Table of Contents

ToggleIntroduction

What Is Block Reward in Bitcoin?

In Bitcoin, the block reward is what miners get for adding a new block to the blockchain through mining. It comprises two main parts:

- Block Subsidy: A fixed amount of new bitcoins is generated with each block. Initially 50 bitcoins, it halves every four years through a ” bitcoin halving ” process (e.g., 25, 12.5, 6.25 bitcoins). Halving repeats until the maximum supply of 21 million bitcoins is reached.

- Transaction Fees: Miners also earn fees for including transactions in the block. Users can attach fees to incentivize priority. The miner who successfully mines the block collects these fees.

The total block reward, a combination of block subsidy and transaction fees, motivates miners to secure the network. As the block subsidy diminishes with halving events, transaction fees become more crucial, influencing the fee-to-reward ratio and impacting the Bitcoin network’s economics and security.

Read On: How Miners Are Preparing for Bitcoin Halving 2024?

Mining Rewards and Their Evolution

The decentralized nature of the Bitcoin ecosystem relies on a structured incentive system, particularly mining rewards. Initially, miners are compensated with a predetermined amount of newly created Bitcoin for verifying a new block, acting as a reward, and introducing new coins at a set issuance rate.

The block reward undergoes changes through programmed halving events, reducing mining rewards by 50% every four years. This crucial event limits the total Bitcoin supply to never exceed 21 million, ensuring scarcity and potential value.

Successive halving events have significantly decreased the initial 50 Bitcoins per block, prompting miners to adapt for profitability through operational efficiencies.

Learn More: Is Bitcoin Mining Profitable?

What is the Bitcoin Fee-to-Reward Ratio?

The Bitcoin fee-to-reward ratio indicates the share of total block rewards derived from transaction fees paid by users within the Bitcoin network.

Transaction fees enable users to compensate miners, incentivizing the inclusion of their Bitcoin (BTC) transactions in a block. Miners commonly prioritize transactions with higher fees to maximize their earnings. However, fee amounts can vary based on things like network congestion and the size of a user’s transaction in bytes.

Miners play a pivotal role in the Bitcoin network by solving intricate mathematical puzzles to validate transactions and enhance network security. As a reward, miners receive newly created BTC (referred to as block reward or block subsidy) and any fees associated with the transactions included in the blocks.

