Table of Contents

ToggleKey Takeaways:

- The Ripple (XRP) price closed the previous day’s trade at $0.4793 with a market capitalization of $24.11 billion and a circulating supply of 49.96 billion XRP

- After being heavily undervalued, the XRP price is attempting to undergo a parabolic recovery by surging 10% to 15% in the coming days to reach the upper targets

| Current Price | $0.4985 |

| Market Cap | $24.93 billion |

| Circulating Supply | 49.96 billion |

| Total Supply | 100 billion |

| Vol (24H) | $2.95 billion |

| Change (7D) | +2.49% |

Technical Analysis for October 2022

The XRP price has been progressive since the beginning of the month and is expected to maintain a firm upswing until the end. The token soared from the 0 FIB level at $0.32 and reached the 0.618 FIB level at $0.52. Failing to surpass these levels, the token is hovering between 0.618 & 0.382 FIB levels.

However, with a rebound, the prices are expected to clear the upper resistance and head towards 0.786 FIB levels at $0.57. This move may further trigger a price rise beyond $0.6 and eventually reach the 1 FIB level at $0.64 by the end of the monthly trade.

Technical Analysis at a Glance

The XRP price was trading very close to $1 a couple of months earlier, but the market collapsed in May, dragging the price below $0.3. Since then, the token has been trying to ignite a parabolic recovery to regain the lost levels. Presently, with the advancement of the Ripple vs SEC lawsuit, the market sentiments are turning in favour of bulls.

Hence, a significant upswing is expected to continue for some more time.

| Short-Term | Ripple just rose from the bottom and hence may continue surging to reach immediate resistance at the earliest. |

| Mid-Term | The XRP price is trying hard to flip from the bearish divergence and hence a rebound may soon uplift the price in the upcoming days |

| Long-Term | As mentioned, the token is carrying out a parabolic recovery to reach the neckline |

Technical Indicators & Pivot Levels

| Indicator | Value (STF/HTF) | Action (STF/HTF) |

| Relative Strength Index(RSI) | 52.56 / 52.68 | Neutral / Neutral |

| MACD | -0.02 / -0.045 | Sell / Sell |

| Average Directional Index(ADX) | 23.39 / 43.23 | Buy / Buy |

| Ultimate Oscillator | 59.43 / 64.45 | Buy / Buy |

| Bull-Bear Power | 0.0215 / 0.13 | Buy / Buy |

Pivot Levels

| Moving Average | Short Term | Long Term |

| MA 5 | $0.486 | $0.470 |

| MA 10 | $0.482 | $0.409 |

| MA 20 | $0.490 | $0.382 |

| MA 50 | $0.496 | $0.615 |

| MA 100 | $0.482 | $0.710 |

| MA 200 | $0.420 | $0.491 |

Ever since the past couple of weeks, the market sentiments for Ripple have been coiling up as the platform experiences a growth in the buying pressure. Hence, positive growth may be expected with the XRP price for the next couple of days as the RSI has reached the average levels and continues to be neutral in both time frames. The MACD is still bearish in STF & HTF but may flash a bullish signal.

Additionally, all the other prominent indicators are bullish, which indicates the strength of the rally is increasing. Also, the growing dominance of the bulls may offer the price the required boost to reach the required levels at the earliest.

How are the on-chain metrics faring?

- Ever since the XRP price gained momentum during mid-September, the development activity has dropped notably

Source: Santiment

- XRP whales display immense confidence over the upcoming rally as they continue to accumulate more. The holding of the whales with more than 10K but below 10M XRP is swelling ever since the beginning of 2022

