Table of Contents

ToggleMacro Overview

- US Job Openings: The number of job openings came in lower than expected and lower than the previous month’s figures. This data is considered bullish for the crypto market, which saw an uptick following the announcement.

- US Unemployment Rate: The unemployment rate came in at 4%, higher than the forecasted 3.9%. Despite the typically bullish implication for the crypto market, the market saw a decline post-announcement, indicating mixed signals. Traders are advised to be cautious and manage risk during these uncertain events.

- US Unemployment Claims: Unemployment claims were higher than expected, which is historically bullish for crypto due to the inverse relationship between these figures and crypto market performance.

Crypto Markets Overview

- Market Movement: This week, the crypto market experienced a 2.63% uptick, bringing the total market capitalization to $2.494 trillion. Notably, BTC saw a rise of 3.30% and ETH saw a fall of -0.30%. Bitcoin’s dominance stands at 54.90%, while Ethereum’s holds at 17.85%.

- US Spot Bitcoin ETFs See Strong Inflows: Despite a sideways market, US spot Bitcoin ETFs continued their positive streak. This week, they recorded their second-best day of net inflows since inception , with $886.6 million.

- Ripple CEO Predicts XRP ETFs by 2025: Ripple CEO Brad Garlinghouse stated in a live broadcast that XRP ETFs are inevitable, expecting spot XRP ETFs to emerge in 2025. The XRP price remained largely unchanged following the announcement.

Top Tokens Update

- Token Merger Finalization for Fetch.ai, SingularityNET, and Ocean Protocol: On June 13, 2024, Fetch.ai, SingularityNET, and Ocean Protocol will finalize their token merger as part of the ASI Alliance. This alliance aims to build an ethical, decentralized AI ecosystem. The $FET, $AGIX, and $OCEAN tokens will merge into the new Artificial Superintelligence ($ASI) token.

– $FET converts to $ASI with a total supply of 2.63055 billion tokens.

– $AGIX converts to $ASI at a rate of 1 to 0.433350.

– $OCEAN converts to $ASI at a rate of 1 to 0.433226.

Existing token holders can swap their tokens for $ASI through a secure migration contract. This merger will create the largest open-source, decentralized AI network.

- IOTA Launches EVM Network Targeting DeFi and Real-World Assets: IOTA has launched its layer 2 Ethereum Virtual Machine (EVM) network, aimed at integrating real-world assets into the blockchain. This new network focuses on the tokenization of physical assets and includes built-in protections against transaction ordering and MEV. The initiative introduces new functionalities to the IOTA ecosystem, enhancing its role in the DeFi space.

- Uniswap Foundation Postpones Vote, UNI Price Drops: The Uniswap Foundation has delayed the vote for token staking and delegation rewards, causing a decline in UNI’s price. In a statement on X social media platform, the Foundation cited a new issue raised by a stakeholder that requires additional diligence before proceeding with the proposed upgrade. Due to the immutability and sensitivity of the upgrade, the Foundation made the decision to postpone the vote. They apologized for the delay and promised to keep the community informed of any developments regarding future timeframes.

“Big Picture: Upcoming Weeks’ Key Economic Events”

| DATE | TIME | EVENT | USUAL EFFECT |

| June 12 | 6:00 PM | US Core CPI (Yearly) | Actual’ less than ‘Forecast’ is good for crypto |

| June 12 | 11:30 PM | US Federal Funds Rate | Actual’ less than ‘Forecast’ is good for crypto |

| June 12 | 11:30 PM | US FOMC Statement | More dovish than expected is good for crypto |

| June 13 | 6:00 PM | US Core PPI (Monthly) | Actual’ less than ‘Forecast’ is good for crypto |

| June 13 | 6:00 PM | US Unemployment Claims | Actual’ greater than ‘Forecast’ is good for crypto |

Note: “Events in red font signify severe impact, while those in yellow indicate moderate.”

