Table of Contents

ToggleMacro Overview

- US Unemployment Rate: The US unemployment rate met expectations, resulting in a neutral impact on the crypto market. Despite this, the market reacted positively, and Bitcoin has historically formed local tops or bottoms around these announcements.

- US Non-Farm Employment Change: The US Non-Farm Employment Change came in below expectations, which is positive for the crypto market given their historically negative relationship.

- US Job Openings (MoM): US job openings came in slightly lower than expected. The market reacted positively initially but declined later.

- US Unemployment Claims: US Unemployment Claims came in slightly below expectations, which is neutral for the crypto market.

Crypto Markets Overview

- Market Movement: This week, the crypto market experienced a -4.47% fall, bringing the total market capitalisation to $1.954 trillion. Notably, BTC saw a fall of -4.31% and ETH saw a fall of -5.17%. Bitcoin’s dominance stands at 57.32%, while Ethereum’s holds at 14.73%.

- US Spot Bitcoin ETFs See $211 Million in Outflows: Spot Bitcoin ETFs experienced $211 million in outflows, extending the streak of negative flows. Fidelity’s FBTC led with $149.49 million in outflows on 5th Sep, while spot Ether ETFs saw comparatively smaller net movements.

- Bitcoin Network Hashrate Hits New All-Time High: The Bitcoin network hashrate reached a new peak on Sept. 1, surpassing 742 exahashes per second (EH/s). CryptoQuant data shows the steady rise in hashrate since 2021, driven by the adoption of more advanced mining hardware like ASICs.

- Mastercard Expands Non-Custodial Crypto Spending via New Partnership: Mastercard has partnered with European crypto payments provider Mercuryo to enable spending from self-custodial wallets. Following its pilot with MetaMask, the new euro-denominated debit card lets users spend cryptocurrencies like Bitcoin at over 100 million merchants within the Mastercard network.

Top Tokens Update

- Pavel Durov Defends Telegram’s Privacy Stance After Release: Following his release in France, Telegram CEO Pavel Durov defended the platform’s strong commitment to privacy and human rights amidst legal challenges. TON coin saw a small uptick after his statement.

- Polygon Begins MATIC to POL Token Migration: Polygon has started migrating from MATIC to POL tokens as part of its Polygon 2.0 roadmap, aimed at enhancing network functionality and scalability. This transition marks a significant step in preparing the Layer-2 network for future expansions.

- Offchain Labs Launches Arbitrum Stylus for DApp Development: Offchain Labs has introduced Arbitrum Stylus, a virtual machine that expands decentralized application (DApp) development by supporting multiple programming languages. Stylus integrates WebAssembly (WASM), allowing developers to use languages like Rust, C, and C++ alongside Ethereum’s EVM framework, enhancing accessibility and flexibility for Web3 development.

- Upcoming Top Unlocks:Immutable (IMX) UnlockDate: September 6

Tokens Unlocked: 32.47 million IMX

Current Circulating Supply: 1.57 billion IMX

Neon (NEON) UnlockDate: September 7

Tokens Unlocked: $19.3 million (5.39% of total supply)

Additionally, the market is watching smaller unlocks from Worldcoin (WLD), Mode (MODE), Zeus Network (ZEUS), and Galxe (GAL), ranging from $4.1 million to $7.1 million.

“Big Picture: Upcoming Weeks’ Key Economic Events”

| DATE | TIME | EVENT | USUAL EFFECT |

| Sep-10 | 7:00 PM | US SEC Chair Gensler Speaks | – |

| Sep-11 | 6:00 PM | US CPI y/y | Actual’ less than ‘Forecast’ is good for crypto |

| Sep-12 | 6:00 PM | US PPI m/m | Actual’ less than ‘Forecast’ is good for crypto |

| Sep-12 | 6:00 PM | US Unemployment Claims | Actual’ greater than ‘Forecast’ is good for crypto |

| Sep-12 | 6:15 PM | EZ ECB Press Conference | More dovish than expected is good for crypto |

Note: “Events in red font signify severe impact, while those in yellow indicate moderate.”

Bitcoin Technical Analysis

Summary:

- The current sentiment around BTC is Neutral. (Uncertain)

- This week, Bitcoin continued to fluctuate within a range, showing uncertain movements. It’s expected to remain indecisive for a few more days. Greater clarity may emerge after the upcoming CPI and PPI data releases. Currently, technical indicators and other factors are mixed, suggesting that it’s prudent to take a cautious approach and minimize risk during these times.

- Key support levels to consider are around $56000(CMP), $54500 and $52650. On the upside, resistance levels is at $59650 & $61600.

- It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

- For profit-taking, strategically selling near the outlined resistance levels/support levels is a recommended approach. Always exercise caution and implement sound risk management practices in trading endeavours.

