In a major show of confidence at the CoinDesk Consensus Conference in Austin, Texas – Jeremy Allaire, CEO of Circle, which is the company that issues the USDC stablecoin took the stage at the event and said,

“We’ve successfully navigated this crisis, and have actually upgraded the market infrastructure behind USDC to be by far the strongest, safest digital dollar on the internet today, hands down, there’s no question”

Moreover, Allaire also claimed that the USDC stablecoin, which is the second largest by market capitalization in the crypto market – has emerged from the major banking crisis that happened early in March 2023, much stronger and safer than before.

For some context, early in March 2023, a major banking institution, known as the Silicon Valley Bank (SVB) was hit by major liquidity issues and what immediately followed was a massive bank run. However, in that mess, USDC had about $3.3 billion worth of cash reserves deposited in that bank which it couldn’t access and recover during the bank run due to the liquidity crunch that the bank was facing.

Read more: USDC Breaks it Dollar Peg Post SVB Collapse

Almost immediately after this news was released, USDC lost its dollar peg in the market, falling well below 50 cents on the dollar for a brief while. But it soon recovered after the US government and other regulatory bodies stepped in to save depositors’ funds. The biggest statement came from United States Treasury Secretary Janet Yellen announcing that

“The treasury is focused on depositors’ needs and won’t bail the (SVB) bank out”.

Read on to know more: Why did USDC Stablecoin break its Dollar Peg after the Silicon Valley Bank Collapse?

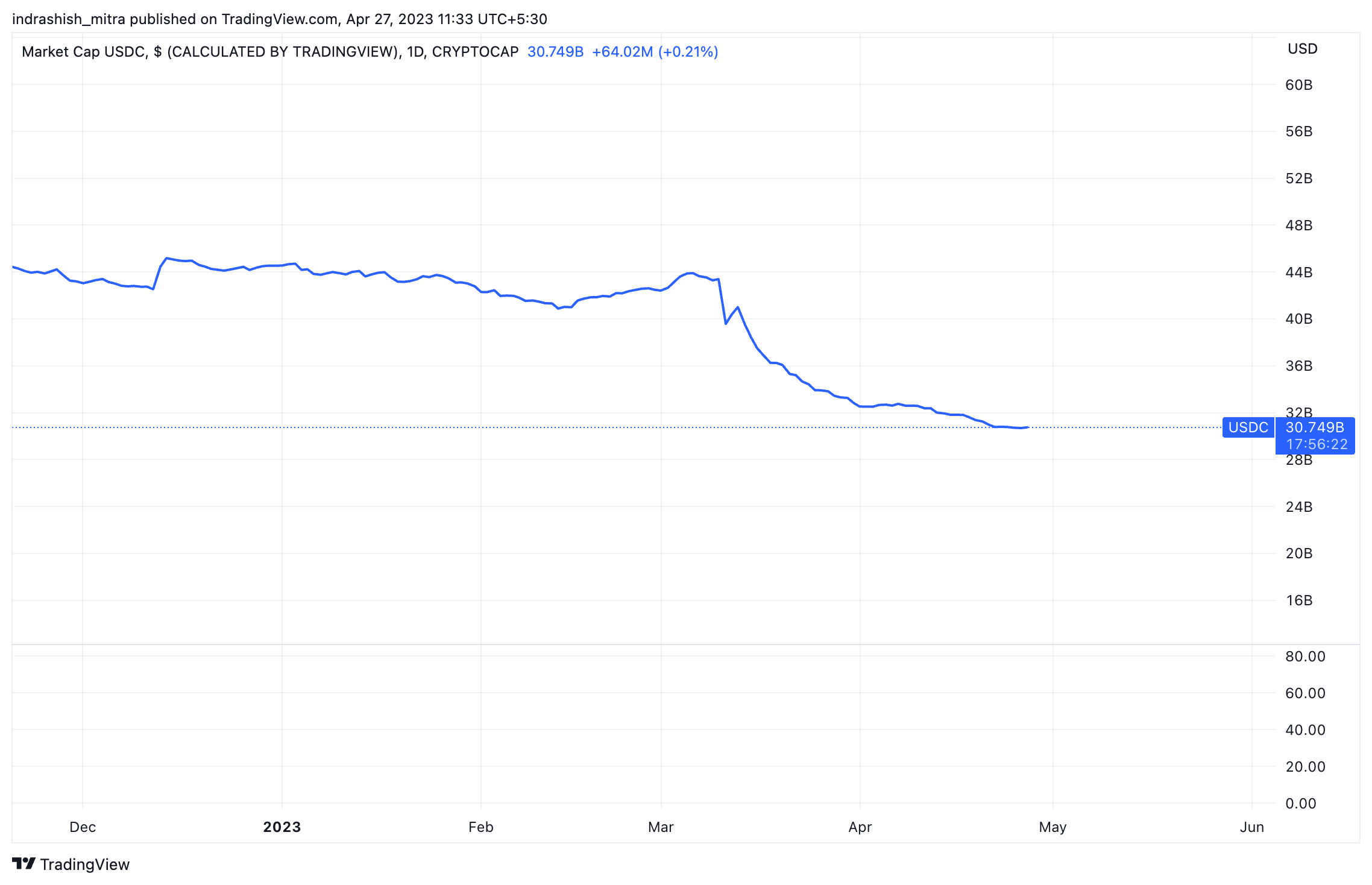

This event had left investors spooked and that sparked massive outflows in the second-largest stablecoin by market capitalization. In fact, USDC’s market capitalization has fallen by over 25% from a little over $40 billion just before the collapse of the Silicon Valley Bank to now around $30 billion, about six weeks after the collapse.

