Table of Contents

ToggleKey Takeaways:

- Crypto whales, including Bitcoin whales, hold significant digital assets, profoundly influencing market dynamics.

- Bitcoin whales differentiate themselves from regular holders through their massive holdings, long-term perspective, and market impact.

- Prominent Bitcoin whales, like Satoshi Nakamoto, Michael Saylor, the Winklevoss twins, Roger Ver, and Barry Silbert, play pivotal roles in the crypto ecosystem.

- Understanding Bitcoin whales and their activities is crucial for gauging market sentiment and predicting price fluctuations.

- Bitcoin whales are not merely investors; they are architects of market trends, shaping the future of cryptos.

What are Crypto Whales?

In the ever-evolving landscape of cryptos, the term “whales” often surfaces in discussions about Bitcoin and other digital assets. Crypto whales are not marine creatures but rather individuals or entities holding substantial amounts of a particular crypto, particularly Bitcoin. These entities possess a considerable share of the Bitcoin market and, as a result, wield the power to influence its price and ecosystem significantly.

Bitcoin whales are typically characterized by their ownership of a large number of Bitcoins, often in the thousands or even tens of thousands. The crypto community closely monitors their activity because their actions can trigger substantial market movements. Understanding these Bitcoin whales’ actions is crucial for gauging market sentiment and potential price fluctuations.

Crypto enthusiasts and analysts regularly scrutinize data, such as Bitcoin whales’ wallet addresses, holdings, and transaction history, to gain insights into their behavior. Tracking the activity of the top Bitcoin whales provides valuable information about whether they are accumulating more Bitcoin, selling off their holdings, or moving assets between wallets. This monitoring helps form predictions and understand the broader dynamics of the Bitcoin market.

In the next sections, we’ll delve deeper into the fascinating world of Bitcoin whales, exploring their activities, motivations, and impact on the crypto landscape.

What sets Bitcoin Whales apart from Crypto Holders?

As we have understood so far, Bitcoin whales stand out as a unique category of participants due to their exceptional holdings and market influence. Thus, understanding how Bitcoin whales differ from the average crypto holder is essential for grasping the crypto market dynamics. Here’s a breakdown of what sets Bitcoin whales apart:

- Enormous Holdings: Bitcoin whales possess a substantial number of Bitcoins, often numbering in the thousands or even tens of thousands. This starkly contrasts regular crypto holders who typically own smaller fractions of Bitcoin.

- Market Influence: With their substantial holdings, Bitcoin whales have the power to impact the Bitcoin price significantly. Their buying or selling activity can trigger market rallies or crashes, making traders and analysts closely watch their actions.

- Institutional vs. Retail: Bitcoin whales are often institutions, large investors, or early adopters who entered the market when Bitcoin was in its infancy. In contrast, crypto holders encompass a broader range of retail investors and traders.

- Long-Term Perspective: Bitcoin whales tend to have a long-term perspective on their investments. They may hold onto their Bitcoin for years, while crypto holders often trade more frequently.

- Wallet Activity: Bitcoin whales’ wallet activity is closely monitored. Their movements, such as transferring large sums of Bitcoin between wallets, can signal significant decisions, like portfolio rebalancing or profit-taking.

- Impact on Market Sentiment: Bitcoin whales’ actions often dictate market sentiment. When they accumulate more Bitcoin, it can signal confidence in the market, while large-scale sell-offs may create fear and uncertainty.

- Liquidity: Bitcoin whales often have access to significant liquidity, allowing them to enter or exit the market with minimal price slippage. Crypto holders may not enjoy the same level of liquidity.

Understanding these distinctions is crucial for anyone navigating the crypto market. Bitcoin whales play a pivotal role in shaping its landscape, making their behavior a subject of constant observation and analysis.

Additional Read: What are Crypto Whales Buying Now?

