Table of Contents

ToggleMacro Overview

- US Unemployment Claims (Weekly): Latest claims came in below expectations and previous levels, indicating a bearish signal for the crypto market.

Crypto Markets Overview

- Market Movement: This week, the crypto market experienced a 0.10% uptick, bringing the total market capitalisation to $2.275 trillion. Notably, BTC saw a rise of 0.23% and ETH saw a fall of -3.32%. Bitcoin’s dominance stands at 59.20%, while Ethereum’s holds at 13.43%.

- Tesla (TSLA) Holds $763M Bitcoin, Despite Significant Transfers in Q3 2024: Tesla confirmed it did not sell any BTC holdings in Q3 but moved all $760 million worth from its public wallet for the first time in two years. Arkham Intelligence reports Tesla made several transactions, including $75.18M, $76.08M, and $77.16M, to two separate, unidentified wallets. No Bitcoin was sold or converted to stablecoins or other cryptocurrencies.

- Microsoft to Vote on Bitcoin Investment Assessment at December Shareholder Meeting: Microsoft has included a proposal to assess Bitcoin investments as a voting item in its upcoming Dec. 10 shareholder meeting, per a recent SEC filing. Proposed by The National Center for Public Policy Research, the assessment considers Bitcoin’s volatility and Microsoft’s existing processes for managing its corporate treasury.

- Stripe Acquires Stablecoin Platform Bridge for $1.1 Billion: Payments giant Stripe has acquired Bridge, a stablecoin platform, for $1.1 billion, as reported by venture capitalist Michael Arrington. The acquisition enhances Stripe’s integration into the crypto space.

Top Tokens Update

- Ripple Sells $100M in XRP Amid Slow ‘Uptober’ and Kamala Harris Donation: On October 21, Ripple sold its 200 million XRP treasury reserve for the month, transferring funds to its typical address for monthly transactions. The sale followed Ripple’s On-Demand Liquidity (ODL) model, moving XRP at market prices to buyer.

- Ankr Integrates TON Blockchain for Telegram dApps: Web3 provider Ankr has integrated with the TON blockchain, enabling developers to build dApps for Telegram’s 950 million users. Through Ankr’s API, developers can access on-chain data without deploying their own nodes, creating an instant connection to TON. ANKR’s price has remained steady this week.

- Solana Hits Record Fee Revenue Again: Solana’s Layer-1 blockchain set another revenue record on Oct. 23, generating $8.7 million, following its previous high of $8 million a day prior, per Blockworks Research. Solana first surpassed Ethereum in July, reaching $25 million in weekly fees. This surge has been driven by high trading volumes on Solana-based memecoin platforms like Pump.fun and Moonshot.

“Big Picture: Upcoming Weeks’ Key Economic Events”

| DATE | TIME | EVENT | USUAL EFFECT |

| Oct-29 | 12:10 AM | US SEC Chair Gensler Speaks | |

| Oct-29 | 7:30 PM | US JOLTS Job Openings | Actual’ less than ‘Forecast’ is good for crypto |

| Oct-30 | 6:00 PM | US Advance GDP q/q | Actual’ less than ‘Forecast’ is good for crypto |

| Oct-31 | 6:00 PM | US Core PCE Price Index m/m | Actual’ less than ‘Forecast’ is good for crypto |

| Oct-31 | 6:00 PM | US Unemployment Claims | Actual’ greater than ‘Forecast’ is good for crypto |

| Nov 1 | 6:00 PM | US Unemployment Rate | Actual’ greater than ‘Forecast’ is good for crypto |

Note: “Events in red font signify severe impact, while those in yellow indicate moderate.”

