Table of Contents

ToggleIntroduction

In the ever-evolving world of cryptos, staying ahead of the game is key to making informed investment decisions. Traditional indicators often lose their edge as they become widely adopted, but innovation in the crypto space never sleeps. Glassnode and ARK Invest have introduced a groundbreaking approach to on-chain analysis that promises to sharpen your crypto investment edge.

Their report, titled “Coin Time Economics: A New Framework for Bitcoin On-Chain Analysis,” presents fresh insights that could redefine how we evaluate Bitcoin’s investment potential. In this article, we will delve into this innovative approach, explore its significance, and shed light on what it might mean for the world’s premier crypto.

Bitcoin’s on-chain data holds the key to understanding its behavior and potential future movements. Let’s unravel the details of this exciting new framework and how it could revolutionize your approach to Bitcoin analysis.

Cointime Economics Framework

Glassnode and ARK Invest have dedicated almost two years to developing a groundbreaking framework for Bitcoin on-chain analysis. This brand-new framework offers a fresh perspective, seeking to deliver a more accurate evaluation of Bitcoin’s market dynamics. However, it’s crucial to emphasize that this framework is not meant to be the sole basis for investment decisions and should not be considered as financial advice.

The heart of this innovative approach is the concept of “coin time economics,” which introduces the measurement of supply and demand for BTC using a novel metric known as “coin blocks.” But what exactly is coin time economics?

In essence, coin time economics revolves around the premise that the significance of a BTC transaction is closely tied to the time elapsed since the coins were last moved.

For instance, a BTC that has remained untouched for a decade holds more weight in analysis than one that recently changed hands, as the crypto community widely acknowledges.

However, this framework’s exclusion of “lost” BTC from its calculations sets this framework apart. Unlike most crypto analyses that include lost Bitcoins, which can potentially distort results, this framework focuses on precise evaluations.

