Ocean Protocol Price Prediction 2023: Can Bull Rise the OCEAN Price Beyond $0.5?

Ocean Protocol has the potential to increase in value over the next few years. Factors such as increasing adoption, major partnerships, and the development of new features could all contribute to an increase in the OCEAN price beyond $0.5 in 2023.

Table of Contents

ToggleKey Takeaways:

- Ocean Protocol is heading to close the monthly trade on a bullish note by maintaining a consistent surge since the beginning of the current month

- The accumulated bullish momentum may enable the price to maintain a strong bullish trend for an extended period to reach the desired target of $1

- The supply on exchanges has dried while the addresses communicating with the platform intensifies that suggest the user interaction and their interest is swelling

Additional Read: The Sandbox Price Prediction

| Price | $0.38 |

| 24H Price Change | +0.25% |

| 7D Price Change | +22.1% |

| MarketCap | $165.72 million |

| Circulating Supply | 613.09 million |

| Trading Volume | $42.59 million |

| ATH | $1.94 |

| ATL | $0.013 |

Ocean Protocol Price History

- Ocean Protocol was founded in 2017 and began to trade in during Q4 2019 and maintained a stagnant trend below $0.05 until the end.

- The volatility slightly increased since the beginning of 2020 and raised to form a new ATH at $0.5 by mid but close the yearly trade at around $0.33

- The OCEAN price quickly gained immense bullish momentum since the start of 2021 and ignited a bull run to mark new highs around $1.7 in April but quickly dropped to $0.35 and closed the yearly trade an inch short of $1

- Woefully, the price began to drop heavily with the beginning of 2022 and continued till the end marking the bottom at around $0.12 but regained bullish momentum with the beginning of 2023 and raised close to 150%

Ocean Protocol Technical Analysis

Source: Tradingview

- The OCEAN price began to rise with the start of 2023 as the volatility rise notably with a notable rise in the trading volume

- The price maintained its trend within a rising parallel channel and appears to have ignited a rebound just before testing the lower support

- The bulls appear to have accelerated but also facing a notable bearish action due to which the trend remains compressed between a narrow range

- Presently, the trading volume has slashed drastically due to which the trend may remained capped below the average ranges of the channel for the next few weeks

- However, after undergoing minor consolidation around these levels, the price may breakout and rise towards the resistance, piercing through the average levels ahead

Overview of Ocean Protocol On-chain Analysis:

