Table of Contents

ToggleUnderstanding The Puell Multiple

The Puell Multiple is a powerful crypto trading indicator that provides valuable insights into Bitcoin’s market cycles and can help traders make more informed decisions. As one of the many indicators for crypto trading, the Puell Multiple specifically focuses on Bitcoin and offers unique perspectives on market efficiency.

The Puell Multiple is calculated by dividing the daily issuance value of Bitcoin (in USD) by the 365-day moving average of the daily issuance value. This simple formula captures the relationship between the market price of Bitcoin and the mining rewards earned by miners. In essence, it gauges whether Bitcoin is overvalued or undervalued based on mining economics.

When the Puell Multiple is low, it suggests that the mining rewards are relatively high compared to the market price of Bitcoin. This could indicate a potential undervaluation, implying a favorable time to accumulate or trade Bitcoin. Conversely, a high Puell Multiple signifies that mining rewards are relatively low compared to the market price, possibly signaling an overvaluation and a potential time to consider selling or taking profits.

By tracking the Puell Multiple over time, traders can gain insights into the prevailing market sentiment and identify potential entry or exit points. It helps to gauge the supply and demand dynamics in the Bitcoin market, which can be invaluable for making informed trading decisions.

Integrating the Puell Multiple into your trading strategy allows you to leverage this valuable indicator to trade more efficiently. It complements other BTC indicators and technical analysis tools by providing a unique perspective on market cycles driven by mining economics. Understanding the Puell Multiple empowers traders to navigate the volatile crypto market with more confidence and potentially improve their trading outcomes.

In summary, the Puell Multiple is a crucial tool for assessing Bitcoin’s valuation relative to mining rewards. Its calculation offers insights into market efficiency, allowing traders to use this indicator alongside other crypto trading indicators to make more informed decisions. By understanding the Puell Multiple and incorporating it into your trading strategy, you can strive for greater efficiency and potentially enhance your crypto trading success.

Read More: What Is Bitcoin Rainbow Chart?

How to Trade Using Puell Multiple

The Puell Multiple is a valuable crypto trading indicator that can enhance your trading efficiency and help you make more informed decisions in the crypto market. By understanding how to interpret the Puell Multiple and applying effective trading strategies, you can leverage its insights to potentially improve your trading outcomes.

Interpreting the Puell Multiple involves analyzing its value in relation to historical data and market conditions. A low Puell Multiple suggests that Bitcoin is potentially undervalued, indicating a favorable time to accumulate or enter long positions. This could be a signal for traders to consider buying Bitcoin or increasing their holdings. On the other hand, a high Puell Multiple indicates a potential overvaluation, signaling a possible time to sell or take profits.

