Table of Contents

ToggleIntroduction

The crypto market is a difficult place, be it for investing, crypto trading or simply participating in the ecosystem. There are a whole lot of things that one needs to learn and understand – and sometimes change a certain way of thinking completely to adjust to this revolutionary new industry that is attempting to change finance at very core level. And to further add to that, there isn’t a lot of history to this space either.

Bitcoin has been around for well over a decade, but most of the remaining projects and blockchain networks have been around for less than even a decade. While this creates a certain amount of risk and ambiguity around the industry life cycle and projecting its growth, the other side of the matter is that it is practically a once-in-a-lifetime opportunity to invest in these companies and their products and services so early on in their lifecycle. This opportunity can provide incredible upside for crypto investors, but also brings about increasing volatility and difficulty to evaluate and research these opportunities.

In the following article, we will try to outline some of the best places and crypto research tools you can begin your foray into the crypto industry and learn more about the space. These range everything from the absolute basics all the way to up intermediate levels of knowledge and understanding. We will divide our crypto research tools article into three distinct aspects and list those tools under those three umbrellas. The three categories are:

- About the crypto project

- Price and technical analysis

- On-chain crypto analysis

Tool |

Brief description |

| CoinMarketCap | CoinMarketCap is practically one of the most popular and well known crypto wesite in the rapidly growing nascent industry that is referred to by everybody in the industry. |

| CoinGecko | Similar to CoinMarketCap, CoinGecko is yet another crypto tracking terminal website that allows retail users to access more information about crypto projects. |

| TradingView | TradingView is one of the most popular online, web-based charting tools out there in the market. |

| Santiment | Santiment is an extremely popular crypto on-chain analytical tool that provides access to loads of features and other crypto analysis methods ranging from social dominance, exchange flows, valuation metrics and financial analysis. |

