Table of Contents

ToggleKey Takeaways:

- Bitcoin and gold offer distinct characteristics and serve different purposes within investment portfolios.

- Bitcoin presents opportunities for growth and innovation in the digital economy due to its finite supply and potential for widespread adoption.

- Gold historically serves as a reliable hedge against inflation and currency devaluation, offering stability and preservation of capital over time.

- Investors should carefully evaluate their investment goals, risk tolerance, and time horizon when considering whether to buy Bitcoin or gold.

- Diversification across assets, including both Bitcoin and gold, may help mitigate risk and capitalize on the unique strengths of each asset class.

- Conduct thorough research and consult with financial professionals before making any investment decisions to align with individual financial objectives.

Introduction

In the realm of investments, two heavyweight contenders vie for supremacy: Bitcoin vs gold. While gold has long reigned as the ultimate store of value and a symbol of wealth, Bitcoin has emerged as a disruptive force, challenging traditional notions of currency and investment. This clash between the age-old allure of gold and the revolutionary potential of Bitcoin has sparked a heated debate among investors and enthusiasts alike.

Is Bitcoin the new gold, poised to usurp its predecessor and claim the throne of ultimate safe haven asset? Or will gold continue to retain its shine, standing firm against the onslaught of digital disruption? Join us as we delve into the Bitcoin vs Gold debate, exploring the strengths, weaknesses, and potential futures of these two formidable assets. Whether you’re a seasoned investor seeking to diversify your portfolio or a curious newcomer navigating the intricacies of the financial landscape, this exploration of Bitcoin and gold promises to enlighten and intrigue. So, fasten your seatbelts and prepare for a journey through the ages, where ancient wisdom meets cutting-edge technology in a battle for investment supremacy.

What is Bitcoin?

Bitcoin, often hailed as digital gold, is the pioneering crypto that revolutionized the world of finance. Created in 2008 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto, Bitcoin is introduced as an open-source software in 2009. One of its defining features is its fixed supply, with a maximum cap of 21 million coins, making it inherently deflationary. As of early May 2024, Bitcoin boasts a staggering market capitalization of $1.22 trillion, cementing its status as the leading crypto in terms of market value.

Bitcoin has garnered attention not only for its technological innovation but also for its remarkable investment performance. With a compound annual growth rate (CAGR) of approximately 103% since 2011, Bitcoin has delivered extraordinary returns to investors. In 2023 alone, Bitcoin recorded nearly 165% returns, further solidifying its reputation as a high-growth asset in the volatile world of cryptos.

Additional Read: Bitcoin Halving in 2024

Key Features of Bitcoin

- Decentralization: Bitcoin operates on a decentralized network of computers, known as nodes, without the need for a central authority or intermediary. This decentralized nature ensures transparency, security, and censorship resistance.

- Limited Supply: Bitcoin’s protocol specifies a maximum supply of 21 million coins, creating scarcity similar to precious metals like gold. This finite supply is programmed into the blockchain and contributes to Bitcoin’s value proposition as a store of value.

- Immutable Ledger: Transactions on the Bitcoin blockchain are recorded on a public ledger that is immutable and tamper-proof. This transparent ledger ensures the integrity of transactions and prevents double-spending, enhancing trust in the Bitcoin network.

- Pseudonymity: While Bitcoin transactions are recorded on a public ledger, the identities of users are pseudonymous. Users are identified by cryptographic addresses rather than personal information, providing a degree of privacy and confidentiality.

- Security: Bitcoin’s security is upheld by its proof-of-work consensus mechanism, which requires miners to expend computational power to validate transactions and secure the network. This robust security model has withstood the test of time, making Bitcoin one of the most secure blockchain networks in existence.

As Bitcoin continues to evolve and capture the imagination of investors worldwide, its key features remain fundamental to its enduring value proposition in the ongoing Bitcoin vs Gold debate.

What is Gold?

