Table of Contents

ToggleIntroduction

Crypto wallets represent a fundamental prerequisite for engaging in the buying, selling, and storage of crypto. Venturing into the realm of crypto without a crypto wallet is inconceivable. However, it’s important to recognize the array of crypto wallet types available, each catering to unique requirements.

Multisignature wallets address a critical concern for crypto owners – security.

Security considerations in the realm of crypto predominantly revolve around security protocols and the safeguarding of crypto wallets. Any vulnerabilities in the protocols underpinning crypto or flaws in crypto wallets pose a potential risk to your valuable digital assets.

The multisig wallet emerges as a viable solution to security challenges. Explore the workings of multisignature wallets in the following paragraphs.

Multisignature Wallet: An Overview

Simply put, multi-signature (multi-sig) crypto wallets require approval from two or more individuals for outgoing transactions, bolstering security against digital asset theft. While ideal for businesses or joint holdings, the setup can be technically complex, and many individuals may find it unnecessary. These wallets involve multiple signatures, each linked to distinct private keys, with a set threshold required for transaction validation.

The operational process remains consistent, allowing any participant to initiate a transaction by signing with their private key, but it stays pending until others sign.

Multisig wallets may use N-of-N or N-of-M configurations, like the 2-of-2 method or a 3-of-4 setup, each requiring specific validations.

It’s crucial to distribute multisig private key access among entities to avoid a single security breach leading to the loss of multiple keys. Blockchains support multi-signature wallets, and exchanges employ them, enhancing security by storing keys in diverse locations.

Read On: What is Metadata in Blockchain Transactions?

Key features of a Multi-Signature Wallet

The discussion on “What is multisig in crypto?” should highlight key features, starting with the requirement for multiple private keys to authorize crypto transactions.

Types of Multi-Signature Wallets

An exhaustive overview of multisignature wallets requires a discussion of the various types available, distinguished by the current number of private keys within the wallet. The type of multisignature crypto wallet is also determined by the critical factor of the number of signatures necessary to authorize transactions. Here are the common types prevalent today:

2-of-2 Multisig Wallets:

- Rely on two-factor authentication, with private keys stored on different devices.

- For example, one key on a computer and another on a mobile device.

- Transactions can be authorized without signatures from both devices, enhancing security.

- However, there is a higher risk of losing access to funds if either device is compromised.

1-of-2 Multisig Wallets:

- Facilitate sharing funds among multiple users.

- Allows any of the two private keys to generate the signature, eliminating the need for both keys for wallet operation.

- Enables each party to access funds independently without requiring intervention from the other.

2-of-3 Multisig Wallets:

- Require two out of three private keys to authorize transactions.

- Ideal for exchanges seeking enhanced security for hot wallets.

- Enhances security functionalities for exchanges by distributing private key storage.

- The exchange maintains one key online, another on an isolated physical device, and assigns storage of the third key to a security company.

- This setup ensures better security by involving multiple entities, making multisig wallets a safe option.

Moreover, the offline backup further reinforces security for the hot wallet, providing additional protection if the security partner becomes inactive. This multifaceted approach answers concerns about the safety of multisig wallets effectively.

Learn More: What are Blockchain Intents?

How Does a Multi-Signature Wallet Work?

