Table of Contents

ToggleIntroduction

As the crypto world gears up for the highly anticipated Bitcoin halving event scheduled for April 20 at midnight, IST, excitement and speculation are reaching fever pitch. This pivotal event, occurring roughly every four years, holds immense significance for Bitcoin investors and enthusiasts alike. With the Bitcoin halving set to reduce mining rewards from 6.25 to 3.125 BTC per block, it is crucial for investors to understand the potential implications and opportunities that lie ahead. This comprehensive guide will delve into the top five essential things every Bitcoin investor should know as they prepare for the Bitcoin Halving 2024.

Top 5 Things All Bitcoin Investors Should Know Before Bitcoin Halving 2024

- Historical Significance: Understanding the historical significance of Bitcoin halving is paramount for investors seeking to navigate the current market landscape. Previous halving events have consistently triggered significant price surges, driven by the reduction in the flow of new Bitcoin and the resulting increase in scarcity. Investors can gain valuable insights into potential price movements and investment strategies by examining past performance trends and market dynamics surrounding halving events.

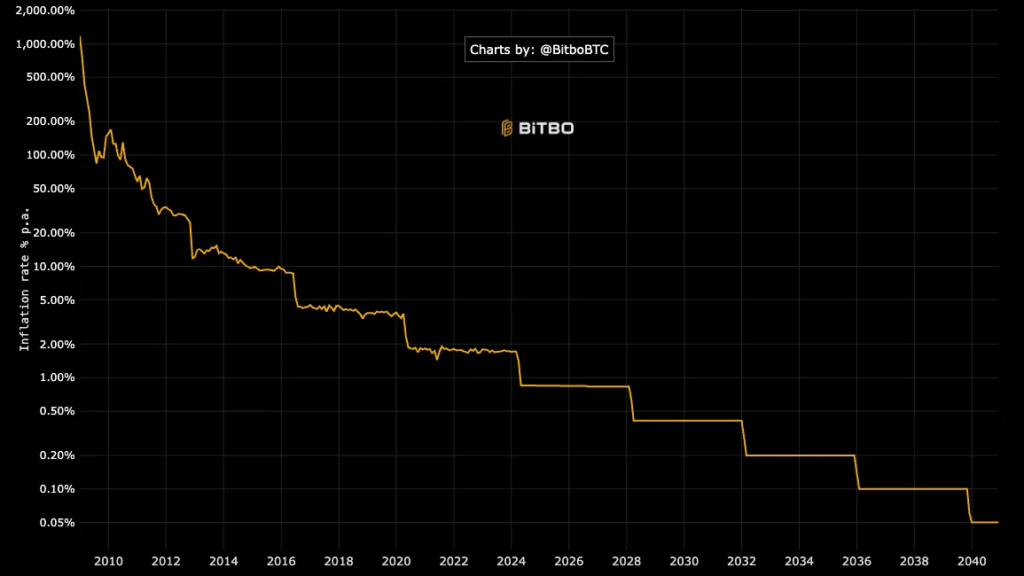

- Impact on Market Dynamics: The upcoming halving is expected to have profound implications for Bitcoin’s market dynamics. With the supply of new Bitcoins set to decrease by half, from the current 6.25 BTC to 3.125 BTC after Bitcoin Halving 2024, the balance between supply and demand could undergo significant shifts, potentially leading to increased price volatility and market fluctuations. Investors must stay informed and adapt their investment strategies accordingly to navigate the evolving post-halving market conditions.

- Heightened Investor Interest: The anticipation surrounding the Bitcoin halving has fueled heightened investor interest and enthusiasm in the crypto market. Institutional investors and investment funds are increasingly allocating capital to Bitcoin, viewing it as a legitimate asset class with significant growth potential. As investor demand surges, Bitcoin price could experience considerable upward momentum, presenting lucrative opportunities for savvy investors.

- Long-Term Investment Implications: While the immediate impact of the Bitcoin halving event may result in short-term price fluctuations, investors need to consider the event’s long-term implications. As the supply of new bitcoins dwindles over time, Bitcoin’s scarcity is expected to increase, potentially driving sustained price appreciation in the years to come. Investors with a long-term outlook should focus on accumulating and holding Bitcoin as a store of value amid evolving market dynamics.

- Strategic Positioning: As the Bitcoin halving approaches, strategic positioning is crucial for investors seeking to capitalize on potential price movements and maximize returns. Whether it’s diversifying their investment portfolio, implementing risk management strategies, or staying informed through thorough research and analysis, investors must take proactive steps to navigate the uncertainties surrounding the halving event. By staying vigilant and adaptable, investors can position themselves for success in the ever-evolving landscape of the crypto market.

Know More: How is Bitcoin Halving Different this Time?

Additional Insights

In addition to the top five essential insights outlined above, investors should consider several additional factors as they prepare for the Bitcoin Halving 2024.

- Technological Advancements: The Bitcoin ecosystem continues evolving, with ongoing technological advancements driving innovation, network efficiency, and scalability improvements. Investors should stay informed about developments such as the Lightning Network and Taproot upgrade, which could impact Bitcoin’s utility and adoption in the long term.

- Regulatory Landscape: Regulatory developments play a significant role in shaping the crypto market’s trajectory. Investors should monitor regulatory updates and developments in key jurisdictions, as regulatory uncertainty can impact market sentiment and investment decisions. A clear and favorable regulatory framework could catalyze increased institutional adoption and investment in Bitcoin.

- Macroeconomic Factors: Bitcoin price dynamics are influenced by macroeconomic factors such as inflation, monetary policy decisions, and geopolitical events. Investors should consider the broader economic landscape and how macroeconomic trends may impact Bitcoin’s value proposition as a hedge against inflation and economic uncertainty. In times of economic instability, Bitcoin has demonstrated resilience as a non-correlated asset with the potential to preserve and grow wealth over the long term.

Read more: Bitcoin Price Prediction

Conclusion

As we countdown to April 20, 2024, the Bitcoin community is excited about the upcoming halving event. By understanding the historical significance, market dynamics, investor interest, long-term implications, and strategic positioning outlined in this guide, investors can make informed decisions and seize opportunities in the wake of this transformative event. As Bitcoin continues its journey towards mainstream adoption and global recognition, the Bitcoin Halving 2024 represents a significant milestone in the ongoing evolution of the crypto market.

Additional Read: Historical Bitcoin Fees Pattern Ahead of Bitcoin Halving

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more