Table of Contents

ToggleKey Takeaways:

- After the steep fall, the Decentraland price is consolidating within a very narrow range as the bullish volume fades up.

- The bears continue to supersede the bulls, which may prevent the price from undergoing a bullish divergence.

- The drop in the user and whale activity suggests the bearish clouds hover over the MANA price for a long time.

Decentraland Overview as of 16 June 2023

| Decentraland (MANA) Price | $0.33 |

| 24-Hour Price Change | +0.18% |

| 7D Price Change | =20.1% |

| Market Capitalization | $624.93 million |

| Circulating Supply | 1.87 billion |

| Trading Volume | $35.48 million |

| All-Time High (ATH) | $5.9 |

| All-Time Low (ATL) | $0.0078 |

| Fear-Greed Index | 47 (Neutral) |

| Sentiment | Bearish |

| Volatility | 12.72% |

| Green Days | 12/30 (40%) |

MANA Price Forecast for this Week

The Decentraland price has been trading within a descending trend since the beginning of the current week. The token continued to drop as the broader market condition became uncertain due to multiple external factors. This drove the price to mark the lows for the year close to $0.3. Presently, the bulls are trying to halt the bearish actions but lack the momentum required to pierce through the interim resistance.

The technicals have become largely bearish, which suggests the price may soon begin a fresh descending trend. However, some possibilities of a rebound may be expected, and it may certainly be weaker than expected and prone to get rejected. Therefore, the Decentraland price prediction for the week continues to be uncertain as the bulls and the bears display passive behavior at the moment.

Read More: The Sandbox Price Prediction

Decentraland Price Prediction for June 2023

Ever since the markets rose in the first few weeks of 2023, the bears have successfully driven the price lower every month. The MANA price also began the June trade on a bearish note, withstanding a plunge of nearly 40%. The price, however, is believed to undergo a quick rebound, but the mounting bearish pressure may not allow it to do so. Hence, the trend is expected to remain consolidated in a very narrow region.

An extended consolidation usually triggers massive price action, which depends mainly on the volume of the token. The volume has been slashed heavily by close to $10 million, which may further reduce the volatility. Hence, the MANA price may be negatively impacted as the bulls may remain off-the-shore for a longer time. Therefore, by the end of the month, the Decentraland price may trade around $0.5 to $0.65, if the bearish action clams down.

Decentraland Price Prediction 2023-2024

After the bull and bear markets in the recent past, the year 2023 was believed to be largely consolidated. Although the bulls made every effort to keep up the momentum of the rally, the bears continued to hold their dominance over the rally. Hence, the price is believed to close the H1 trade on a bearish note. However, during the second half of 2023, market conditions are expected to ease, which may raise the levels to $0.75 to $0.95 by the end of the year. An extreme bullish push may lift the price above $1 too.

The price is believed to maintain a healthy upswing since the start of 2024 and sustain above the major resistance at $1.09. The rally may further rise beyond $1.6 and may encounter beamish action during the second quarter. However, the bulls may quickly jump in and trigger a significant rebound. The upswing may further transform into a bull run during the second half of 2024 and soar beyond the current ATH to form a new one above $5.

MANA Price Prediction 2023-2050

| YEAR | Decentraland Price Forecast |

| 2023 | $0.85 to $0.92 |

| 2024 | $6.5 to $8.8 |

| 2025 | $8.2 to $9.5 |

| 2026 | $7.5 to $7.7 |

| 2030 | $15 to $20 |

| 2040 | $25 to $28 |

| 2050 | $45 to $50 |

Decentraland Technical Analysis

Source: Tradingview

- Ever since the beginning of the year, the MANA price has been trading within a decisive symmetrical triangle

- The recent drop has dragged the price lower and close to the crucial support zone between $0.27 to $0.29

- The technicals continue to remain bullish as RSI is trading at the ground levels, while MACD flashed an accumulated selling pressure, hence flashing bearish flags for the crypto in the short term

- Therefore, the MANA price could test the lower support and trigger a rebound to reach the first target at $0.352, later at $0.42 which may pave the way for the crypto to reach beyond $0.52 quickly.

Will Decentraland Price Drop Again in 2023?

The Decentraland price has been trading in extreme bearish conditions, reaching its lowest levels in history. Even if the price continues to fall to new lows, it may be followed by a spectacular rebound that quickly recovers the losses. Therefore, the MANA price may eventually rise and maintain a healthy upswing for the rest of 2023.

