Table of Contents

ToggleMacro Overview

- US Prelim GDP q/q :The preliminary GDP quarter-over-quarter came out higher than expected. Historically, GDP and crypto have had a negative correlation, making this development bearish for the crypto market but positive for the overall economy.

- US Unemployment Claims (Weekly): The latest US Unemployment Claims came in as expected, slightly below the previous number. This outcome is considered neutral for the crypto market.

Crypto Markets Overview

- Market Movement: This week, the crypto market experienced a -2.01% fall, bringing the total market capitalisation to $2.07 trillion. Notably, BTC saw a fall of -1.75% and ETH saw a fall of -3.10%. Bitcoin’s dominance stands at 57.34%, while Ethereum’s holds at 14.84%.

- OpenSea Receives SEC ‘Wells Notice’ Over NFTs : The U.S. SEC issued a Wells notice to NFT marketplace OpenSea, indicating plans for enforcement action. The SEC claims that NFTs on the platform are securities, according to OpenSea CEO Devin Finzer. Following the news, NFT tokens experienced a dip, signaling a negative market reaction.

- Telegram CEO Charged in France, Released on $5.5M Bail : Pavel Durov, CEO of Telegram, was charged in France for failing to address criminal behavior on the platform. After nearly four days in detention, he was released on €5 million bail with restrictions on leaving the country. Following this news, Telegram’s Toncoin (TON) saw an uptick, indicating market relief.

- Sony’s Ethereum Layer-2 Testnet Launch : Sony’s blockchain subsidiary has launched the “Minato” testnet for its Ethereum Layer-2 blockchain, Soneium, alongside an incubation program for developers. This initiative follows a joint venture with Web3 provider Startale to drive blockchain adoption. Minato offers a development environment that mirrors mainnet conditions to support high-volume applications.

- Stablecoin Market Reaches New Heights Amid Growing Institutional Adoption : The stable coin market surged to an all-time high of over $169 billion this week, as reported by DefiLlama. This growth is largely attributed to rising institutional interest, spurred by the recent launch of spot Bitcoin and Ethereum ETFs.

- AI Tokens Fail to Rally Despite Higher-Than-Estimated Nvidia Earnings : Nvidia surpassed expectations with an EPS of $0.68 and $30 billion in revenue for Q2. However, both NVDA and several AI tokens declined, as investors may have already priced in the positive report following last week’s rally in AI tokens.

Top Tokens Update

- Upcoming Major Token Unlocks –Optimism (OP) – August 31:

A significant unlock of 32.21 million OP tokens is scheduled. Given Optimism’s key role in Ethereum scaling, this event could generate substantial interest in the market, possibly affecting the token’s price dynamics. - dYdX (DYDX) – September 1:On the first of September, 8.33 million DYDX tokens will be unlocked. This unlock may impact the liquidity and price movement of the token as investors and traders react to the increased supply.

- Sui (SUI) – September 3:

The final and most considerable unlock of 83.88 million SUI tokens will take place on September 3. This large-scale token release is expected to significantly influence the SUI market, drawing considerable attention from investors and traders due to its potential impact on market dynamics.

“Big Picture: Upcoming Weeks’ Key Economic Events”

| DATE | TIME | EVENT | USUAL EFFECT |

| September 4 | 7:30 PM | US Job Openings (MoM) | Actual’ less than ‘Forecast’ is good for crypto |

| September 5 | 6:00 PM | US Unemployment Claims | Actual’ greater than ‘Forecast’ is good for crypto |

| September 6 | 6:00 PM | US Non-Farm Employment Change | Actual’ less than ‘Forecast’ is good for crypto |

| September 6 | 6:00 PM | US Unemployment Rate | Actual’ greater than ‘Forecast’ is good for crypto |

Note: “Events in red font signify severe impact, while those in yellow indicate moderate.”

Bitcoin Technical Analysis

Summary:

- The current sentiment around BTC is Neutral. (Uncertain)

- Last week, the cryptocurrency market remained choppy with no significant sell-off news. Bitcoin (BTC) is currently caught between two open CME gaps and has been moving sideways. The trend remains unclear, with the upcoming PCE index release on August 30 and the monthly unemployment rate next week potentially impacting market direction. Historically, September has been a challenging month for the crypto market, raising the likelihood of BTC dropping to the $56,000–$57,000 range to fill the CME gap. On the upside, key resistance is noted at the late $60,000s level.

- Key support levels to consider are around $58000 and $57-56000 (CME Gap). On the upside, resistance levels is at $61500-$62000 (CME Gap), $65,00 & $67,000.

- It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

- For profit-taking, strategically selling near the outlined resistance levels/support levels is a recommended approach. Always exercise caution and implement sound risk management practices in trading endeavours.

