Table of Contents

ToggleKey Takeaways:

- The SushiSwap price closed the previous day’s trade at $1.699 with a market capitalization of $225.87 million and a circulating supply of 127.24 million

- SUSHI price has traded within a narrow range for nearly 4 to 5 months and hence is believed to set up a firm bullish trade very soon

| Current Price | $1.66 |

| Market Cap | $211.47 million |

| Circulating Supply | 127.24 million |

| Total Supply | 244.54 million |

| Vol (24H) | $144.65 million |

| Change (7D) | +17.10% |

Technical Analysis for November 2022

Since the token’s sharp drop during the May 2022 crash, the SUSHI price has followed a similar pattern. However, much like previous attempts, the token has been attempting to rise rapidly since early October 2022. Unfortunately, the rally appears to be capped below $2, and the price is likely to be rejected at these levels.

As a result, the SUSHI price is expected to regain bullish momentum following a minor pullback followed by consolidation. However, the current pullback in the price appears to have occurred as a result of a rising wedge. Hence, the price may remain inflated in order to reclaim the lost levels as soon as possible.

Read more: Sushiswap Price Prediction

Technical Analysis at a Glance

After declining hard from the yearly highs, the SUSHI price plateaued for more than 4 months. However, the prolonged consolidation has now uplifted the price to some extent but still continues to remain under bearish captivity. As long as the price does not slice through the immediate resistance, the fear of a significant pullback may continue to haunt the rally ahead.

| Short-Term(5 hours) | The price is preparing to rebound and reach $1.9 in the next few hours as the selling volume has decreased notably |

| Mid-Term(Daily) | Despite the interim pullback, the price could remain within an ascending trend and maintain a firm upswing forming constant higher highs & lows to reach the target beyond $2.2 |

| Long-Term(Weekly) | The recent announcement of $52M in SUSHI by the biggest asset management company may have propelled the price high, which is expected to continue for long |

Technical Indicators & Pivot Levels

| Indicator | Value (Short Term(5 Hours)/Long Term (Weekly)) | Action (Short Term(5 Hours)/Long Term (Weekly)) |

| Relative Strength Index(RSI) | 51.14 / 47.09 | Neutral / Neutral |

| MACD | 0.052 / -0.435 | Buy / Sell |

| Average Directional Index(ADX) | 27.33 / 26.65 | Sell / Buy |

| Ultimate Oscillator | 43.52 / 61.05 | Sell / Buy |

| Bull-Bear Power | -0.124 / 0.712 | Sell / Buy |

Pivot Levels

| Moving Average | Short Term(5 Hours) | Long Term (Weekly) |

| MA 5 | $1.714 | $1.53 |

| MA 10 | $1.752 | $1.34 |

| MA 20 | $1.707 | $1.32 |

| MA 50 | $1.544 | $2.91 |

| MA 100 | $1.458 | $7.02 |

| MA 200 | $1.298 | $3.51 |

SushiSwap appears to be preparing for a significant upswing, as short-term fractuals, despite being bearish, are indicating the possibility of going long very soon. Because the indicators are bearish in the short term, a minor pullback is possible. However, the long-term forecast is extremely bullish, implying that the bulls are preparing to set up a massive bullish trade in the coming days.

