Table of Contents

Toggle1. BTC (Bitcoin)

- Category: Layer 1

- Brief Description: Bitcoin is the first decentralised digital currency, enabling peer-to-peer transactions without the need for a central authority. It utilizes a blockchain, where transactions are recorded transparently and secured through cryptography.

- Tokenomics/Unlocks: Bitcoin has a maximum supply of 21 million BTC, with about 19 million already mined. The mining process rewards miners with new BTC, and this reward decreases approximately every four years in an event called the halving.

- Fundamentals: Bitcoin is often regarded as digital gold due to its limited supply and growing adoption among institutions. It is seen as a hedge against inflation and currency devaluation.

- Technicals: BTC is bullish for the medium to long term due to several factors: historically bullish halving events, a break from a six-month consolidation, potential political support from Trump in the upcoming U.S. election, and favorable macro data following recent interest rate cuts. Key levels for accumulation are $69k, $66k, and $63k, while levels to consider reducing positions are $95k-$100k and $125k.

- Chart:

2. ETH (Ethereum)

- Category: Layer 1

- Brief Description: Ethereum is a decentralised platform that enables developers to build and deploy smart contracts and decentralised applications (dApps). Its versatility has made it the foundation for numerous blockchain projects.

- Tokenomics/Unlocks: Ethereum has a circulating supply of around 120 million ETH, with no hard cap on total supply. The introduction of Ethereum 2.0 aims to transition the network from a proof-of-work to a proof-of-stake model, impacting its supply dynamics.

- Fundamentals: Ethereum’s extensive ecosystem includes DeFi (decentralised finance) applications, NFTs (non-fungible tokens), and more. Its significant developer activity underlines its ongoing innovation.

- Technicals: ETH is currently in the accumulation phase, lagging behind BTC and underperforming. With ETH/BTC at key trendline support, there’s a bullish outlook for ETH and its ecosystem tokens. The momentum will strengthen once it successfully reclaims $2800. Key levels for accumulation are $2500 and $2200, while levels to consider reducing positions are $3900 and $4750.

- Chart:

3. SOL (Solana)

- Category: Layer 1

- Brief Description: Solana is designed for high-speed and low-cost transactions, making it a popular choice for developers looking to build scalable applications. It employs a unique consensus mechanism called Proof of History (PoH) to enhance its speed.

- Tokenomics/Unlocks: Solana’s total supply is approximately 587 million SOL, with an inflationary model in its early years, gradually reducing over time to stabilize supply.

- Fundamentals: Solana has gained traction in the DeFi and NFT spaces, attracting numerous projects and users due to its high throughput and low fees.

- Technicals: SOL is bullish and outperforming its peers, as it attempts to break out from the accumulation phase. Once it achieves this breakout, SOL could move towards its last all-time high, which would also positively impact its ecosystem tokens. Key levels for accumulation are $158 and $120, while levels to consider reducing positions are $203 and $249.

- Chart:

4. ARKM (Arkham)

- Category: AI

- Brief Description: Arkham is focused on blockchain transparency by providing tools to deanonymize transactions. It aims to enhance security and trust within the blockchain ecosystem.

- Tokenomics/Unlocks: ARKM’s total initial supply is 1 billion tokens, with key allocations to ecosystem incentives (37.3%), core contributors (20%), and investors (17.5%). Tokens for contributors, advisors, and investors unlock linearly over three years after an initial one-year lock, while the foundation treasury unlocks over seven years. No additional token emissions are planned.

- Fundamentals: Arkham’s innovative approach targets the growing demand for transparency in blockchain, making it a potentially valuable tool for both users and regulators.

- Technicals: ARKM is a fundamentally strong token with significant developments expected in 2025, positioning it well for performance in the AI and exchange sectors. Key levels for accumulation are $1.34 and $1.10, while levels to consider reducing positions are $1.85 and $2.30.

- Chart:

5. BEAMX (Beam)

- Category: Gaming

- Brief Description: Beam focuses on integrating gaming with blockchain technology, developed by the Merit Circle DAO. It aims to provide a platform where gamers can benefit from decentralised finance features.