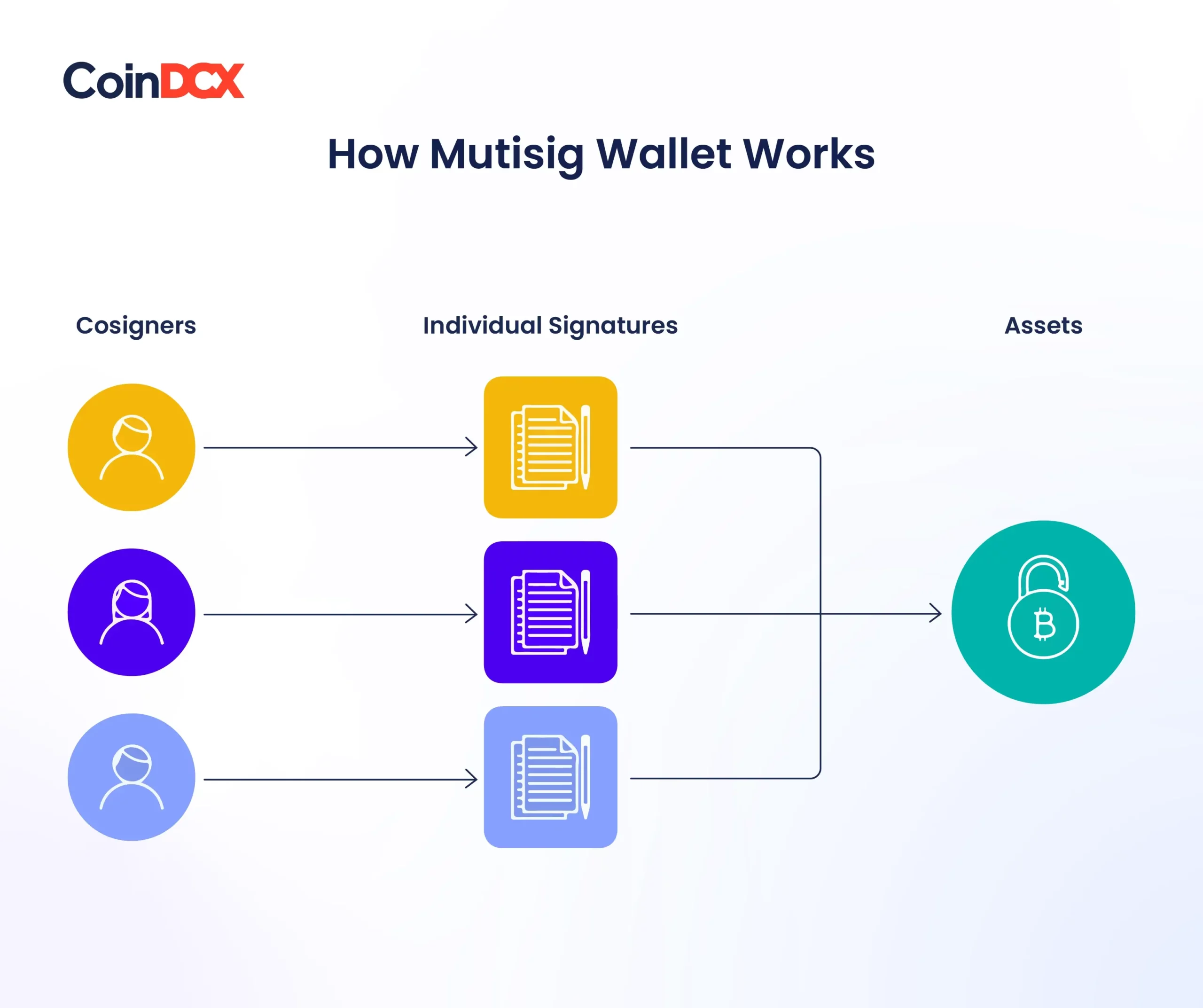

When establishing a multisig wallet, whether through an exchange or self-custody, it’s essential to generate a unique multisignature address associated with the wallet for fund reception. To initiate a transaction from such a wallet, a specified number of co-signers must sign the transaction, exemplified by needing two out of three private keys for authorization in a two-of-three multisig setup.

Source: CoinGecko

For fund transfers from the multisig wallet, involved parties collaboratively sign the transaction using their private keys. Once the requisite number of signatures is acquired, the transaction is deemed authorized and can be broadcast to the blockchain for processing.

Multisignature wallets enhance crypto security by addressing the risks linked to a single compromised key. Even if one private key is compromised, an attacker would still require access to the additional necessary keys to execute a transaction.

