Table of Contents

ToggleKey takeaways:

- Understand what Bitcoin is and how it works.

- Understanding the nuances behind proof-of-work (PoW) and the mining process.

- Exploring what a 51% attack is and how probable it might be.

- Finally, discuss and answer the question, “Is Bitcoin actually decentralized?”

Bitcoin, the first and most well-known crypto – aka the king coin, has gained immense popularity and sparked significant debates about its decentralization. To assess whether Bitcoin is truly decentralized, it is crucial to understand the core principles and mechanisms underlying this digital currency.

What is Bitcoin?

At its core, Bitcoin is a decentralized digital currency that operates on a peer-to-peer network. It was created back in 2009 by an anonymous individual or group of individuals known as Satoshi Nakamoto. Bitcoin is based on a revolutionary technology called blockchain, which serves as a public ledger to record and verify all transactions happening over the network.

Unlike traditional fiat currencies, Bitcoin is not issued or controlled by any central authority such as a government or financial institution. Instead, it is governed by a network of participants known as “miners.” These miners use powerful computers to solve complex mathematical problems and validate transactions on the network.

Bitcoin’s decentralization stems from its distributed nature, where the blockchain is replicated and maintained by a vast network of computers spread across the globe. This decentralized network ensures that no single entity has complete control over the currency or the transactional data. It also reduces the risk of censorship and manipulation.

Furthermore, Bitcoin’s decentralized nature enables individuals to transact directly with one another without the need for intermediaries. This peer-to-peer nature empowers users with greater control over their funds and promotes financial inclusivity by providing access to anyone with an internet connection.

In summary, Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, utilizing blockchain technology to secure and verify transactions. Its decentralization ensures a transparent and censorship-resistant financial system, where power is distributed among participants rather than concentrated in the hands of a few centralized entities.

Mining: Bitcoin Proof of Work Model

One of the key aspects of Bitcoin’s decentralization is its mining process, which operates on a Proof of Work (PoW) consensus mechanism. Mining is crucial in securing the network, validating transactions, and minting new Bitcoins. Understanding how mining works provides insights into Bitcoin’s decentralized nature.

In the Bitcoin network, miners compete to solve complex mathematical problems using powerful computers. This process is energy-intensive and requires significant computational resources. Miners aim to find a specific hash value that meets the network’s criteria, known as the “proof of work.” Once a Bitcoin miner is able to find the solution successfully, they can add a new block of transactions to the blockchain and are rewarded with newly minted Bitcoins as an incentive.

The decentralized nature of Bitcoin’s mining lies in its open participation. Anyone with the necessary hardware and software can become a miner and join the network. This distributed participation ensures that no single entity or group can control the majority of the mining power, preventing centralized control over the network.

Additionally, the PoW consensus mechanism makes it extremely difficult for malicious actors to manipulate the blockchain. The computational effort required to alter the past blocks and rewrite the transaction history would be astronomically high, making Bitcoin’s blockchain highly secure and resistant to tampering.

Read on: Bitcoin Halving in 2024

What is a 51% attack?

While Bitcoin is known for its decentralized nature, it is important to understand the concept of a 51% attack, which poses a potential threat to its decentralization. A 51% attack refers to a theoretical scenario where a single entity or group gains control over more than 50% of the total mining power in a blockchain network.

In the context of Bitcoin, if a single entity controls the majority of the mining power, they have the potential to manipulate the blockchain and disrupt its integrity. They can potentially modify transactions, double-spend coins, and exclude certain transactions from being confirmed. This undermines the decentralized nature of the network as it gives undue influence and control to a single party.

However, executing a 51% attack on the Bitcoin network is very challenging due to its size and the immense computational power required. Bitcoin’s security lies in its robust network of miners distributed worldwide. The system is built in such a way that as the network grows more and more, with more diverse participants joining in – the possibility of executing a 51% attack goes on decreasing.

Thus, Bitcoin’s decentralized nature mitigates the risk of a 51% attack, as it relies on the collective efforts of numerous miners to maintain the network’s security. Additionally, ongoing research and development in blockchain technology aim to enhance the network’s resistance against such attacks.