Additional Read: Gala Price Prediction

Decentraland On-Chain Analysis Overview

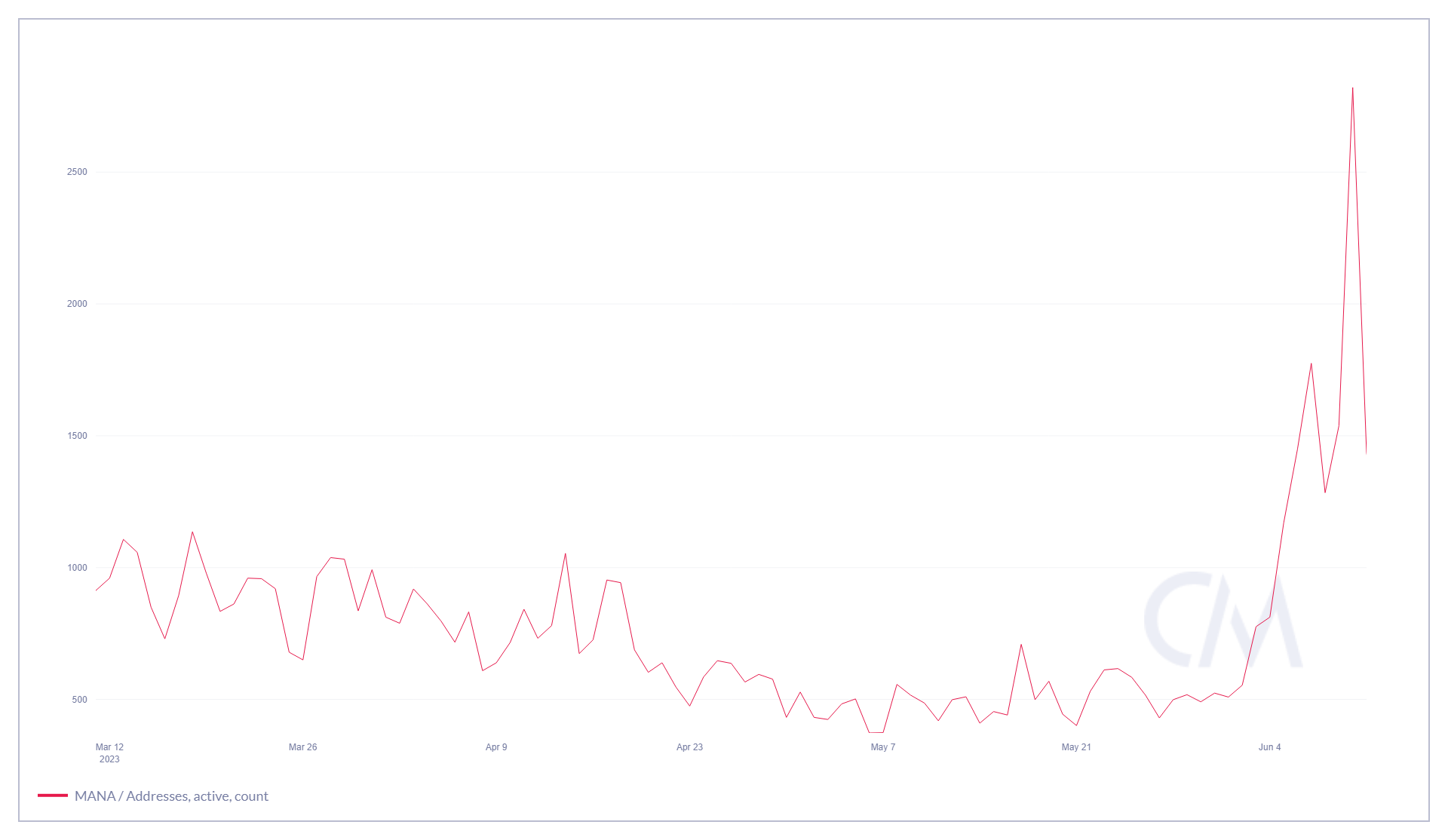

Decentraland Daily Active Address

Source: Coinmetrics.io

- The active address count indicates the number of addresses interacting with the platform to perform a trade, regardless of whether it is a buy, a sell, or a swap trade

- The rise or drop in the active address levels directly impacts the value of the crypto as it determines the user activity over the platform.

- Presently, the DAA levels are dropping after soaring high to mark levels around 2821. The active address count is currently hovering around 1435 and heading towards the south, indicating a huge drop in the coming days

Decentraland Supply in Top 100 Addresses

Source: Santiment

- The supply in the top 100 addresses can also be considered as whale addresses as they hold nearly 1% of the circulation

- The rise and drop of the levels may not directly impact the price but may certainly impact the sentiments of the traders in the long term

- The supply has dropped from a high of around 1.59 billion to the current level of $1.57 billion, indicating that these top addresses may have liquidated some of their holdings