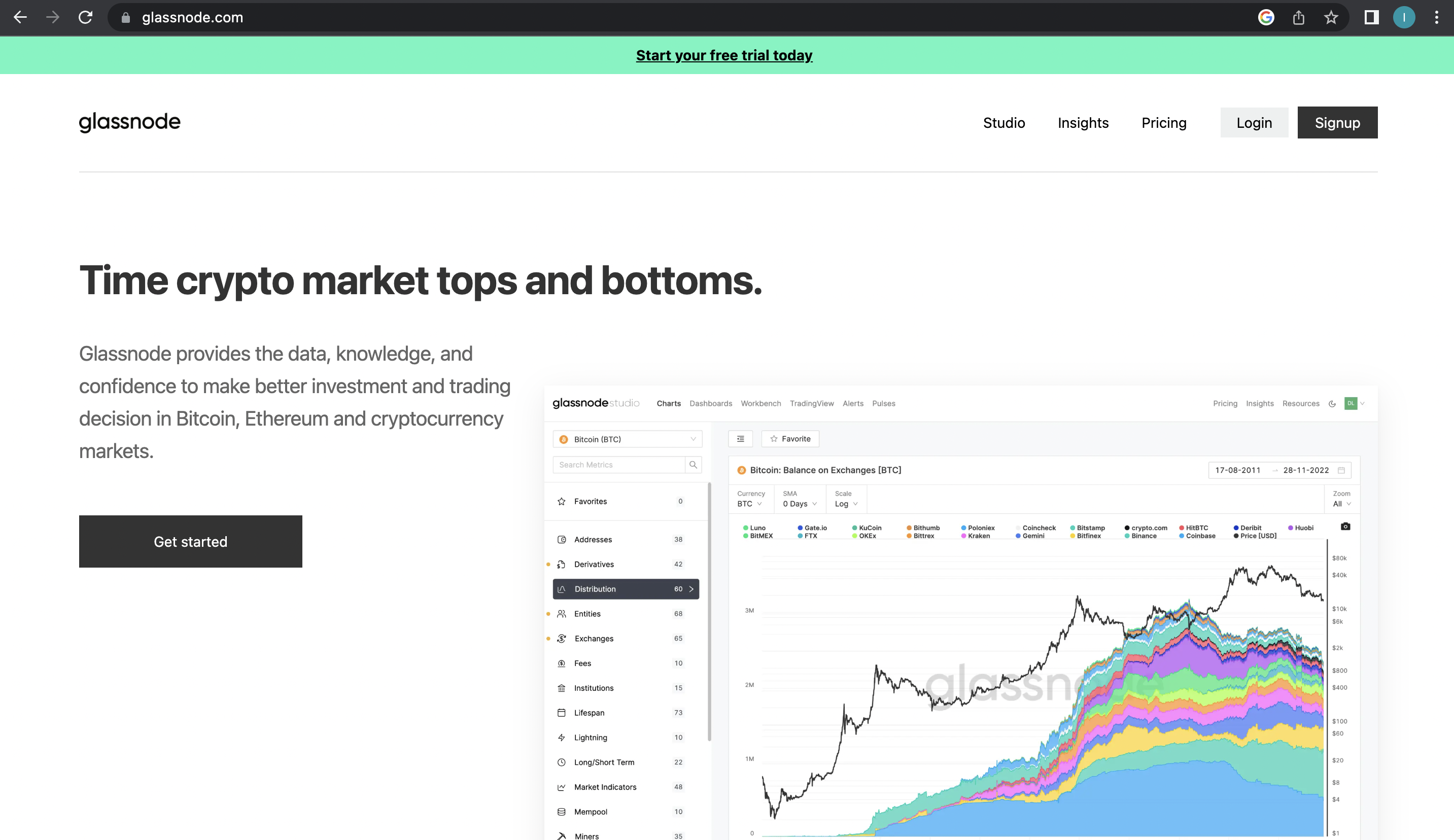

| Glassnode | Working along similar lines on that of Santiment, Glassnode is also another very reputed on-chain analytics platform. Beyond on-chain data, such as exchanges supply, circulating supply, daily active addresses, transaction counts, etc. |

