Table of Contents

ToggleKey Takeaways:

- Bitgert price has dropped by more than 10% since the beginning of the month and is believed to be maintaining a fine downswing.

- The bulls appear to have become passive at the moment, which may hinder the price action in the coming days.

- The decline in social dominance may indicate a shift in traders’ focus, which is not conducive to a healthy rally.

Bitgert has taken the crypto space by storm and has become the top choice for investors with its innovative technology and dedicated team. In just 600 days, the price soared by more than 10 times and attracted huge profits. One of the main features of the platform is its flexibility. The user can invest in very small portions and hold them for as long as he/she wants to.

The token has gained huge user attention and adoption in very little time and soared by more than 3000%, slashing a couple of zeros in its value. However, the price further dropped by more than 83% and continues to trade within the same levels at the moment. The technicals have now dropped to negative levels, and hence the possibility of the price rebounding from the lower support has faded to a large extent.

Bitgert (BRISE) Technical Overview

- The BRISE price is trading within a descending triangle, and the recent rejection from the upper resistance appears to push the price toward the apex of the consolidation.

- Besides, the Bollinger Bands, after undergoing an extreme squeeze, dragged the price lower as the selling volume spiked up.

- In the meantime, the selling volume has accumulated heavily, due to which the strength of the rally has waned as the ADX is extremely bearish.

- Therefore, the price may drop by more than 15% to reach the lower support of the triangle, beyond which a rebound may be expected.

Bitgert (BRISE) On-Chain Overview

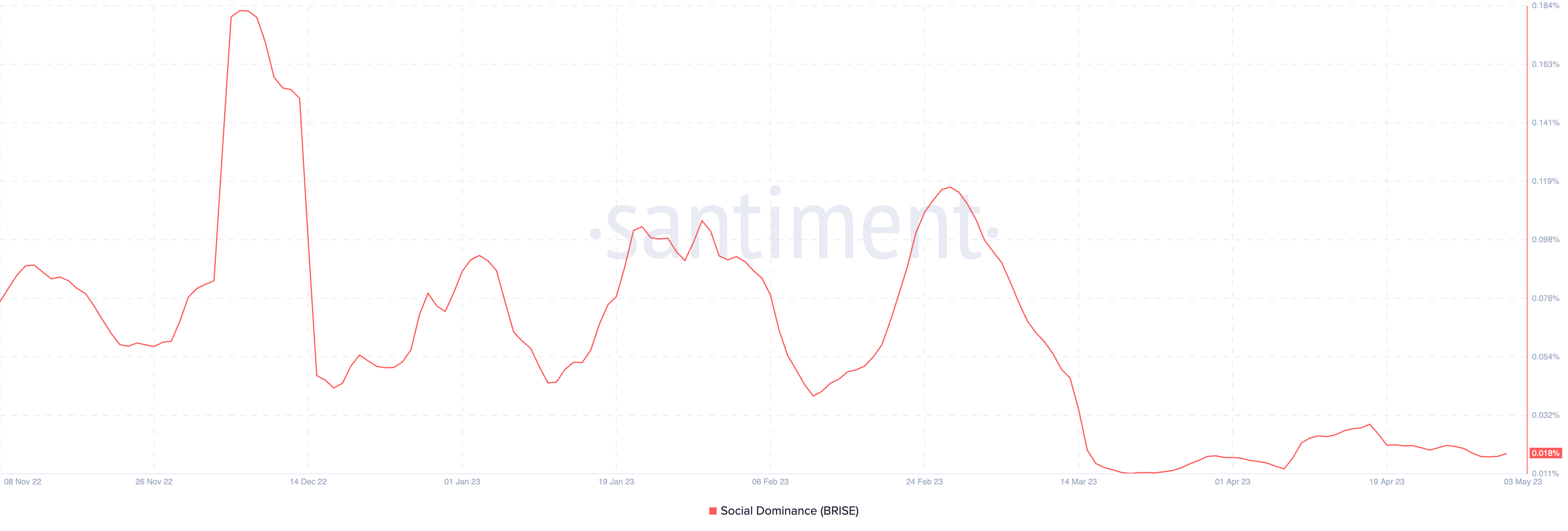

Bitgert Social Dominance

The social dominance of a token is nothing more than its presence on social media platforms. It considers the social volume of the token, which is nothing but the number of searches related to the token during a selected time frame. If the social dominance of the token surges, then it is believed that the number of messages, posts, or discussions related to the token is greater compared to that of the top 100 assets according to the market cap.

