Table of Contents

ToggleKey Takeaways:

- Ripple’s notable 75% intraday spike in July was short-lived, and XRP price is currently hovering around $0.52, forming a descending triangle pattern.

- Sustaining above the $0.42 support level is crucial for XRP’s bullish prospects, and its recent week’s optimism and potential recovery can result in a breakout from these levels that could lead to a strong follow-up rally toward $0.65 and $0.72.

- The supply held by the top 1% of XRP addresses has steadily declined in 2023. While the percentage decrease may seem modest, it signals a significant trend. This suggests that larger XRP holders are reducing their positions, potentially indicating a shift towards a more decentralized distribution of XRP.

XRP Price Technical Overview

- Ripple’s XRP is a token that has been a relatively poor performer till July 2023, when it saw a near 75% intraday spike, going from under $0.5 to touch $0.9 in a span of a couple of hours. This was, of course, thanks to the positive development coming out of the Ripple Labs vs the SEC lawsuit in the US.

- However, despite the very bullish outcome of the lawsuit – where the court ruled that XRP was, in fact, not a security that the SEC was claiming it to be, thus out of its purview – XRP’s near 75% intraday rally was very short-lived, and the token price came back to $0.5 level, and is currently trading around $0.52.

- This has resulted in the formation of a descending triangle pattern on the chart (depicted by the blue trendline), and sustenance above the $0.42 support is going to be crucial for the bullish prospects of the XRP price.

- However, in the last two weeks or so, XRP price has managed to see some optimism and some amount of recovery and is currently trading just below the downward trendline (diagonal trendline marked in blue), which also coincides with the long-term 200-day exponential moving average.

- If, in the coming weeks, we see a recovery in the XRP token price that results in a breakout from the 50-day and 200-day EMA along with the diagonal resistance trendline and also the Fibonacci pivot level of $0.55 – XRP price could see a strong follow-up rally soon after.

- The immediate targets for XRP price after such a breakout would be $0.65 (R1) and $0.72 (R2), according to the Fibonacci pivot points depicted on the chart.

- On the downside, the region between the Fibonacci pivot point of S1 at $0.45 and the horizontal level at $0.42 is going to be a crucial support zone for XRP price going forward.

