Table of Contents

ToggleKey Takeaways:

- Verge price began the monthly trade on a bullish note and surged by more than 300% to mark highs above $0.01

- The bullish momentum continues to prevail, due to which the price is expected to maintain a firm upswing, overcoming the bearish impact.

- The technicals also favor the crypto, due to which the bears may intervene less in the progress of the rally.

Traders Premier League

CoinDCX presents India’s biggest battlefield for traders:- The Traders Premier League. The 45-day league is a great opportunity to showcase your future trading skills and win attractive prizes. The participants will be divided into groups, competing with each other to be the winners.

The contest has already started and will last up to 6 August 2023 till night 11:59 pm. Refer to the official announcement to learn more!

Verge Overview as of July 07, 2023

| Verge Price | $0.008467 |

| 24 Price Change | +9.72% |

| 7D Price Change | +189.8% |

| Market Cap | $139.12 million |

| Circulating Supply | 16.52 billion |

| Trading Volume (24-Hour) | $185.09 million |

| ATH | $0.3 |

| Fear-Greed Index | 55 (Greed) |

| Sentiment | Bullish |

| Volatility | 73.56% |

| Green Days | 15/30 (50%) |

XVG Price Forecast For This Week

The Verge price began the week with a huge upswing, breaking the year-long consolidation below $0.003. The price rise was assisted by a huge influx of liquidity as the trading volume also soared from around $6.2 million to levels above $500 million. Presently, a significant drop in the volume is witnessed due to which the prices have fallen apart, but after a brief consolidation, a notable rebound appears imminent.

After rising consistently for nearly a week, the bulls appear to have drained out, and hence the bears are extracting their profit to some extent. However, the RSI and MACD both are bullish and display a massive accumulation of buying pressure. Therefore, this may keep up the bullish momentum of the crypto and raise the price above $0.01 initially. By the end of the week, the price is expected to trade between $0.0105 to $0.011.

Read More: Monero Price Prediction

Verge Price Prediction for July 2023

Ever since the crypto space witnessed the massive fall of the Terra ecosystem, the XVG price dropped below $0.005, and with the FTX fallout, the price plunged below $0.03. The price has since traded sideways below these levels until a major breakout occurred and triggered a huge upswing beyond $0.01. After marking the yearly highs, the XVG price has dropped slightly but continues to remain under the bullish influence.

The price in the first week manifested a massive jump and hence is believed to remain slightly consolidated for the next few days. Once the bulls regain their strength, the price is believed to trigger a fresh bullish wave. During the last week, the XVG bulls may utilize their accumulated strength to lift the rally above its recent highs and mark new yearly ATH above $0.012 to $0.015

Verge Price Prediction 2023-2024

The year 2023 is believed to ease the impact of the 2022 bear market, and moreover, H2 2023 could mark the resurgence of the bulls. The price has already begun the H2 trade on a bullish note and is believed to maintain a similar trend until the end of the year. However, the bears may intervene and try to restrict the rally, but the bullish momentum could prevent them from doing so. By the end of the year, the XVG price may set up a new ATH for 2023 at around $0.025 and close the trade on a bullish note.

The price may begin the 2024 trade on a bullish note and is believed to maintain a fine upswing throughout the first quarter. After marking the levels close to $0.04, the bears may drag the price lower to close the H1 trade, forming the lows for the year. During the second half of the year, the price is believed to rebound from the bearish trend and head to mark new highs for 2024. By the end of the year, the Verge (XVG) price may trade between $0.085 to $0.1.

XVG Price Prediction 2023-2050

| Year | Verge Price Forecast |

| 2023 | $0.0245 to $0.0255 |

| 2024 | $0.085 to $0.115 |

| 2025 | $0.125 to $0.13 |

| 2026 | $0.078 to $0.082 |

| 2030 | $0.56 to $0.75 |

| 2040 | $1.5 to $1.9 |

| 2050 | $3 to $4 |

Verge Technical Analysis

Source: Tradingview

- The XVG price in the short term is trading within a bullish pattern as it is trading within an ascending triangle.

- The rally is very close to its apex, which may further trigger a bullish breakout beyond the pattern.

- The stochastic RSI has triggered a bullish reversal from support, indicating that the price may also trigger a bullish rebound soon.

- Once the price clears, the major resistance around $0.01 may rise high to mark the new highs around $0.0125.

Additional Read: Bitcoin Price Prediction

Will the Verge Price Rise Again in 2023?

The Verge (XVG) price has maintained a narrow consolidation for over a year and is believed to utilize the accumulated strength. The rally has triggered a huge bullish move, so the trend may remain elevated for the rest of the year. Therefore, while the Verge (XVG) price may experience slight bearish action, the trend may largely remain elevated.

