Table of Contents

ToggleMacro Overview

- U.S. Federal Interest Rate: The U.S. Federal Reserve cut interest rates by 50bps, coming in below both expectations and the previous rate. This is bullish for the overall market, leading to a strong upside move, which is expected to continue given the healthy price action.

- US Unemployment Claims: Came in lower than expected, slightly negative due to its inverse relationship with the crypto market. Despite the announcement, the market remained stable, showing resilience. Weekly unemployment data tends to have minimal impact on crypto.

Crypto Markets Overview

- Market Movement: This week, the crypto market experienced a 5.85% uptick, bringing the total market capitalisation to $2.159 trillion. Notably, BTC saw a rise of 7.16% and ETH saw a rise of 6.06%. Bitcoin’s dominance stands at 58.06%, while Ethereum’s holds at 14.23%.

- MicroStrategy Expands BTC Holdings with New $458M Purchase: MicroStrategy has purchased 7,420 BTC for ~$458.2 million at an average price of ~$61,750 per Bitcoin. The company has achieved a BTC yield of 5.1% quarter-to-date and 17.8% year-to-date. As of September 19, 2024, they hold 252,220 BTC, acquired for ~$9.9 billion at an average price of ~$39,266 per Bitcoin.

- Bhutan Holds Twice as Much Bitcoin as El Salvador: Bhutan reportedly holds 13,029 BTC (around $758 million), surpassing El Salvador’s Bitcoin holdings, according to Arkham Intelligence. These holdings stem from Bitcoin mining operations run by Druk Holdings (DHI), Bhutan’s investment arm.

- Coinbase’s cbBTC Becomes Third-Largest Wrapped BTC Token in Just One Week: Launched on Sept. 12, Coinbase’s cbBTC has quickly grown to nearly 2,000 tokens in circulation, making it the third-largest wrapped Bitcoin (WBTC) token. It surpassed competitors like Huobi BTC (HBTC) and renBTC (RENBTC), while BitGo’s WBTC remains dominant with 153,000 tokens in circulation.

Top Tokens Update

- Ethereum Developers Consider Splitting ‘Pectra’ Upgrade: Ethereum developers are contemplating dividing the highly anticipated Pectra upgrade into two parts due to the numerous priorities and complexities involved. Initially set to be Ethereum’s biggest hard fork, some developers argue that splitting it could mitigate risks associated with implementing too many changes at once. This decision may ultimately prove positive for ETH’s future, as it allows for more manageable updates and enhancements.

- Sui Network TVL Reaches Record High, SUI Price Jumps 30%: On September 19, the total value locked (TVL) on the Sui Network hit a record $810.5 million, while the SUI token surged over 30% in the past week. This growth represents a 283% increase year-to-date, despite earlier market fluctuations. The TVL indicates rising interest in Sui’s DeFi offerings, with all leading protocols showing gains.

- Solana Breakpoint Event Unveils Key Announcements, Including Franklin Templeton Partnership: At the 2024 Solana Breakpoint event in Singapore, Franklin Templeton announced plans to launch a mutual fund on the Solana network, allowing institutional and retail investors to invest in Solana through the asset manager. This follows last year’s Breakpoint, which featured the testnet launch of Firedancer, Solana’s new validator, resulting in an 80% surge in SOL. The current event highlights Solana’s growing ecosystem and aims to foster further innovation and investment.

“Big Picture: Upcoming Weeks’ Key Economic Events”

| DATE | TIME | EVENT | USUAL EFFECT |

| Sep-26 | 6:00 PM | US Final GDP q/q | Actual’ less than ‘Forecast’ is good for crypto |

| Sep-26 | 6:00 PM | US Unemployment Claims | Actual’ greater than ‘Forecast’ is good for crypto |

| Sep-26 | 6:50 PM | US Fed Chair Powell Speaks | More dovish than expected is good for crypto |

| Sep-26 | 9:15 PM | US SEC Chair Gensler Speaks | |

| Sep-27 | 6:00 PM | US Core PCE Price Index m/m | Actual’ less than ‘Forecast’ is good for crypto |

Note: “Events in red font signify severe impact, while those in yellow indicate moderate.”

Bitcoin Technical Analysis

Summary:

- The current sentiment around BTC is Bullish.

- This week, BTC experienced solid gains, aligning with insights from our previous reports. The key driver was the Fed’s 50 basis point interest rate cut, which has positively influenced price action. Currently, BTC’s performance looks healthy in higher time frames, with a significant chance of breaking the six-month consolidation phase and reaching new all-time highs in the coming weeks. For next week, BTC could target the $66-67k range.

- Key support levels to consider are around $61500 and $60400. On the upside, resistance levels is at $65000 & $67000.

- It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

- For profit-taking, strategically selling near the outlined resistance levels/support levels is a recommended approach. Always exercise caution and implement sound risk management practices in trading endeavours.

