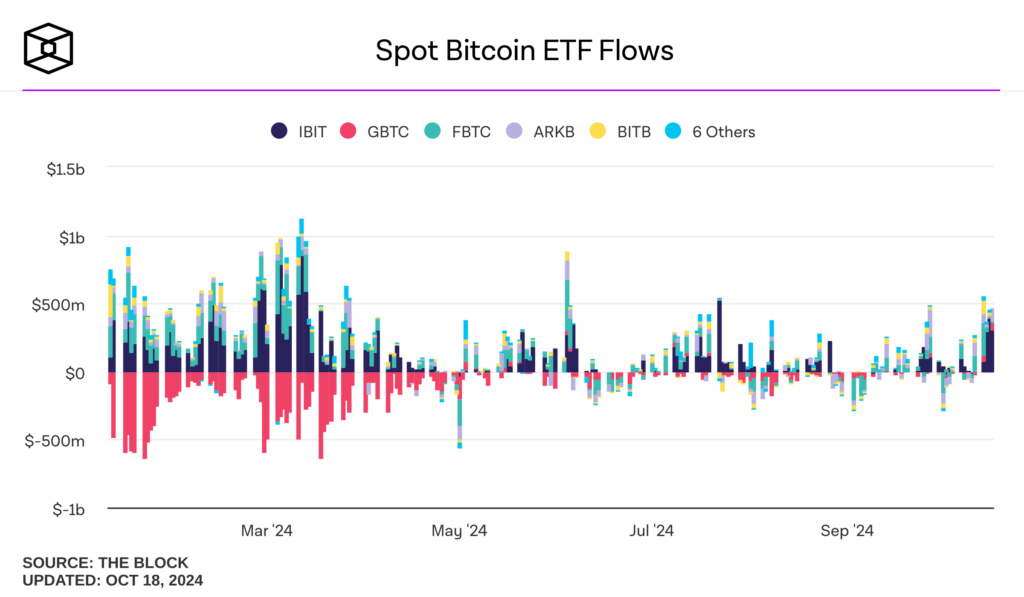

Toggle2024 has been a transformative year for Spot Bitcoin ETFs, as these financial instruments have hit a historic milestone with over $20 billion in inflows since the start of the year. More notably, the last five days alone saw an influx of $2.1 billion, signaling heightened interest from institutional investors. This surge has positioned Spot Bitcoin ETFs as a major catalyst in shaping the future of Bitcoin’s adoption, both for retail and institutional markets. Let’s delve deeper into the significance of this inflow, its potential implications for the Bitcoin price, and how it reflects broader market trends.

Spot Bitcoin ETFs: The Backbone of Institutional Bitcoin Adoption

The introduction of Spot Bitcoin ETFs has been revolutionary for the crypto market. Unlike futures-based ETFs, which track the future price of Bitcoin, Spot Bitcoin ETFs provide investors with direct exposure to Bitcoin by purchasing and holding the actual asset. This simple, yet profound difference allows institutional investors to gain real-time exposure to Bitcoin price movements without dealing with the complexities of direct custody, wallets, or exchanges.

The transparency and regulatory oversight surrounding ETFs also make them an attractive investment vehicle for institutional players. By offering a safe, regulated way to invest in Bitcoin, Spot Bitcoin ETFs have opened the floodgates to capital inflows from hedge funds, asset managers, and even pension funds. The result? Over $20 billion in inflows for 2024, with $2.1 billion arriving just in the last five days.

Read: Spot Bitcoin ETF vs Futures ETF

Why the Record $2.1 Billion Inflows in Just 5 Days?

One of the key questions investors are asking is why Bitcoin ETFs have experienced such a significant surge in inflows in such a short period. Several factors contribute to this phenomenon.

First, market sentiment surrounding Bitcoin ETFs is extremely positive. The US Securities and Exchange Commission (SEC) has recently been more favorable toward crypto-based financial products, increasing the likelihood that additional Bitcoin ETFs will be approved in the near future. This regulatory optimism has helped to buoy the confidence of institutional investors.