Advantages and Disadvantages of Multi-Signature Wallet

| Advantages of Multisig Wallet | Disadvantages of Multisig Wallet |

|---|---|

| Enhanced Security: Mitigates risks associated with a single compromised key. | Technical Complexity: Setting up and managing multisig wallets can be more complex than traditional wallets. |

| Reduced Risk of Theft: Requires multiple signatures for transactions, reducing the risk of unauthorized access and theft. | Limited Accessibility: In certain scenarios, the need for multiple signatures can slow down transaction processes. |

| Shared Control: Ideal for joint accounts or business holdings, allowing multiple individuals to control and authorize transactions. | Potential for Key Loss: Losing access to one private key could result in funds becoming inaccessible if the required threshold isn’t met. |

| Trust Distribution: Distributing private key access among multiple entities enhances trust and security. | Not Widely Supported: Some platforms and services may not fully support multisignature wallets, limiting their widespread use. |

| Compliance and Governance: Can facilitate compliance with regulatory requirements and internal governance structures. | Recovery Challenges: If a co-signer loses their recovery phrase, it may pose challenges in recovering the wallet or accessing funds. |

Use cases of Multi-Sig Wallet

Now that we have taken a deep dive into understanding what a multisignature wallet is and how it works let us take a look into a few of the use cases of multi-sig wallets to understand their application better.

Escrow Protection:

- Facilitates escrow transactions using 2-of-3 multisig wallets, ensuring smooth transactions when both parties agree.

- In case of a dispute, a third party arbitrates and determines the transaction’s direction.

Decentralized Finance:

- Enables trading, borrowing, and lending through collective decision-making without intermediaries.

- Transactions occur with consensus among the minimum threshold of key holders.

Collaborative Ownership:

- Simplifies trust-building among parties collectively owning crypto assets.

- Transactions involving shared assets require unanimous agreement among all parties.

Security in the Crypto Industry:

- Addresses the prevalent security concerns in the crypto industry, including fraud cases and exit scams.

- As the crypto landscape evolves, multisig wallets offer a secure option for holders to retain control of their assets amid collaboration and investment challenges.

Additional Read: Top ERC-20 Wallet

How to Create a Multi-Signature Wallet?

Even though having multisig wallets does not negate the possibility of disadvantages, it is important to explore creating a multisignature wallet to explore the benefits that it brings to the table.

Step 1: Setup Coordination: Establishing a multisignature crypto wallet requires careful coordination and adherence to crypto security best practices.

Step 2: Configuration Choice: Select a crypto wallet supporting multisignature functionality and decide on the configuration (e.g., two-of-three) to determine the required private key signatures for transaction authorization.

Step 3: Public Key Generation: Each co-signer generates their public key through wallet setup, often referred to as a master public key. Follow the wallet setup, create a recovery phrase, and confirm and re-enter the recovery phrase to generate individual public keys.

Step 4: Multisig Wallet Address: Collect co-signers’ public keys, input them into the wallet setup, and generate the multisig wallet address. The wallet is ready to receive funds from an exchange or another wallet.

Step 5: Transaction Execution: Password-protect the multisignature wallet, and co-signers collaboratively sign transactions from their registered wallets for execution.

Step 6: Security Comparison: Multisignature wallets on the blockchain function similarly to two-factor authentication (2FA) or multifactor authentication systems in digital finance

Conclusion

The functionalities and fundamental concepts that underlie multisignature wallets suggest their promising role in the future of crypto. Requiring multiple private keys for transaction signatures, these wallets offer enhanced security. Nevertheless, challenges, such as the need for technical knowledge, can pose significant difficulties.

Yet, the user-friendly configuration options for multisig wallets enhance usability, positioning them as pivotal tools for fostering crypto adoption in the future. It’s important, however, for crypto users to be aware of the challenges tied to multisignature wallets. Begin exploring more about crypto wallets and making informed choices to enter the crypto landscape confidently.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more