Gold, often referred to as the “king of metals,” has held a revered status as a store of value and medium of exchange for centuries. With a rich history dating back thousands of years, gold has been treasured by civilizations worldwide for its intrinsic beauty, rarity, and durability. As a tangible asset with inherent value, gold has served as a hedge against economic uncertainty and currency debasement throughout history. In the modern era, gold continues to play a pivotal role in investment portfolios, offering stability and diversification.

Gold’s appeal as an inflationary hedge has remained steadfast, particularly during times of economic turmoil and market volatility. As central banks and governments implement expansionary monetary policies, the demand for gold as a safe haven asset often increases, driving up its price. As of today, gold commands a market capitalization of over $15 trillion, underscoring its enduring significance in the global financial system.

Key Features of Gold

- Intrinsic Value: Gold possesses inherent value derived from its scarcity, physical properties, and cultural significance. Unlike fiat currencies, which rely on government decree, gold’s value is universally recognized and accepted.

- Limited Supply: Gold’s scarcity contributes to its value as a store of wealth. While new gold deposits are continuously discovered, the overall supply of gold grows slowly, maintaining its status as a finite and precious resource.

- Historical Store of Value: Throughout history, gold has served as a reliable store of value, preserving wealth across generations. Its durability and resistance to corrosion ensure that gold retains its purchasing power over time.

- Diversification Benefits: Gold offers diversification benefits to investment portfolios, helping to mitigate risk and offset losses during periods of market volatility. Its low correlation with other assets, such as stocks and bonds, enhances portfolio stability.

- Liquidity: Gold enjoys widespread liquidity in global markets, with active trading on exchanges and over-the-counter markets. Investors can easily buy, sell, and trade gold in various forms, including bullion, coins, and exchange-traded funds (ETFs).

As the Bitcoin vs Gold debate rages on, gold’s enduring legacy and key features continue to shape its role as a cornerstone asset in the financial landscape. While Bitcoin presents a novel alternative, gold’s time-tested characteristics and status as a tangible store of value remain unparalleled in the eyes of many investors.

Additional Read: Crypto vs Fiat Currency

Key Differences Between Bitcoin vs Gold

| Feature | Bitcoin | Gold |

|---|---|---|

| Origin | Created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. | Mined and treasured for thousands of years, with historical significance dating back to ancient civilizations. |

| Supply | Finite supply capped at 21 million coins, with a predetermined issuance schedule. | Limited supply, with new mining production adding to existing above-ground reserves. |

| Portability | Highly portable digital asset, easily transferable across borders and accessible via digital wallets. | Physically tangible, requiring secure storage and transportation. |

| Divisibility | Divisible into smaller units, with each bitcoin divisible into 100 million satoshis. | Divisible into smaller units, typically measured in grams or ounces. |

| Volatility | Known for its price volatility, with sharp fluctuations in value driven by market sentiment and adoption trends. | Generally less volatile compared to Bitcoin, offering stability as a long-term store of value. |

| Utility | Functions as a digital currency and decentralized payment system, with potential applications in remittances, micropayments, and decentralized finance (DeFi). | Primarily used as a store of value, jewelry, and in industrial applications, with limited utility as a medium of exchange. |

| Store of Value | Viewed by proponents as digital gold, offering a hedge against inflation and currency devaluation. | Traditionally regarded as a reliable store of value, preserving wealth over time and across generations. |

| Accessibility | Accessible to anyone with an internet connection and compatible hardware or software wallets. | Accessible to investors through physical ownership, gold-backed ETFs, and allocated accounts with bullion dealers. |

| Regulation | Subject to varying degrees of regulation and scrutiny by governments and regulatory bodies worldwide. | Subject to regulations governing mining, trading, and ownership, varying by jurisdiction. |

| Adoption | Gaining adoption as an alternative investment and digital asset class, with growing institutional interest. | Universally recognized and accepted, with widespread ownership and institutional backing. |

As the Bitcoin vs Gold debate continues, investors weigh the contrasting characteristics and attributes of these two assets to determine their role in diversified investment portfolios. While Bitcoin offers digital innovation and potential for outsized returns, gold provides stability and enduring value as a time-tested store of wealth.