Read More: Ripple Price Prediction

Ripple On-chain Overview

XRP Active Address Count

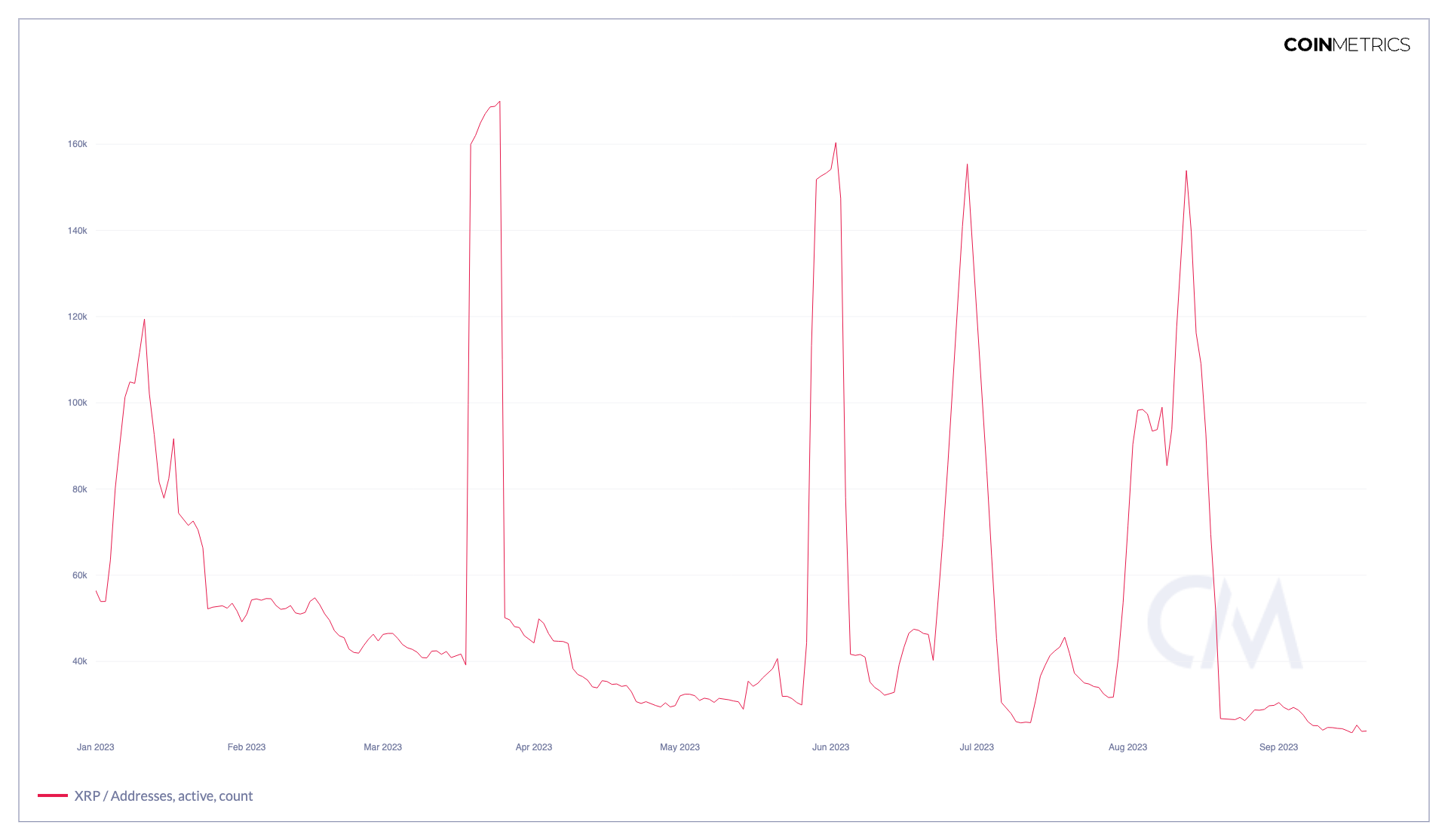

One noteworthy on-chain metric for Ripple’s XRP is its active address count. This metric has displayed a relatively flat trend over recent months, with occasional sharp spikes recorded on specific days, notably in March, June, July, and August 2023. However, it’s crucial to note that while active addresses experienced sporadic increases, overall on-chain transactions have remained somewhat subdued. XRP’s transaction volume has shown more significant activity only during periods of high volatility or market events. This discrepancy between active addresses and transaction volume could be seen as slightly concerning.

The sporadic spikes in active addresses might suggest increased interest or attention on those particular days. Still, the lack of sustained transaction activity raises questions about the network’s overall utilization and whether XRP is being held rather than actively used for transactions. This dynamic is something to monitor, as it could potentially impact XRP’s long-term growth and adoption.

