Table of Contents

ToggleKey Takeaways:

- Introduction of Crypto ETFs: The launch of Bitcoin (BTC) and the potential approval of Ethereum (ETH) ETFs have had a profound impact on the investment landscape. These ETFs blend features of stocks and mutual funds, offering diversified portfolios of digital assets traded on major exchanges.

- Bitcoin ETF Overview: Bitcoin ETFs are exchange-traded funds linked to the price of Bitcoin, providing indirect exposure to BTC’s price movements through futures contracts traded on conventional exchanges like stocks. This allows traditional investors to participate in Bitcoin’s market without owning the crypto directly.

- Types of Bitcoin ETFs: There are two primary types of Bitcoin ETFs:

- spot Bitcoin ETFs: These hold actual BTC, correlating directly with Bitcoin’s market price. They involve purchasing Bitcoin from the spot market and are seen as influencing genuine demand for Bitcoin.

- Bitcoin Futures ETFs: These do not hold Bitcoin but engage in futures contracts, speculating on future BTC prices. They offer flexibility, including the ability to short BTC, but their value can deviate from the spot price due to market expectations.

- Comparative Analysis with Ethereum ETFs: Both Bitcoin and Ethereum ETFs predominantly fall under futures ETFs, enabling speculation on future price movements. Spot ETFs, which directly hold the underlying crypto, are perceived to influence market dynamics more directly by reflecting current market prices.

- Market Impact and Regulatory Outlook: The introduction of spot Bitcoin ETFs in early 2024 marked a regulatory milestone, attracting substantial assets under management and institutional adoption. spot Ethereum ETFs are pending approval, anticipated to further diversify investment options in the crypto market.

- ETFs’ Effect on Market Dynamics: ETFs are expected to enhance market accessibility and liquidity, potentially stabilizing crypto prices and validating Bitcoin and Ethereum as credible assets in the eyes of regulators and mainstream investors.

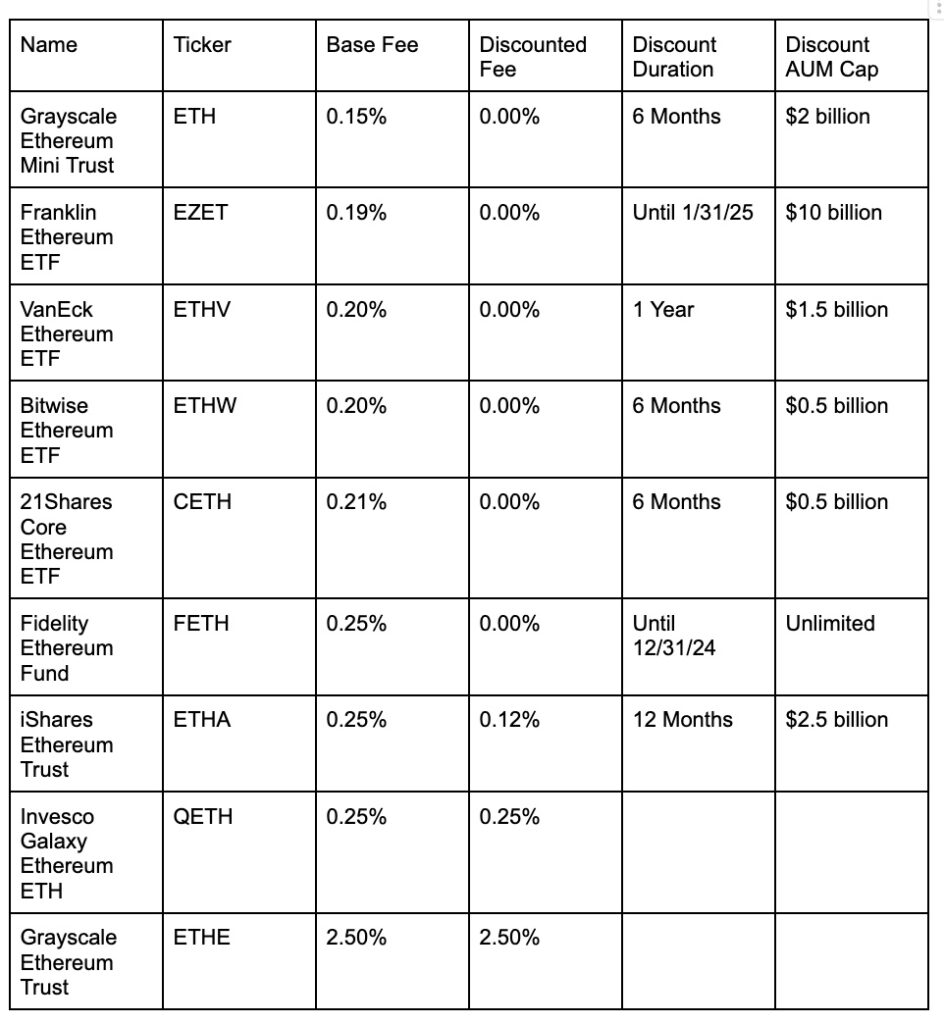

- Spot Ethereum ETF Approved: Ethereum ETFs have now been approved to trade by the US SEC on July 23, 2024 – a major watershed moment for the crypto industry as a whole as the first altcoin ETF goes live. Five spot Ethereum ETFs, including notable funds, will start trading on CBOE, with additional ETFs expected on Nasdaq and NYSE Arca pending announcements.