Source: Santiment

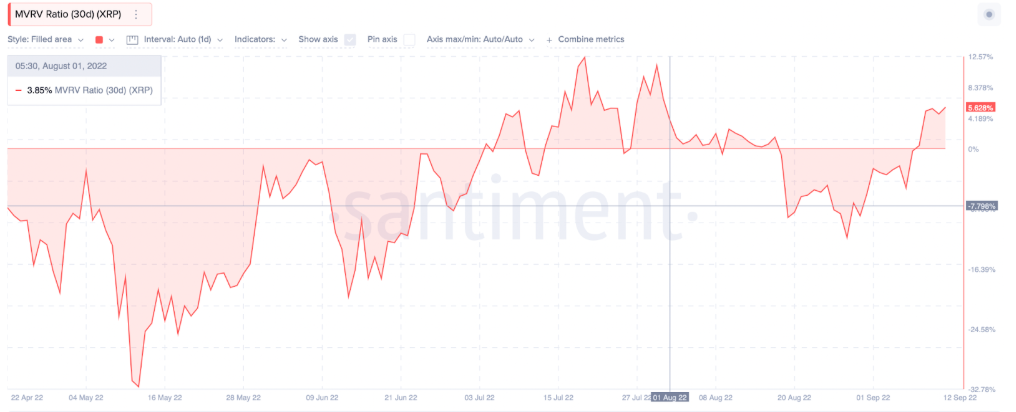

- The MVRV ratio that indicates whether the token is undervalued or overvalued has been rising to reach +5.6%, signifying the asset gaining value

Source: Santiment

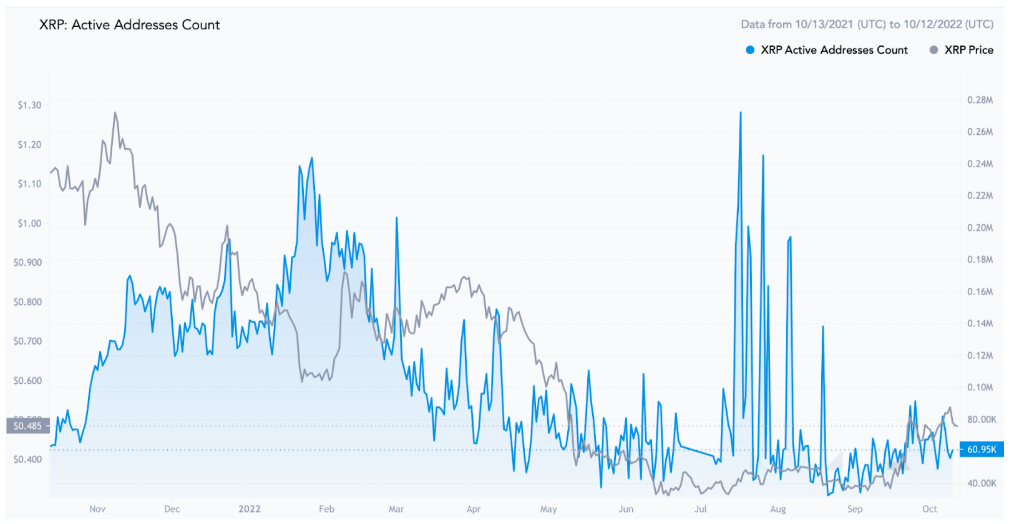

- The active address count had dropped heavily, but ever since the beginning of September, the address count is on rising, indicating the market participants reentering the platform

Ripple (XRP) Technical Analysis for Short Term

- The XRP price has maintained a notable upswing since the beginning of the month, maintaining the lower trend line

- A brief pullback is anticipated as the price has retraced from the lower bands of the Bollinger Bands and reached the upper bands

- Therefore, before continuing with the upswing, the XRP price may drop to $0.47 and rebound firmly to reach $0.54, surpassing $0.51

- At these levels, the price must be held steady by the bulls for it to rise toward $0.6.

Ripple (XRP) Technical Analysis for Long-Term

- Ripple experience a sudden influx of liquidity during the mid of September which uplifted the token from the consolidation that it was stuck up for more than 4 months

- With a jump, the XRP price ignited a parabolic recovery, following a trend within an ascending triangle

- Presently, the XRP price is closer to test one of the crucial resistance at $0.5114. If it clears these levels successfully, then a jump beyond $0.55, the upper resistance of the triangle is imminent

- Conversely, a failure may compel the apex of the triangle to be extended until the price decides on the next action which may be dependent on the volume induced.

Where & How to Buy Ripple(XRP)?

Buying or selling Ripple (XRP) and any of your desired crypto assets are simple & secure on CoinDCX. All you need to do is follow the below-mentioned steps,

- Download the CoinDCX App on your smartphone

- Enter the details and register yourself

- Complete the KYC

- Once your profile is verified, fun your wallet and buy XRP

FAQs

Is Ripple bullish or bearish?

Ripple (XRP) is bullish in the short-term & long-term as the bulls appear to be poised to uplift the price close beyond the immediate resistance at the earliest.

What is the current RSI for XRP?

The RSI for the short term is 57 while for the long-term is 60.

Is it a good time to buy XRP?

XRP is displaying huge potential to go long in the coming days. Therefore, with a proper research & observing the market sentiments, one can buy XRP at the right time.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more