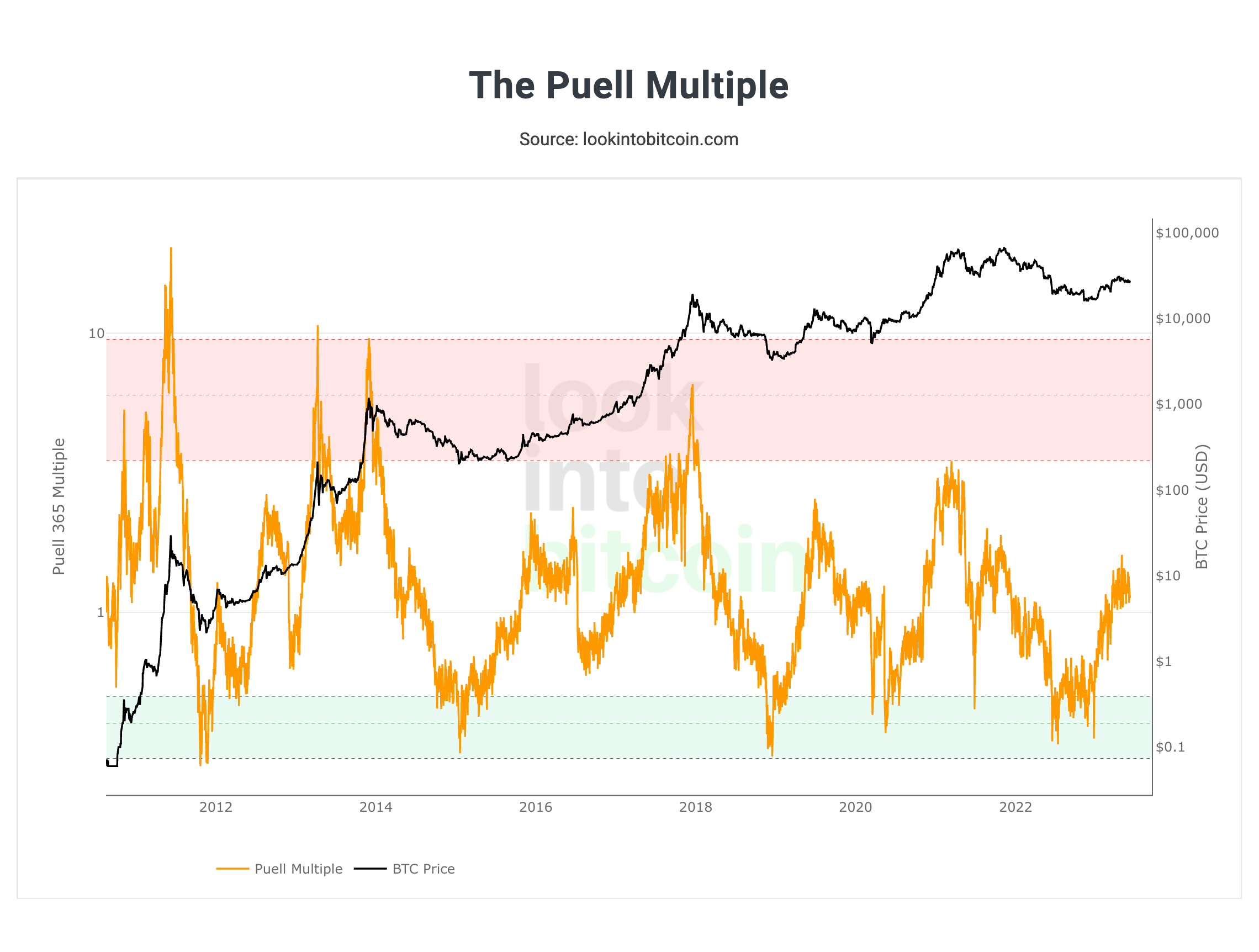

Bitcoin Puell Multiple | Source: LookIntoBitcoin

One popular trading strategy using the Puell Multiple is based on identifying extreme levels. Traders monitor the Puell Multiple and look for instances when it reaches historically low or high values. When the Puell Multiple hits an extreme low, it may indicate a potential market bottom and a favorable time to buy Bitcoin. Conversely, when the Puell Multiple reaches an extreme high, it could suggest an impending market correction or a good opportunity to consider selling or shorting Bitcoin.

Another strategy involves tracking the trends and changes in the Puell Multiple over time. Traders monitor the Puell Multiple’s movements and observe whether it is trending upwards or downwards. Rising values could indicate an increase in mining costs relative to the market price, potentially leading to price appreciation. Falling values, on the other hand, might suggest decreasing mining costs relative to the market price, potentially signaling a market correction or a time to take profits.

It’s important to note that while the Puell Multiple can provide valuable insights, it should not be the sole factor in your trading decisions. It is advisable to use the Puell Multiple in conjunction with other indicators for crypto trading and perform comprehensive analysis before executing trades.

In conclusion, integrating the Puell Multiple into your trading strategy can enhance your decision-making process in the crypto market. By interpreting its values and implementing effective trading strategies, you can potentially capitalize on market inefficiencies and improve your trading performance. However, always remember to use the Puell Multiple in combination with other BTC indicators and conduct thorough analysis to make well-informed trading decisions.

Understanding Macro Tops and Macro Bottoms

In the Puell Multiple chart attached above, the red zones indicate the region where Bitcoin miners have the maximum incentive to sell, thanks to the highest profitability available to them. This is typically a region of a macro top – where miners have a large share of tokens in their treasury, and they look to sell their BTCs in exchange for fiat to invest in their mining machines to effectively be able to improve their share of the mining economy by getting more mining rigs hooked up into the system.

Similarly, on the downside, the green zones depict a region of minimum miner profitability and, thus is a zone where miners consolidate hash power and choose not to sell their tokens in the market. Smaller miners in this zone typically tend to hold on to their treasuries and also, at the same time, even shut down their mining rigs to conserve the operating costs of running mining rigs. Thus this is a zone where there is a lot of consolidation of hash power that happens in the market, where more well off miners with excess cash reserves are able to capture more of the mining share and effectively gain an upper hand.

Additional Read: Bitcoin Stock-To-Flow Model Explained

Conclusion

The Puell Multiple is a powerful crypto indicator that can significantly enhance your trading efficiency in the volatile crypto market. By understanding how to interpret and use the Puell Multiple effectively, you can gain valuable insights into Bitcoin’s market cycles and make more informed trading decisions.

Integrating the Puell Multiple into your trading strategy allows you to identify potential undervaluation or overvaluation of Bitcoin based on mining economics. This indicator complements other crypto trading indicators and provides a unique perspective on market efficiency. By tracking the Puell Multiple over time, you can identify favorable entry or exit points, potentially maximizing your trading profits.

To use the Puell Multiple effectively, traders can employ various strategies such as identifying extreme levels or tracking trends over time. These strategies allow you to capitalize on potential market bottoms or tops and adjust your positions accordingly.

In conclusion, by incorporating the Puell Multiple into your crypto trading toolkit, you can gain a deeper understanding of Bitcoin’s valuation and market dynamics. This indicator empowers you to trade more efficiently, potentially improving your trading outcomes and increasing your chances of success in the crypto market. Happy investing!

FAQs

Which indicator is good for crypto trading?

The Puell Multiple is a valuable crypto trading indicator as it provides insights into Bitcoin's market cycles and potential undervaluation or overvaluation. By tracking this indicator, traders can make more informed decisions and potentially capitalize on favorable trading opportunities in the crypto market.

What is the Puell multiple formula?

The Puell Multiple formula is calculated by dividing the daily issuance value of Bitcoin (in USD) by the 365-day moving average of the daily issuance value. This formula helps determine the relationship between the market price of Bitcoin and the mining rewards earned by miners, providing insights into market efficiency.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more