- Overall Potential and Conclusion: The introduction of BTC and ETH ETFs signifies a maturation phase for cryptos, offering broader investor access, reduced volatility, and diversified investment opportunities. These developments are poised to reshape the crypto landscape, paving the way for sustained growth and mainstream adoption.

ETFs an Overview:

Crypto ETFs made a significant impact on the investing market with the introduction of BTC and ETH ETF propositions. An ETF is a hybrid investment vehicle, blending features of individual stocks and mutual funds, offering a diversified portfolio of assets traded on major stock exchanges.

Unlike mutual funds valued once at the end of the day, ETFs reflect real-time price changes, allowing investors to trade them throughout the day like regular stocks. A Bitcoin ETF is a natural evolution tailored to the crypto industry, mirroring the value of Bitcoin. It enables participation in the BTC market without the need for direct ownership, simplifying the process for traditional investors, who can have a stake in Bitcoin’s value fluctuations without holding BTC itself.

Learn More: Index Funds vs Crypto ETFs

What is a Bitcoin ETF?

A Bitcoin futures ETF is an exchange-traded fund comprised of assets linked to the price of Bitcoin. Unlike being traded on a crypto exchange, these ETFs are traded on a conventional exchange.

Presently, the underlying assets in Bitcoin futures ETFs consist of Bitcoin futures contracts, which are traded on the Chicago Mercantile Exchange. A futures contract is a standardized agreement in which two parties commit to exchanging a specific quantity of assets on a designated day at a predetermined price.

The creation of these ETFs involves acquiring futures contracts from the CME Group and assembling them into a fund. Subsequently, the company makes the fund available to investors for purchase on an exchange. The futures contracts within the fund are then actively managed.

There are two types of Bitcoin ETFs you can explore:

- Spot Bitcoin ETFs custody actual BTC by acquiring an equivalent amount from the market when investors buy shares, ensuring a direct correlation between ETF shares and Bitcoin holdings. This, combined with the rebalancing process, provides a reliable way to track Bitcoin’s price fluctuations. This was launched earlier this year in 2024.

- Bitcoin futures ETFs, in contrast, don’t own Bitcoin but involve investors in futures contracts, where they commit to buying or selling Bitcoin at predetermined prices on specific dates. The value of futures ETFs is influenced not only by Bitcoin’s spot price but also by expectations of its future price, potentially causing deviations from the spot price. Futures ETFs offer flexibility, with the ability to short BTC, introducing their advantages and risks not present in spot Bitcoin ETFs.

Additional Read: spot Bitcoin ETF vs Bitcoin Futures ETF

Comparative Analysis of Bitcoin & Ethereum ETF

A good number of globally available exchange-traded funds (ETFs) for Bitcoin (BTC) and Ethereum (ETH) predominantly fall under the category of “futures ETFs.” These instruments enable traders to speculate on the future prices of BTC or ETH by investing in futures contracts associated with Bitcoin or Ethereum. These contracts involve agreements to buy or sell assets at predetermined prices on specified future dates.

In contrast, crypto spot ETFs offer direct exposure to the underlying crypto. Through a spot ETF, traders or investors can acquire these assets at their current “spot price,” eliminating the need for direct handling or management of the underlying crypto—a task often perceived as complex.

The ETF holds Bitcoin or Ethereum on behalf of its shareholders within a trust, and the ownership of a portion of this trust is represented by ETF shares.

Given that spot ETFs require the actual purchase of Bitcoin from the spot market, many argue that they hold an advantage over futures ETFs. This is because spot ETFs influence genuine demand for Bitcoin on the spot market, consequently impacting the BTC price.

Spot ETFs are traded on exchanges, akin to regular stocks, facilitating easy buying and selling during market hours. However, as of now, there are no approved spot Bitcoin ETFs in the United States.

Timelines for spot Bitcoin ETFs

The launch of spot Bitcoin ETFs in early 2024 marked a significant milestone for the crypto industry, providing investors with a regulated and accessible way to gain exposure to the world’s largest digital asset. As of July 2024, the spot Bitcoin ETF landscape has rapidly evolved, with several funds hitting the market and attracting substantial assets under management (AUM).

