Table of Contents

ToggleKey Takeaways:

- The Render Token price has been bullish since the beginning of 2023 and despite a drastic pullback, the price has managed to maintain an ascending trend

- The bulls are now expected to hold the price above the gained levels and push further to test the higher targets

- An increase in the user’s interest is recorded and hence the platform is expected to gain traction in the coming days

Render Token has been one of the biggest performing cryptos of the year as it has been successful in attracting investors onto the platform. Render, which aims to provide a decentralized processing unit (DPU) on the blockchain, has been bullish in the past few days for several reasons.

Firstly, the platform is about to get cheaper and faster to operate as it moves onto the Solana network, which is known to handle 2,500 TPS. Secondly, the network has been improvised as developers have incorporated stable diffusion into the network. This offers a latent text-to-image diffusion model that generates a photo-realistic image of any given text.

Lastly, the Render community approved a proposal, RNP-003 by voting which allocates 50% of emissions in the first year to the foundation’s development fund. It helps to set up future grants making within the ecosystem.

Render Token (RNDR) Technical Overview

Source: Tradingview

- The RNDR price is trading within an ascending triangle which is largely considered a bullish

- The price after testing the pivotal resistance has faced rejection and hence the price is believed to take a backfoot

- It is currently plunging down and hence may reach immediate support at around $1.587 as the RSI is dropping

- Besides, a significant upswing may be triggered as the ADX or Average Directional Index continues to maintain huge bullish strength

Read more: Ethereum Price Prediction 2023

Render Token (RNDR) On-Chain Overview

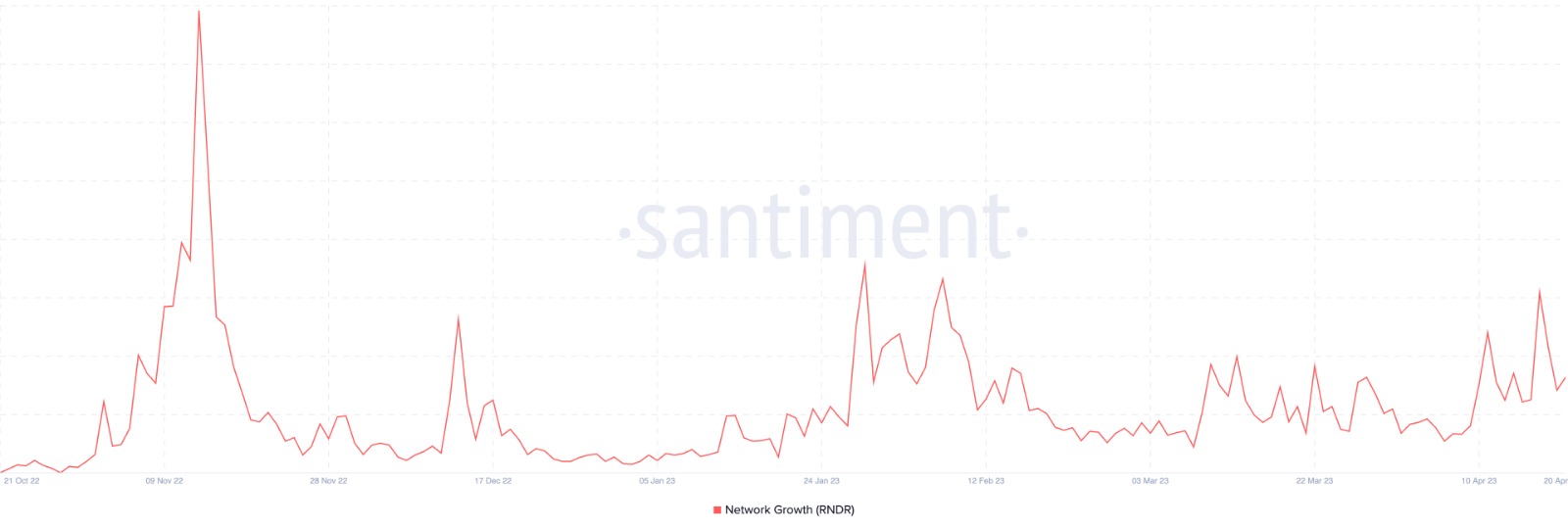

Render Token Network Growth

Source: Santiment

Network growth is nothing but the number of new addresses created on the network in a day. These metrics usually spike whenever the markets turn bullish, indicating a rise in the trader’s interest, but may soon witness a drop after the trend wanes. It may also be considered an indicator of an incoming correction.

Presently, the network growth of Render Token is incremental, meaning, new addresses have been created over the network and have either placed a buy, a sell, or a swap order. The rise in the metrics indicates the growing adoption of the project and helps to determine whether the platform is gaining traction or not.