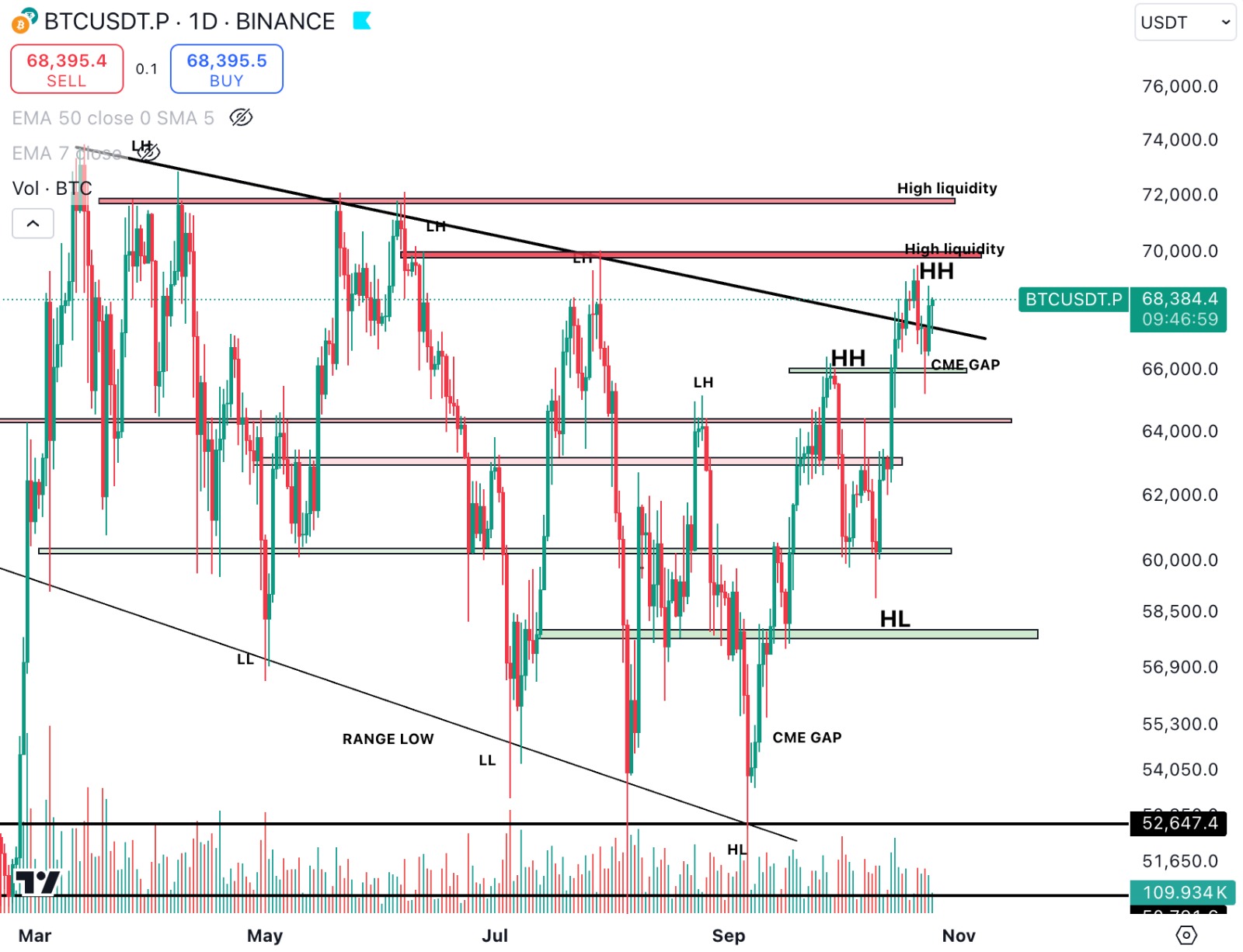

Bitcoin Technical Analysis

Summary:

- The current sentiment around BTC is Neutral.

- As anticipated in last week’s report, BTC traded choppily, with unclear price action. While BTC has left a few small CME gaps—potentially bearish as it might move to fill them—technicals still suggest a bullish setup. Expect continued choppiness next week, with potential clarity in direction later in the week, following key macro events.

- Key support levels to consider are around $66000 and $64400. On the upside, resistance levels is at $70000 & $72000.

It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent. - For profit-taking, strategically selling near the outlined resistance levels/support levels is a recommended approach. Always exercise caution and implement sound risk management practices in trading endeavours.

Ethereum Technical Analysis

Summary:

- The current sentiment around ETH appears Neutral to Bullish .

- ETH experienced a decline last week but continues to respect key trendlines. With BTC’s direction remaining unclear, ETH is likely to experience choppy to bullish price action in the coming week, according to current technicals. Notably, Solana outperformed both BTC and ETH last week.

- Significant support levels include $2450 and $2333, while resistance levels to watch are at $2710 and $2800.

- These levels play a crucial role in determining potential price movements. It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

Disclaimer: “The information, advise and/or views provided on this page are that of the author or company and are for informational purposes only. The Platform does not intend to: (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, or (ii) to provide accounting, legal, or tax advice, or investment recommendations, or (iii) make any representation of any kind, express or implied, on accuracy, availability, reliability or completeness of the same. Note Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. AT NO TIME WILL THE PLATFORM BE LIABLE FOR YOUR USE OR RELIANCE OF THE SAID INFORMATION, ADVISE AND/OR VIEW WHICH IS SOLELY AT YOUR OWN RISK.”

Related posts

State of the Crypto Market

“VIP Exclusive: Dive into News, Macro Insights, and Crypto Analysis!”

Read more

Token Analysis: Chainlink (LINK)

Get insights on Exclusive Technical Analysis Report -$LINK

Read more