Table of Contents

ToggleKey Takeaways:

- Injective price has stretched by more than 400% and marked new highs for 2023 at around $6.9

- The price is expected to remain elevated for some more time ahead which may trigger a fine bull run to hit $10 in the coming days

- The rise in new users along with the rise in trading activity is believed to keep up the bullish momentum of the token

Similar to the majority of cryptos, the Injective price has also maintained a steep upswing ever since the beginning of 2023. While the month of February remained largely bearish for most of them, INJ price held up above the crucial support levels, indicating the bulls may trigger a fine upswing quickly after the bearish influence fades away.

The beginning of the month turned out to be extremely bullish for the AI token which successfully surged by more than 90% within a fortnight, almost doubling its value. While the market participants hold the perception of a significant dump, the INJ price appears to be pre-programmed to reach the major resistance at $7.764.

The market is slowly flipping from the bearish trend and in such a case, another bullish wave may secure the levels above the crucial resistance. Meanwhile, after a giant price action in Q1, will the token maintain a similar upswing in Q2?

Read more: Injective Protocol Price Prediction

Injective (INJ) Technical Overview

Source: Tradingview

- Injective price has been largely bullish for the past few months and hence is believed to maintain a notable upswing ahead

- The price has maintained steep higher highs and lows since the beginning which may help the price to achieve the interim resistance at $7.7

- However, the price is closely trading along the resistance of the Bollinger Bands which may compel the price to undergo a minor pullback to the interim support

- This may trigger a bounce that may uplift the price levels beyond the major resistance and head high to reach close to a double-digit figure