According to recent data, there are currently 12 spot Bitcoin ETFs trading on major US exchanges, with a combined AUM of over $60 billion. The largest spot Bitcoin ETF, the IShares Bitcoin Trust Blackrock, has amassed an impressive $18.93 billion in assets since its launch in January 2024, according to data from ETF.com. Other notable funds include the Grayscale Bitcoin Trust ETF from Digital Currency Group, Inc. with $17.11 billion AUM and the Fidelity Wise Origin Bitcoin Fund from Fidelity with $10.39 billion AUM.

The rapid growth of spot Bitcoin ETFs can be attributed to several factors, including increased institutional adoption, regulatory clarity, and growing investor demand for exposure to the crypto market. The approval of these ETFs by the US Securities and Exchange Commission (SEC) has also helped to legitimize the asset class and attract a wider range of investors, including those who were previously hesitant to invest directly in Bitcoin due to concerns about security, storage, or regulatory compliance.

As the spot Bitcoin ETF market continues to evolve, investors can expect to see more funds launched in the coming months and years, offering a diverse range of investment strategies and exposure to the crypto market. However, it is important to note that investing in spot Bitcoin ETFs carries risks, and investors should carefully consider their investment objectives, risk tolerance, and the specific features and risks of each fund before making a decision.

Timelines for spot Ethereum ETFs

On July 23, 2024, the crypto market witnessed a significant milestone as the U.S. Securities and Exchange Commission (SEC) approved the first spot exchange-traded funds (ETFs) for Ethereum (ETH), marking a notable expansion in the availability of crypto investment vehicles. This decision follows the successful launch of Bitcoin (BTC) ETFs earlier in the year, which have attracted substantial investment interest, drawing tens of billions of dollars since January. The introduction of Ethereum ETFs opens up the second-largest crypto to a broader range of investors who prefer trading through traditional brokerage accounts.

This approval comes after a prolonged and uncertain journey. Just weeks prior, the approval seemed unlikely. However, in late May, the SEC began engaging with ETF issuers, culminating in the approval of a crucial filing on May 23, which paved the way for the final decision. This development is seen as a significant step towards integrating cryptos into mainstream financial markets, providing a more accessible and familiar investment vehicle for conventional investors.

The introduction of Ethereum ETFs is expected to impact the price of Ethereum significantly. Analysts predict that while the inflows might not match those of Bitcoin ETFs due to Ethereum’s lack of a first-mover advantage, the new investment vehicle could still attract billions of dollars in the first year. Some analysts forecast Ethereum’s price could surge to $6,500, driven by the increased accessibility and demand facilitated by the ETFs.

Overall, the launch of Ethereum ETFs signifies a pivotal moment in the evolution of the crypto market, offering investors a new, regulated way to gain exposure to one of the most prominent digital assets. This development is likely to enhance the legitimacy and appeal of cryptos in the broader financial landscape.