While the possibility of a 51% attack still exists from a theoretical point of view, the decentralized nature of Bitcoin, combined with the distributed mining power, makes it highly improbable. Nonetheless, the Bitcoin community must remain vigilant and continually strengthen the network’s security protocols to uphold the decentralized principles on which it was built.

Bitcoin Hash Rate

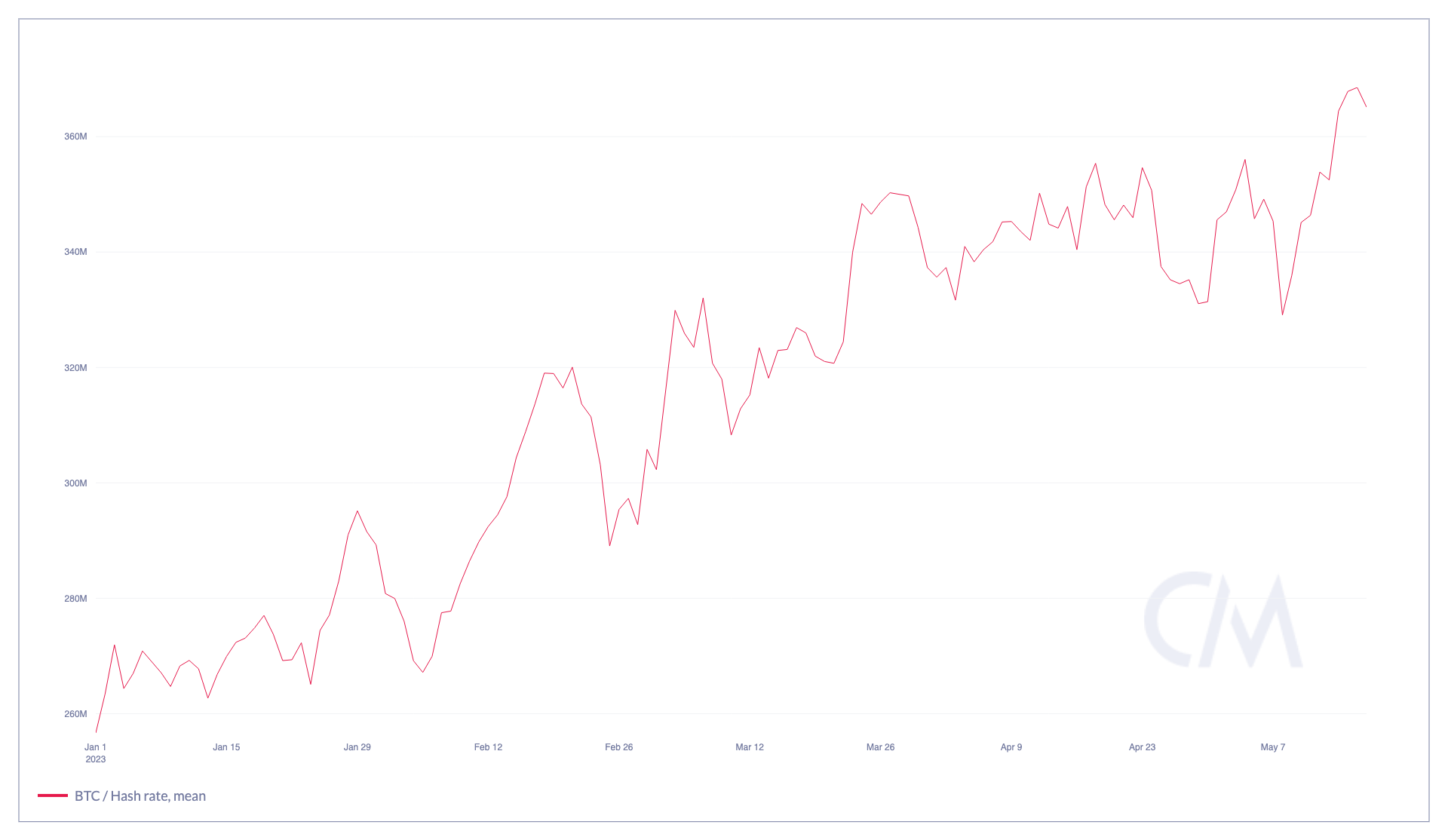

The hash rate is a fundamental concept in the functioning of the Bitcoin network and plays a crucial role in determining the network’s security and decentralization. In simple terms, the hash rate refers to the computational power dedicated to mining Bitcoin and securing its blockchain. The following image represents the hash rate of the Bitcoin network in the form of a chart:

Miners compete to solve complex mathematical problems using powerful hardware known as mining rigs. The hash rate represents the speed at which these miners perform these calculations. It is measured in hashes per second (H/s), kilohashes per second (kH/s), megahashes per second (MH/s), gigahashes per second (GH/s), and even terahashes per second (TH/s).