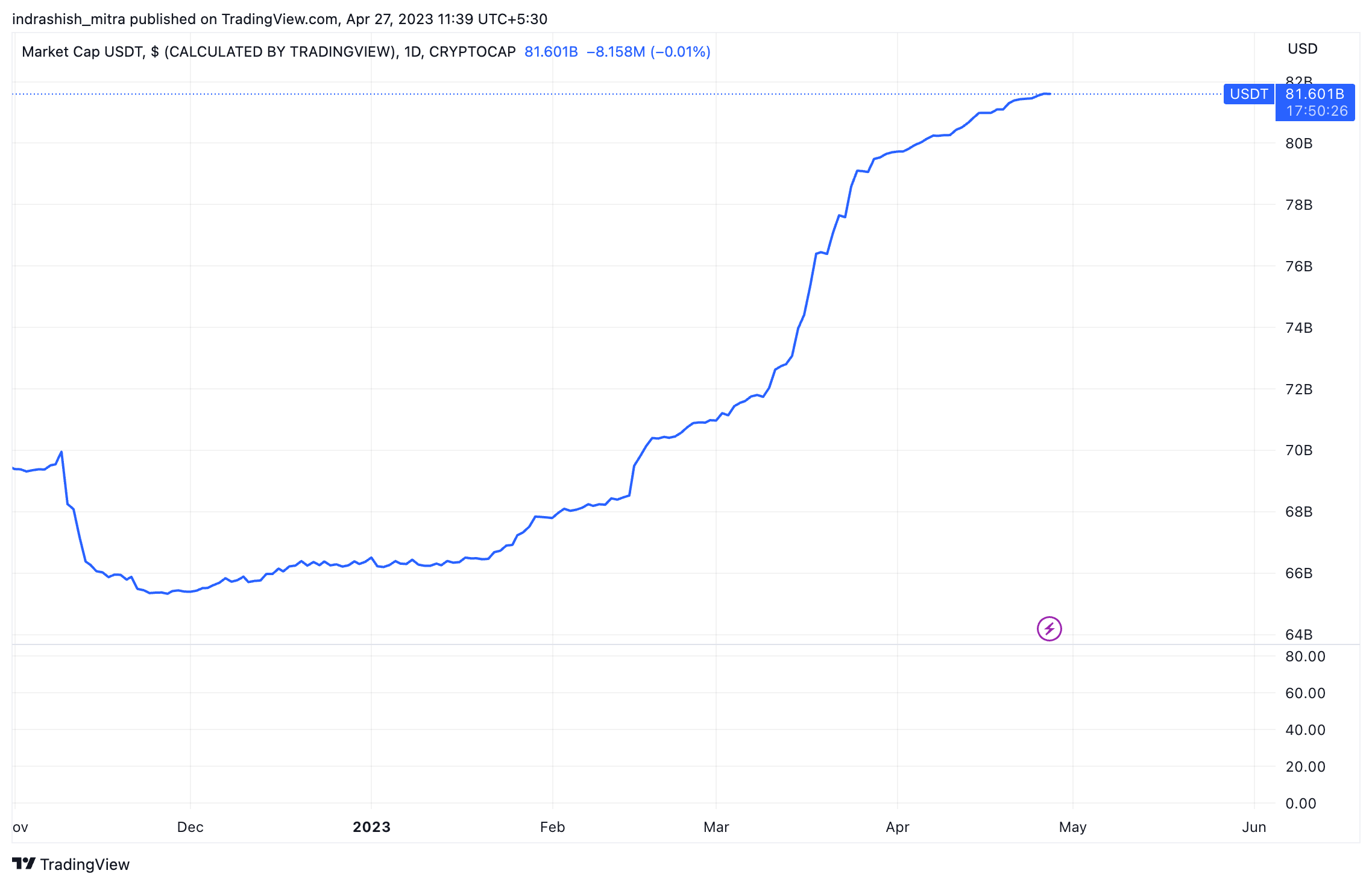

This is definitely a major loss in terms of reputation and credibility in the stablecoin, considering that it also happens to be a centralized one at that. According to a report by CoinDesk, Allaire confidently drew a contrast between USDC and other “alternatives we don’t know much about” – with was none other than USDT stablecoin, issued by the company, Tether. While Tether has had its own share of misgivings and criticisms about having actual cash reserves to back all the stablecoins it is issuing, it has managed to retain the top spot in terms of market capitalization and since the brief USDC depegging fiasco has managed to gain a bit of market share too!

As you can see from the chart above, since the incident, USDT’s market capitalization has gone from about $72 billion, all the way up to nearly $82 billion as of writing this article. It is now yet to be seen how things play out in the stablecoin market in the future.

Additional read: USDT vs USDC

Values as on April 27, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more