Table of Contents

ToggleKey Takeaways:

- The GNS price has been bearish since its inception, while the fresh descending trend may drag the price lower in the coming days

- The bulls appear to be weak at the moment which may impact the price movement and may even test the interim support

- The GNS price ha extended its volatility in recent times which may further impact the price positively

| Price | $6.91 |

| 24H Price Change | -4.55% |

| 7D Price Change | -22.7% |

| MarketCap | $210.6 million |

| Circulating Supply | 30.45 million |

| Trading Volume | $18.37 million |

| ATH | $12.45 |

| ATL | $0.259 |

Gains Network Price History

- Gains Network is one of the popular decentralized leveraging platforms that began its trade during the NFT boom in Q4 2021

- The price began its trade under the bearish influence marking the bottom and quickly rose high at the beginning of 2022

- However, multiple events compelled the price to slash further but a rebound that sparked during the second half of 2022 raised high

- The price at the beginning of 2023 ignited a fine upswing and soared high to hit the ATH above $12.

- However, the price has experienced a notable price plunge but holding above the support levels, which signals the revival of a bullish trend soon

Read More: Drep Price Prediction

Gains Network Technical Analysis

Source: Tradingview

- The price has been trading within an ascending triangle since the beginning of 2023 and has faced a couple of rejections from the resistance

- However, the price has ignited a rebound from the support before and it is trying to ignite a similar rebound presently

- Woefully, the RSI is heading towards the south and hence the price is believed to breakdown the lower support for a while

- Meanwhile, a rebound may kick-in that may lift the price back again within the ascending triangle which may further head to reach the edge of the consolidation to spark a fine upturned ahead

Overview of Gains NetworkOn-chain Analysis:

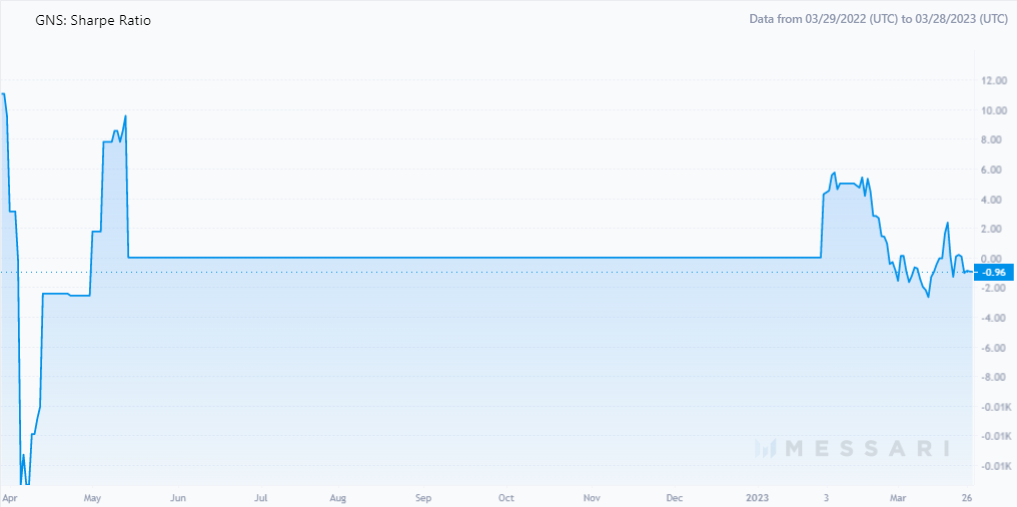

Gains Network Sharpe Ratio

Source: Messari.io

Sharpe ratio is one of the most widely used methods to determine the risk-adjusted relative returns. It compares the fund’s returns to its investment to the actual returns expected. In short, it describes whether the investment is attracting returns or it is a very risky investment. A good sharpe ratio is considered to be above 1 that offers excess returns relative to volatility.

However, in case of Gains Network, the sharpe ratio has dropped below 1 indicating the investment is involving significant risks. The ratio remained stagnant at 0 for quiet a long time and began varying with the beginning of 2023.