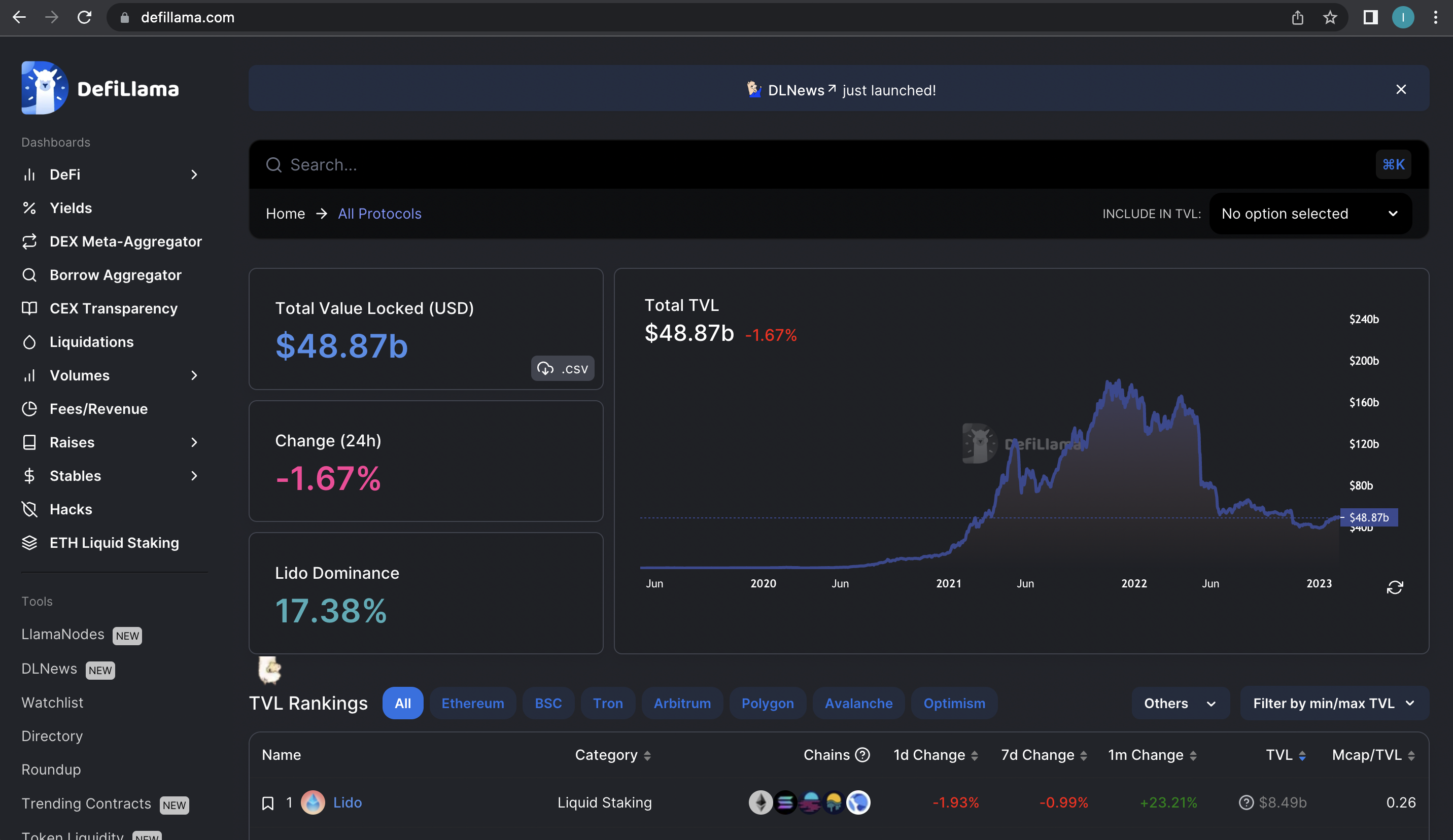

| DefiLlama | DefiLlama is the website that you go to for all things decentralized finance (DeFi). It contains all kinds of data points with regards to DeFi protocols in the market ranging from total-value-locked (TVL), to in-depth information and data for specific protocols too. |

About the Crypto Project

This is the first aspect of crypto research – which is to understand what the crypto project is about and understanding what the project is trying to solve or achieve. Crypto projects have utilities that are varied, ranging from lending and borrowing, to decentralized exchanges, automated market makers, earning passive income in the form of interest or even gaming blockchain projects.