Bitcoin Technical Analysis

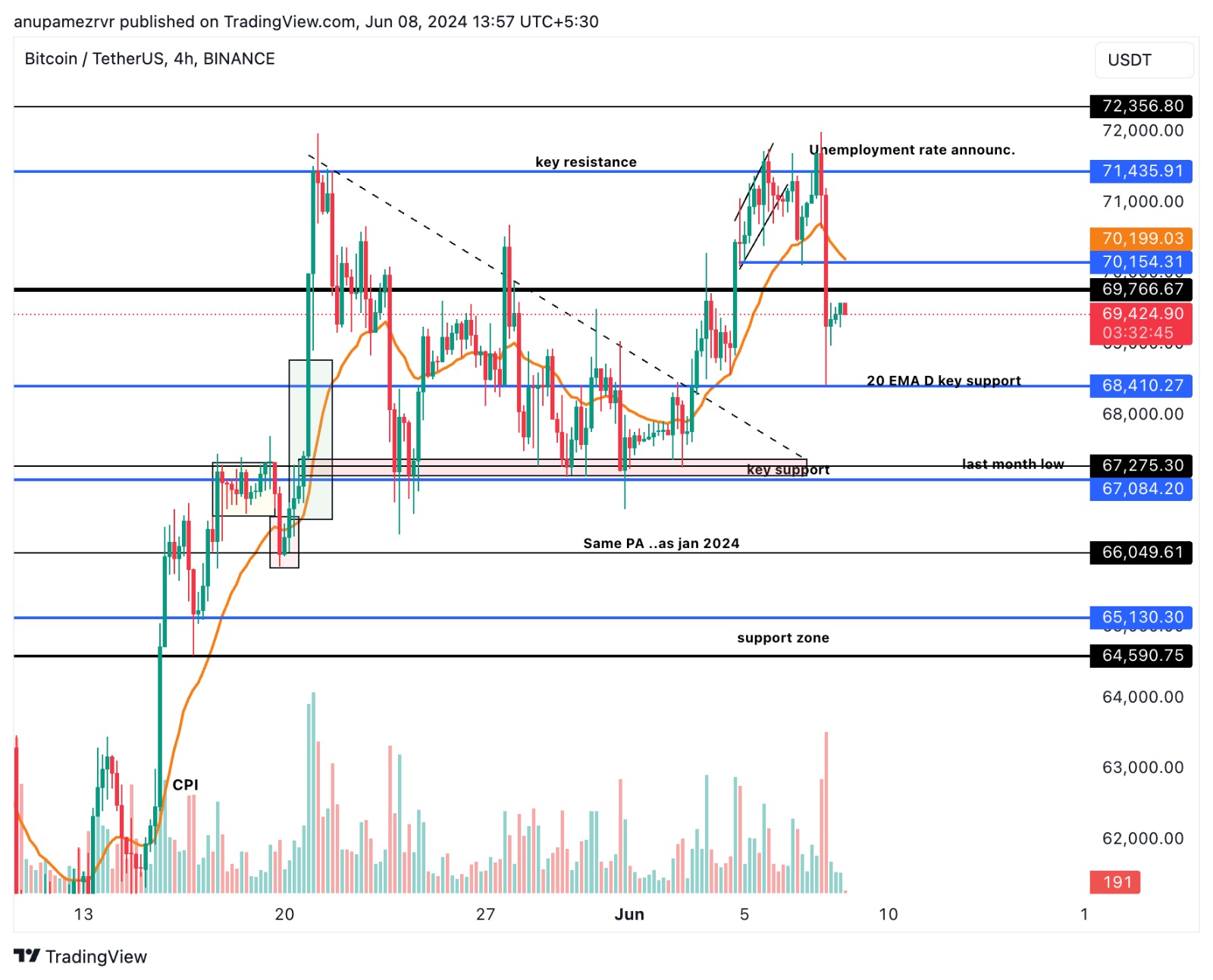

Summary:

- The current sentiment around BTC is bullish.

- This week, the market experienced high volatility due to key U.S. macro data announcements. While the overall week showed promise, Friday saw a sudden drop despite favorable data, creating mixed signals. However, the upcoming week appears bullish as high leveraged longs are cleared, funding rates and open interest return to neutral levels. BTC technically bounced from the 20 EMA D and key support level. Additionally, spot BTC inflows remain positive, indicating bullish sentiment. It’s anticipated that BTC may target and surpass the key resistance level of 71,500 in the coming days.

- Key support levels to consider are around $68,400, $67,000 ,and $66,000. On the upside, resistance levels is at $71,500 , $72,350, & $73,500.

- It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

- For profit-taking, strategically selling near the outlined resistance levels/support levels is a recommended approach. Always exercise caution and implement sound risk management practices in trading endeavors.

Ethereum Technical Analysis

Summary:

- The current sentiment around ETH appears bullish.

- ETH displayed sluggish movement this week, remaining mostly sideways and underperforming BTC. Currently resting at a key support level, ETH is anticipated to rebound if the overall market sentiment remains bullish. The bounce from the 20 EMA Daily support further suggests a bullish outlook for Ethereum.

- Significant support levels include $3650 and $3490, while resistance levels to watch are at $3850, $3950 and $4080.

- These levels play a crucial role in determining potential price movements. It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

Disclaimer: “The information, advise and/or views provided on this page are that of the author or company and are for informational purposes only. The Platform does not intend to: (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, or (ii) to provide accounting, legal, or tax advice, or investment recommendations, or (iii) make any representation of any kind, express or implied, on accuracy, availability, reliability or completeness of the same. Note Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. AT NO TIME WILL THE PLATFORM BE LIABLE FOR YOUR USE OR RELIANCE OF THE SAID INFORMATION, ADVISE AND/OR VIEW WHICH IS SOLELY AT YOUR OWN RISK.”

Related posts

State of the Crypto Market

“VIP Exclusive: Dive into News, Macro Insights, and Crypto Analysis!”

Read more

Token Analysis: Chainlink (LINK)

Get insights on Exclusive Technical Analysis Report -$LINK

Read more