Table of Contents

ToggleThe crypto tax laws have been a topic of interest for a good amount of time now. Ever since the Finance Minister, Nirmala Sitharaman has announced the crypto tax laws during the Budget Session 2022; the Indian crypto community has been looking for rules to help them adhere to the laws set in place.

After the announcement of the 2022 budget in India, the crypto holders were introduced to a 1% TDS and 30% tax on all their crypto gains. However, the 30% tax stayed similar to how the income tax is filed, the important questions came upon filing the TDS for the Virtual Digital Assets.

Serving the crypto community with a customer-first approach since its inception, CoinDCX has taken care of the TDS process for the customer. Being the exchange where buying or selling of crypto assets take place, CoinDCX takes care of the TDS deduction at the time of transaction. Once done, the investors receive a TDS certificate in their respective accounts.

This certificate is the most important document that the customers can use to file their TDS while filing the form for Income Tax Return or ITR.

Read More: What does Non Payment on TDS mean for Retail Crypto Investors

How Is Crypto Income Calculated?

To take a quick scroll though the segments that are taken into consideration for income from the Virtual Digital Assets or Crypto.

- There will be no negating of deduction for expenses

- The cost of acquisition can be considered for deducted

- The crypto losses incurred cannot be deducted from the crypto income

- No other set off of losses from any other type of income is taken into consideration for calculating crypto income.

- There is no carry forward of any losses from cryptos for setting off against crypto income in the future years.

5 Important Tips For Filing TDS On Crypto

Now that we have taken a note on the crypto income calculations, here are the 5 important tips that you should keep in mind for filing the TDS post Budget 2022:

- Keeping the TDS certificates for Form 26Q and Form 26QE.

- To keep a check on the TDS details mentioned in the certificates to avoid confusion.

- Keeping a calculated record of the total taxable income for the financial year, which includes income from all sources.

- Make sure to claim all eligible deductions and exemptions in order to reduce the tax liability.

- If applicable, paying any remaining tax liability, and verifying the ITR.

Note: There is a penalty for late filing under section 234E where a fine of Rs 200 per day is to be paid until the return is filed.

Filing #TDSNotTedious With CoinDCX

To simplify TDS filing for the users, CoinDCX is here to help you out in a seamless procedure. From deducing the TDS to keeping a tab on all your TDS payments, everything at a touch of a click!

- Users will be sent TDS statements at periodic intervals to help them keep a record while also keeping the users updated on any further developments.

- The TDS amount is paid by CoinDCX on behalf of the user every time they do a transaction on the app.

- Easy access to the TDS report & summary along with the TDS certificate at a click of button on the app itself to help users file their returns in the future.

Read On: Guide to Crypto Tax in 2023

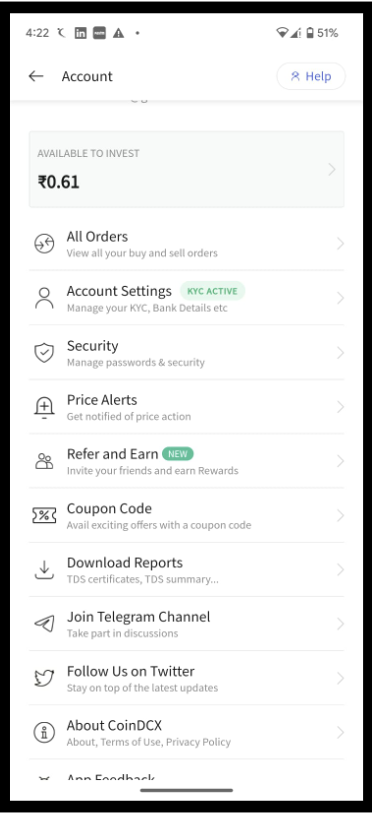

All you have to do is, Go to Account > Download Report

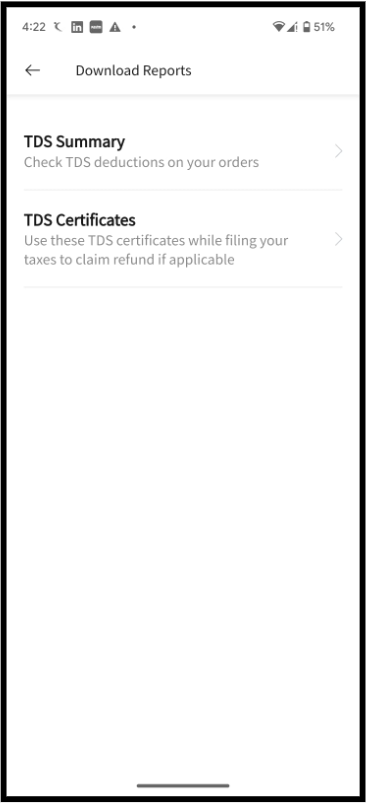

Following that click on TDS Summary or TDS Certificates

Additional Read: 1% TDS For CoinDCX App

The Finance Bill 2023 Update:

As per the Finance Bill an amendment was mentioned in the Income Tax Act under section 271C, which stated that non payment of TDS would include a penalty amount which will be equal to the unpaid TDS that will be imposed by a joint commissioner or a jail term for up to six months. In case of any delay, this can amount to an interest rate of 15% per annum for late payment.

FAQs

Yes, after the Budget 2022 announcement, 1% TDS has been levied on crypto transactions. Due to this, the amount deducted for TDS can be claimed back during the ITR filing. As per the Indian Government, there is a 30% tax levied on crypto income and 1% TDS on crypto transactions. TDS on VDA or crypto has been applicable since July 1, 2022.Do I need to file ITR for crypto?

How much tax do I pay for crypto?

When will TDS on VDA, crypto be applicable?

Related posts

Understanding the Different Types of Cryptos: Coins, Tokens, Altcoins & More Explained

Explore the major types of crypto assets and their unique roles.

Read more

PAWS Telegram Game: The New Tap to Earn Game That Is Beating Hamster Kombat

Discover how to play and earn with PAWS Telegram game.

Read more