The higher the hash rate, the more secure the network becomes against potential attacks, such as a 51% attack. A higher hash rate also increases the difficulty of solving mathematical puzzles, ensuring that new blocks are added to the blockchain at a consistent pace. This process maintains the integrity of the network and prevents any single entity from gaining undue control over the Bitcoin ecosystem.

Furthermore, a higher hash rate enhances the overall efficiency and speed of the network, enabling faster transaction confirmations and maintaining the smooth functioning of the Bitcoin network.

It is important to note that Bitcoin’s hash rate is distributed globally among a vast network of miners, contributing to its decentralized nature. As more miners join the network, the hash rate increases, further strengthening the network’s security and resilience. A higher hash rate signifies a more robust and decentralized Bitcoin ecosystem, providing greater trust and reliability to participants in the digital currency space.

Bitcoin price analysis

Bitcoin has been one of the best performers in 2023 so far. While in percentage terms, there are better performers out there, however, in pure dollar terms, Bitcoin has been the biggest gainer in 2023, nearly doubling its market capitalization at its highest point in 2023. BTC price has since receded from its $30,000 YTD highs and is currently trading between $27,000 to $28,000.

Despite its minor correction and the following weakness over the past 30 days, BTC price is still in a decently bullish price pattern on the chart – currently trading well over its long-term 200-day exponential moving average. BTC price is also attempting to break out of the $27,500 to $28,500 resistance zone. But on the upside, BTC will face stiff psychological resistance at $30,000 and a heavy supply zone at the $32,000 mark, being the upper end of the accumulation zone (marked in grey). Thus while the current scenario looks slightly weak, BTC price is well positioned to recover quickly if the market sentiment improves.

Additional Read: Bitcoin Price Prediction

So, Is Bitcoin Actually Decentralized?

Bitcoin’s decentralization has been a subject of debate and scrutiny in the crypto community for quite some time. While Bitcoin operates on a decentralized network, it is essential to understand the key aspects that contribute to its decentralized nature. Bitcoin maximalists have held the position that Bitcoin continues to be a decentralized force, while some opponents suggest that the risk of a 51% attack runs high.

Firstly, Bitcoin operates on a distributed network known as the blockchain. This blockchain is maintained by a vast network of independent nodes spread across the globe. Each node stores a copy of the entire transaction history, ensuring transparency and preventing any single point of failure.

Secondly, the mining process and the hash rate play a crucial role in maintaining the decentralization of Bitcoin. Using their computational power, miners compete to solve complex mathematical problems to validate transactions and add new blocks to the blockchain. This competition ensures that no single miner or entity can gain control over the network, as it requires immense computing power to manipulate the blockchain.

Additionally, the concept of a 51% attack, where a single entity controls most of the network’s hash rate, is a significant concern regarding decentralization. However, the widespread distribution of mining power globally and the increasing hash rate make it highly improbable for any entity to obtain such control.

Moreover, the participation of such a diverse range of participants, including miners, node operators, developers, and users, contributes to the decentralization of decision-making processes within the Bitcoin ecosystem.

The hash rate and the consensus mechanism ensure the security, integrity, and resilience of the Bitcoin network. As a result, Bitcoin continues to operate as one of the most decentralized and robust cryptos, providing individuals with a decentralized alternative to traditional financial systems.

How To Buy Bitcoin In India?

Ready to dive into the exciting world of Bitcoin? Don’t miss out on the opportunity to ride the crypto wave! Get started today with ABC crypto exchange, the easiest and most secure way to buy Bitcoin in India! Join 1 crore+ Indians on CoinDCX and take your first trade today! All you need to do is sign up, complete the KYC formalities, and buy your first Bitcoin today!

Know More on How to Buy Bitcoin in India

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more