- Tokenomics/Unlocks: BeamX tokens are allocated across several categories and are distributed gradually over four years: 36% is dedicated to liquidity mining, rewarding locked liquidity providers in Beam’s DAO DAPPs; 20% is set for the DAO treasury, unlocking six months post-launch; 17% goes to the Beam Foundation for governance, halting after two years; 7% is allocated to ecosystem partners to drive integration; and 20% is reserved for investors, with tokens distributed over the first two years.

- Fundamentals: With the rise of blockchain gaming, BeamX seeks to capture market interest by offering innovative solutions that combine gaming and finance.

- Technicals: BEAM/BEAMX is a leading token in the gaming sector and is currently in the accumulation phase. It is expected to break out soon as the gaming narrative picks up. Key levels for accumulation are $0.014 and $0.012, while levels to consider reducing positions are $0.03 and $0.042.

- Chart:

6. POPCAT (Popcat)

- Category: Meme

- Brief Description: POPCAT is a meme-based token that leverages internet culture, inspired by a viral cat meme, and engages users through community-driven initiatives.

- Tokenomics/Unlocks: Popcat Token has a total supply of 979 million POPCAT tokens. Token allocation is simple: 91% goes to the liquidity pool to facilitate smooth trading, while 9% is held in a multi-signature wallet for potential future use like development or marketing. This straightforward setup avoids complex fee systems, making POPCAT easy to trade and hold.

- Fundamentals: The token’s appeal lies in its viral nature, often attracting interest based on social media engagement and community activities.

- Technicals: POPCAT is a newly listed Solana meme token with decent hype and a strong community, positioning it to potentially outperform other meme coins this cycle if the meme narrative continues. However, investing in meme tokens carries some risks, so it’s important to position accordingly. Key levels for accumulation are $1.17 and $0.91, while levels to consider reducing positions are $2.68 and $4.00 (based on Fibonacci extension).

- Chart:

Sources: CoinGecko, CoinMarketCap, TradingView.

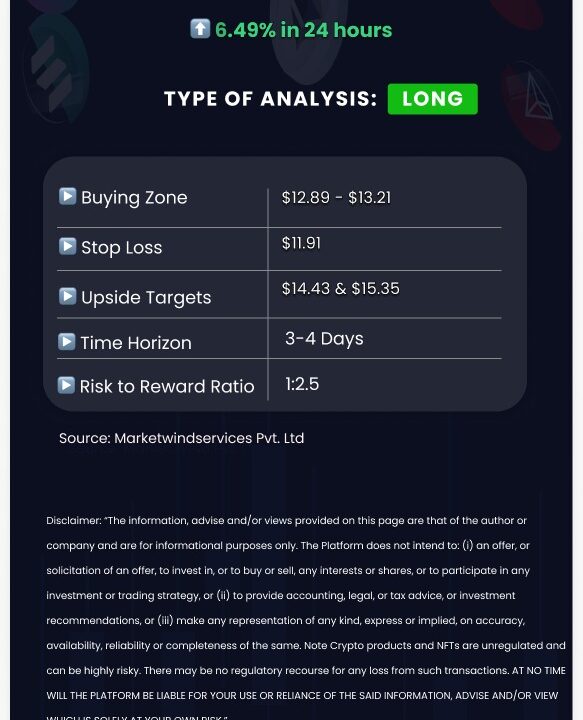

Disclaimer: “The information, advise and/or views provided on this page are that of the author or company and are for informational purposes only. The Platform does not intend to: (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, or (ii) to provide accounting, legal, or tax advice, or investment recommendations, or (iii) make any representation of any kind, express or implied, on accuracy, availability, reliability or completeness of the same. Note Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. AT NO TIME WILL THE PLATFORM BE LIABLE FOR YOUR USE OR RELIANCE OF THE SAID INFORMATION, ADVISE AND/OR VIEW WHICH IS SOLELY AT YOUR OWN RISK.”

Related posts

State of the Crypto Market

“VIP Exclusive: Dive into News, Macro Insights, and Crypto Analysis!”

Read more

Token Analysis: Chainlink (LINK)

Get insights on Exclusive Technical Analysis Report -$LINK

Read more