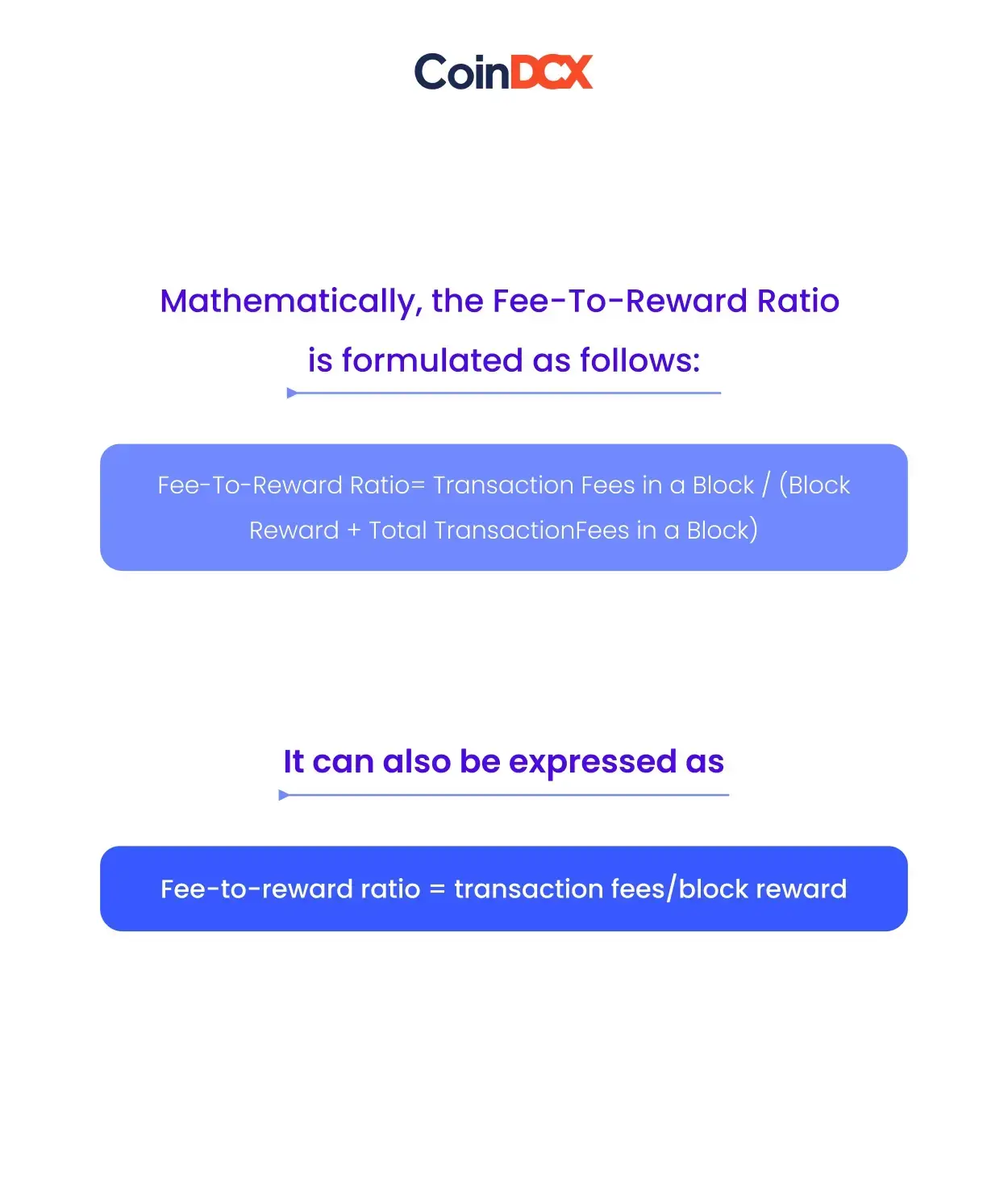

How To Calculate Fee-To-Reward Ratio

An increasing Fee-To-Reward Ratio indicates a growing reliance on transaction fees in comparison to block rewards. Observing this ratio provides insights into the evolving economic dynamics of the Bitcoin network. A high ratio may imply:

- Network congestion, leading to higher transaction fees.

- The imminent approach of a halving event, resulting in reduced block rewards.

- Intensified competition among users to prioritize their transactions.

Even though a low ratio may suggest an abundance of block rewards or diminished competition for block space, it is a scenario often seen during periods of low network activity. To better understand this ratio’s implications, let’s explore three scenarios where the Bitcoin fee-to-reward ratio is greater than 1, equal to 1, and less than 1.

-

Bitcoin Fee-to-Reward Ratio Greater Than 1:

Imagine a scenario with frequent transactions, a block reward of 6.25 BTC, and high demand for block space. Users, eager for prompt transaction validation, are willing to pay substantial fees. Let’s say miners receive 7 BTC in transaction fees for the included transactions, resulting in a fee-to-reward ratio exceeding 1 (1.12).

Bitcoin Fee-to-Reward Ratio: 7/6.25 = 1.12

This competitive scenario arises when users look for quick transaction confirmation.

-

Bitcoin Fee-to-Reward Ratio Equal to 1:

Consider a case where the block reward and total transaction fees earned by miners are identical. Assuming a total fee collection of 6.25 BTC, mirroring the block reward, the fee-to-reward ratio equals 1.

Bitcoin Fee-to-Reward Ratio: 6.25/6.25 = 1

In this situation, fees and block rewards contribute to miners’ revenue equally.

-

Bitcoin Fee-to-Reward Ratio Less Than 1:

Now, envision reduced transaction demand on the network, with users unwilling to pay high fees for validation. If miners receive 4 BTC in transaction fees while the block reward remains at 6.25 BTC, the fee-to-reward ratio is 0.64.

