Table of Contents

ToggleThe crypto regulations set in place since the Budget 2022 has been a very positive big step towards the asset class being regularized by the Indian Government. With the new Budget, came the 30% tax on crypto gains and a 1% TDS on crypto transactions. Before diving into simplifying TDS in crypto, let us take a quick look into the TDS laws and the new update after the Finance Bill 2023.

As per Section 206AB of the Income-Tax Act, 1961:

- If any user has not filed their Income Tax Return in the last two years and the amount of TDS has been ₹50,000 or more in each of these two previous years, then the tax (TDS) to be deducted for Crypto related transactions will be at 5%.

- If an order is placed before 1st July 2022, but the trade is executed on or after 1st July 2022, TDS provisions will apply.

Following the TDS laws of 2022, the Finance Bill that was shared after the Union Budget 2023 is:

An amendment was mentioned in the Income Tax Act under section 271C, in the Finance Bill, which stated that non payment of TDS would incur a penalty amount which will be equal to the unpaid TDS that will be imposed by a joint commissioner or a jail term for up to six months. In case of any delay, this can amount to an interest rate of 15% per annum for late payment.

Read More: 5 Tips to file Crypto TDS

With CoinDCX, #TDSNotTedious

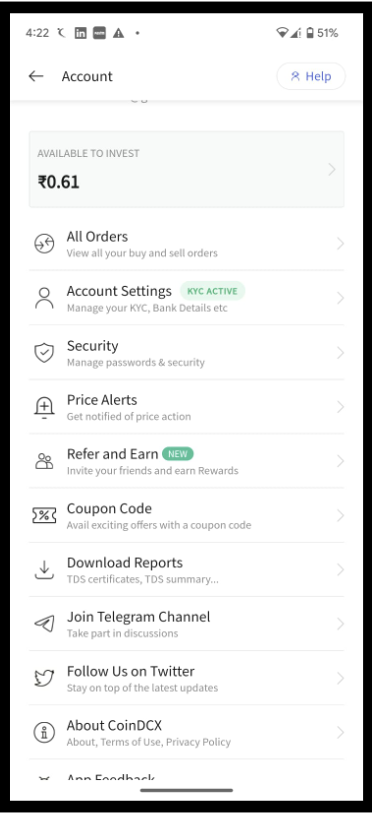

Being a customer-first product, the CoinDCX app is fully equipped for you to keep exploring the crypto space while we help you out with TDS in a seamless procedure. Right from deducting the TDS to keeping tab on all the TDS payments, everything is available for you at a touch of a click!

To simplify TDS filing for the users:

- We pay the TDS on behalf of the customer.

- TDS certificate, report and summary are updated on the CoinDCX app itself.

- Users are sent TDS statements at periodic intervals to help them keep a record while also keeping the users updated on any further developments.

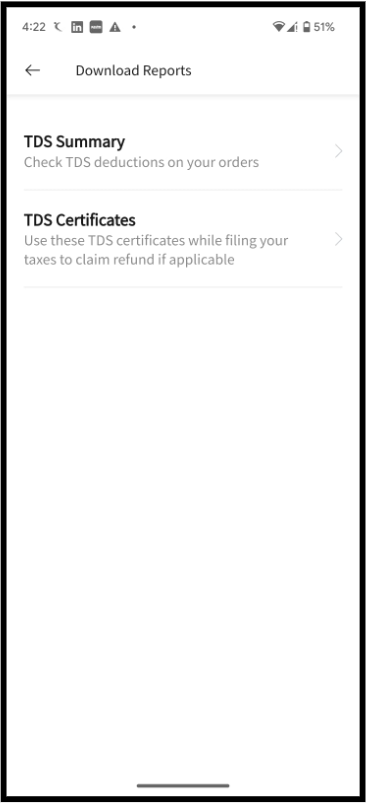

To explore #TDSNotTedious, follow the following process:

- Open the CoinDCX App

- Go to Account > Download Report

- Then click on TDS Summary or TDS Certificates

What is TDS in Crypto?

TDS in crypto or virtual digital assets is the amount deducted on the final sale amount of the asset and not just on the profits. According to the revised tax laws, 1% TDS is applicable on all sell transactions of the crypto assets. Irrespective of a profit or a loss on the trade, the TDS of 1% will be deducted.

To help you understand better, here is an example for TDS. If one sells 100 UDST at 89 INR per token. 1% TDS will be levied on INR 8900, which then amounts to 89 INR. Below table points out the instances when a TDS will be applied:

| Buying of Crypto Tokens | No TDS |

| Selling of Crypto Tokens | 1% TDS |

| Limit Buy on the asset | No TDS |

| Limit Sell on the asset | 1% TDS |

| CIP (buy transaction) | No TDS |

| Earn | No TDS |

Additional Read: Top Tweets on 1% TDS on Crypto

Related posts

FAQs for Crypto Withdrawal Access Requests

All you need to know about crypto withdrawals on CoinDCX.

Read more

CoinDCX Trade Signals: Your Gateway to Trade Smart

Unlock success with CoinDCX’s Trade Signals: Up to 80% Win Rate!

Read more