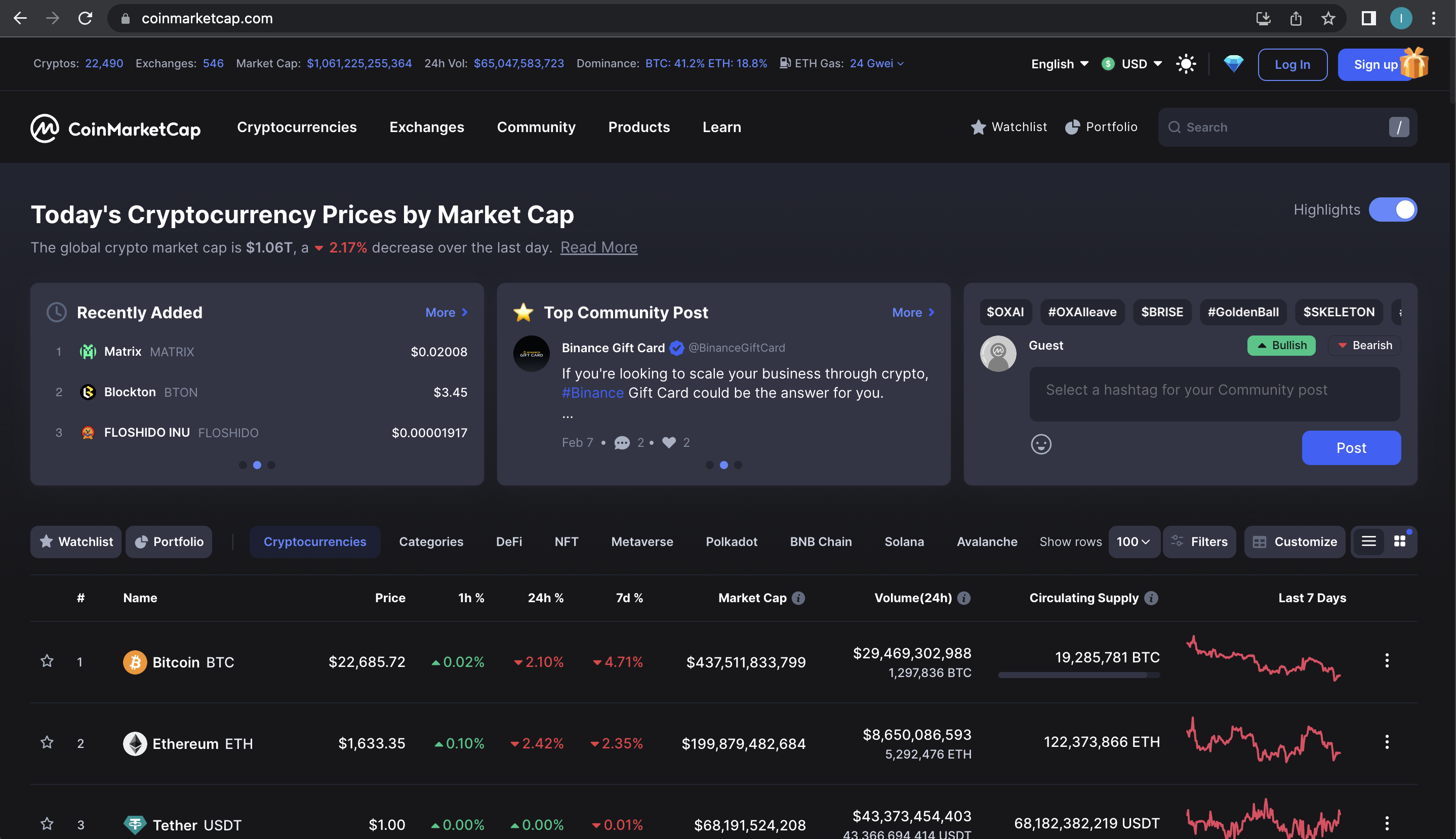

CoinMarketCap

CoinMarketCap is practically one of the most popular and well known crypto site in the rapidly growing nascent industry. It claims to be the world’s most referenced price-tracking website for crypto assets and is probably the first site anybody who is even vaguely aware of cryptos tries to look up. It was launched back in May 2013 with the mission to make crypto more discoverable on the internet, providing information to the public and empowering retail users with unbiased and accurate information to help them making their own conclusions. It also contains details about these crypto projects, handy references to their whitepapers for users to peruse through and even a forum where users can interact.

CMC is widely referenced by financial news organisation all across the world and is one of the most trusted source of crypto data by retail users and institutions too. This has become so popular that at one point – Binance’s investment arm (which is the largest crypto exchange in the world by trading volumes) Binance Capital Management acquired CoinMarketCap in April 2020. The acquisition allows CMC to tap into more data sourced from Binance’s own repositories about crypto projects and enable users to get more information regarding the same.

