Crypto Crash Recap: Series of Events that Impacted the Crypto Market in 2022

As we know, the numerous crashes and layoffs, and halting of withdrawals that the crypto world has seen in 2022 alone, have resulted in creating a diary for the crypto space! To look back into all that took place in the crypto world in 2022; here is a recap of the crypto crash series.

Table of Contents

ToggleIntroduction

The crypto space, similar to any asset class has seen a whole lot of journeys in green as it has seen a whole lot of journeys in red. Being an asset class, the market being a volatile one has always been a basic feature of the space. However, since the pandemic hit the world and the crypto space started to become a widely adopted asset class, a whole other bunch of scenarios changed. What are they?

- Living became very different during the pandemic

- Many governments started printing millions of dollars to circulate in the market

- Some major economics and world GDP rates saw a drop during the pandemic period

Moving past 1.5 years since 2020, by the end of last year, the crypto cycle was massively bullish! Within January 2022, the Bitcoin price started to see a steady drop, till we reach May and the crypto ecosystem sees the fall of one of the most well known stablecoins; Terra LUNA. Now that we are almost entering the last month of 2022, and with the FTX collapse being referred to as ‘another shocking incident’ in the crypto space, most of us feel confused as to what happened before it… As we know, the numerous crashes and layoffs, and halting of withdrawals that the crypto world has seen in 2022 alone, have resulted in creating a diary for the crypto space! To look back into all that took place in the crypto world in 2022; here is a recap of the crypto crash series.

Key Takeaways:

- The overall crypto market cap fell from its $1 trillion value during the crypto winter phase, currently running at $801,423,880,608 (November 21, 2022)

- In less than eight months, Bitcoin (BTC -2.12%) fell 70% from its all-time highs in November 2022, while the second biggest crypto by market cap, Ethereum (ETH -3.13%) took a 78% hit over the same period.

Why is the crypto market crashing & how did it all begin?

According to the Chief Blockchain Architect of the Hybrid Finance Blockchain (HYFI), Rohas Nagpal, the following reasons are what he cited as responsible for the crypto crash:

- Extreme over-the-top valuation of most crypto projects.

- The gloom that was caused by the Russia-Ukraine conflict.

- The numerous the pandemic, COVID-19 lockdowns.

- Governments’ multiple attempts at taking smaller steps into the crypto world.

Series of things that impacted the Crypto Market in 2022

Among the volatile aspect of the crypto market, a few of the incidents that played a big role to propel the market crash are:

The Terra Luna Crash:

A little recap of the incident, the UST got de-pegged heavily and Terraform Labs liquidated all their 40K BTC holdings to stabilize the UST peg. This led to a massive crypto crash as Bitcoin price fell lower than $27,000 for the first time since December 2020. As the crypto space had a bearish start to May’s trade and was consolidating within narrow ranges, a huge influx of BTC destabilized the entire market largely. Further, LUNA price and UST both started plunging hard! And as UST lost its peg, new LUNA coins were minted, which impacted its price heavily. Also, a popular lending protocol Anchor also witnessed huge ANC withdrawals as it offered a 20% yield on UST deposits.

Terra (LUNA) Crash Wrecks Havoc In The Crypto Industry #terra #terraluna #luna #terrausd #ust #lunacrash #terradownfall #cryptocurrency #cryptomarket – https://t.co/XqwEJPkkZi pic.twitter.com/D3QQMwLr8a

— Crypto economy (EN) (@CryptoEconomyEN) May 13, 2022

Read more on: Terra Luna Crash

The Celsius Incident:

Soon after the market crash that followed the LUNA crash, one of the largest crypto lending platforms in the world, Celsius Networks LLC dropped another huge news for all the crypto investors. The New Jersey based crypto lending company announced that it was pausing all withdrawals, swaps, and transfers between accounts, “due to extreme market conditions.” As the announcement hit the crypto space, the biggest crypto asset by market cap, Bitcoin saw a further 14% decrease in value since last Sunday.

The Voyager Steep Fall:

Voyager was a crypto lending and trading powerhouse, which was one of the few digital asset brokerages listed on stock markets anywhere in the world. Soon after the company boasted about its 3.5 million users, the company is now known to have pushed immense unsecured loans to Three Arrows Capital (3AC). A backstabbing incident as the 3AC, a failed hedge fund now appears to have defaulted on all of its obligations, and its founders are reportedly fugitives. As stated by the CEO himself, Stephen Ehrlich, while filing for bankruptcy, the company’s bad financial state was caused by two issue. First, high inflation and rising interest rates have caused crypto prices to dump, with bitcoin down 60% from its all-time high in 2021. Second, Three Arrows Capital, a crypto hedge fund, defaulted on a $650 million loan issued by Voyager in March. An incident that turned sour in June 2022.