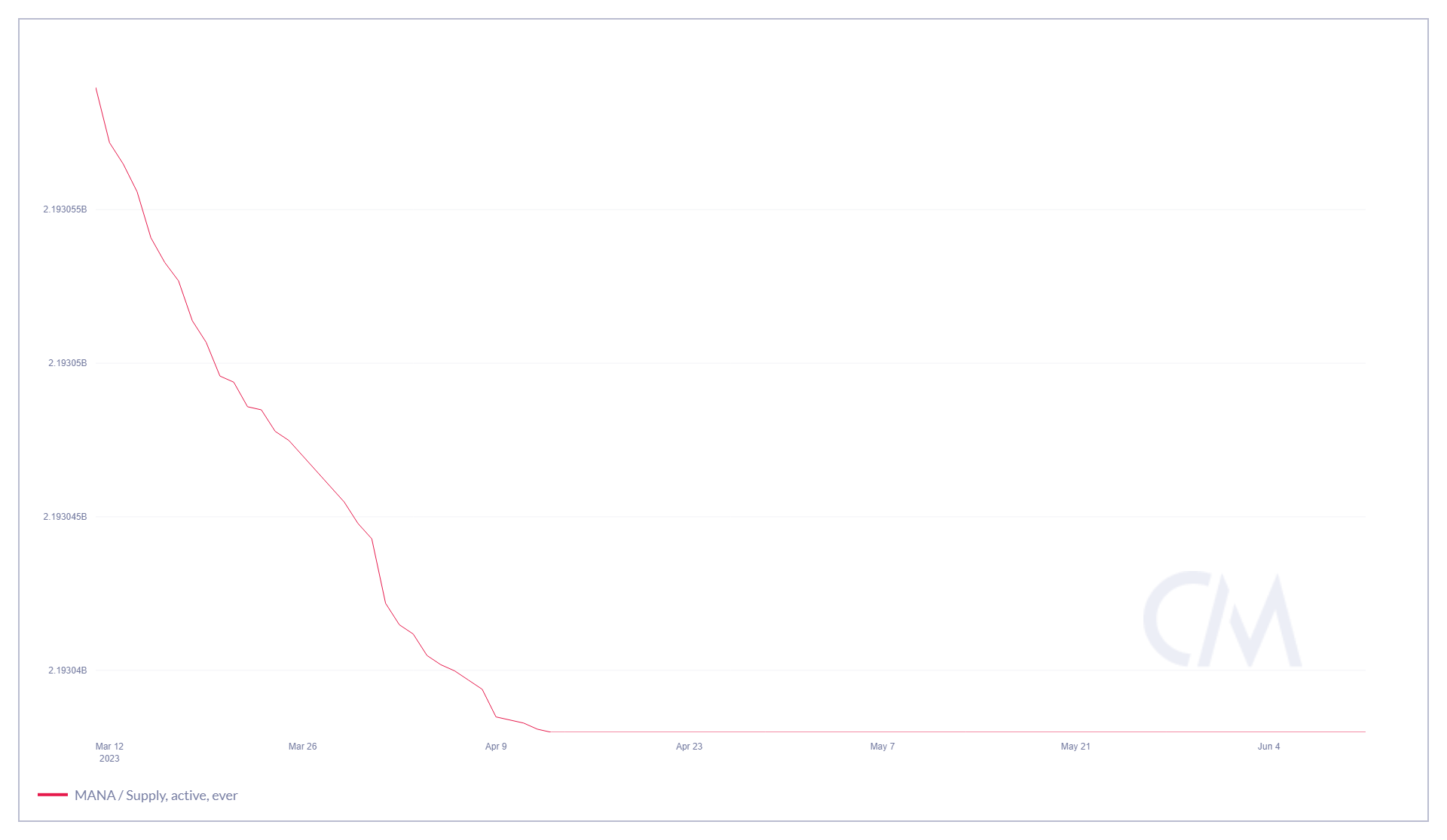

Decentraland Supply Active Ever

Source: Santiment

- The supply active ever indicates the address count that has performed the trade for the very first time

- It may also be considered as the number of new addresses created in the past 24 hours which sheds light on the adoption of the crypto

- Unfortunately, the levels have grounded from the past few months that indicate that no significant amount of new addresses is adding up, reducing the adoption of the platform.

Futures Trading on the CoinDCX app!

Crypto future trading is tedious, risky, etc, which involves acute planning, strategies, proper execution, etc. Hence, many appear to be a daunting task to accomplish. Future trading with CoinDCX offers attractive features and lucrative benefits that may make your trade easy and effective. Along with this, CoinDCX also offers many features like cutting-edge trading tools with up to 20x leverage, etc., and many more.

Therefore, download the CoinDCX app and register now!

FAQs

What will Decentraland be worth in 2025?

The Decentraland price may hover around $8.2 to $9.5 in 2025.

What will be the price of 1 MANA in 2030?

The price of 1 MANA in 2030 could be around $15 to $20.

Will the Decentraland price ever hit $100?

The larger market forecast is largely bullish, and hence the MANA price is believed to achieve the desired target of $100 in the future.

Is Decentraland a safe investment?

The Decentraland price has displayed acute strength a couple of times by soaring by a huge margin and withstanding bearish pressures. Therefore, Decentraland can be considered a safe investment if detailed research and deep analysis are carried out.

What will be the Decentraland price in 2050?

The price of MANA in 2050 could be around $50.

Related posts

Cardano Price Prediction 2024: Can the Chang Upgrade Trigger Rally to $1?

Cardano’s technical strength, and 2024 price predictions analyzed.

Read more

Sui Price Prediction 2024-2030 : Can SUI Price Touch $4 in 2025?

SUI price is struggling hard to lay down a strong bullish trend.

Read more