Table of Contents

ToggleFollowing the win in the Supreme Court against the de-facto ban from the RBI, the crypto space has seen a massive adoption within the Indian mass. If you are new to the space, crypto tokens are basically decentralized digital assets that are usually traded and invested in, much like other traditional assets. The most interesting aspect of these digital tokens is their underlying blockchain technology. This public ledger makes any transactions made within the space visible to everyone.

Owing to the rising popularity of the crypto space, during the Budget 2022 session, the Hon’ble Finance Minister Mrs. Nirmala Sitharaman announced revolutionary changes to the virtual asset class. Considering the magnitude and frequency of these transactions, the government has proposed the following specific tax regime for the industry:

- Income from the transfer of any virtual digital asset to be taxed at the rate of 30%

- TDS of 1% to be charged on payments made for the transfer of virtual assets, above a certain monetary threshold

- The gift of virtual digital assets is proposed to be taxed in the hands of the recipient

As per the regulations, the tax of 30% on your annual returns will be applied annually, during every financial year-end, while the 1% TDS will be made effective from 1st July on “Payment on transfer of Virtual Digital Asset”. . TDS is the tax deducted at the source which is paid to the Government on behalf of the deductor by CoinDCX as a part of compliance with the new crypto taxation rules announced in the Union Budget 2022. This will be available as a credit against your tax liabilities at the end of the financial year.

In compliance to this, all users will have to mandatorily complete their KYC process on/or before July 1, 2022 in order to make any transaction (Buy/Sell) on CoinDCX Pro.

Additional Read: Crypto Tax Guide

CoinDCX Pro/Web

The following table summarises the applicability of TDS on various order types:

| Insta Spot Buy – No TDS is applicable (App)

Quickbuy Insta Buy – No TDS is applicable (Web) |

| Insta Spot Sell – 1% TDS is applicable (App) Quickbuy Insta Sell – 1% TDS is applicable (Web) |

| Spot Buy – INR pairs – No TDS |

| Spot Sell – INR pairs – 1% TDS is applicable |

| Spot Buy – Non-INR pairs (C2C) – 1% TDS |

| Spot Sell – Non-INR pairs (C2C) – 1% TDS |

| Margin Long – 1% TDS on total value of position for both opening and closing orders |

| Margin Short – 1% TDS on total value of position for both opening and closing orders |

| Lend/Earn – No TDS is applicable |

| Futures – No TDS is applicable |

Below are examples of how TDS will be calculated for various order types(Spot/Margin etc.)

| Insta Spot Buy – No TDS is applicable (App)

Quickbuy Insta Buy – No TDS is applicable (Web) |

| Insta Spot Sell – 1% TDS is applicable (App) Quickbuy Insta Sell – 1% TDS is applicable (Web)For example; 1% TDS to be deducted on the overall transaction value. If the sell value is INR 1500, we need to deduct (1%of 1500) as TDS from the user and the user will get (1500-x%of 1500 – fees) in his account. So, we will deduct 1*1500/100 ie INR 15 as TDS and if the fee is 0.3%, we will deduct 0.3*1500/100 ie INR 4.5 as fees, so the user will get back (1500-1*1500/100 – 4.5) = INR 1480.5 in his/her account. |

| Spot Buy – INR pairs – No TDS |

| Spot Sell – INR pairs – 1% TDS is applicable For example 1% TDS will be deducted on overall transaction value. If the sell value is INR 1500, we will deduct 1% of 1500 as TDS from the user, and the user will get (1500 – 1% of 1500 – fees) in their account. So we will deduct 1*1500/100 ie, INR 15 as TDS and if fees are 0.3%, we will deduct 0.3*1500/100 ie, INR 4.5 as fees, so the user will get back (1500-1*1500/100-4.5) = INR 1480.5 in their account. |

| Spot Buy – Non-INR pairs (C2C) – 1% TDS For example: 1% TDS will be deducted on the overall transaction value. We will do the TDS deduction on the base token. Let’s say the user transacts in BTC-USDT and buys 1 BTC at a price of 40,000 USDT. We will ask the user for 1% TDS in USDT ie 1/100*40000 = 400 USDT and 0.3% in fees (whatever the fees is) ie 0.3/100*40000 = 120 USDT, ie, a total of 40520 USDT for this transaction. Both fees and TDS are applied on the value of the transaction. |