Additional Read: Ethereum Price Prediction 2023

Gains Network Volatility

Source: Messari.io

The volatility of a crypto is nothing but the price variation of the token which directly impacts the price as it indicates the level of participation of the market participants. If the volatility increases, then it indicates that more traders are active over the platform carrying out either buy/sell or swap trade. Meanwhile, a drop in the volatility indicates the loss of interest among the investors over the crypto.

The volatility was almost nil and traded flat for quite a long time throughout 2022. However, with the beginning of 2023, the volatility rate shot up suddenly and soared high to hit 1.45 in no time. Although, the levels have dropped a little, yet remain within the positive ranges, impacting the price on a positive note.

Gains Network Price Prediction for 2023

Gains network has remained largely stagnant throughout the year 2022 with less volatility as the price maintained a trend within $2.5 to $4.5. However, with the beginning of 2023, the volatility soared extremely high, uplifting the price beyond a double digit figure within some days. Although the price is facing bearish action, it continues to remain within bullish ranges that may further impact the price positively.

The price is on the verge to rebound from the lower support and end the Q1 trade on a bullish note. Further, maintaining a notable upswing, the price may regain the levels beyond $10 by the end of H1 2023. During the second half of 2023, the price may intensify its upswing which may further lift the price beyond $14 to $15. By the end of the year, the price may witness minor bearish action but close the trade around $16 to $20.

Gains Network Price Prediction for 2024

With a bullish close of the year 2023, the token is believed to carry a similar momentum since the beginning of 2024. The price could rather intensify its upswing after maintaining a low-key trend in the first few months of the year. By the end of Q2 2024, the upswing is expected to transform into a bull rally which may rise beyond $27.

The upswing could later transform into a bull rally during the second half of 2024 where the levels may rise high to reach $35 by the end of Q3 trade. The final quarter could display a monstrous rally with the price levels soaring beyond $50 in no time. Meanwhile, the bears appear to have held a tight grip at these levels, attracting the bears to perform their task ahead.

Gains Network Price Prediction 2025-2030

After marking the highs above $50, the bulls may attempt hard to sustain above these levels for a while in 2025 but the acute bearish action may begin, dropping the levels by 20% to 25%. The bearish market may kick-in and prevail throughout 2026 to mark the bottoms below 60% from its highs. The year 2027 may witness a slight relief from the bear market as a decent recovery may kick-in.

Meanwhile, the price may further begin a giant price action in 2028 which may further transform into a healthy bull market by the end. The price may maintain a giant upswing throughout 2029 indicating the revival of a bull rally and surge high to form new highs. However, after a giant price action, the bulls tend to drain out, inviting the bears who may extract huge profit and shed massive gains throughout 2030.

| Year | Gains NetworkPrice Forecast |

| 2023 | $16 to $20 |

| 2024 | $48 to $52 |

| 2025 | $42 to $45 |

Should you invest in Gains Network in 2023?

Gains network remained largely stagnant since its inception and has been displaying a larger price action since the beginning of 2023. The price is believed to maintain a fine upswing ahead and may offer a good return on the investment. However, before investing, a deep research on the core fundamentals, the team and the future vision of the project is very important. Additionally, a close observation on the price movements may help in better risk management.

FAQs

The Gains Network may reach around $15 to $18 by the end of 2023. The price of 1 GNS may be around $65 to $70 in 2030 Gains Network is believed to soar high in the coming days and reach levels beyond $75. However, in the coming years, the price may even reach beyond $100. The Gains network has increased its volatility of-let and displayed a giant price action and hence with proper research and observation, it may be considered as a safe investment option .What will Gains Network be worth in 2023?

What will be the price of 1 Gains Network in 2030?

Will the Gains network ever hit $100?

Is Gains Network a safe investment?

Related posts

Cardano Price Prediction 2024: Can the Chang Upgrade Trigger Rally to $1?

Cardano’s technical strength, and 2024 price predictions analyzed.

Read more

Sui Price Prediction 2024-2030 : Can SUI Price Touch $4 in 2025?

SUI price is struggling hard to lay down a strong bullish trend.

Read more