Will XRP’s 50% price rally continue going forward?

XRP price has rallied by nearly 50% in the past month and a half, going from $0.32 to $0.46, and even touched local highs of $0.55. Major part of the rally happened between 15th to 24th of September but since then, XRP price has managed to hold on to the highs.

Table of Contents

ToggleKEY TAKEAWAYS:

- XRP price has rallied by nearly 50% in the past month and a half, going from $0.32 to $0.46, and even touched local highs of $0.55.

- Major part of the rally happened between 15th to 24th of September but since then, XRP price has managed to hold on to the highs.

Ripple’s XRP has been in the news for quite some time now, especially amid the raging court battle between the US Securities & Exchange Commission and Ripple Labs over the issuance of XRP, which the SEC claims is a security while Ripple Labs claims otherwise. This had resulted in XRP price to trade in a range-bound manner ever since the beginning of 2022.

However, of late XRP price has begun recovering from the near four month accumulation zone and recovered significantly and is trading up about 50% from its lows. This has primarily been due to the fact that the end of the SEC vs Ripple lawsuit might be close at hand a final decision could be out soon. Along with that, Ripple’s Chief Technology Officer David Schwartz announced on 1 November that it is adding NFTs onto the XRP ledger. The XLS-20, which is the standard for XRPL NFTs, is now enabled on the XRP ledger mainnet.

Not a trick🚨 Treat yourselves to NFTs on the XRP Ledger, starting today. #MintOnXRPL https://t.co/UBAQp0CIHa

— RippleX (@RippleXDev) October 31, 2022

This is a major move that has been welcomed by the community of XRP supporters and people have even begun minting their own NFTs on the XRP ledger. This was a long awaited moment and is finally here and this can be expected to be one of the other reasons that could contribute to the further rally in the token. In a detailed blog post, CTO David Schwartz outlined the move and the benefits it can provide.

Read more: Bitcoin Price Prediction

Thank you for the patience and support in making native NFTs on the XRP Ledger a reality. (4/4)https://t.co/BB0X5Ps3ze

— David "JoelKatz" Schwartz (@JoelKatz) October 31, 2022

RIPPLE TECHNICAL OVERVIEW

From a technical standpoint, XRP price is in a reasonably good place to resume its rally. This is because a major chunk of this recent rally happened back in the middle of September, between the 15th ot the 24th of the month, and after which XRP price has managed to sustains its levels. This indicates that the rally was a strong one and the highs weren’t simply a way to sell off, and the bulls in the market wanted to hold on to that level.

The sustaining of price levels has also cooled down the Relative Strength Index for the crypto token, coming down all the way from its overbought region near the 80 mark down to just shy of 50. Thus the fall in RSI wasn’t accompanied by a fall in price – which means that the bulls were accumulating between $0.45-$0.5 region.

Along with that, XRP price has also undergone a golden crossover of the 50 and the 200 day moving averages – which is another widely recognized bullish chart pattern and hence this is another point in favor of a positive run going forward.