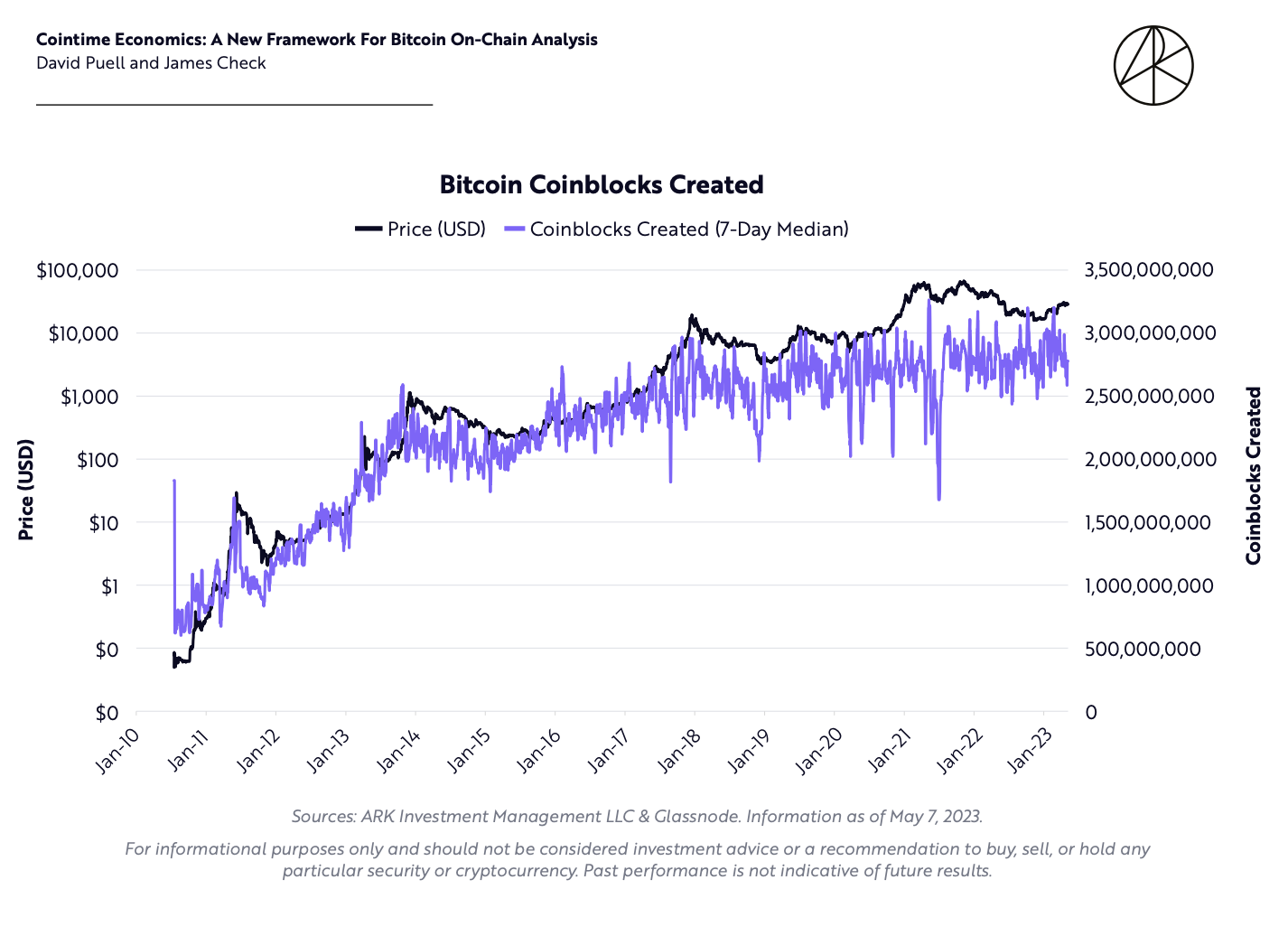

Moreover, the framework introduces the “coin blocks” measurement, a straightforward calculation involving the multiplication of the number of Bitcoins held by the number of Bitcoin blocks during which they remained unspent. For example, holding one BTC for ten blocks results in ten coin blocks.

This approach yields intriguing results. A remarkable correlation reveals that the number of coin blocks is intrinsically linked to Bitcoin’s price. Over time, these two variables have displayed an exceptionally close relationship, although the correlation seems to have shifted slightly during recent bullish market conditions.