Whale Activity Updates – September 2023

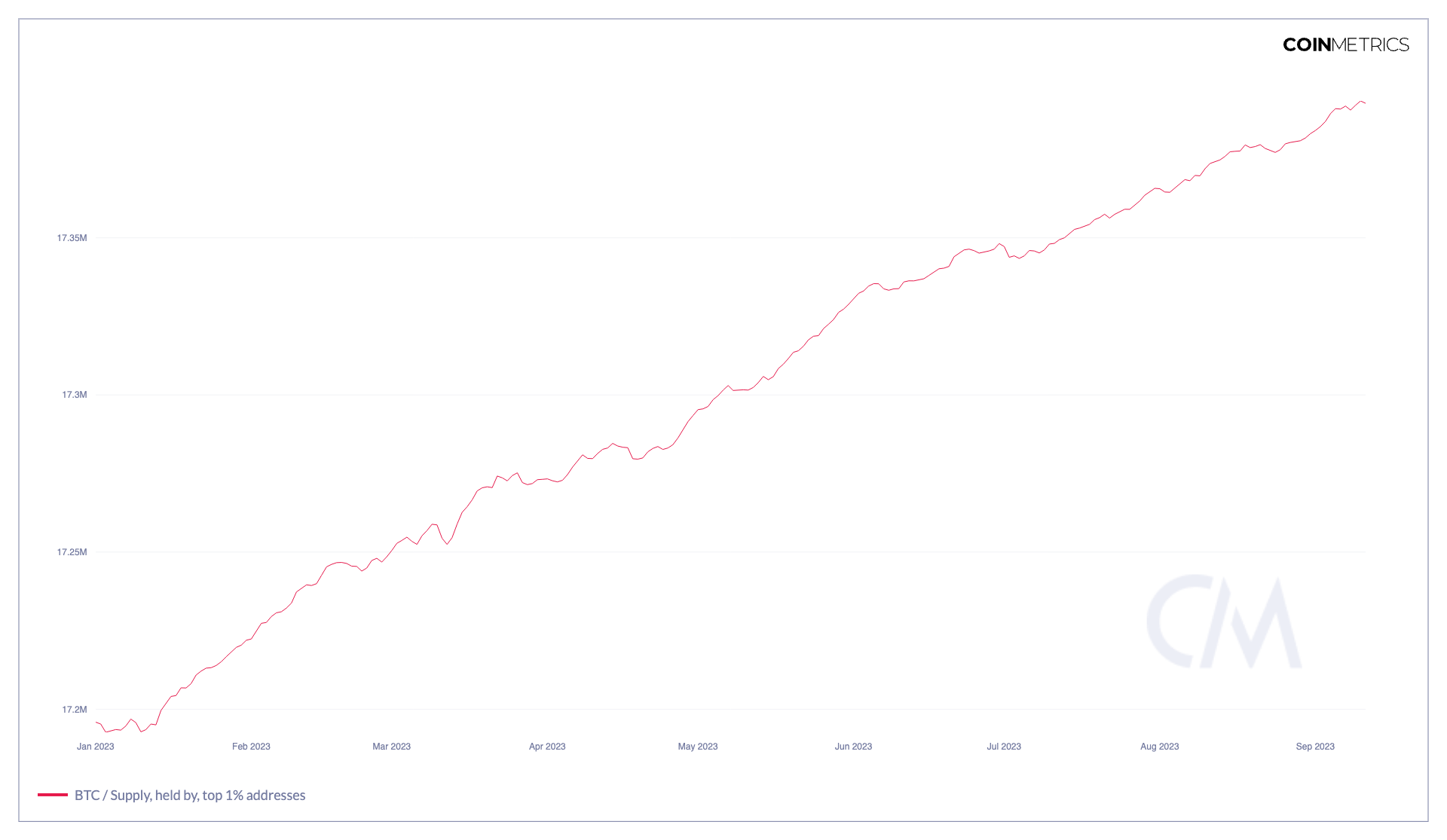

Bitcoin Supply in Top 1% Addresses

A notable trend in the Bitcoin market is the increasing supply of BTC held within the top 1% of addresses. This phenomenon highlights the concentration of wealth within a small fraction of the Bitcoin community. As Bitcoin’s popularity has grown over the years, so too has the number of individuals and institutions acquiring this digital asset.

BTC supply held by top 1% of addresses has been on a consistent uptrend from about 17 million BTC at the beginning of 2023 to 17.39 million BTC as of writing this article.