| Spot Sell – Non-INR pairs (C2C) – 1% TDS For example 1% TDS will be deducted on overall transaction value (the deduction will be on the base token). Let’s say, the user transacts in BTC-USDT and sells 1 BTC at a price of 40,000 USDT, we will give back to the user after deducting 1% TDS in USDT ie, 1/100*40000 = 400 USDT – a total of 39600 USDT for this transaction. |

| Margin Long – 1% TDS on total value of position for both opening and closing orders For example: 1% TDS will be deducted on overall actual transaction value including leverage. So if a user is buying 1 BTC at a price of 40,000 USDT at 10x leverage, the margin required would be 4000 USDT, but the actual transaction value would be 40,000 USDT; hence, in this case, we will apply TDS on the entire 40,000 USDT. Let’s say the user transacts in BTC-USDT and takes a leverage position of 1 BTC at a price of 40,000 USDT, we will then ask the user for 1% TDS in USDT ie, 1/100*40000 = 400 USDT and 0.2% in fees (whatever the fees is) ie, 0.2/100*40000 = 120 USDT, ie, a total of (520 USDT + margin + TDS required for selling) required for this transaction. Both fees and TDS are applied to the value of the transaction. TDS required for closing position needs to be taken in the form of extra margin. |

| Margin Short – 1% TDS on the total value of position for both opening and closing orders Same as Margin Long. The user must maintain an extra margin corresponding to the TDS value. |

| Lend – No TDS is applicable |

| Earn – No TDS is applicable |

| Futures – No TDS is applicable |

Note: 0.2% fee is indicative and is subject to changes. Please use this only for reference.

The Finance Bill 2023

After the introduction of the TDS laws during the Union Budget 2022, during the Budget session of this year, there was a new Finance Bill that was shared. The new amendment was included in the Income Tax Act under section 271C, in the Finance Bill. It stated that non-payment of TDS would incur a penalty amount which will be equal to the unpaid TDS that will be imposed by a joint commissioner or a jail term for up to six months. In case of any delay, this can amount to an interest rate of 15% per annum for late payment.

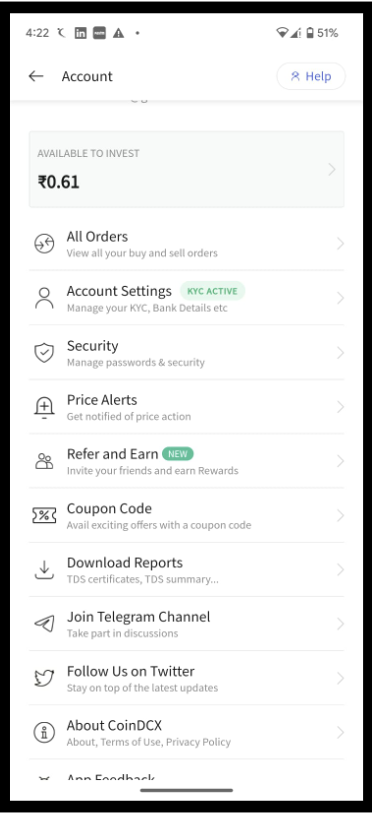

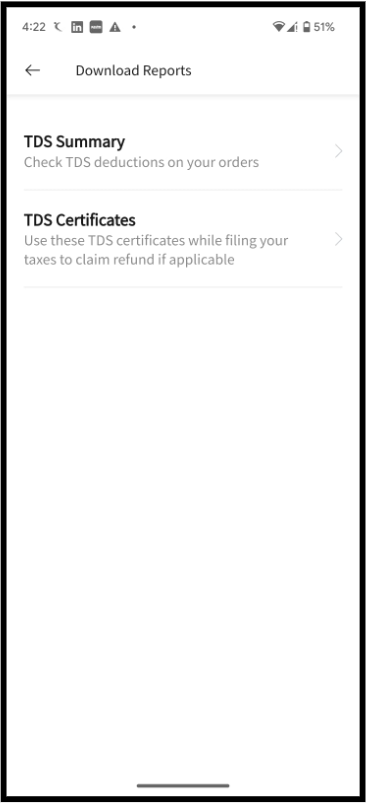

Staying true to its customer-first approach, and working towards making TDS simpler for the crypto community, CoinDCX worked out a solution to make the app TDS compliant. The app is upgraded to provide an easy-to-access crypto TDS certificate for continued seamless trading experience.