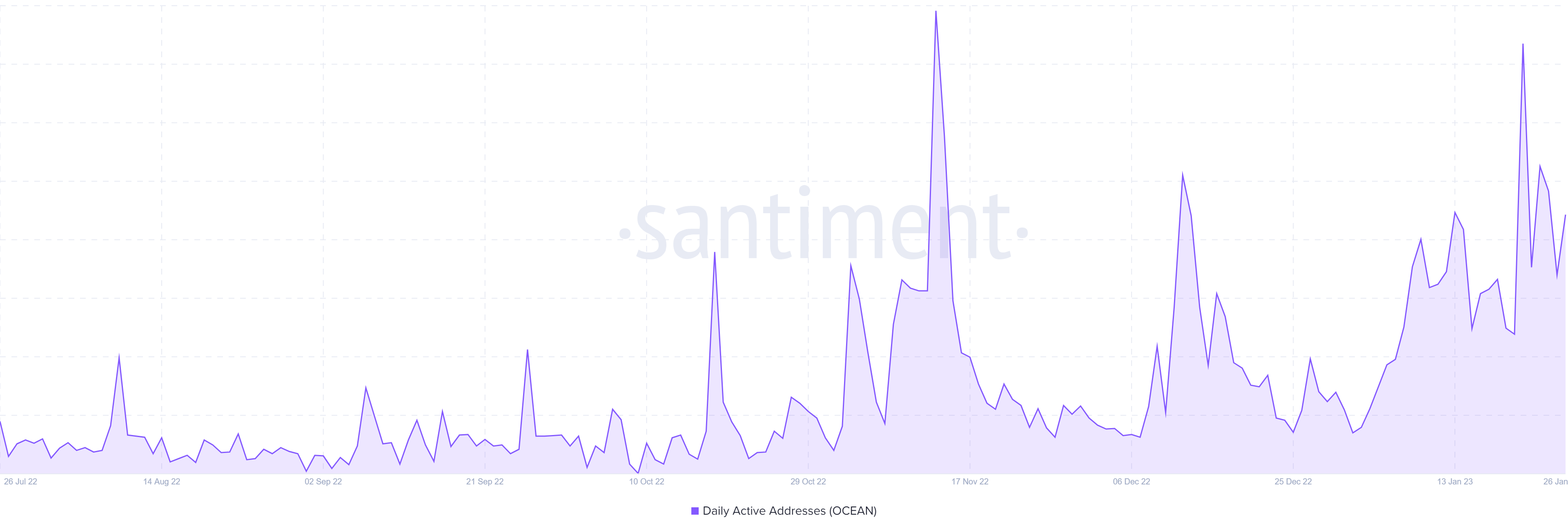

Ocean Protocol Daily Active Address

Source: Santiment

The daily active addresses(DAA) are the number of addresses communicate with the platform on daily basis. It is the number of addresses that perform trade on the platform regardless of whether the trade is buy, sell or a swap. Each addresses is considered only once per day and the a drop in the metrics indicates a shift of focus of the traders on other platforms.

The DAA levels have been extremely volatile from the last few months of 2022 that surged close to 1000. However, it also dropped below 200 for sometime, but eventually regained the levels close 900. The growth in the DAA levels indicates the traders intensifying their activity over the platform, due to which the volatility could surge, impacting the price on a positive note.

Read More: Ethereum Shanghai Upgrade Sceduled

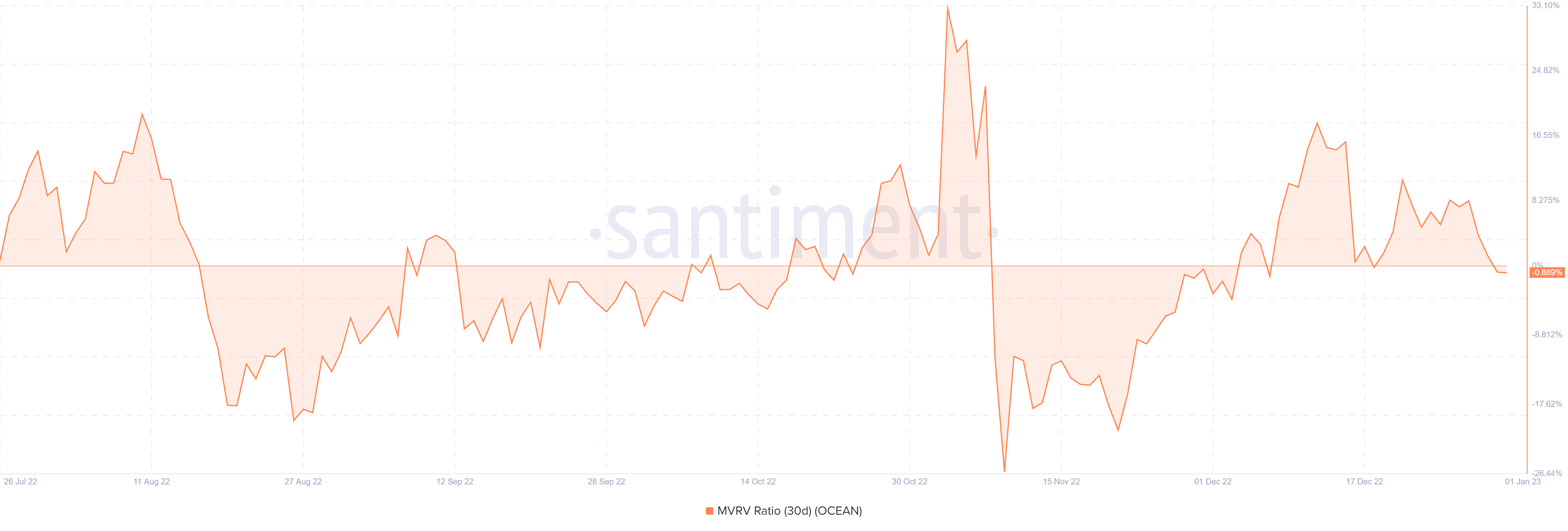

Ocean Protocol MVRV Ratio (30D)