Read more: Best Free Crypto Trading Tools

CoinGecko

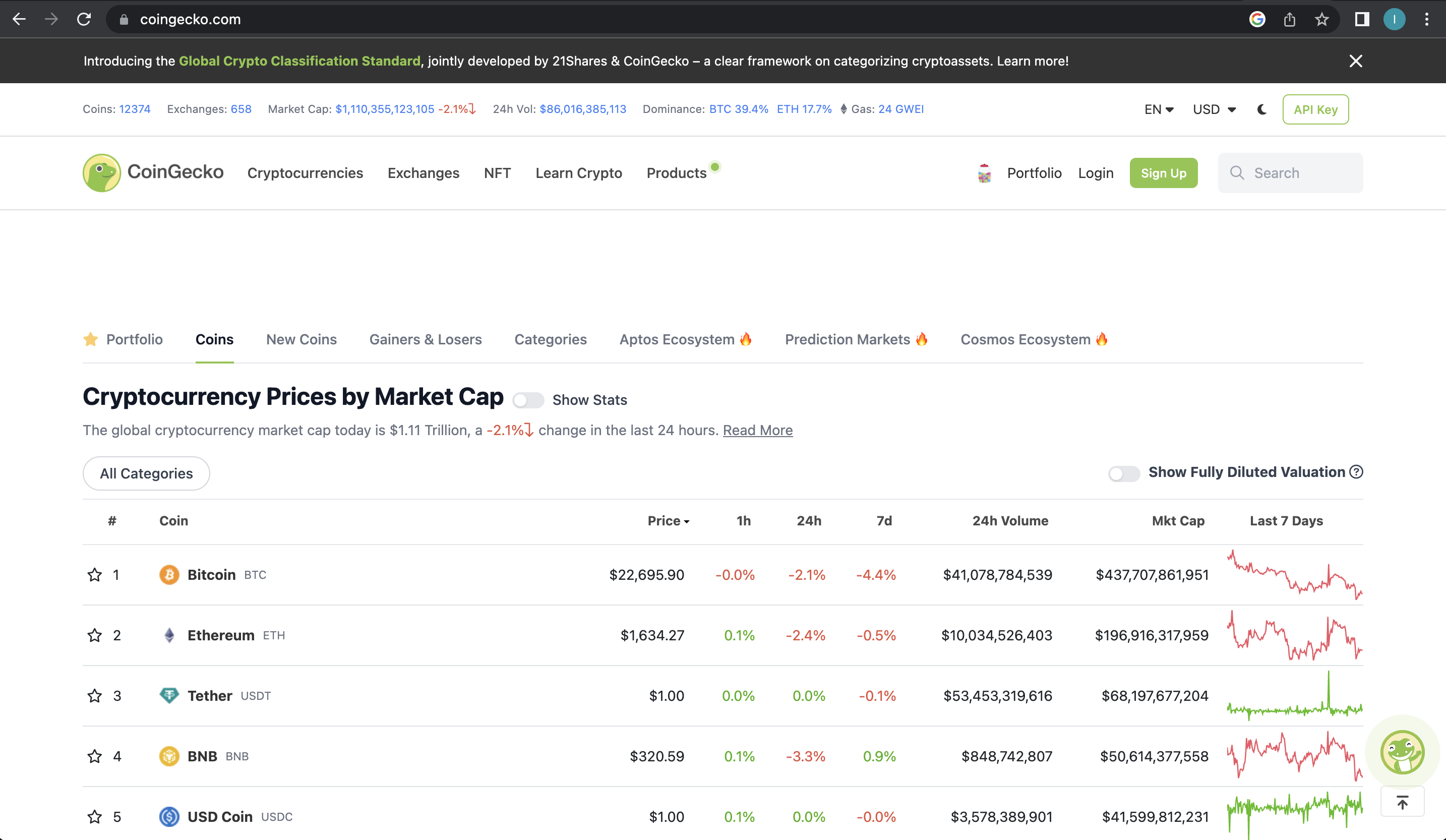

Built with a similar vision as CoinMarketCap, CoinGecko is yet another crypto tracking terminal website that allows retail users to access more information about crypto projects. CoinGecko works in a very similar way to that of CMC, by means of tracking crypto projects, price feed and help provide a platform for uninterrupted access to crypto data.

Founded in 2014, it was started with the mission to democratize the access of crypto data and empower users with actionable insights. The company also does deep dives into the crypto space to provide valuable insights to users on their platform through the means of crypto reports, as well other kinds of publications, newsletters and more. These are platforms that are sure-shot way to begin your journey into crypto research and analysis.