Bitcoin ETFs have crossed $20b in total net flows (the most imp number, most difficult metric to grow in ETF world) for first time after huge week of $1.5b. For context, it took gold ETFs about 5yrs to reach same number. Total assets now $65b, also a high water mark. pic.twitter.com/edldEimfqd

— Eric Balchunas (@EricBalchunas) October 17, 2024

Second, macroeconomic conditions have played a vital role. Global inflationary pressures, a declining interest rate environment, and concerns over traditional financial markets have made Bitcoin an attractive alternative investment. For investors looking for a hedge against economic uncertainty, Bitcoin’s finite supply and decentralized nature make it a compelling store of value.

Read: Bitcoin vs Gold

Third, as Bitcoin becomes more mainstream, the accessibility offered by Spot Bitcoin ETFs has attracted a wide variety of investors. The convenience of ETFs, combined with the ability to trade them on major stock exchanges, provides institutional players with liquidity and flexibility. This ease of entry has likely contributed to the recent influx of $2.1 billion in just five days.

Institutional Investors: The Driving Force Behind Bitcoin ETF Inflows

The involvement of institutional investors has been the defining factor in the record Bitcoin ETF inflows in 2024. These large-scale investors, including hedge funds, mutual funds, and pension funds, have sought ways to gain exposure to the crypto market without the complexities and risks associated with holding Bitcoin directly. Spot Bitcoin ETFs offer a regulatory-compliant, liquid investment vehicle that fits perfectly into their portfolios.

A major reason behind the appeal is the regulatory oversight that ETFs provide. Unlike direct Bitcoin investments, which can be volatile and pose security challenges, Spot Bitcoin ETFs operate under strict regulations, ensuring transparency and minimizing risks for institutional investors. This has contributed to the surge in institutional participation, driving Bitcoin ETF performance and creating the conditions for record inflows.

Furthermore, many institutions are looking to hedge their portfolios against macroeconomic risks, such as inflation, currency devaluation, and geopolitical instability. Bitcoin, with its deflationary properties and decentralized infrastructure, has emerged as an appealing option. As more institutions realize the potential of Bitcoin ETFs to diversify their holdings, the flow of capital into these products is likely to continue accelerating.

The Impact of $20 Billion Inflows on Bitcoin Price

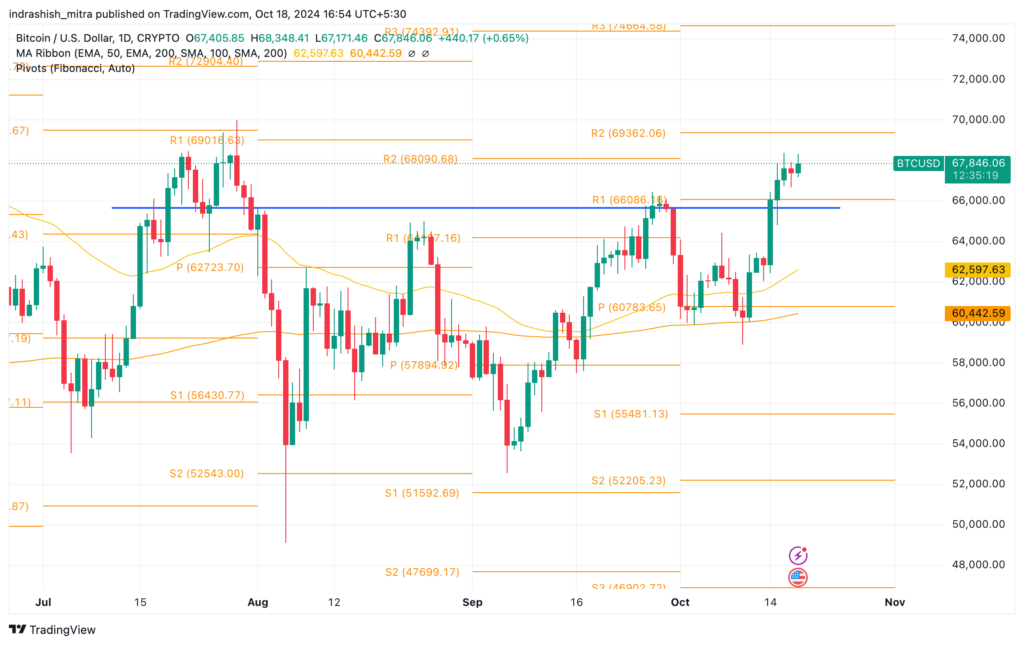

While the influx of capital into Bitcoin ETFs has been monumental, the Bitcoin price itself has remained relatively subdued, hovering below $68,000 despite the bullish sentiment. This disconnect between inflows and price has raised questions about the dynamics at play in the market.