Source: Santiment

The average price of the token determines whether the current price is undervalued or overvalued. The MVRV ratio is the comparison between the realised price and the market price to determine the current position of the price trend. If the MVRV levels hover within the positive ranges, it indicates the traders are willing to sell and extract their profits.

The MVRV ratio of Ocean Protocol had been trading below the average levels for quiet a long time until the volatility kicked-in. Since then the levels have been testing extreme support and resistance levels at -26.5% and +18.15% respectively. Woefully, the MVRV ratio has dropped and dropped below the average levels indicating the traders extracting their profit after the asset being overvalued for an extended period.

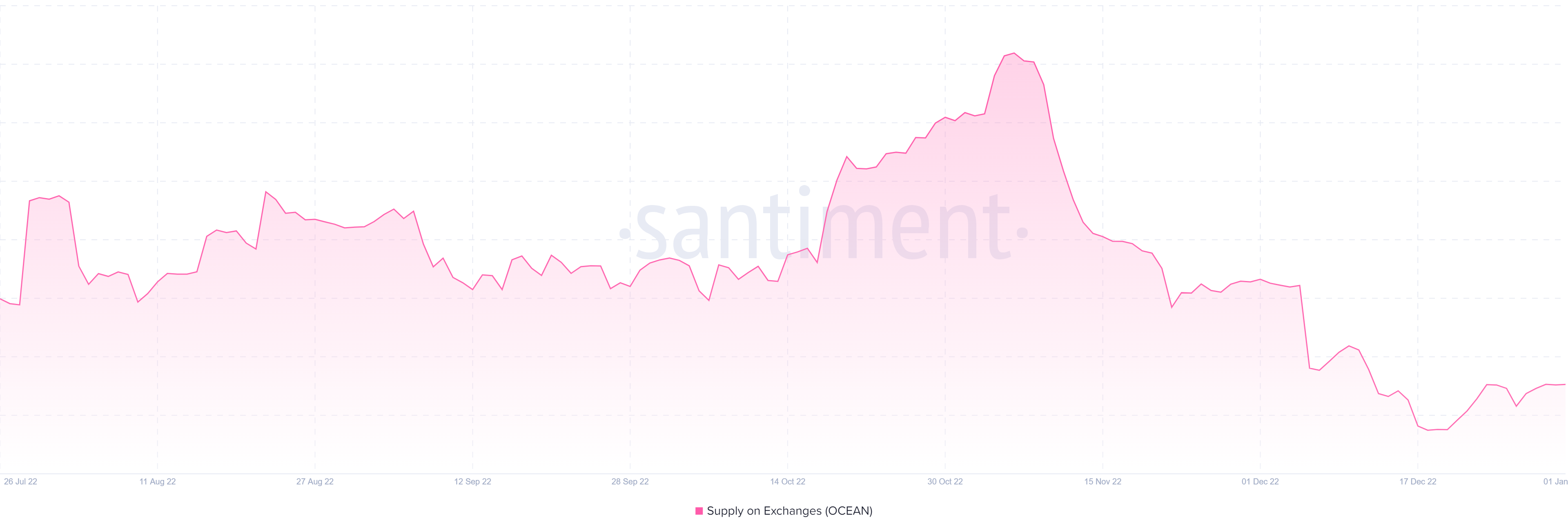

Ocean Protocol Supply on Exchanges

Source: Santiment

The supply on exchanges indicates the number of tokens being held by them on their wallets. It usually marks the sentiments of the market participants as they tend to transfer their tokens back to the exchanges when they feel to sell them or swap them. This is when the supply on the exchanges spikes high to mark the highest levels.