Read more: Uniswap Price Prediction

Sushiswap On Chain Analysis

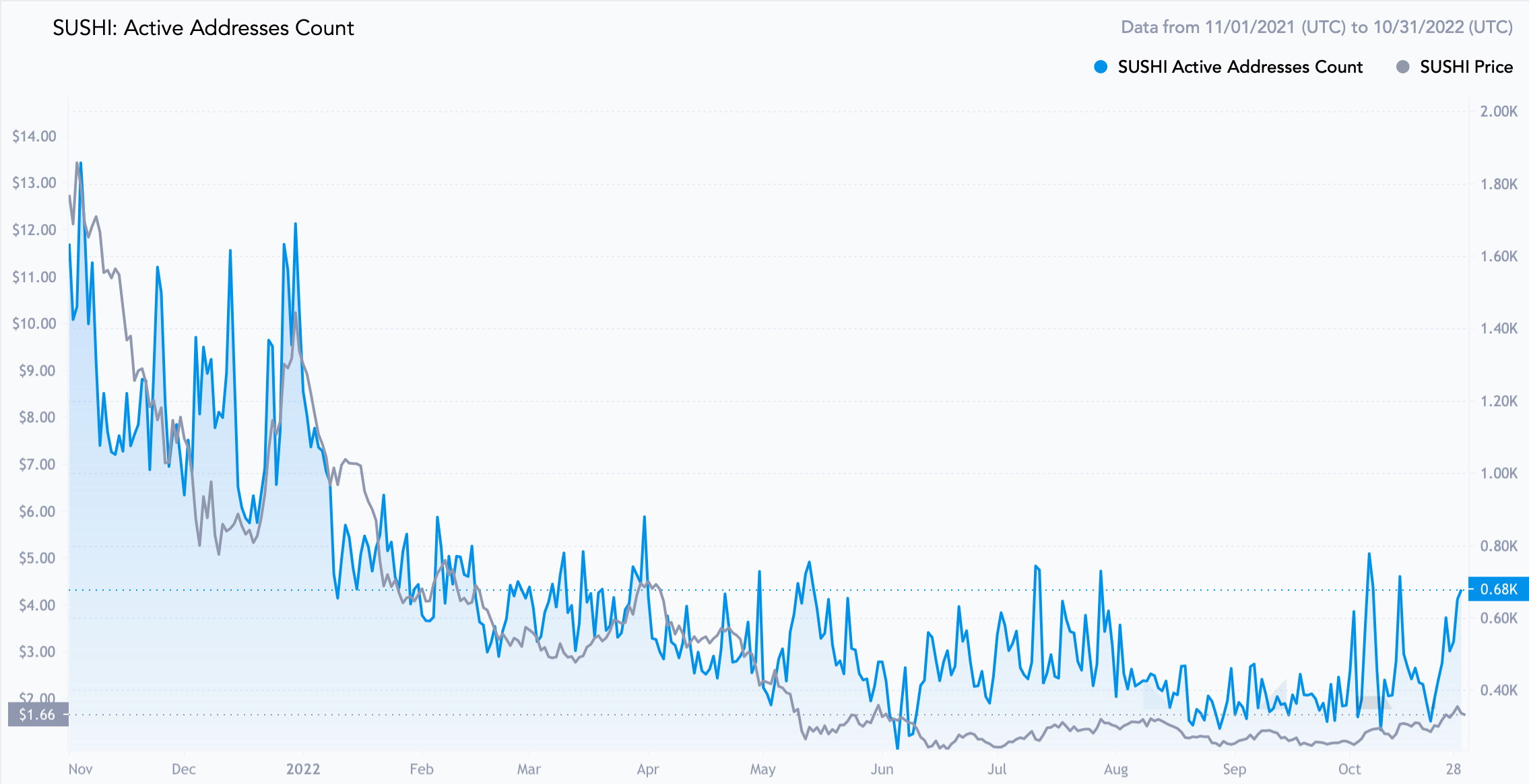

- The active address on Sushiswap has been on a rise, reaching the highest level of 0.8K which is the highest in the past 4 months, regardless of the price maintaining a stagnant trend