Ethereum Technical Analysis

Summary:

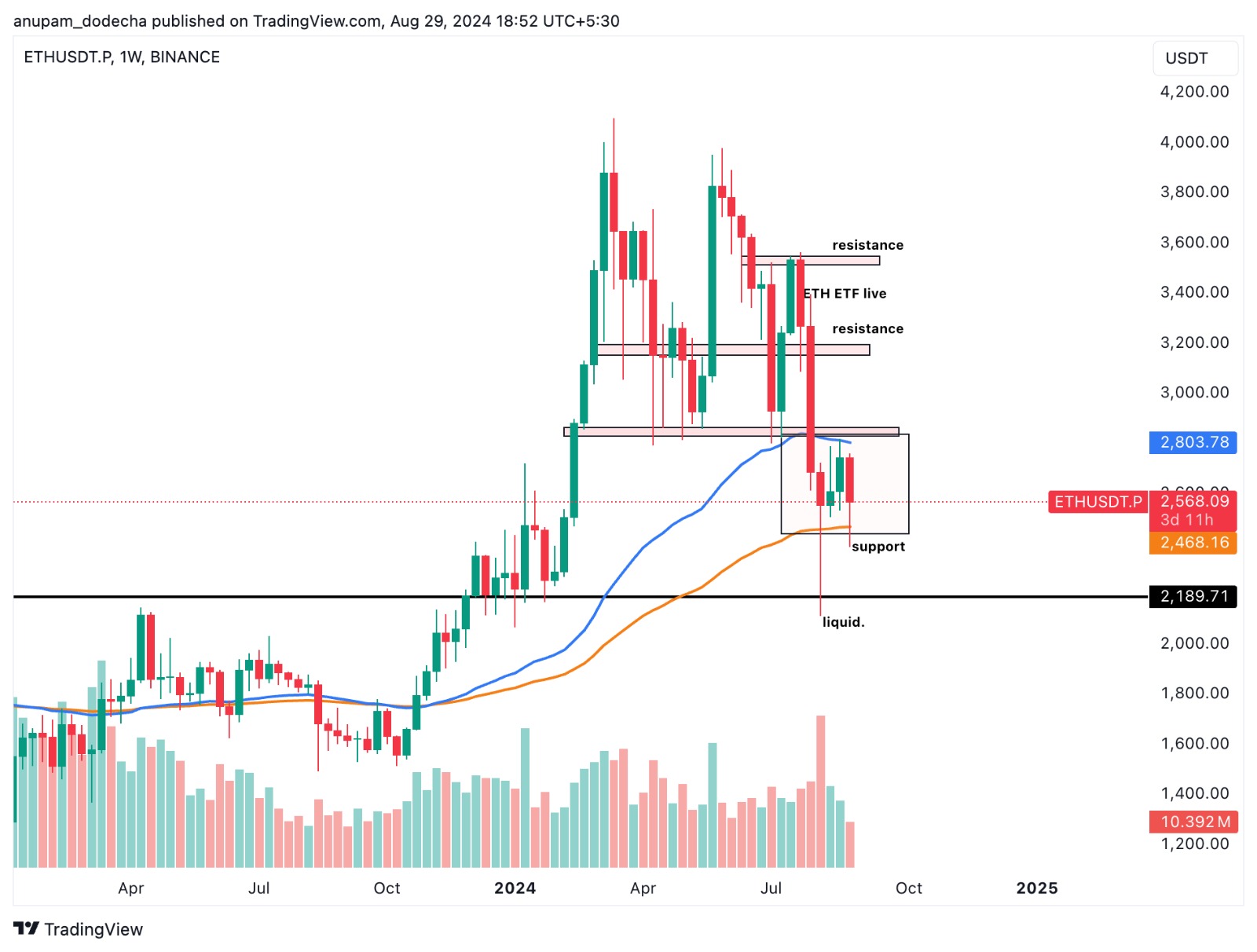

- The current sentiment around ETH appears neutral. (Uncertain)

- ETH has mirrored Bitcoin’s recent path, currently trading between the 50 EMA weekly resistance and the 100 EMA weekly support. It is expected to move sideways for the next few days until Bitcoin establishes a clearer direction. On a positive note, the ETH/BTC pair has found strong support, suggesting that ETH and ETH-related tokens may outperform in the coming days.

- Significant support levels include $2400 and $2190, while resistance levels to watch are at $2800 and $3050.

- These levels play a crucial role in determining potential price movements. It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

Disclaimer: “The information, advise and/or views provided on this page are that of the author or company and are for informational purposes only. The Platform does not intend to: (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, or (ii) to provide accounting, legal, or tax advice, or investment recommendations, or (iii) make any representation of any kind, express or implied, on accuracy, availability, reliability or completeness of the same. Note Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. AT NO TIME WILL THE PLATFORM BE LIABLE FOR YOUR USE OR RELIANCE OF THE SAID INFORMATION, ADVISE AND/OR VIEW WHICH IS SOLELY AT YOUR OWN RISK.”

Related posts

State of the Crypto Market

“VIP Exclusive: Dive into News, Macro Insights, and Crypto Analysis!”

Read more

Token Analysis: Chainlink (LINK)

Get insights on Exclusive Technical Analysis Report -$LINK

Read more