Read more: Bitcoin price prediction

One potential explanation is that while Bitcoin ETF inflows have surged, other factors, such as regulatory uncertainty in certain regions, have kept Bitcoin’s price from reflecting the full magnitude of institutional interest. Additionally, while Bitcoin ETFs provide exposure to Bitcoin, they do not directly impact supply and demand in the same way that spot market purchases do, as the underlying assets are held by the ETF providers rather than traded on public exchanges.

Nevertheless, the long-term impact of Bitcoin ETFs on Bitcoin’s price is expected to be significant. As institutional adoption continues to grow, the increased demand for Bitcoin could drive prices higher in the coming months. Many analysts believe that if current trends continue, Bitcoin could break past previous all-time highs, with some predicting prices well above $100,000 in the near future.

Broader Market Implications of Spot Bitcoin ETF Growth

The growth of Bitcoin ETFs is not only affecting Bitcoin’s price but also reshaping the broader crypto landscape. The success of Spot Bitcoin ETFs has legitimized Bitcoin as a mainstream financial asset, paving the way for more crypto-based ETFs to enter the market.

For example, several financial firms are currently awaiting approval for Ethereum ETFs and other crypto products. The approval of these products would significantly broaden the scope of institutional participation in the crypto market, driving further capital inflows and enhancing liquidity across the board.

Moreover, the record $20 billion in inflows into Bitcoin ETFs is an important indicator of broader market sentiment. It reflects a growing recognition among traditional investors that cryptos are here to stay, and they offer unique opportunities for diversification and risk management. As more institutional investors incorporate Bitcoin into their portfolios, we can expect continued growth in both ETF inflows and crypto adoption.

The Future Outlook for Spot Bitcoin ETFs

The record-breaking Bitcoin ETF inflows in 2024 mark a pivotal moment for the crypto market. With $2.1 billion in inflows in just the past five days and $20 billion for the year, it is clear that Spot Bitcoin ETFs have established themselves as a core component of institutional investment strategies. But what does the future hold for these ETFs and the broader crypto market?

One potential development is the approval of additional crypto-based ETFs. Several financial firms have filed applications with the SEC for Ethereum ETFs and other digital asset ETFs, and many analysts believe that approval is imminent. If these products are greenlit, it could lead to even greater capital inflows into the crypto market, further driving prices and adoption.

In addition to new products, the ongoing evolution of the Bitcoin ETF market will likely bring more innovation and competition. As more ETFs are launched, we can expect to see an increase in options for investors, including leveraged ETFs, inverse ETFs, and other specialized products designed to meet specific investment objectives.

Finally, the continued rise of Spot Bitcoin ETFs is expected to have a lasting impact on the broader financial system. As more traditional financial institutions recognize the value of Bitcoin and other cryptos, we may see a greater integration of digital assets into the global economy. This could include the development of new financial products, services, and infrastructure designed to facilitate the adoption of cryptos on a global scale.

Conclusion: Spot Bitcoin ETFs and the Future of Institutional Investment

In conclusion, the record-breaking $20 billion inflows into Spot Bitcoin ETFs in 2024 underscore the growing importance of these financial instruments in the crypto market. With over $2.1 billion in inflows in just the past five days, Spot Bitcoin ETFs are leading the charge in institutional adoption, providing a safe, regulated way for large-scale investors to gain exposure to Bitcoin.

As Bitcoin ETFs continue to grow in popularity, their impact on the Bitcoin price and broader market dynamics will become increasingly apparent. The success of these ETFs is a testament to the growing acceptance of Bitcoin as a legitimate financial asset, and their continued rise will likely shape the future of both the crypto market and the global financial system.

Ultimately, Spot Bitcoin ETFs represent a bridge between traditional finance and the world of digital assets, offering investors the opportunity to participate in the crypto market without the complexities and risks of direct ownership. As more capital flows into these funds, Bitcoin’s influence on the global economy is only set to expand.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more