ETF’s Effect on BTC Price

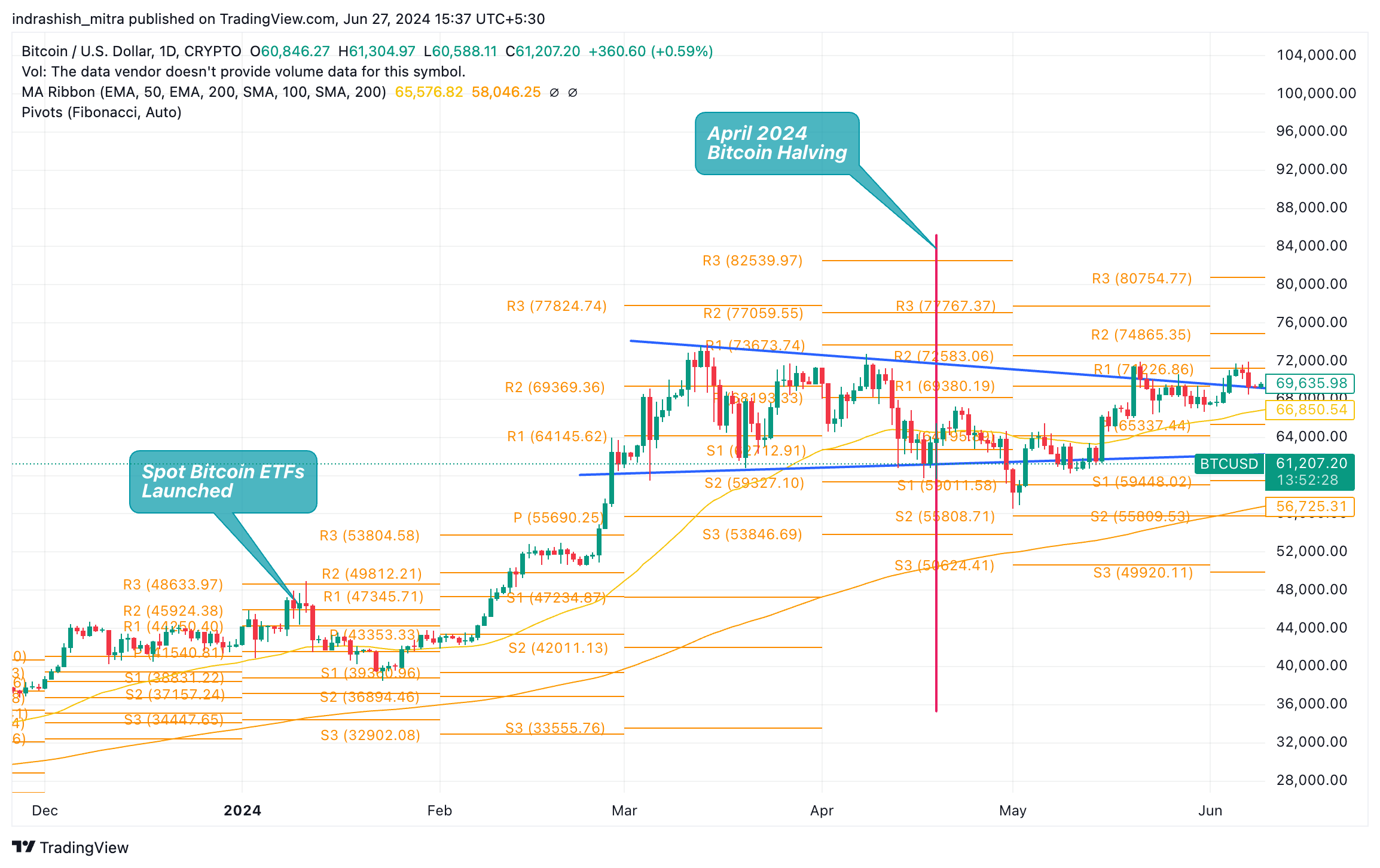

The effect of the launch of spot Bitcoin ETFs in the US on Bitcoin price globally has been largely positive – and it has been in line with other positive news around Bitcoin about Bitcoin Halving in April 2024.

As is evident from the chart above – Bitcoin price rallied from under $50,000 levels to create new all-time highs near $74,000 – resulting in a solid 60% rally in the timeframe, after the launch of the spot Bitcoin ETFs and leading up to the Bitcoin Halving 2024.

Read On: Bitcoin Price Prediction

ETF Impact on the Overall Crypto Market

The launch of Bitcoin ETFs and the impending arrival of spot Ethereum Exchange-Traded Funds (ETFs) are poised to reshape the crypto landscape significantly. These forthcoming ETFs, focused initially on Bitcoin and Ethereum, are expected to bring about several positive developments:

- Enhanced Market Accessibility: ETFs provide a more accessible entry point for traditional investors into the crypto market, potentially attracting significant institutional capital and fostering broader acceptance.

- Increased Liquidity: The introduction of these ETFs is anticipated to inject liquidity into the market. They offer a regulated and convenient avenue for investors to trade crypto assets, potentially enhancing market efficiency.

- Stability in Pricing: With heightened liquidity and investor participation, ETFs could help mitigate price volatility in the crypto sphere, fostering a more stable trading environment.

- Validation by Markets: Approval of Bitcoin and Ethereum ETFs would validate these cryptos in the eyes of regulatory bodies, bolstering their credibility and potentially drawing more mainstream investors.

- Diversified Investment Opportunities: These ETFs offer investors diversified exposure to the crypto market, enabling them to spread risk across various assets within a single investment vehicle.

Overall, the introduction of these ETFs, starting with Bitcoin and progressing towards Ethereum, holds promise for reshaping how cryptos are perceived and accessed by a broader investor base, potentially ushering in a new phase of growth and maturity for the crypto industry.

Learn More: Ethereum Price Prediction 2024

Conclusion

In conclusion, the launch of spot Bitcoin ETFs in January 2024 and the recent approval of spot Ethereum ETFs in July 2024 mark significant milestones for the cryptocurrency market. These ETFs democratize access to digital assets, attract institutional capital, and enhance market liquidity. Their ability to reduce price volatility and offer diversified investment opportunities could pave the way for broader mainstream adoption. The approval of both spot Bitcoin ETFs and spot Ethereum ETFs not only validates these cryptos in the eyes of regulatory bodies but also strengthens their credibility as viable investment assets. As the crypto market evolves, the introduction of ETFs is set to play a pivotal role in shaping its future trajectory, potentially driving sustained growth and maturation. Investors and stakeholders are closely monitoring these developments, anticipating how these ETFs will impact market dynamics and investor sentiment moving forward.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more