Read more: Top Questions to consider before Investing in Crypto in 2023

Price & Technical Analysis

The next category of crypto trading tools definitely has to be this. Price and technical analysis is a major part of both crypto trading and crypto investing and thus this crypto analysis tool becomes extremely important for all crypto market participants out there who are going to be putting their hard earned money into this nascent industry. This category basically consists of one tool that covers the whole gamut of technical analysis, and fundamentally better than anybody else. This crypto analysis tool is so good that even other companies like brokerage companies and even crypto exchanges integrate this into their charting softwares. Yes, I am talking about none other than TradingView.

TRADINGVIEW

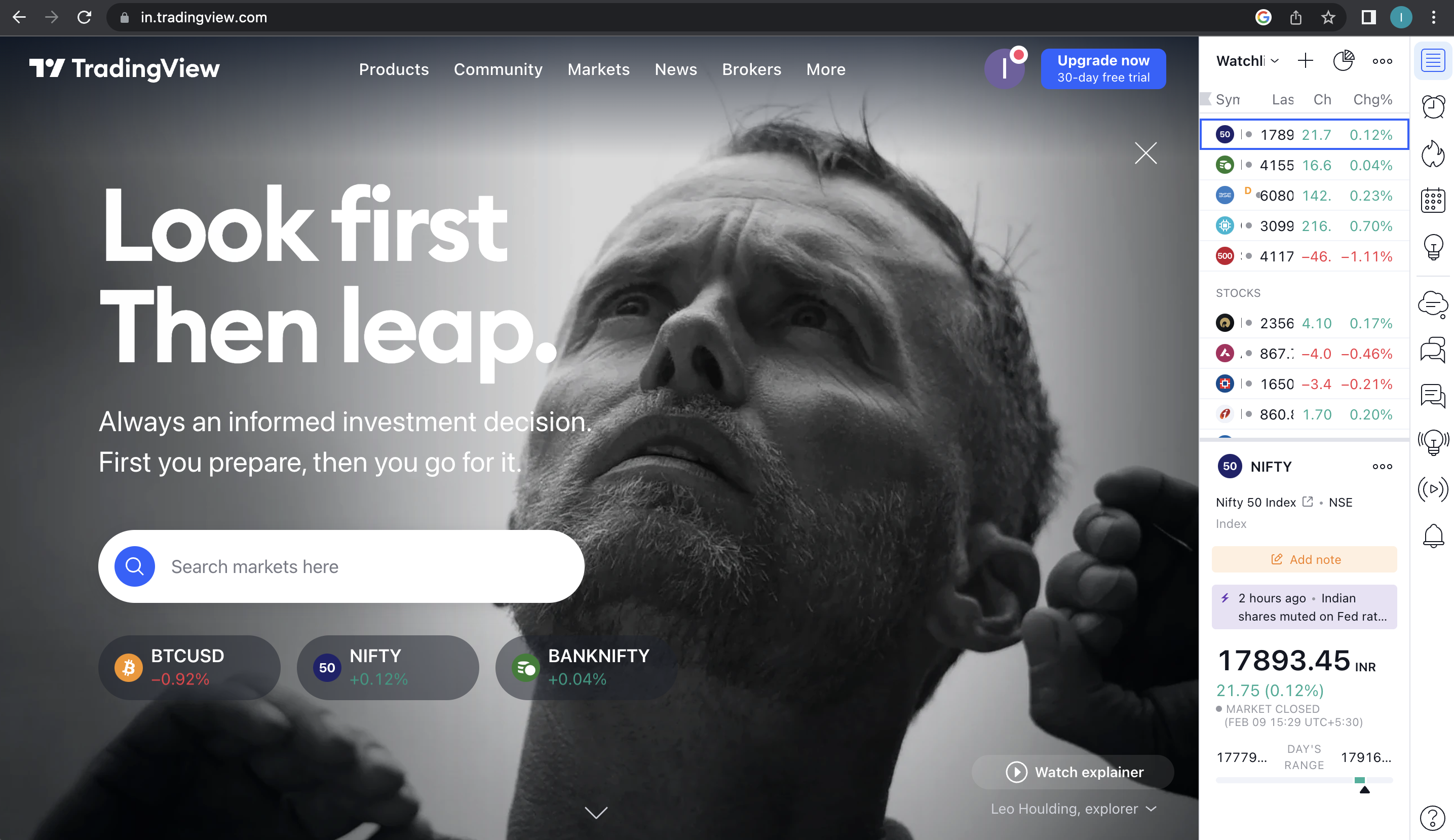

TradingView is one of the most popular online, web-based charting tools out there in the market. There is a free and a paid version, that provides a series of additional features. But even the free version is a great place to start, especially for crypto traders. TradingView caters to all aspects of the capital markets, equities, money markets like bonds, futures and even crypto assets.

TradingView has a huge repository of technical tools built into the software, ranging all the way from various different charting techniques like candlesticks to Heiken Ashi and line charts. It also consists of tools to mark on the chart and analyse technical patterns to understand underlying asset behaviour and even consists of hundreds of free accessible technical indicators for you to apply and come to an informed decision before investing in any crypto asset.

Read more: Crypto Investing Strategy

Crypto On-chain Analysis

This is the last but not the least – maybe one of the most important category of crypto research tools that investors and crypto traders need to be aware of. Crypto on-chain analysis is pretty much akin to fundamental analysis in the world of equities and stock markets. It analyses crypto projects at a fundamental level, ranging from valuations based on supply, social sentiments and all the works!