Source: Messari.io

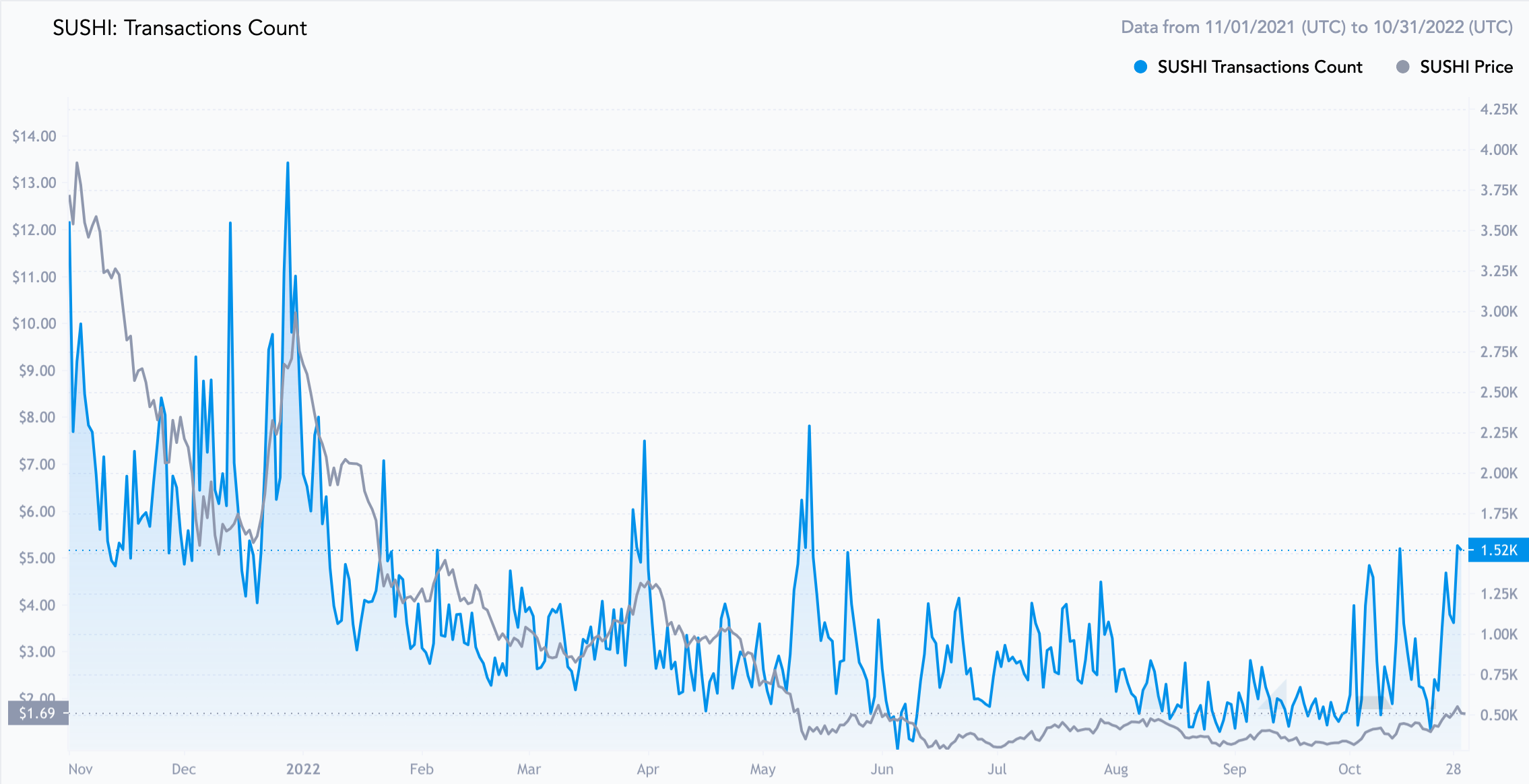

- Along with the raised active addresses, the transaction count also has been surging heavily despite the flat price action since the beginning of October. After rebounding from the lows of 408, the count has raised to 1.5K signalling awakening interest by users over on-chain