Verge On-chain Analysis Overview

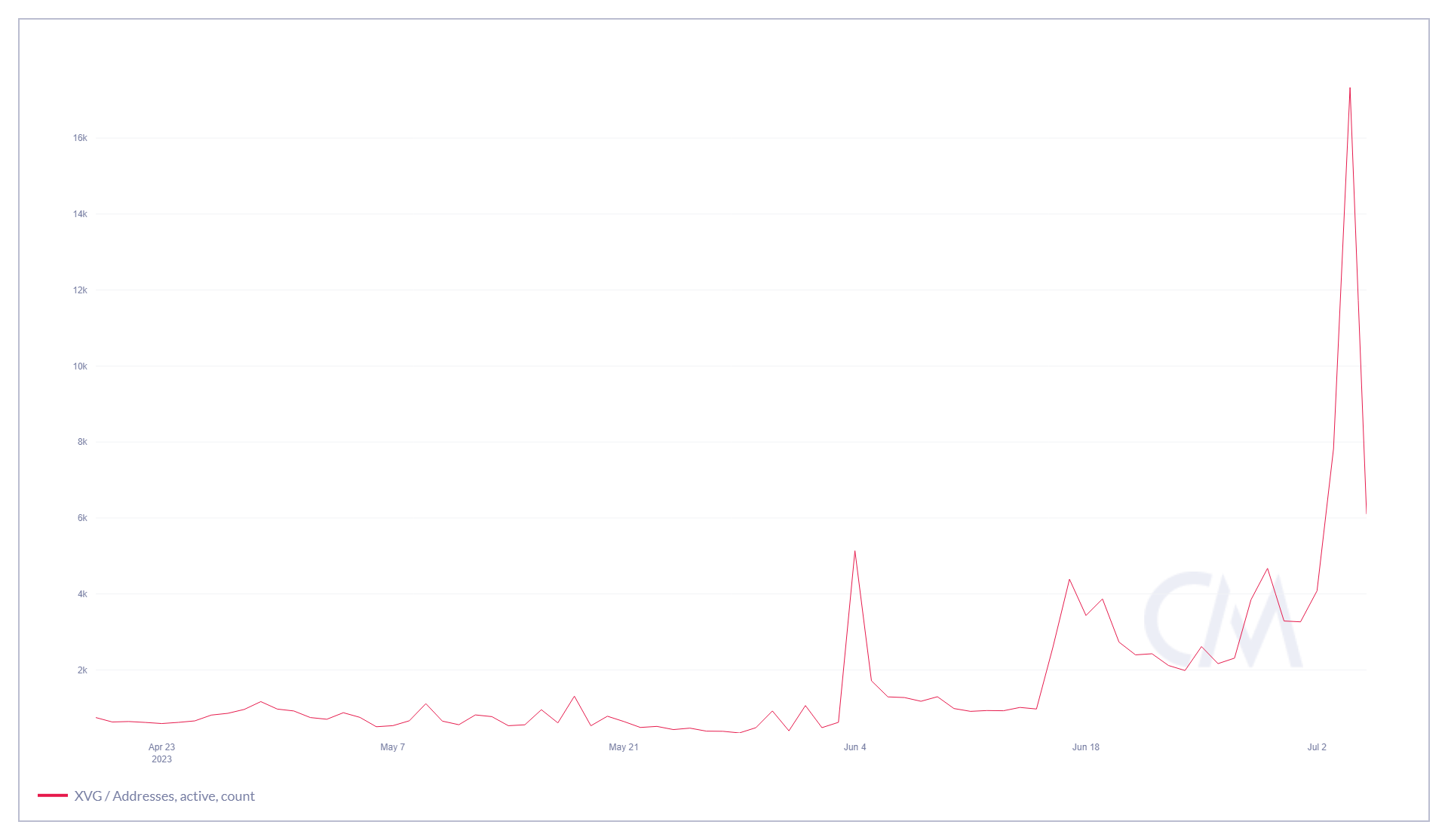

Verge Active Address Count

Source: Coinmetrics.io

The active address count indicates the number of addresses interacting with the platform to perform a trade. The trade may be either buy, sell, or swap address, but each address is considered only once per day regardless of the number of transactions carried out during the period. The rise and drop of the active address count directly impact the price of the crypto as it records the user activity.

The active address count has spiked heavily during the beginning of the monthly trade, due to which the price has undergone a notable spike. The rise in the active address count indicates the increased participation of the traders, which may keep the token volatile.