However, the supply has dropped heavily in since the mid-December, flashing bullish signals as the investors now believe in long-term hold. The tokens are been transferred away from the exchanges and could be held in their own wallet. This could induce significant bullish momentum and uplift the price soon.

Ocean Protocol Price Prediction for 2023

The year 2023 has began with a ray of hope as the entire crypto space including Ocean Protocol had been enduring extreme bearish trend that compelled to shed off nearly 90% of the value. The price has been maintaining a steep upswing ever since the beginning of the year and expected to maintain a notable upswing ahead.

The price which is trading around $0.35 currently, is believed to rise high in the coming days and close the Q1 trade around $0.5. After withstanding some bearish actions, the price is believed to resume with an upswing by the end of Q3. The Q4 trade may gain extensive bullish momentum as the crypto space could be at the foothill of the upcoming bull run and close the yearly trade around $0.8 to $0.85.

Ocean Protocol Price Prediction for 2024

The bullish momentum is expected to rise the price levels since the beginning of 2024 and quickly attain the much awaited target at $1. The buying pressure could have accumulated and hence the bears may certainly not drag the price lower then. Therefore, the OCEAN price may end the Q1 trade around $1.2 and further maintaining a decent upswing may close the H1 trade between $1.35 to $1.42.

Moving ahead, the second half is believed to be largely bullish which may even flash the possibility of a bull run. If this materializes, then the price may rise beyond the current highs close to $2. By the end of Q3, the price may form new ATH at $2.2 and witness a minor pullback. By the end of 2024, the price may resume with a steep upswing and secure levels around $2.5.

Ocean Protocol PRICE PREDICTION 2025-2030

After undergoing a steep upswing throughout 2024, the year 2025 could be consolidated. The price may witness a minor pullback that could drag the price below $2. Moreover, the descending trend may even ignite a bearish market that could prevail during Q1 & Q2 2026. Further, the markets may rejuvenised and the bulls may gain significant strength and begin to rise. By the end of 2026, the bulls may gain uplift the price and may spark a notable upswing that may turn into a bull run in 2027.

The price is believed to rise and mark new highs in 2027 close to $5 or higher and may even sustain beyond these levels for a while. However, after achieving some milestone, the price may be compelled to enter a bear market until the end of 2028. The year 2029, may remain largely consolidated and by the end of 2030, the OCEAN price may trade close to $6.89 to $7.65.

| Year | Ocean Protocol Price Forecast |

| 2023 | $0.8 yto $0.85 |

| 2024 | $2.5 to $2.65 |

| 2025 | $5.2 to $5.7 |

Should you invest in Ocean Protocol in 2023?

Ocean protocol has been trading under acute price compression from quiet a long time and hence is believed to explode, once the market sentiments turn completely in favour of bulls. However, the volume has intensified since the beginning of 2023 that indicates the change in the market sentiments. Before investing in OCEAN or any other crypto, a deep research on the project, the team, its future vision, etc is very important. Alongside, a close observation on the price movements is also a must to determine entry & exit points.

FAQs

Ocean Protocol is believed to range between $0.8 to $0.85 by the ned of 2023 The price of 1 OCEAN is believed to hover between $6.75 to $7.5. Ocean Protocol appears to be extremely bullish in nature in the long term and after achieving $7 in 2030, may secure a double digit figure in the future. Ocean Protocol has been maintaining above the crucial support, each time the price faces a bearish action. Therefore, it can be considered as a safe investment, provided one has carried intensive research and close observation on market trends. What will Ocean Protocol be worth in 2023?

What will be the price of 1 Ocean Protocol in 2030?

Will Ocean Protocol ever hit $10?

Is Ocean Protocol a safe investment?

Related posts

Cardano Price Prediction 2024: Can the Chang Upgrade Trigger Rally to $1?

Cardano’s technical strength, and 2024 price predictions analyzed.

Read more

Sui Price Prediction 2024-2030 : Can SUI Price Touch $4 in 2025?

SUI price is struggling hard to lay down a strong bullish trend.

Read more