Supply in the Top 1% Addresses

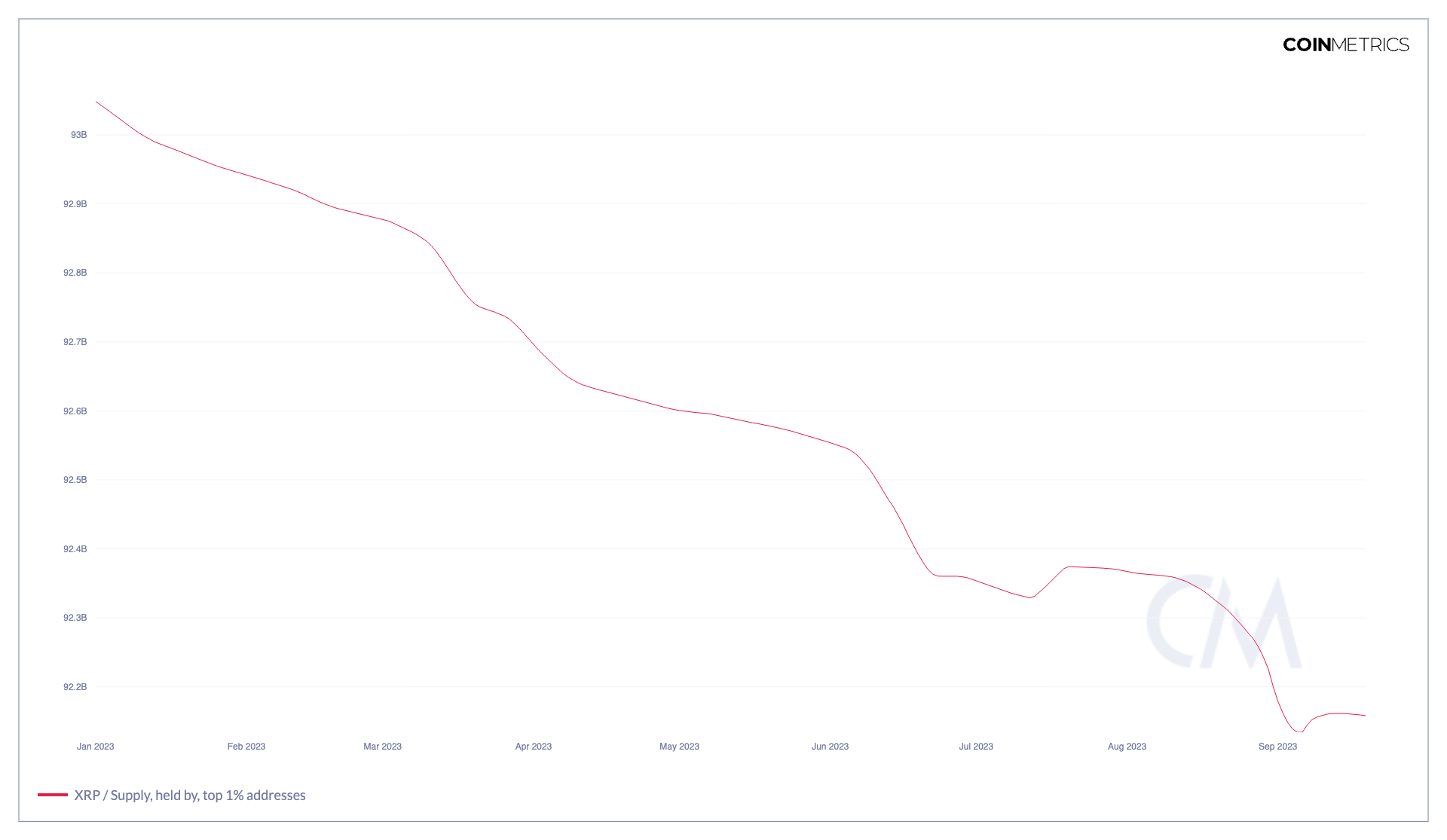

Another essential on-chain metric for XRP is the supply held by the top 1% of addresses. Throughout 2023, this metric has displayed a consistent decline, indicating that the wealthiest XRP holders, or whales, have been gradually reducing their holdings.

While the percentage decrease in this metric might appear relatively small since the beginning of 2023, it signifies a notable trend. This trend suggests that larger XRP holders, who often have the potential to influence market dynamics, are reducing their positions.

A declining supply in the hands of the top 1% addresses could potentially indicate a shift in market dynamics or investor sentiment. It might imply a move towards a more decentralized distribution of XRP, which can be viewed positively for the coin’s long-term stability and adoption. However, it’s important to continue monitoring this metric to understand its broader implications for XRP’s ecosystem.

Conclusion

Ripple’s XRP has faced a rollercoaster year, marked by significant price fluctuations and a critical legal battle win. Its technical outlook hinges on maintaining support at $0.42 while aiming for a breakout above the 200-day exponential moving average and key resistance levels.

On-chain metrics reveal a concerning disparity between active addresses and transaction volume, suggesting that XRP’s utility for transactions remains subdued. Additionally, the declining supply in the hands of the top 1% of addresses implies a potential shift in market dynamics towards greater decentralization, which could impact XRP’s long-term prospects. Monitoring these metrics is crucial to understanding the coin’s future trajectory.

Additional Read: BTC Active Addresses Surge 18% in September, What’s up with BTC price?

Values as of September 20, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more