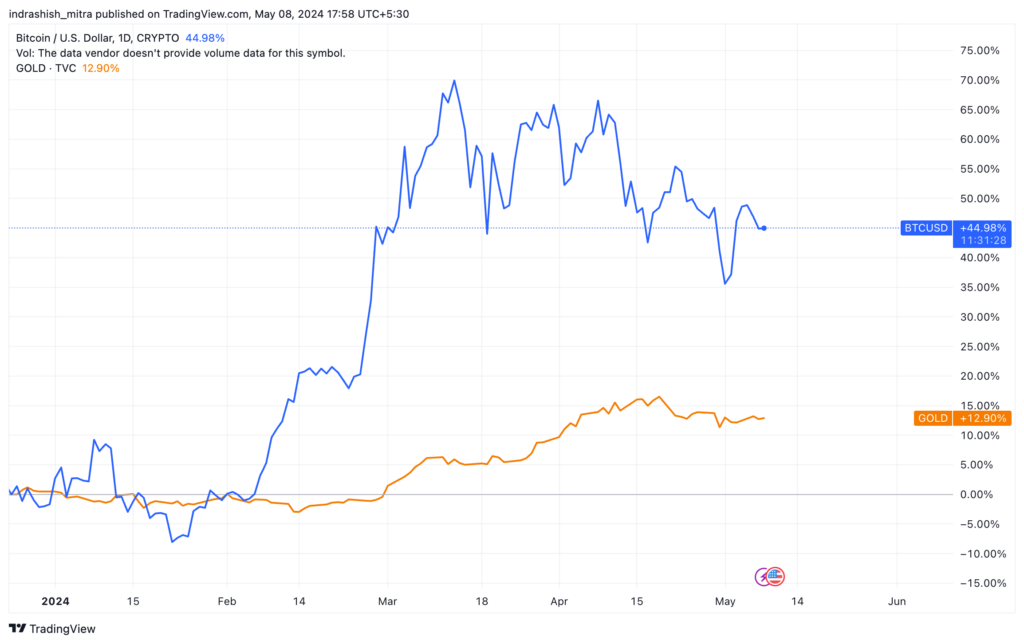

Bitcoin vs Gold: Technical Analysis

From a technical point of view, Bitcoin price has given far better returns in 2024, and historically over the past decade as well. However, this can be attributed to the fact that Bitcoin as an asset class is far smaller and more volatile than Gold. As mentioned earlier, while Bitcoin has a market cap of about $1.22 trillion, Gold has a massive global market cap of over $15 trillion! Gold has in fact given very good returns in 2024 so far, amid international tensions and other concerns as more and more central banks of the world resort to buying up tonnes of gold as reserves.

Know More: Is Bitcoin Bull Run Coming?

Should you buy Bitcoin vs Gold?

Investors should carefully evaluate their investment goals, risk tolerance, and time horizon when considering whether to buy Bitcoin or gold. Both assets offer unique characteristics and serve different purposes within a diversified portfolio.

Bitcoin, as a digital currency and decentralized store of value, presents opportunities for growth and innovation in the digital economy. Its finite supply and potential for widespread adoption may appeal to those seeking exposure to emerging technologies and alternative investments.

On the other hand, gold has historically served as a reliable hedge against inflation and currency devaluation. Its tangible nature and long-standing status as a store of wealth provide stability and preservation of capital over time.

Ultimately, the decision to buy Bitcoin or gold depends on individual preferences, financial objectives, and market conditions. Some investors may choose to hold both assets to benefit from their respective strengths and diversify risk across different asset classes. It’s essential to conduct thorough research and consult with financial professionals before making any investment decisions.

How to invest in Bitcoin?

Investing in Bitcoin is a straightforward, quick, and secure process with the CoinDCX App. To get started, follow these steps:

- Download the CoinDCX crypto app.

- Register by providing your information.

- Complete KYC verification and verify your mobile number and email address.

- Once your profile is verified, deposit funds into your wallet.

- Buy Bitcoin or any other crypto of your choice!

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more