Ethereum Technical Analysis

Summary:

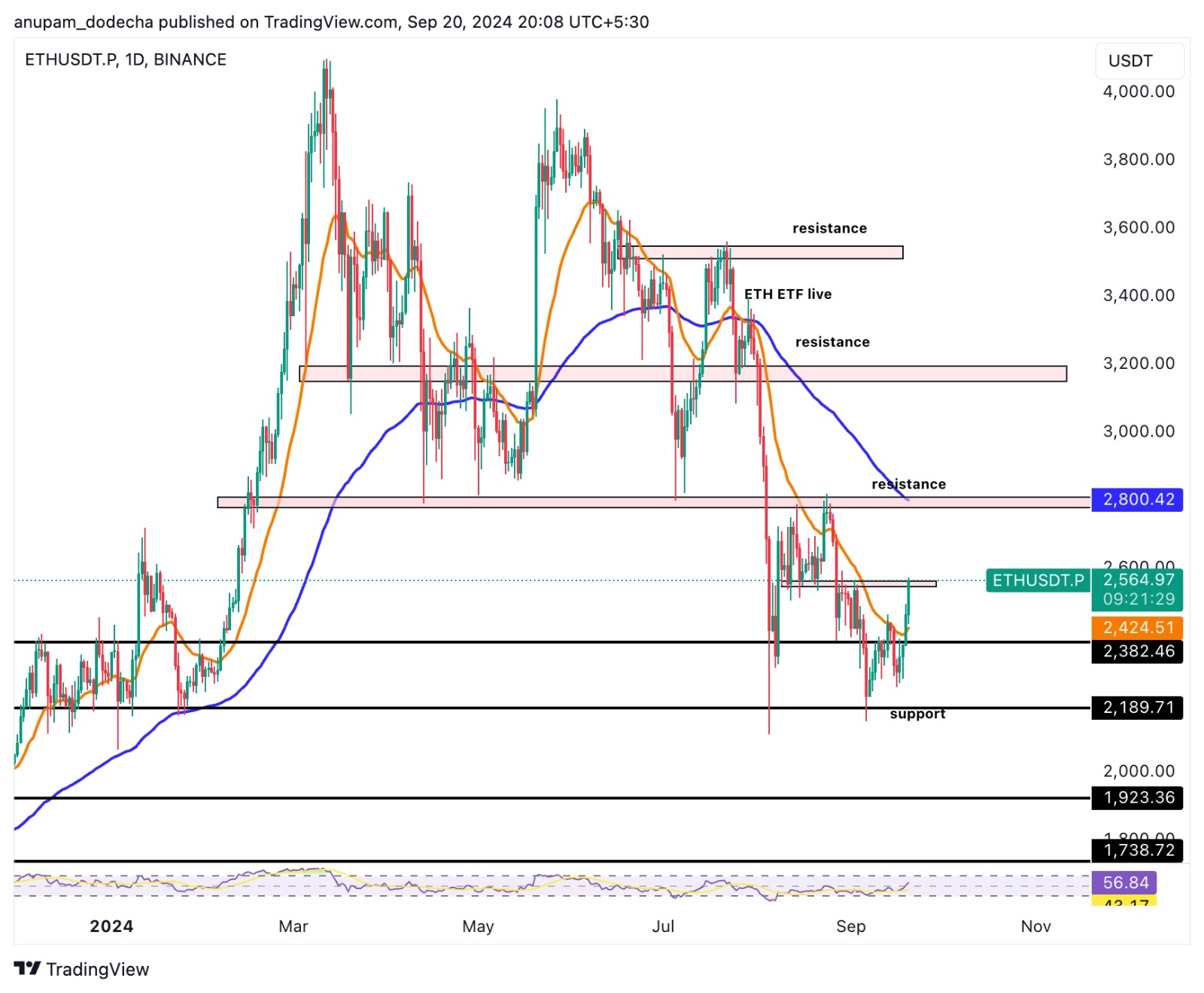

- The current sentiment around ETH appears bullish.

- This week, ETH delivered returns comparable to BTC, with its technicals also appearing bullish. However, for a longer-term upward trajectory, ETH needs to reclaim the crucial $2800 level. For the upcoming week, ETH looks poised for bullish movement, especially as BTC dominance has experienced a pause.

- Significant support levels include $2385 and $2190, while resistance levels to watch are at $2550 and $2800.

- These levels play a crucial role in determining potential price movements. It is advisable to evaluate potential entry points around the mentioned support levels for long entries and at resistance levels for short entries. Additionally, setting limits to manage potential losses is prudent.

Disclaimer: “The information, advise and/or views provided on this page are that of the author or company and are for informational purposes only. The Platform does not intend to: (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, or (ii) to provide accounting, legal, or tax advice, or investment recommendations, or (iii) make any representation of any kind, express or implied, on accuracy, availability, reliability or completeness of the same. Note Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. AT NO TIME WILL THE PLATFORM BE LIABLE FOR YOUR USE OR RELIANCE OF THE SAID INFORMATION, ADVISE AND/OR VIEW WHICH IS SOLELY AT YOUR OWN RISK.”

Related posts

State of the Crypto Market

“VIP Exclusive: Dive into News, Macro Insights, and Crypto Analysis!”

Read more

Token Analysis: Chainlink (LINK)

Get insights on Exclusive Technical Analysis Report -$LINK

Read more