Voyagers, today we made the difficult decision to temporarily suspend trading, deposits, withdrawals, and loyalty rewards. Read more at: https://t.co/bpGFqQtjAs

— Stephen Ehrlich (@Ehrls15) July 1, 2022

One incident started to give rise to another, and just like dominos, the incidents started to occur one after another. Terra’s downfall led to Three Arrows’ default led to Voyager’s reckoning.

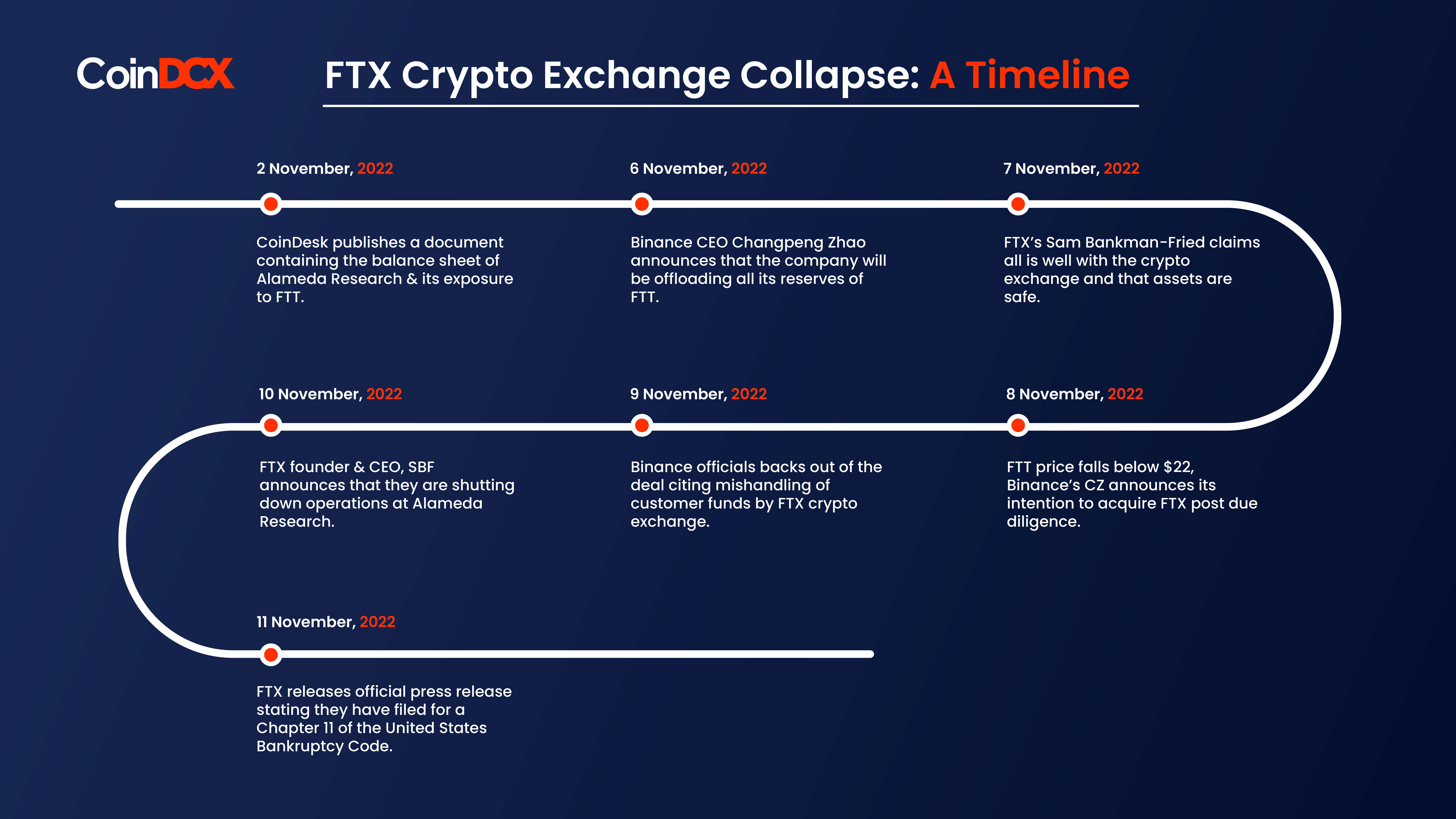

The FTX Collapse:

Fed Interest Rates:

Apart from the incidences that the crypto space encountered, the follow up incident of making billions of dollars worth on money available during the pandemic; the hike in FED Interest rates. The rise in rates took place thrice in only a couple of months time.