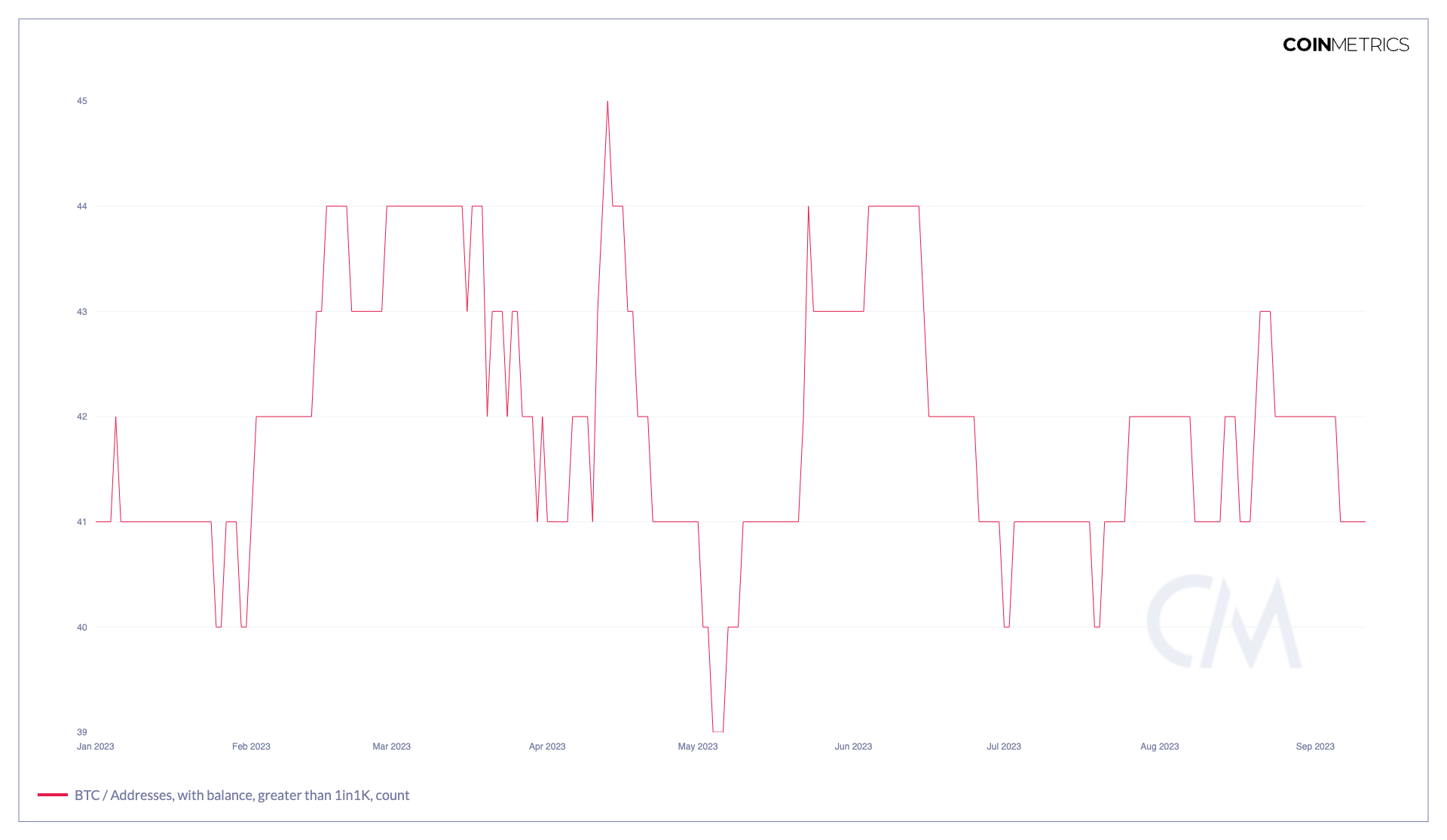

Address Count with ≥ .1% Supply

One intriguing development observed throughout 2023 in the Bitcoin ecosystem is the stagnation of the Address Count with ≥ .1% Supply. This metric refers to the number of addresses that collectively hold at least 0.1% of the total Bitcoin supply. In other words, it measures Bitcoin wealth distribution among a relatively small group of Bitcoin whales.

The fact that this metric remained stagnant suggests that the concentration of Bitcoin wealth among the top holders did not change significantly over the year. While Bitcoin is often lauded for its decentralized nature, this particular metric highlights that a significant portion of the crypto remains in the hands of a few.

Read More: Bitcoin Price Prediction

Supply in Addresses with Banalance Greater than 1000 BTC

One notable trend in 2023 has been the consistent uptick in the Supply in Addresses with Balance Greater than 1000 BTC. This metric tracks the amount of Bitcoin held in addresses with balances exceeding 1000 BTC, a substantial sum by any standard. The increase in this metric indicates that a growing number of addresses are accumulating larger amounts of Bitcoin.

Several factors could contribute to this trend. Institutional investors, corporations, and high-net-worth individuals might be actively accumulating Bitcoin, driving up the supply in these large addresses. Additionally, it could reflect a growing interest in Bitcoin’s long-term potential as a store of value and investment asset.

This uptrend suggests that larger entities continue to see value in holding significant amounts of Bitcoin, which may influence market dynamics and sentiment. It also raises questions about the evolving nature of Bitcoin ownership and its potential impact on the crypto’s future trajectory.