Woefully, the social dominance of Bitgert has dropped heavily for more than a month, indicating that traders have now shifted their focus away from the token. Therefore, it may not be good for a healthy rally, as the bears may maintain significant dominance over the rally ahead.

Bitgert Adjusted Price DAA Divergence

Of all the metrics, the daily active address, or DAA, is the most known, which is the number of unique addresses interacting with the platform on a daily basis. This enables measuring the overall network activity and, hence, makes it a valuable indicator to evaluate the cryptos. Therefore, it can be further analyzed that the DAA levels may directly impact the value of the crypto.

The higher the prices, the more people get attracted to invest in the crypto, which increases the DAA, which may lead the investors to start evaluating the token at the higher price and buy more. Therefore, to create some forecast potential in this metric, a price-DAA divergence signal is created that indicates when the daily addresses and prices deviate from each other.

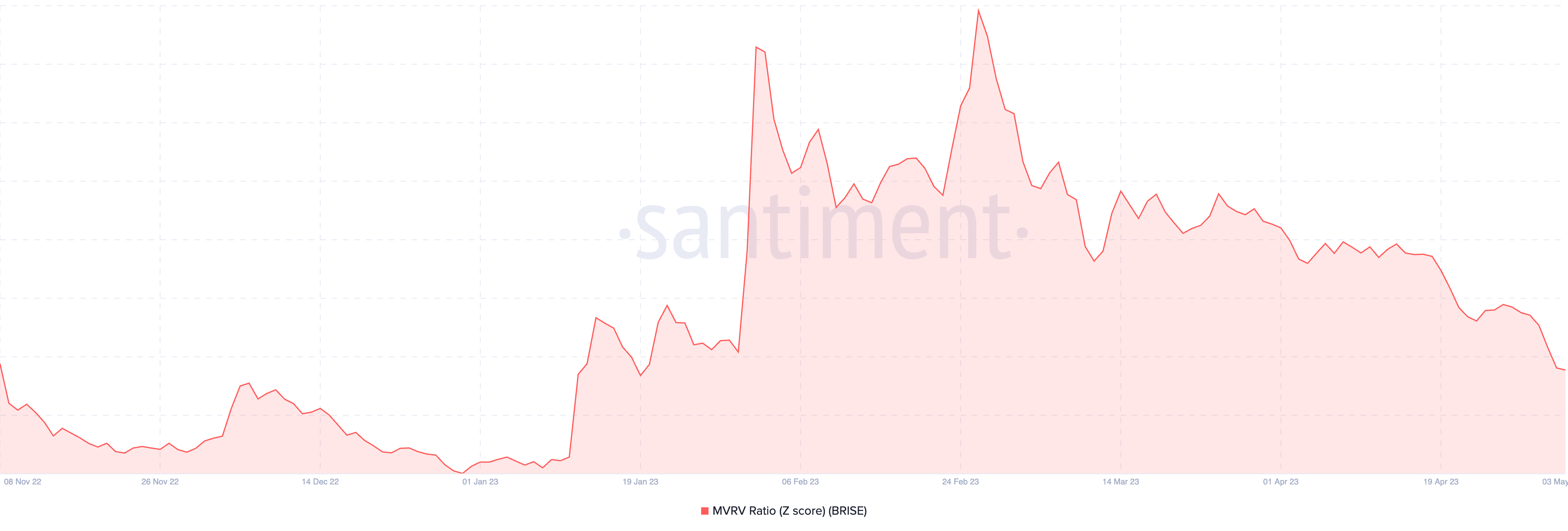

Bitgert MVRV Ratio

The MVRV ratio is nothing but a comparison between the market value and its realized price or value to get the fair value of the token, which can also be considered the average price. This price is used to determine whether the current price is undervalued or overvalued. If the levels are lower than the fair value, then it is considered undervalued, or if the price levels are elevated, then it is overvalued.

The MVRV ratio has been bearish and at lower levels for quite a long time, but the recent upswing has elevated the levels beyond the average range. Although the MVRV ratio has dropped slightly, it also has the possibility of maintaining a healthy upswing.

Concluding Thought

The Bitgert price is currently trading at around $0.0000003593, with a drop of 0.04% in the past 24 hours, and appears to be under extreme bearish pressure. While the token has lost its hold over social platforms, the drop in the MVRV ratio also asserts that the bears are in action. Therefore, until the bulls reclaim their dominance, the price is believed to continue testing lower targets.

Values as on May 3, 2023.

Read more: Bitgert Price Prediction

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more