Bitcoin Fee-to-Reward Ratio: 4/6.25 = 0.64

This scenario suggests that the block reward surpasses the total transaction fees collected, possibly occurring during lower network congestion or when users are less competitive in adding transactions to the next block.

Why is Bitcoin’s Fee-To-Reward Ratio Important?

The Bitcoin fee-to-reward ratio is crucial for understanding the evolving economic incentives within the network, influencing users, miners, and overall blockchain stability and security.

Impact of Bitcoin’s Fee-To-Reward Ratio on Transaction Costs for Users

For users engaging in transactions on the Bitcoin network, the changing Fee-To-Reward Ratio may influence transaction costs. A higher ratio indicates a growing reliance on transaction fees for miner revenue. This situation, particularly during periods of high network congestion, could lead to heightened competition among users vying for transaction priority, resulting in increased fees. Conversely, network upgrades or scaling solutions addressing congestion might alleviate such pressures, providing relief in transaction costs.

As the ratio continues to evolve:

- Behavioral Shifts: Miners may adopt more sophisticated fee algorithms to maximize earnings. This could involve dynamic fee adjustments based on network congestion or offering tiered transaction confirmation times based on fees.

- Consolidation: The mining industry may experience increased consolidation. As transaction fees become crucial for profitability, economies of scale and operational efficiency will become even more critical. Smaller miners might exit the industry or merge operations with larger entities to stay competitive.

- Geographical Redistribution: Given the impact of electricity costs on mining profitability, regions offering cheaper electricity might witness a surge in mining operations, especially if fee-based revenues become the primary income source for miners.

Additional Read: How to Mine Bitcoin on Smartphone?

Advantages And Disadvantages of Bitcoin’s Fee-To-Reward Ratio

| Advantages | Disadvantages |

|---|---|

| Encourages decentralized mining and network contribution. | Ratio subject to rapid changes impacting miner income. |

| Promotes quicker confirmations through fee-based prioritization. | High ratios may raise transaction fees during congestion. |

| Adjusts to market changes, tech advancements, and user behavior. | Higher reliance on fees may lead to miner consolidation. |

| Insights into network stability based on user fee willingness. | Cheaper electricity regions may see increased mining. |

| Assesses network sustainability after block reward halving. | Users paying lower fees may face slower processing times. |

| Reflects market sentiment through transaction costs. | Concerns about security post-halving if fees are insufficient. |

| Encourages miners to use advanced fee algorithms. | Small miners may struggle, reducing efficiency. |

| Cheap electricity regions see increased mining. | Increased mining may impact the environmental footprint. |

| Reflects competition for transaction validation. | Users may need to adjust fees based on urgency and network conditions |

Impact Bitcoin Transactions in a Post-Mining Era

While the ratio dynamics will shift from relying on newly created BTC to transaction fees, its role in controlling transaction prioritization and enhancing network efficiency will persist in the Bitcoin ecosystem.

The fee-to-reward ratio linked to freshly created BTC will become irrelevant once all Bitcoin is mined and the block reward reaches 0. At that point, miners won’t receive compensation through a block reward for adding a new block to the blockchain.

Instead, the sole factor influencing the fee-to-reward ratio will be users’ transaction fees to include their transactions in blocks. The ratio’s significance will endure as it mirrors user competition to promptly validate transactions. Users will adjust their fee offerings based on urgency and network conditions, prompting miners to prioritize transactions with higher fees.

The fee-to-reward ratio will continue to impact the speed and reliability of transaction confirmations in the post-mining stage. Users offering higher fees may experience faster processing, while those opting for lower fees might encounter slower confirmation times.

Conclusion

The intricacies of Bitcoin’s Fee-To-Reward Ratio go beyond numerical complexities, reflecting the complex dynamics within crypto ecosystems. As Bitcoin charts its course, this ratio is set to transform into more than a metric. Stakeholders, ranging from miners to investors, need to demonstrate insight, recognizing that the blockchain domain involves not only codes and coins but also thoughtful choices and shared outcomes. In an age where digital assets reshape the concept of value, maintaining a balance between value and vision becomes important.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more