Read On: What Happens After All 21 Million Bitcoins are Mined?

Top Bitcoin Whales

Now, let us take a closer look at some of the most significant Bitcoin whales, shedding light on the individuals and institutions that shape the Bitcoin landscape.

- Satoshi Nakamoto: The Enigmatic Originator

At the dawn of Bitcoin’s existence, an entity known as Satoshi Nakamoto crafted this revolutionary crypto, and to this day, their true identity remains shrouded in mystery. Nakamoto’s Bitcoin address holds approximately 1 million BTC, a staggering sum that translates to roughly $19.2 billion in today’s crypto market. If Nakamoto is indeed an individual and not a collective effort, this would establish them as the most substantial crypto whale in history. - Michael Saylor: MicroStrategy’s Bitcoin Maestro

Michael Saylor stands as a prominent figure in the realm of Bitcoin whales. An accomplished American entrepreneur and businessman, Saylor’s personal Bitcoin holdings exceed 17,732 BTC, valued at over $1.14 billion. Notably, his company, MicroStrategy, embarked on a Bitcoin accumulation journey in 2020. While the precise quantity held by Saylor’s firm remains undisclosed, experts estimate it to be in the billions, further solidifying his status among the elite Bitcoin whales. - The Winklevoss Twins: From Facebook Foes to Crypto Titans

Renowned for their legal battle with Mark Zuckerberg over the creation of Facebook, the Winklevoss twins redirected their $65 million settlement into Bitcoin investments. This strategic move allowed them to amass approximately 70,000 bitcoins, alongside a diversified crypto portfolio. Their early Bitcoin investments established them as substantial players in the crypto world. - Roger Ver: The ‘Bitcoin Jesus’

Roger Ver, often referred to as the ‘Bitcoin Jesus,’ has been a prominent crypto advocate since 2011. His impressive Bitcoin holdings amount to around 335,000 BTC. Ver’s involvement in various crypto ventures, including Ripple, bitcoinstore.com, and Kraken, underscores his profound impact on the crypto landscape. He has consistently hailed Bitcoin as one of humanity’s most remarkable inventions. - Barry Silbert: Pioneering Crypto Investment

Barry Silbert, an early Bitcoin adopter, purchased Bitcoin worth approximately $175,000 in 2012 when each Bitcoin cost a mere $11. His foresight and commitment to cryptos led to the establishment of Digital Currency Group (DCG) in 2013, a conglomerate comprising five crypto-focused companies. DCG has since accrued assets exceeding $28 billion, encompassing Bitcoin and Ethereum, making Silbert’s journey in the crypto world not only lucrative but also profoundly influential.

These five individuals and entities represent the upper echelon of Bitcoin whales, wielding substantial influence in digital assets. Their actions and investments continue to shape the evolving landscape of cryptos.

Conclusion

In the ever-evolving Bitcoin market, the role of Bitcoin whales remains a captivating and influential phenomenon. These substantial holders of Bitcoin, often shrouded in mystery, cast ripples across the crypto seas, with their actions closely monitored by enthusiasts and analysts alike. As we have delved into the world of Bitcoin whales, explored their notable figures, and dissected their intriguing activities, it becomes clear that they are not just investors but architects of market trends.

As we continue whale watching and scrutinizing Bitcoin whales’ wallets, we must remember that their activity plays a pivotal role in shaping the crypto landscape. The largest Bitcoin holders of 2023 have the power to propel this digital asset to new heights or stir the seas of volatility. The Bitcoin whales’ movements are not just a spectacle; they are a force to be reckoned with, capable of charting Bitcoin’s course into the future.

FAQs

What is a Bitcoin whale?

A Bitcoin whale is an individual or entity that holds a significant amount of Bitcoin, typically a sum that can influence the market due to its size.

How many Bitcoin whales are there?

The exact number of Bitcoin whales is challenging to determine since it depends on the amount of Bitcoin held by each entity. Generally, there are thousands of Bitcoin wallets with substantial holdings.

Are Bitcoin whales a threat to the market?

Bitcoin whales can impact short-term price movements, but they don't necessarily pose a threat to the overall market. Their actions are closely watched and analyzed by the crypto community.

How do Bitcoin whales affect smaller investors?

Bitcoin whale activity can lead to price volatility, impacting smaller investors' portfolios. However, long-term investors often focus on the technology's fundamentals rather than short-term price fluctuations.

What are the risks of being a Bitcoin whale?

Bitcoin whales face unique risks, including security threats, regulatory scrutiny, and the responsibility of managing large holdings. Additionally, their trading decisions can impact their own investments.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more