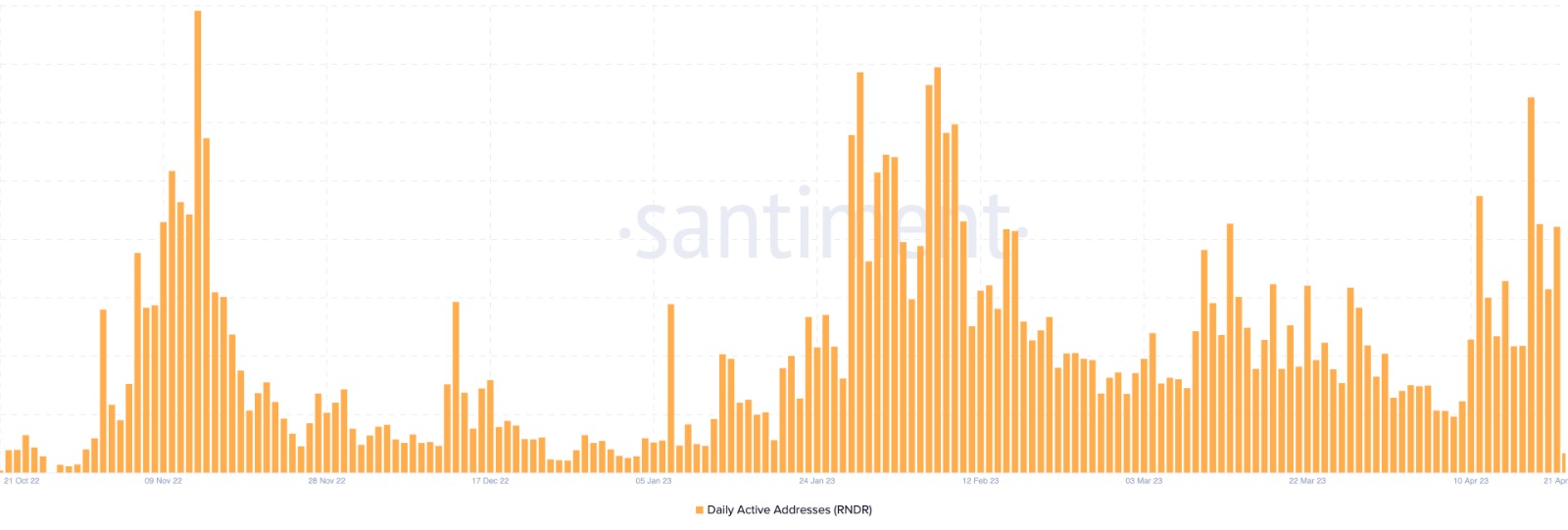

Render Token Daily Active Address

Source: Santimnet

The daily active address, on the other hand, is the number of addresses that interact with the platform on a daily basis. All the addresses are considered regardless of whether it is a new address or a returning address, or whether it is a buy, sell, or swap address. The metrics usually determine the mindset of market participants, as the DAA rises when the market is bullish and drops otherwise.

Presently, the levels have soared heavily in the past few days, indicating the rising interest among market participants. The increased activity further raises volatility, which further uplifts the price towards the next targets.

Read on: Axie Infinity Price Prediction

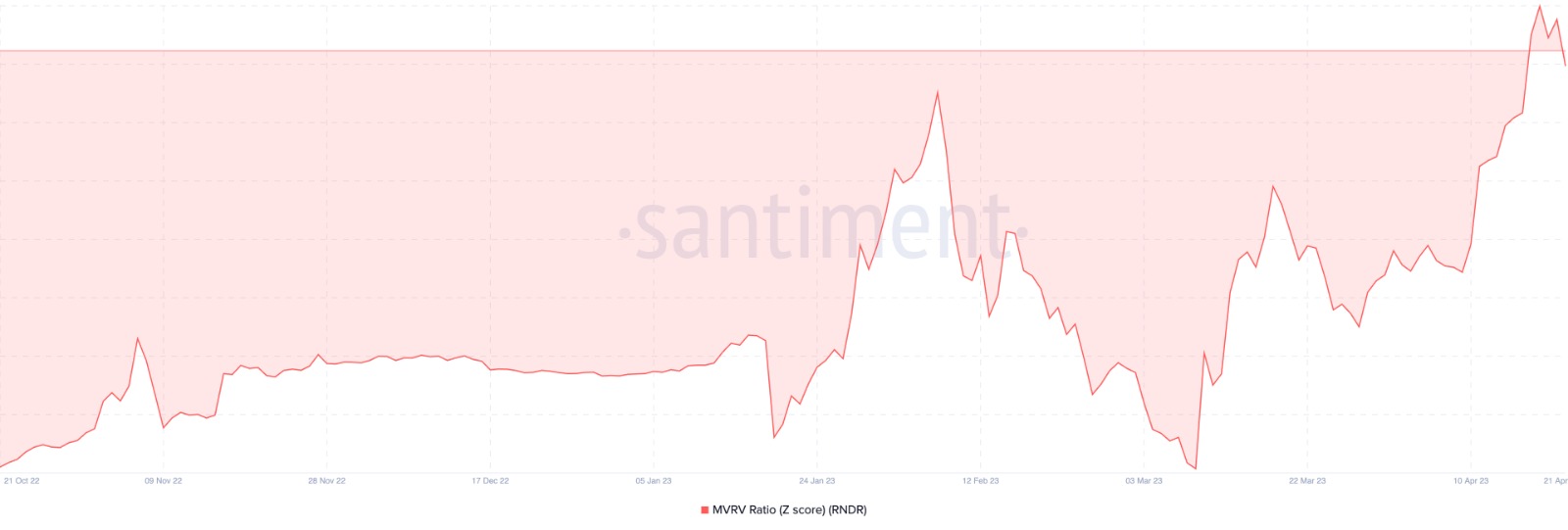

Render Token MVRV Ratio

Source: Santiment

The MVRV ratio is a comparison between the market capitalization and the realized capitalization to get the fair value of the token. The fair value helps to determine whether the token is undervalued or overvalued. If the current price is above the fair value, it is considered overvalued; otherwise, it is undervalued.

The MVRV ratio of the Render token has been trading within the undervalued range for quite a while and recently surged beyond the average levels. Hence, the price is gaining some value, but it also carries the possibility of a notable plunge as traders tend to extract profit from a price surge.

Concluding Thought

The Render token has been trading under a bullish influence for quite some time, and hence, the price is believed to maintain a fine upswing ahead. While the soaring network growth and DAA levels indicate a growing traction, the drop in the MVRV ratio may raise some concerns regarding the price rally. However, the price is believed to trigger a fine upswing, once the bearish influence evaporates.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more