Read more: Ripple XRP price prediction

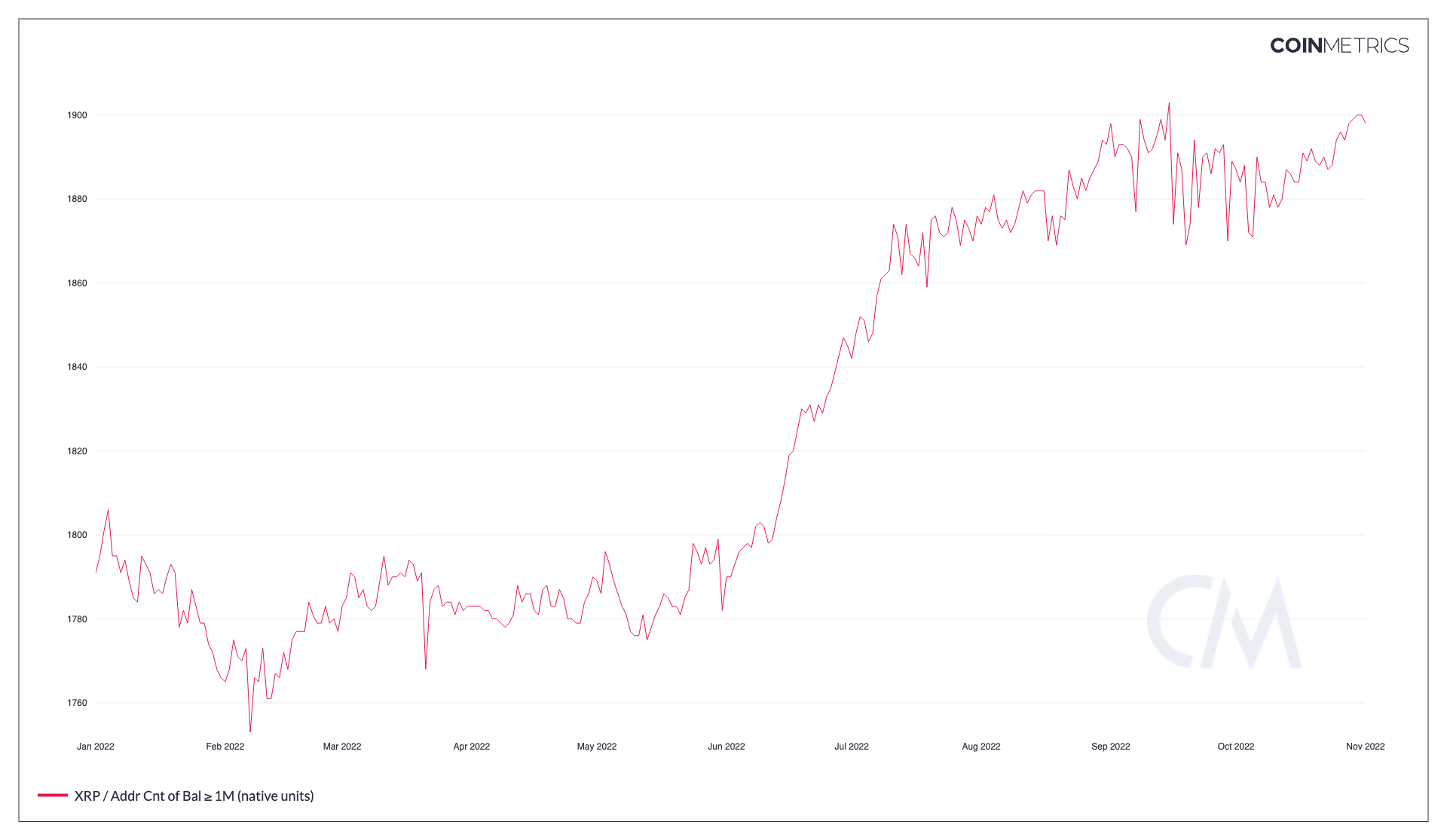

Number of Addresses with more than 1 million XRP near ATH!

On the on-chain metric front, the number of XRP addresses holding more than 1 million XRP tokens in them is currently just shy of touching its all-time-high. This is a very positive metric since it indicates that the number of large investors with a lot of XRP tokens in their wallets are willing to bet even more and are buying into the coin, expecting it to go up further soon.