Read On: Bitcoin Technical Analysis

Coin blocks Destroyed

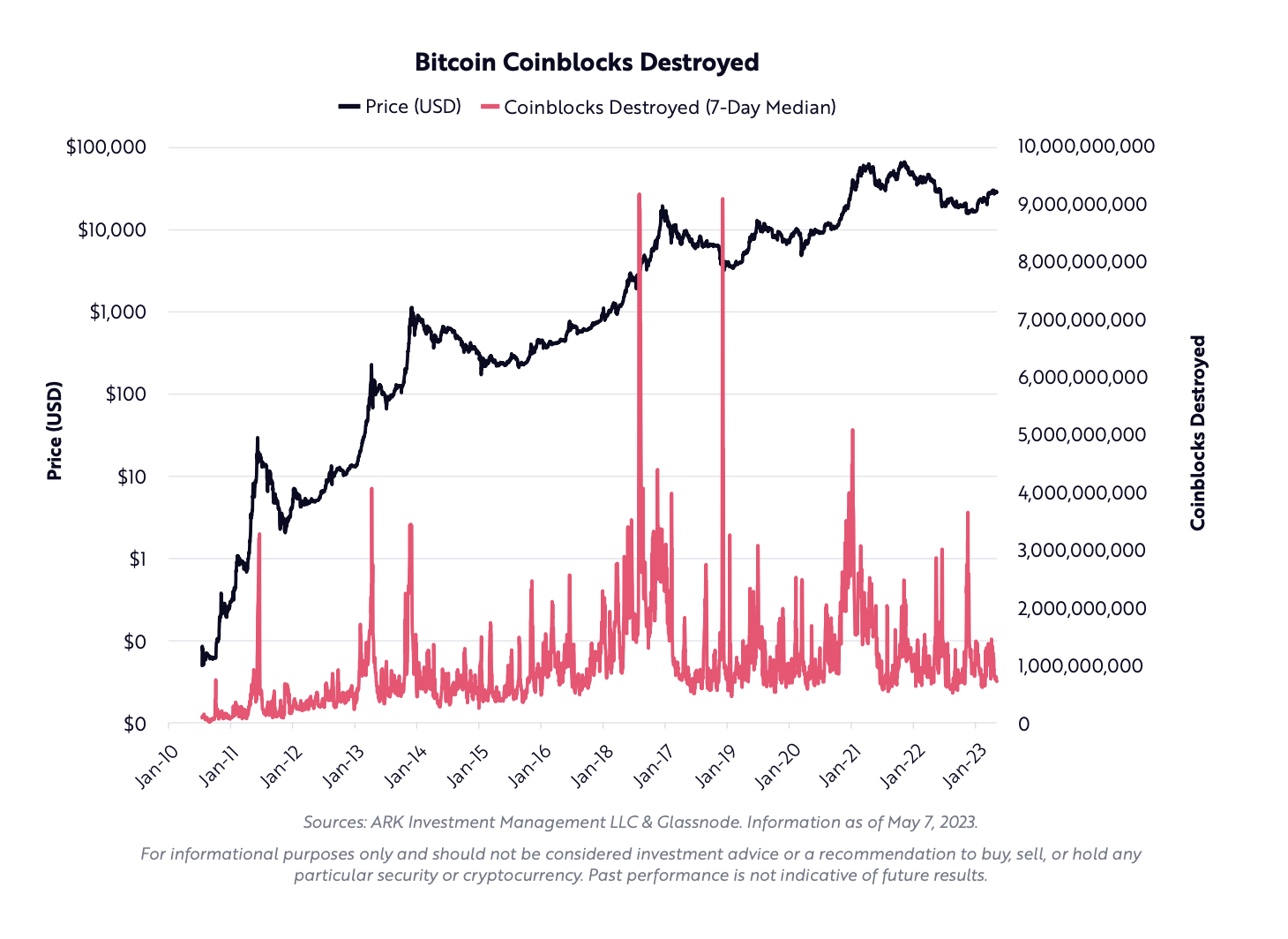

The groundbreaking concepts introduced by Glassnode and ARK Invest extended further to include “coin blocks destroyed,” shedding light on yet another essential facet of Bitcoin’s on-chain activity. This concept delves into the impact of transferring Bitcoin and how it affects its “coin blocks.”

In simple terms, when a Bitcoin is moved, it destroys all accumulated coin blocks, essentially resetting its “coin time” back to zero. Coin blocks destroyed, while not a literal destruction, carry significant importance in Bitcoin analysis.

It signifies that the moment a Bitcoin is transferred, its historical significance in terms of coin blocks is nullified.

This perspective contrasts with existing methods like HODL waves, which treat every Bitcoin as having equal importance regardless of how long it has been held. Coin time economics, as outlined by the authors, says that each Bitcoin’s significance varies depending on the number of coin blocks it possesses.

Coin blocks destroyed adds depth to this analysis. It looks at how many coin blocks have been destroyed since the inception of Bitcoin. Notably, high levels of coin block destruction suggest that long-term holders or “smart money” are actively selling their Bitcoin. Coin block destruction tends to correlate with price peaks in Bitcoin; intriguingly, it spikes during price crashes.

One interesting anomaly that the report highlights is the absence of significant coin block destruction when Bitcoin reached its second peak in November 2021. This could suggest unusual market manipulation during that rally. The correlation between the number of coin blocks stored and Bitcoin’s price peaks and troughs is highly pronounced. When the number of coin blocks stored dips below zero, it often signifies Bitcoin reaching either a high or a low point.

BTC activity – Measuring Supply Activity

In the context of the new framework for Bitcoin on-chain analysis, the report introduced another vital concept known as “BTC activity.” This metric aims to gauge the level of activity within the Bitcoin network and is pivotal in understanding its supply dynamics. The authors delve into two significant sub-concepts:

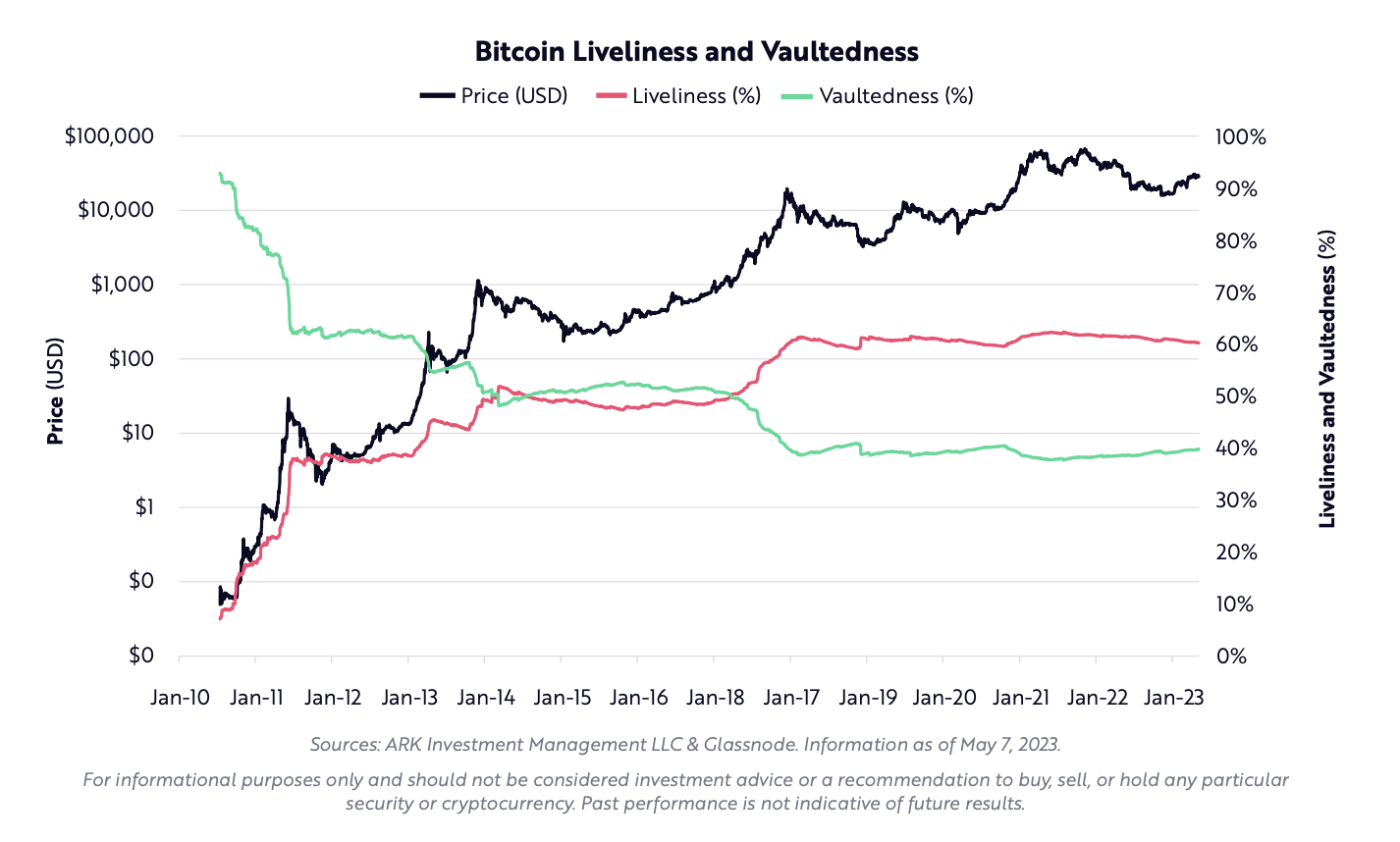

- Liveliness, which measures the activity level in the Bitcoin network.

- Vaultedness, which gauges its dormancy, all within the framework of coin time economics.

Liveliness is calculated by dividing the total number of coin blocks destroyed by the total number of coin blocks created. It essentially reveals how active Bitcoin is regarding the movement of its supply. In contrast, vaultedness measures dormancy by dividing the total number of coin blocks stored by the total number of coin blocks created. It provides insights into how many Bitcoins remain relatively untouched over time.

Remarkably, the analysis contradicts the common belief that most of the BTC in circulation is dormant. Instead, it showcases that Bitcoin has become more active, especially following the 2017 bull market.

The report has also introduced two additional concepts:

- Active supply, which is derived by multiplying the total supply of BTC by its liveliness ratio

- Vaulted supply, which is determined by multiplying the supply by its vaultedness ratio.

These calculations reveal that 60% of BTC’s supply is actively circulating, while 40% remains dormant.

The key takeaway is that the Bitcoin network is more dynamic and active than commonly perceived, even though a substantial portion of it remains inactive.

Importantly, these metrics offer an alternative perspective on miner-held BTC, shedding light on how conventional on-chain analysis often underestimates the amount of BTC held by miners. This novel approach to analyzing Bitcoin’s on-chain data provides a deeper understanding of its supply dynamics, which can be invaluable for investors and analysts alike.

Learn More: Bitcoin Price Prediction

How to Use Cointime Economics Framework?

In the third segment of the report, the authors illuminate the practical applications of the Cointime Economics Framework within Bitcoin on-chain analysis. They outline three distinct ways to harness this innovative approach for a deeper understanding of Bitcoin’s behavior.