A GLANCE AT FED’S HISTORY OF HIKES IN INTEREST RATE IN 2022

| Date | Rate Change (bps) | Federal Funds Rate |

| September 21, 2022 | 75% | 3.00% to 3.25% |

| July 27, 2022 | 75% | 2.25% to 2.5% |

| June 16, 2022 | 75% | 1.5% to 1.75% |

| May 5, 2022 | 50% | 0.75% to 1.00% |

Major tokens have seen a hit in value since the Fed has made monetary policy changes to tame inflation. Some organizations and crypto investors have liquidated their holdings for the last couple of months due to rising prices of fuel and essentials. The US inflation is at its highest compared to the last four decades’ pattern. As mentioned above, inflation is the aftermath of the pandemic that took over the world. Nasdaq and S&P saw a drop of 4 and 3.3& respectively. The CNBC report during the last week of August 2022, hinted at ETH whales making an exit ahead of the anticipated ETH merge. With rising unemployment numbers and a relatively low purchasing power, investors fear pumping money into crypto and traditional markets.

Read more on FED rates here.

WHAT ARE THE REASONS FOR THE CRYPTO CRASH?

- The crypto space gained huge attention during the 2021 bull run that attracted strong hands from all industries. However, the massive adoption also bought the crypto space under the regulatory radar. Since then Bitcoin maintained descending consolidation while altcoins underperformed more than BTC.

- Another probable reason for the crypto crash may be the rise in the Customer Price Index(CPI) which is the highest inflation since 1981. Not only crypto but the global financial markets have also been hit severely.

- The increasing strength in the US dollar is one of the main reasons for the sideway trend of the crypto markets, which has negatively impacted the stock markets and cryptos in turn.

- In an attempt to calm the rising inflation, the FED raised the interest rates which is a recession indicator, inducing uncertainty among the traders, who opted out of the markets to secure their capital

- Coming to the crypto-space, the investors are taking too much leverage hampering the volatility in the near term.

- The lack of liquidity within the markets is also a major reason for the crypto crash as the investors are unable to liquidate their large positions

- Since the beginning of the year 2022, the crypto markets witnessed multiple security breaches which have shaken up the masses

- One of the major reasons for this crypto crash is the influencers manipulating the prices with their mentions which is only for a short time frame.

Read in detail on: FTX Collapse

Things That Crypto Investors Should Know

CoinDCX has not been exposed to any of the incidents that took place which caused the market to crash this year. As the highest-valued exchange of India, CoinDCX continues to be a customer-first exchange. Soon after the market went into a shock with the FTX incident, CEO and co-founder of CoinDCX, Sumit Gupta shared the way CoinDCX operates in order to protect the customers and its ways for risk management:

- We never expose user funds to price and credit risk

Your funds are your funds and your crypto is your crypto. We never lend or take any actions with your assets without prior consent.All customer assets are held 1:1. This means that customers can access their funds at any time.

- We do not have a native token

Many exchanges have native tokens that form a large part of their net worth. Native tokens can be used as a store of value and medium of exchange across products and liquidity. Incentives such as airdrops are offered to users to increase the value of native tokens. This exposes the users to asset concentration risk as well as liquidity risk.

CoinDCX has taken a conscious decision to not have a native token. This helps safeguard our users from the above risks & more that are associated with launching a native token. - Risk Management is an integral part of CoinDCX

CoinDCX keeps stringent security checks to ensure user funds are safe in hot and cold wallets. CoinDCX wallets are state of the art and have multi-party-computation (MPC) which means that no single transfer from these wallets can happen without going through a set of rules which require authentication from the users themselves. - We are fully audited

Our systems and processes are regularly audited. We also conduct daily audits of user funds and map them across the wallets. Our 24×7 risk monitoring thresholds ensure we don’t miss events that pose risk to user funds.

Additional Read: CoinDCX on Proof of Reserves

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more