Ethereum Technical Analysis

Summary:

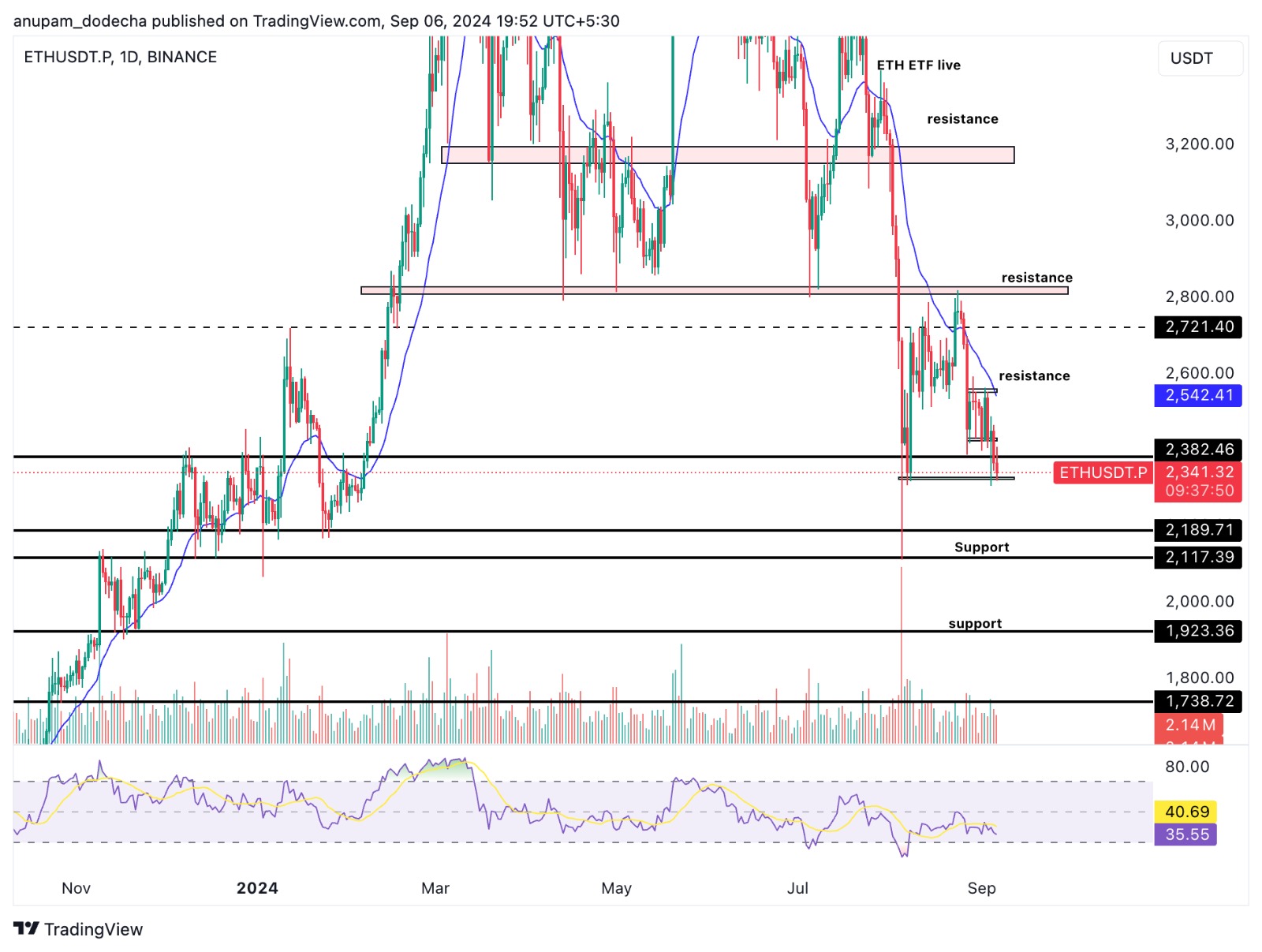

- The current sentiment around ETH appears neutral. (Uncertain)

- Ethereum also exhibited choppy behavior this week, underperforming compared to Bitcoin. ETH is currently at a critical level; a drop below this level could lead to further declines. Expect continued volatility in the upcoming week, with CPI and PPI data being key indicators to watch. Given the unclear direction, it’s advisable to reduce risk during this period.

- Significant support levels include $2325 (CMP) and $2190, while resistance levels to watch are at $2425 and $2550.

- These levels play a crucial role in determining potential price movements. It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

Disclaimer: “The information, advise and/or views provided on this page are that of the author or company and are for informational purposes only. The Platform does not intend to: (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, or (ii) to provide accounting, legal, or tax advice, or investment recommendations, or (iii) make any representation of any kind, express or implied, on accuracy, availability, reliability or completeness of the same. Note Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. AT NO TIME WILL THE PLATFORM BE LIABLE FOR YOUR USE OR RELIANCE OF THE SAID INFORMATION, ADVISE AND/OR VIEW WHICH IS SOLELY AT YOUR OWN RISK.”

Related posts

State of the Crypto Market

“VIP Exclusive: Dive into News, Macro Insights, and Crypto Analysis!”

Read more

Token Analysis: Chainlink (LINK)

Get insights on Exclusive Technical Analysis Report -$LINK

Read more