- Enhancing Analogous On-Chain Analysis Measures: The authors introduce the Market Value to Realized Value Ratio (MVRV) as an example of analogous on-chain analysis. MVRV assesses whether Bitcoin is overvalued or undervalued. However, the accuracy of MVRV has declined over time due to diminishing data variation. By incorporating Cointime Economics, specifically Active Cap to Investor Cap (Aviv), MVRV regains some of its precision. Aviv provides a clearer picture of BTC’s valuation.

- Improving On-Chain-Based Economic Models: Following the introduction of MVRV, the report scrutinized Bitcoin’s inflation rate, highlighting that traditional measures may underestimate it. Under Cointime Economics, the inflation rate applies solely to BTC that hasn’t been lost. This adjusts the inflation rate closer to 2.5%, in contrast to the generally believed 1.5%. The dynamic nature of this assessment means that inflation can fluctuate based on the liveliness or dormancy of the Bitcoin network, as measured by BTC supply. Increased liveliness, as noted, can lead to higher inflation.

- Creating Novel On-Chain and Economic Models: The last key point of the framework is the introduction of the concept of “Cointime Price,” a unique economic model. It offers a clearer perspective on Bitcoin’s potential low points across crypto market cycles. Unlike traditional indicators such as Realized Price, Cointime Price factors in the nuances of Cointime Economics. This fresh approach suggests that BTC’s fair value and price lows could be overstated as estimated by conventional models. Therefore, investors and analysts relying on traditional metrics should consider the insights derived from Cointime Economics when making investment decisions.

By integrating these methodologies into Bitcoin on-chain analysis, analysts can access a richer, more accurate understanding of Bitcoin’s behavior, valuation, and potential price movements. These applications underline the significance of adopting this new framework for evaluating Bitcoin’s on-chain metrics, paving the way for more precise analyses and informed investment decisions in the crypto market.

Know More: Top Free Crypto Trading Tools in 2023

What does this mean for Bitcoin & Crypto Market?

Now, what implications does this new Cointime Economics framework hold for Bitcoin and the broader crypto market? It offers a fresh perspective on how investors, especially institutional ones, are evaluating and understanding Bitcoin’s value.

Bitcoin is often likened to digital gold, but this comparison only grazes the surface of its true nature. Bitcoin is, at its core, a blockchain – one of the most secure in the world. This blockchain is not just a digital asset but a ledger and a foundational network layer. Therefore, analyzing the Bitcoin network itself is arguably the most accurate way to gauge its value, and, by extension, the value of BTC.

This shift toward on-chain analysis indicates that institutional investors are placing increasing importance on understanding the inner workings of cryptos. Consequently, individual retail investors should consider these aspects more closely as well.

However, as today’s analysis reveals, existing on-chain indicators often lack the precision they seem to promise due to inherent biases and faulty assumptions. What sets Cointime Economics apart is its acknowledgment of Bitcoin’s evolving nature. It recognizes that the crypto landscape is continually changing, and this evolution will persist.

The fundamental flaw in many established on-chain and economic indicators is their static nature. In contrast, Cointime Economics introduces dynamic indicators that account for the shifts in crypto networks over time, offering a potentially more accurate assessment of value.

This new framework’s implications stretch beyond Bitcoin alone. While Bitcoin is relatively straightforward compared to many of its crypto peers, established indicators can be even less accurate when applied to most altcoins. The versatility of Cointime Economics suggests that it could be used to analyze various coins and tokens more effectively, irrespective of their complexity.

Read More: Technical Indicators & Analytical Tools For Crypto Futures Trading

Conclusion

In the ever-evolving world of cryptos, understanding value is paramount. The emergence of Cointime Economics as a groundbreaking framework for on-chain analysis signifies a paradigm shift in how we evaluate digital assets, particularly Bitcoin. It sheds light on the growing interest of institutional investors in the intricate workings of crypto networks. This innovative approach to analysis emphasizes the importance of understanding a crypto’s inner mechanics. However, it reveals that biases and assumptions hamper many traditional on-chain indicators.

The key takeaway from Cointime Economics is adaptability. It has introduced dynamic indicators that account for the ongoing evolution of crypto networks. It offers a fresh perspective, not only for Bitcoin but for the entire crypto market. It suggests that embracing these new methods can provide investors with a competitive edge.

In conclusion, Cointime Economics represents a new frontier in crypto analysis, inviting investors to broaden their horizons and seek innovative ways to uncover the true value of digital assets.

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more