- CoinDCX pays the TDS on behalf of the customer.

- TDS certificate, report and summary are updated on the CoinDCX app itself.

- Users are sent TDS statements at periodic intervals to help them keep a record while also keeping the users updated on any further developments.

To explore #TDSNotTedious, follow the following process:

- Open the CoinDCX App

- Go to Account > Download Report

- Then click on TDS Summary or TDS Certificates

Why TDS is applicable on the buying of Non-INR pairs (C2C) unlike INR pairs (C2C)?

TDS is not applicable on the BTC-INR pair but on the BTC-USDT pair because when you buy the Non-INR pair the exchange actually first sell the base pair. For eg: If you want to buy BTC with USDT, here USDT is getting sold and BTC is getting bought.

How much TDS is applicable on margin orders with leverage?

The effective margin amount will be = margin based on leverage + Margin required for TDS. The Margin required for TDS will be 1% of the total order value while opening and closing the position. This implies that the effective margin can increase by upto 20% to account for TDS.

Let us take an example of 10x leverage of 10,000 USDT Margin order:

| Before 1st July | After 1st July |

| Margin required : 1000 USDT (approx) | Margin required : 1000 USDT (approx) |

| TDS Margin required : 0 | TDS Margin required : 200 USDT (approx)

100 USDT for opening position (approx) 100 USDT for closing position (approx) |

| Effective margin : 1000 USDT (approx) | Effective margin required: 1200 USDT (approx)

Out of which 200 USDT will be deposited to the income tax department as part of TDS regulation. This is not a loss and can be claimed back. |

Here is a step-by-step look into how your CoinDCX Pro app experience will be after the 1%TDS is applied. For example, if you create a Sell order for 1 BTC at INR 40,00,000 (refer to the images below), your order details will look as follows:

Order Value = INR 40,00,000

Transaction Fees (0.2% of 40,00,000) = INR 8,000

TDS applicable (1% of 40,00,000) = INR 40,000

Hence, Total Order Value (what you get) = INR 40,00,000 – (8000 + 40,000) = INR 39,52,000

On the other hand, for all crypto-to-crypto (ie, C2C) transactions, 1% TDS will be applicable on both Buy and Sell orders. For example, if you create a Buy order for 0.5 BTC at value of USDT 20,000 (refer to images below), your order details will look like:

Order Value = USDT 20,000

Transaction Fees (0.2% of 20,000) = USDT 40

TDS applicable (1% of 20,000) = USDT 200

Total Order Value (what you pay) = USDT 20,000 + (40 + 200) = USDT 20,240

Note: Similar 1% TDS calculation will also apply to Sell orders for C2C transactions.

Pro Tip: You can always check the “Order Details” page to view your TDS deductions for each transaction (reference image below).

To view transaction details on individual orders:

- Go to the “Orders” tab on your CoinDCX Pro App

- Select the Order you want to view

Will the 1% TDS be applicable if the investor is paying 30% tax?

As per the Government regulation, 30% tax is applicable on your Crypto gains. But this tax along with the overall income tax payable based on your other sources of income can be adjusted with the TDS deducted.

You can also file for a TDS refund based on your income slabs, for more detailed information visit Income Tax India – File TDS Return.

For all your queries, click on FAQs.

Disclaimer: According to the CBDT circular dated June 23, 2022 [read here], TDS is applicable on the Net order amount. In simple words, the Net order amount is the transaction value minus the exchange fees. In order to comply with the revised Income Tax regulations, we will be soon shifting to the NET TDS DEDUCTION formula, as per which the calculation is to be set at 1%. To understand this better, please refer here.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more