Table of Contents

ToggleKey Takeaways

- Bitcoin is currently trading around $30,000 and has been for the past few days with depleted volatility.

- The bulls and the bears remain still, so the price is failing to rise above the resistance or drop below the crucial support.

- Although technicals are flashing bullish signals, the price may continue to linger around $30,000 for a while.

Bitcoin Price Action

Bitcoin price action has been bullish since the beginning of the year after being largely bearish throughout 2022. The price reached its lowest level, triggered a rebound, and surged by more than 90% to reach a level of nearly $31,500. The price has been stuck around $30,000 for weeks and is not displaying any possibility of a bullish breakout. The price previously constantly tested the upper resistance zone between $31,055 and $31,652 but failed to clear. This drained the bulls, and the price dropped below $30,300, which kept the price consolidated within a range.

Additional Read: Bitcoin Price Prediction

Market sentiments

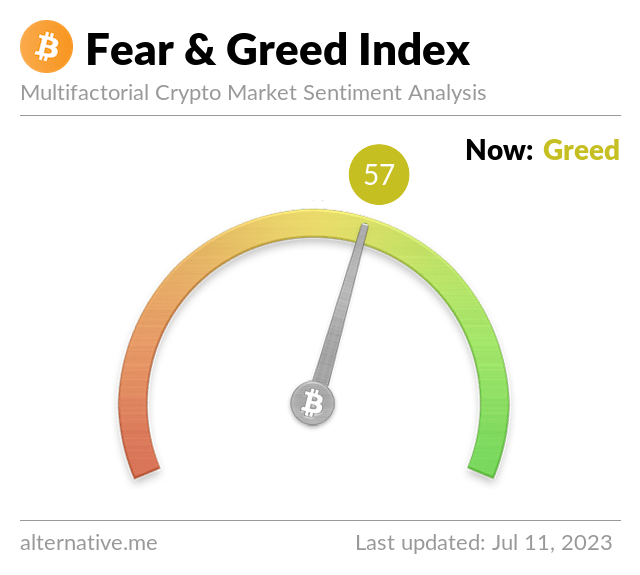

The market sentiments often change as per the price movements of Bitcoin. If the price is maintaining a huge upswing after a bullish breakout, the sentiments usually flip from bearish to bullish or neutral to bullish and flip to bearish in the other way. The market sentiments is analyzed based of the Fear and Greed Index, which is currently pointing at 56 (Greed)

The more the levels are in green or above 50, it indicates the market participants are bullish over crypto; hence their greed is increasing. Conversely, if the levels drop below 40 into the red zone, then the sentiments of the traders are said to be bearish as they fear the next price action.

Technical analysis and key levels

Source: Tradingview

- The Bitcoin price is trying to breach the descending triangle’s resistance as the buying pressure intensifies in the short term.

- During the previous attempt, the price failed to break the bearish pattern, which led to a significant drop toward the support zone.

- A similar trend may drag the price lower toward support if the price faces rejection from the current levels.

- In an extended bearish case, a notable plunge may drag the price below the support zone, marking new lows for the month at around $29,500.

Read On: How Often does Bitcoin Price Fluctuates

Impacts of news and events

The Bitcoin price has been largely impacted by external events ever since the Terra Ecosystem collapsed in May 2022. Since then, the adoption by large institutions has led to a major spike in the BTC price, and the regulatory updates and crackdown have dragged the levels lower. Besides, events like FOMC meetings, CPI rates, the strength of the DXY Index, etc., and many more have been influencing the BTC price.

Alongside this, one of the major events that may impact the BTC price is the upcoming halving event. Bitcoin halving, where-in the miner’s rewards will be halved every four months, is scheduled to take place in April 2024. The BTC price after each halving has triggered a massive bull run to mark a new ATH in the next 12 to 16 months. Therefore, is the previous action repeats, the price is believed to mark a new ATH somewhere in the last few months of 2025.

Read More: Bitcoin Halving in 2024

Conclusion

Bitcoin price movement can be considered the backbone of the entire crypto market, as the majority of the top tokens follow the dominant crypto very closely. Now that the BTC price is lingering around the $30,000 price zone, the altcoins are also experiencing a consolidated trend. Therefore, the BTC price is believed to explode after reaching the apex of the ongoing compression, which may lift the entire crypto space very soon.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more