Santiment

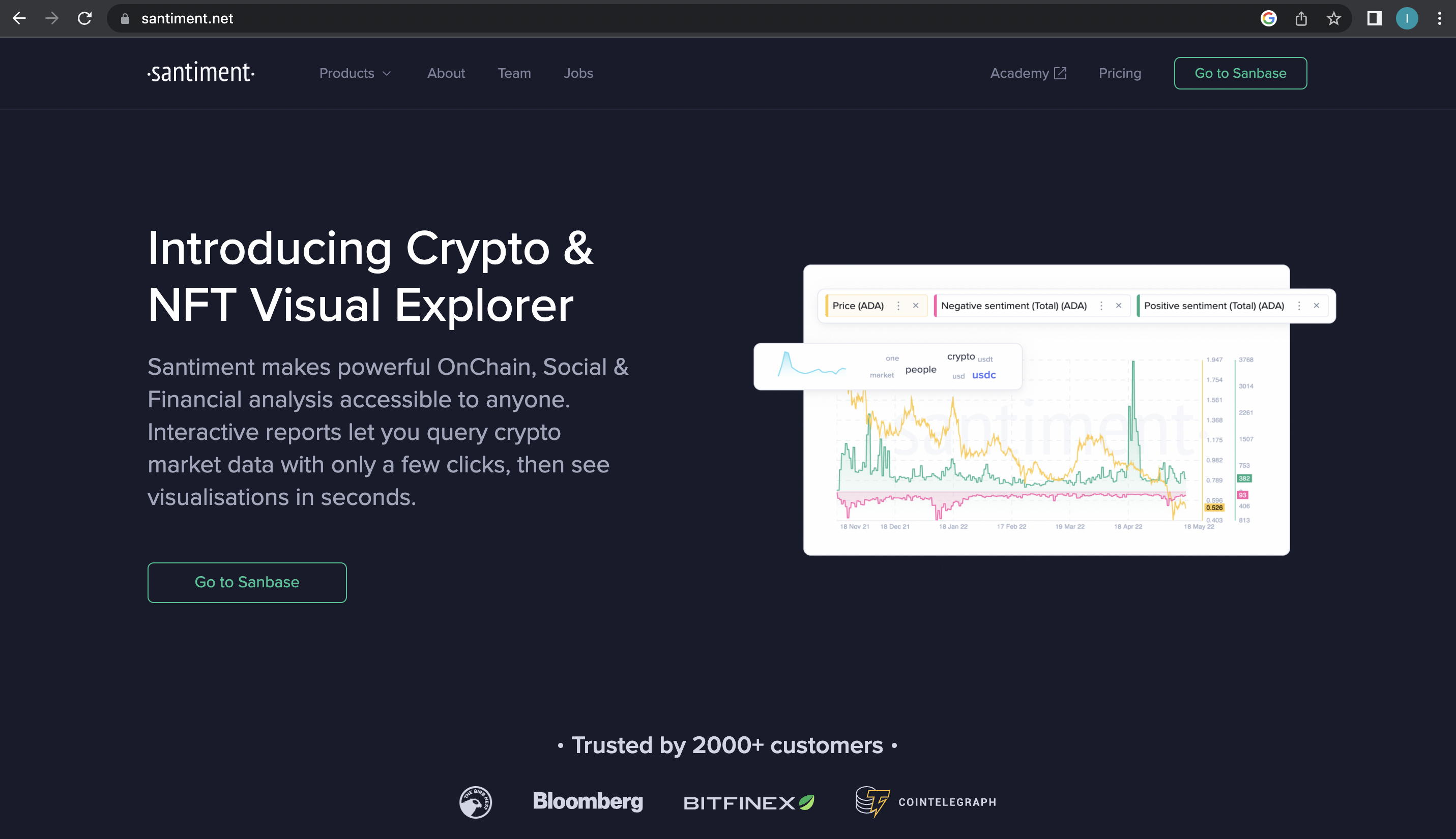

Santiment is an extremely popular crypto on-chain analytical tool that provides access to loads of features and other crypto analysis methods ranging from social dominance, exchange flows, valuation metrics and financial analysis. Crypto investors and traders get a deep insight. It also a behaviour analytics platform for cryptos, and even development information on 900+ crypto assets. It aims to create market standards for crypto market data, best practices and project transparency.

Glassnode

Working along similar lines on that of Santiment, Glassnode is also another very reputed on-chain analytics platform. Beyond on-chain data, such as exchanges supply, circulating supply, daily active addresses, transaction counts, etc, Glassnode also covers many other metrics for various different cryptos, with specific focus on Bitcoin. Derivatives, Miner data, Potential market top/bottom indicators (NUPL, percent of addresses in profit, etc) and Purpose BTC ETF data are examples of other metrics that they cover.

Read latest on chain metric analysis for trending crypto tokens on CoinDCX Crypto News & Updates

DefiLlama

Last but not the least is DefiLlama. DefiLlama is the website that you go to for all things decentralized finance (DeFi). It contains all kinds of data points with regards to DeFi protocols in the market ranging from total-value-locked (TVL), to in-depth information and data for specific protocols too. TVL is one of the most commonly used on-chain metric when it comes to evaluating a DeFi protocol running on any blockchain network. It is essentially a gauge of users’ trust towards a particular DeFi protocol and also the level of interest users have.

Conclusion

In the world of blockchain and Web3, data in openly and freely available. However, blockchains being a heavily technical subject – it becomes very difficult for the retail investor to gather these kinds of information and data points directly from the original source. This is where crypto analytical tools come into the picture to help retail investors make better decisions in the market.

Read more: Which is the best crypto to invest in?

FAQs

What is the best way to research crypto?

The best way to research a crypto project is to have a wholistic of the project itself, then taking a look at the price structures of the token and finally analysing the various on-chain metric data available pertaining to the crypto asset.

What is the best crypto research site?

There are various websites for various aspects of crypto research. For technical analysis, TradingView can be considered one of the best while for background understanding, CoinMarketCap and CoinGecko can be good places to start. For on-chain metric data, one can refer to Santiment, Glassnode and DefiLlama for in-depth research.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more