Source: Messari.io

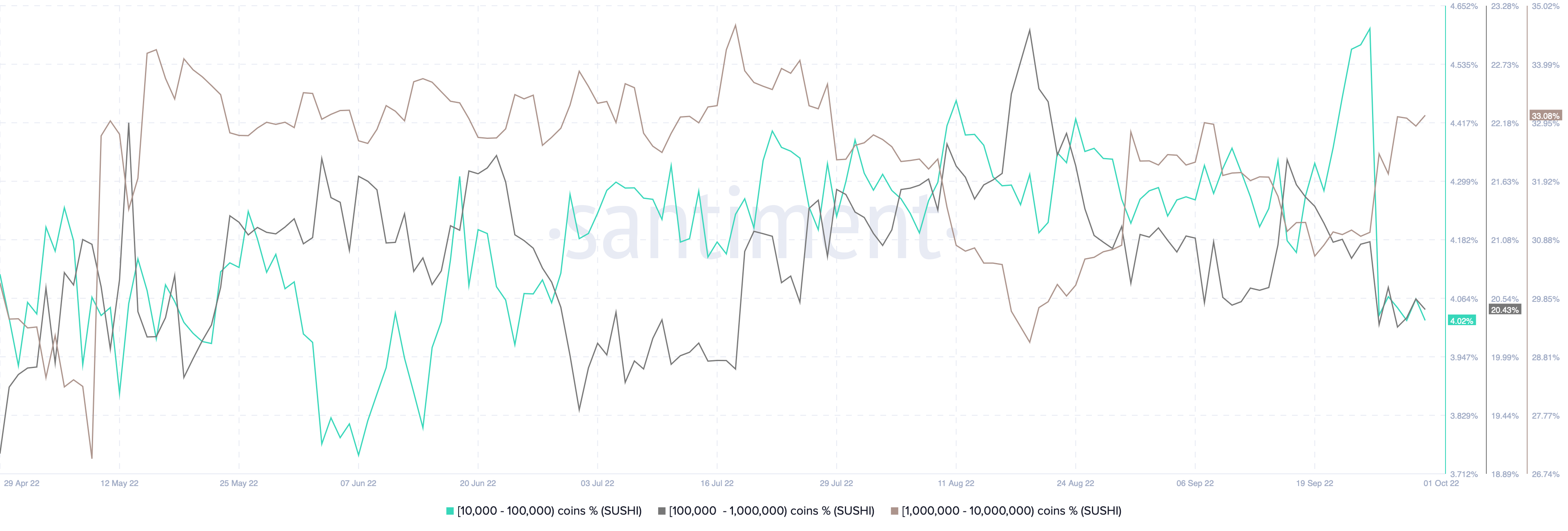

- The whales continue to hold enough SUSHI, are not impacted by the current bearish market trend. The whales, holding the tokens from 10K to 10M have been largely maintaining their within the entire circulating supply

Source: Santiment

- The supply on exchanges has been rising in the past couple of weeks which indicates the availability of enough liquidity on the exchanges to carry out the buy or sell trade

Sushiswap (SUSHI) Technical Analysis for Short Term

Source: Tradingview

- Since the increase in volume sparked a decent upswing, the SUSHI price has been trading within an ascending parallel channel.

- However, recent price action forced the price to fall below the channel, but a bullish push recorded in the last few hours allowed the token to re-enter it.

- Due to a decrease in buying pressure, the price may hover along the lower support of the channel before undergoing a minor upswing towards the channel’s middle bands.

- If the bulls maintain their strength at these levels, the price may rise to the channel’s resistance near $2.

Sushiswap (SUSHI) Technical Analysis for Long-Term

Source: Tradingview

- The SUSHI price broke above the initial resistance at $1.613 with a significant increase in volume and is currently retesting the levels.

- The price is expected to ignite a significant upswing after experiencing a catapult action from this resistance to raising towards the next target

- However, the bears may tighten their grip and limit the rally at $2.2, but the SUSHI price may reach the first target at $2.756 after a brief accumulation.

- Furthermore, prices may remain inflated and reach the interim resistance level of $3.692, triggering a strong upswing towards the next target of $4.9.

Where & How to Buy Sushiswap(SUSHI)?

Sushiswap (SUSHI) can be bought or sold easily & safely on CoinDCX. Just follow the below-mentioned steps

- Download the CoinDCX App

- Enter the details required for registration

- Complete KYC

- Fund your wallet and buy SUSHI

Related posts

Bitcoin (BTC) Technical Analysis: Balancing Short-Term Caution with Long-Term Optimism

Key Takeaways: Long-Term Strength: Bitcoin price’s longer-term trends, as indicated…

Read more

Bitcoin Technical Analysis: BTC Price Feared To Drop Below $27,000 Again!

Key Takeaways: After trading under the bearish influence, Bitcoin price…

Read more