Table of Contents

ToggleKey Takeaways:

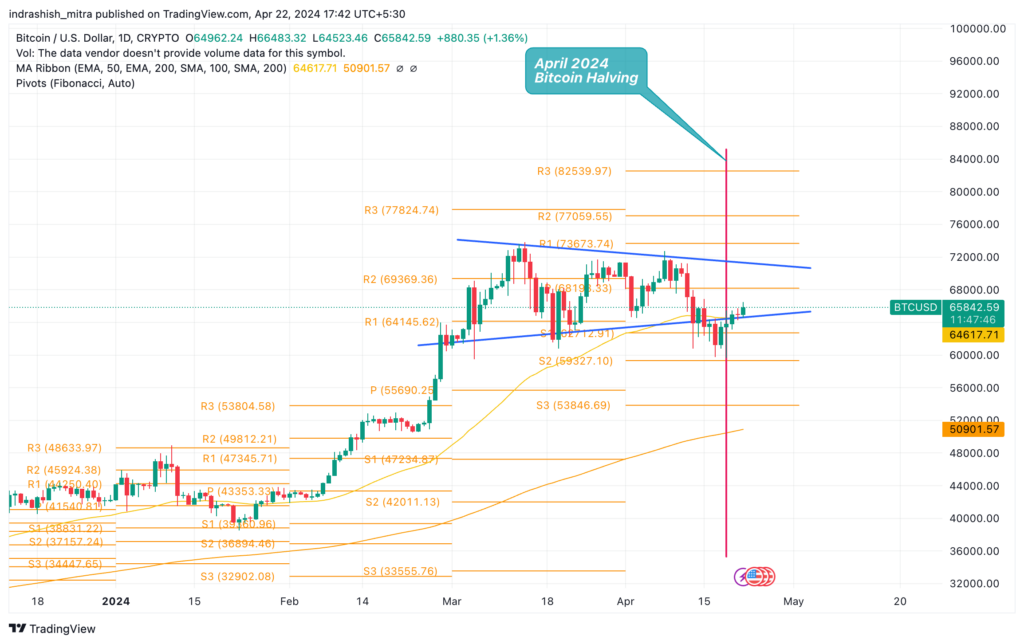

- Long-Term Strength: Bitcoin price’s longer-term trends, as indicated by the 50-day, 100-day, and 200-day EMAs, demonstrate underlying strength in the crypto market despite short-term caution.

- Mixed Sentiment: The oscillators present a mixed sentiment, with conflicting signals indicating bullish and bearish market momentum.

- Cautionary Signals: Negative sentiment in the 20-day EMA and the slight bearish pressure from the volume-weighted moving average urge caution among investors.

- Potential for Reversal: Immediate resistance at $73,673 presents a key level for Bitcoin price, with a potential bullish reversal if this level is surpassed.

- Overall Optimism: Despite short-term uncertainties, the overall technical analysis hints at an optimistic outlook for Bitcoin price, with potential for bullish momentum if key resistance levels are breached.

Read More: Bitcoin Price Prediction

Bitcoin Price: $65,840

Bitcoin Technical Analysis: Moving Averages

| Moving Average | Value | Sentiment |

| Bitcoin Price 20 EMA | $65,867 | Negative |

| Bitcoin Price 50 EMA | $64,625 | Positive |

| Bitcoin Price 100 EMA | $59,267 | Positive |

| Bitcoin Price 200 EMA | $50,906 | Positive |

| Bitcoin Price Volume Weighted Moving Average | $66,154 | Negative |

View:

Despite a negative sentiment reflected in the 20-day EMA at $65,867, Bitcoin price’s longer-term trends remain positive, with the 50-day, 100-day, and 200-day EMAs all signaling upwards. However, caution is warranted as the volume-weighted moving average sits slightly lower at $66,154, indicating potential bearish pressure.

Bitcoin Technical Analysis: Oscillators

| Oscillator | Value | Sentiment |

| Bitcoin Price Awesome Oscillator | -3022 | Neutral |

| Average Directional Index (14) | 44 | Neutral |

| Relative Strength Index (14) | 50 | Neutral |

| MACD Level (12,26) | -752 | Negative |

| Stochastic %K (14,3,3) | 49 | Neutral |

| Momentum (10) | -1233 | Positive |

| Commodity Channel Index | -19 | Neutral |

View:

Bitcoin’s price oscillators show a mixed sentiment, with neutral readings prevailing in indicators such as the Awesome Oscillator, ADX, RSI, Stochastic %K, and Commodity Channel Index. However, a negative MACD level at -752 suggests potential bearish pressure, while positive momentum at -1233 offers a hint of bullish momentum. Overall, while the technical indicators present a balanced outlook, investors should remain cautious due to the conflicting signals, indicating potential market uncertainty.

Know More: Bitcoin Halving is Completed

Bitcoin Technical Analysis: Fibonacci Pivots

| R3 | $82,539 |

| R2 | $77,059 |

| R1 | $73,673 |

| P | $68,193 |

| S1 | $62,712 |

| S2 | $59,327 |

| S3 | $53,846 |

View:

Bitcoin’s price sits at $65,840, hovering near the pivot point of $68,193, with immediate resistance at $73,673 and support at $62,712. Observing the Fibonacci pivot levels, the price is currently below the pivot point, indicating a potential bearish bias. However, if Bitcoin manages to surpass the resistance at $73,673, it could signal a bullish reversal towards higher levels.

Bitcoin Technical Analysis: Overall View

Despite short-term caution signaled by the negative sentiment in the 20-day EMA and the slight bearish pressure indicated by the volume-weighted moving average, Bitcoin’s longer-term outlook remains optimistic. Positive trends in the 50-day, 100-day, and 200-day EMAs suggest underlying strength in the market. While the oscillators present a mixed sentiment, with hints of both bullish and bearish momentum, the overall technical analysis implies a balanced view with potential for bullish reversal if Bitcoin surpasses the resistance at $73,673.

Related posts

Pi Network KYC Deadline and Mainnet Launch: What You Need to Know

Complete Pi Network KYC to unlock full Mainnet access.

Read more

Guide to Crypto Tax in India [Updated 2024]

Decoding crypto taxation in India and all you need to know!

Read more