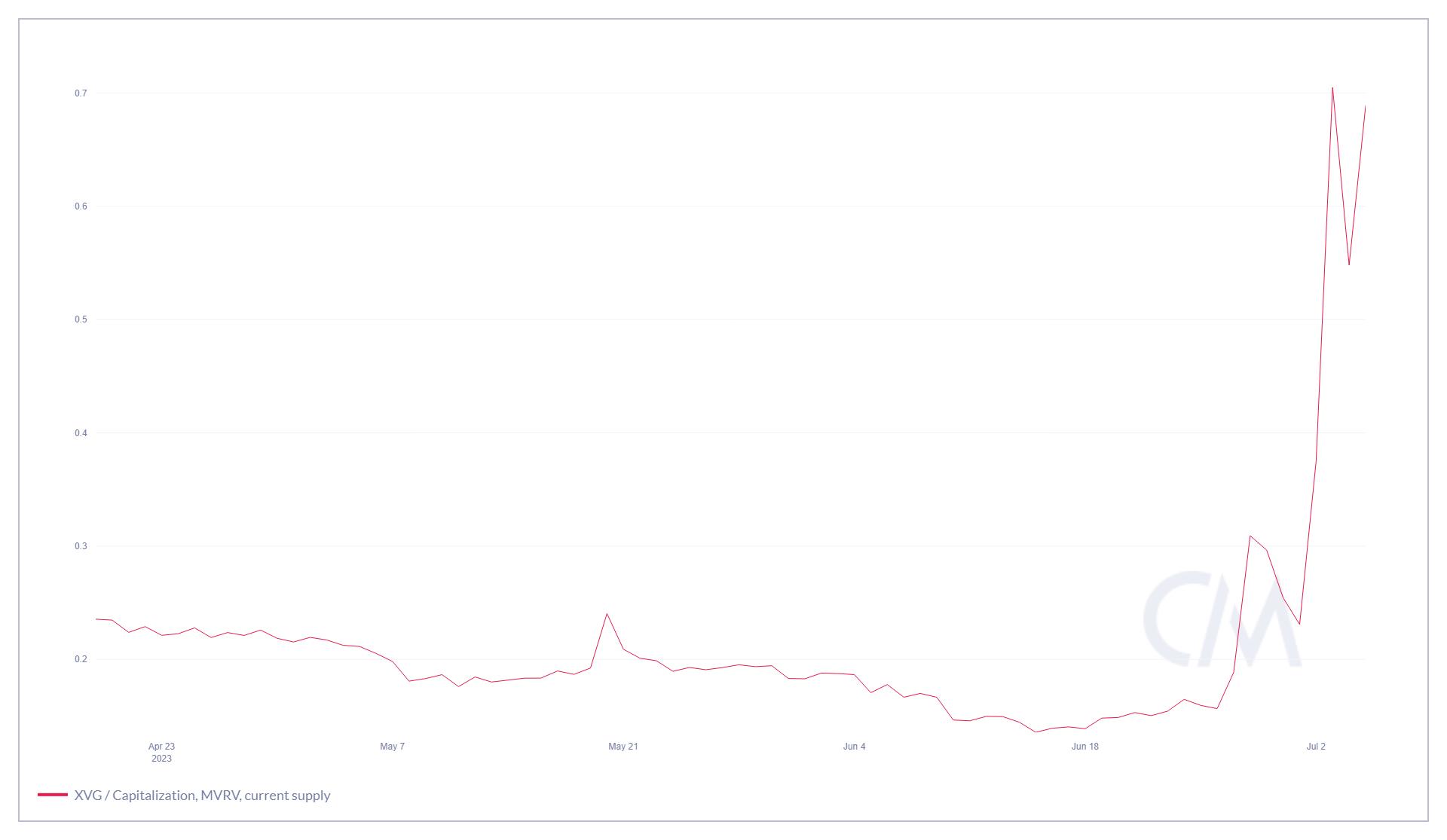

Verge MVRV Ratio

Source: Coinmetrics.io

The MVRV ratio is a comparison between the market capitalization and its realized capitalization to get the fair value of the crypto. This fair value determines whether the current price is undervalued or overvalued. If the ratio soars high, then it can be said that the price is gaining value and hence may be prone to a healthy pullback as the bears may extract some gains to attract new liquidity onto the platform.

Futures Trading on CoinDCX App!

India’s leading crypto exchange, CoinDCX, offers you the best spot and futures trading experience. With cutting-edge trading tools and attractive benefits like low trading fees, etc, future trading with CoinDCX has become simpler and safer. You only need to download the CoinDCX App on your smartphone and register.

FAQs

The XVG price may trade around $0.125 to $0.13 in 2025. The price of 1 XVG could be around $0.56 to $0.75 in 2030. The price is speculated to be bullish in the long term and may also soar high to reach the $1 milestone in future. Verge token has withstood 2021 bullish and also held above the strong support throughout 2022, manifesting its strength. Therefore, with deep research and close price analysis, Verge can be considered as safe investment. The Verge price could trade around $3 to $4 in 2050.What will Verge be worth in 2025?

What will be the price of 1 XVG in 2030?

Will the Verge price ever hit $1?

Is Verge a safe investment?

What will be the Verge price in 2050?

Related posts

Cardano Price Prediction 2024: Can the Chang Upgrade Trigger Rally to $1?

Cardano’s technical strength, and 2024 price predictions analyzed.

Read more

Sui Price Prediction 2024-2030 : Can SUI Price Touch $4 in 2025?

SUI price is struggling hard to lay down a strong bullish trend.

Read more