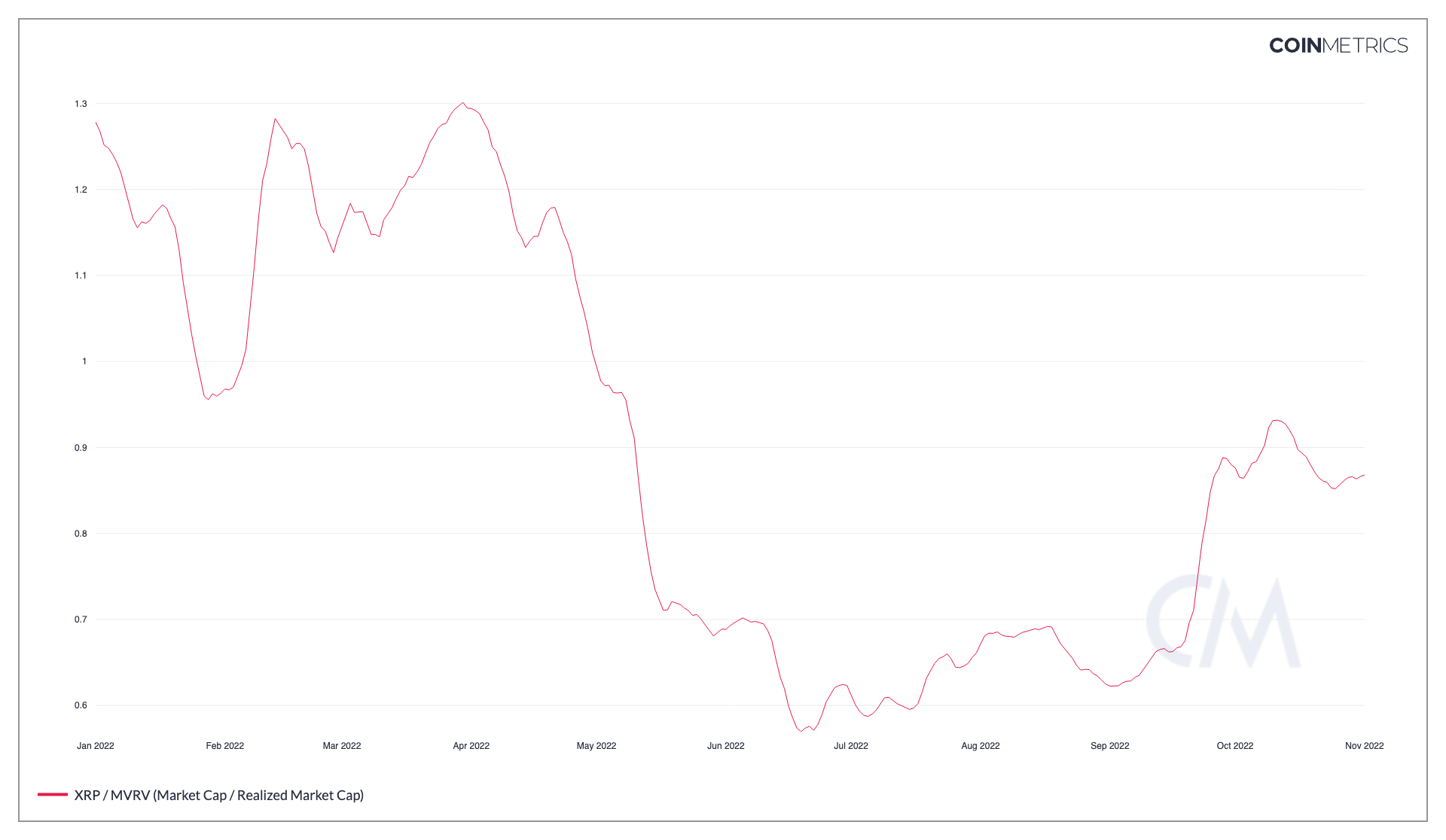

Healthy MVRV Ratio levels for XRP

MVRV ratio or the market value to realised value ratio is a metric that tried to determine and get a sense of when price is above or below “fair value”, and to assess market profitability. Extremely high levels indicate that market participants are valuing a coin at high premiums and could be indicative of a potential correction soon, while low levels indicate that the asset is undervalued and usually suggest late stage bear market region.

In the case of XRP, we can see it is currently just slightly below the 0.9 mark. This indicates that the downside for XRP price is more or less properly valued and that large cross-section of the supply is near break even, or held at a loss. Thus a further breakdown from here is unlikely and a rally could follow, if broader sentiments remain positive.

Read more: XRP Technical Analysis

Conclusion

Well, in conclusion we can safely say that XRP price is well primed for a good rally going forward, provided that the overall crypto market sentiments remain optimistic. Everything from the number of ‘millionaire HODLers’ to valuation metrics like MVRV indicate that the crypto is well positioned to be a recovery candidate. These on-chain metrics are also directly supported by technical analysis, which also position XRP at the edge of a positive breakout, thus boding well for the immediate future of the token.

Prices as on 2nd November, 2022.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more