Injective (INJ) On-Chain Overview

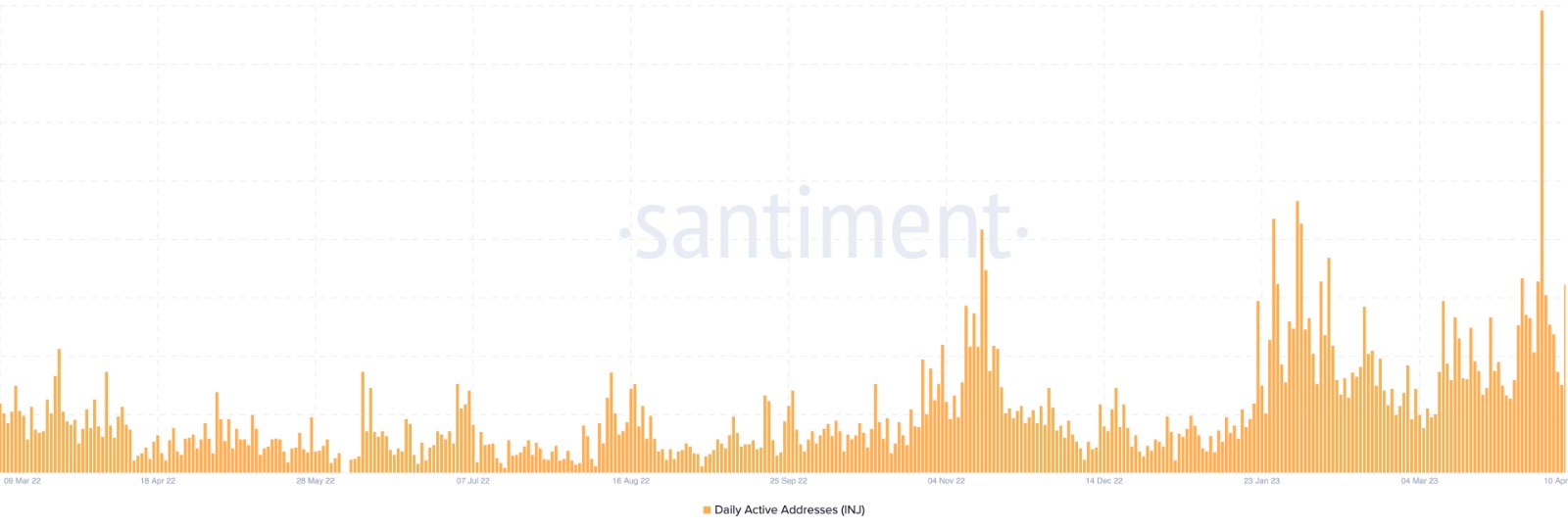

Injective Daily Active Address

Source: Santiment

The platform remains active if it records immense user activity. Daily active addresses count the number of addresses that interacted with the platform. Regardless of whether the addresses are of a buy, a sell, or a swap, the DAA considers them all but only once per day. The rise or drop in the levels indicates the growing or fading popularity of the asset within the crypto space.

After maintaining decent levels for a pretty long time, the DAA has spiked high in the past few weeks which has also impacted the INJ price as well. The rise in the levels indicates heavy user activity over the platform which has induced heavy bullish momentum within the token.

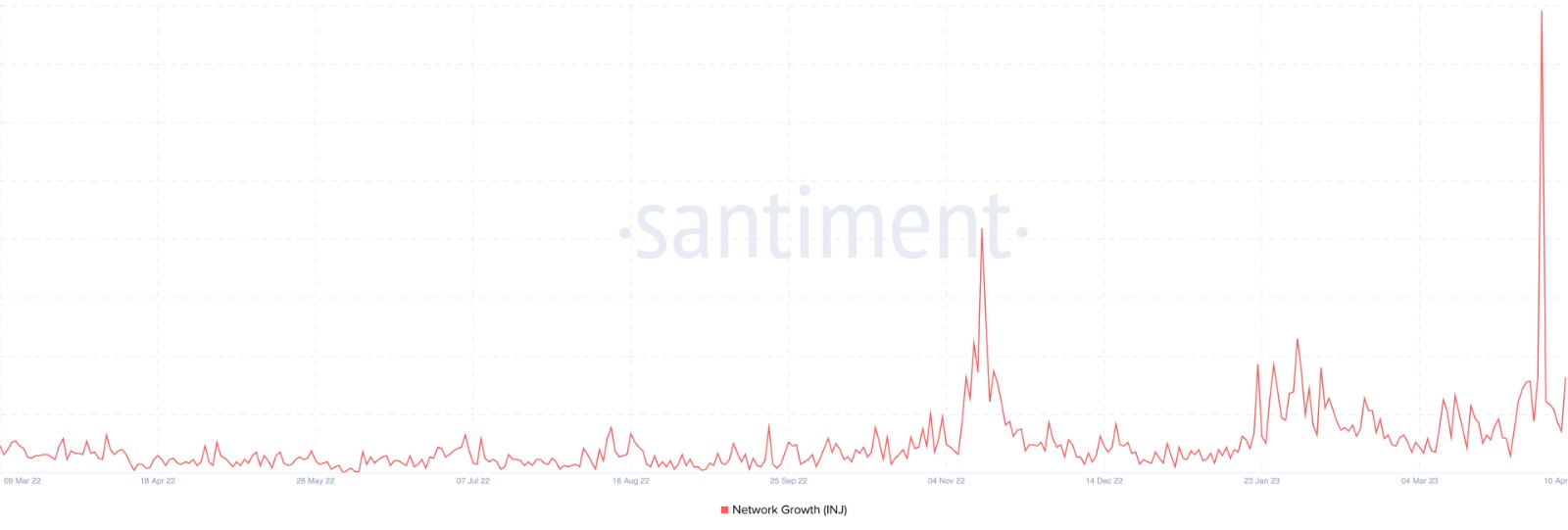

Injective Network Growth

Source: Santiment

The network growth is pretty much similar to that of Daily active addresses, but it only considers the activity of the addresses carried out for the first time. It records the number of new addresses that transfer for the very first time. It can also be considered the number of new addresses being created and transacted for the first time.

It signifies the adoption over time and can also be used to identify when the project is gaining traction or losing. The levels were grounded for quite a long time which has spiked heavily in the past few days. It indicates a large number of new addresses have been created and also carried out transactions for the first time.

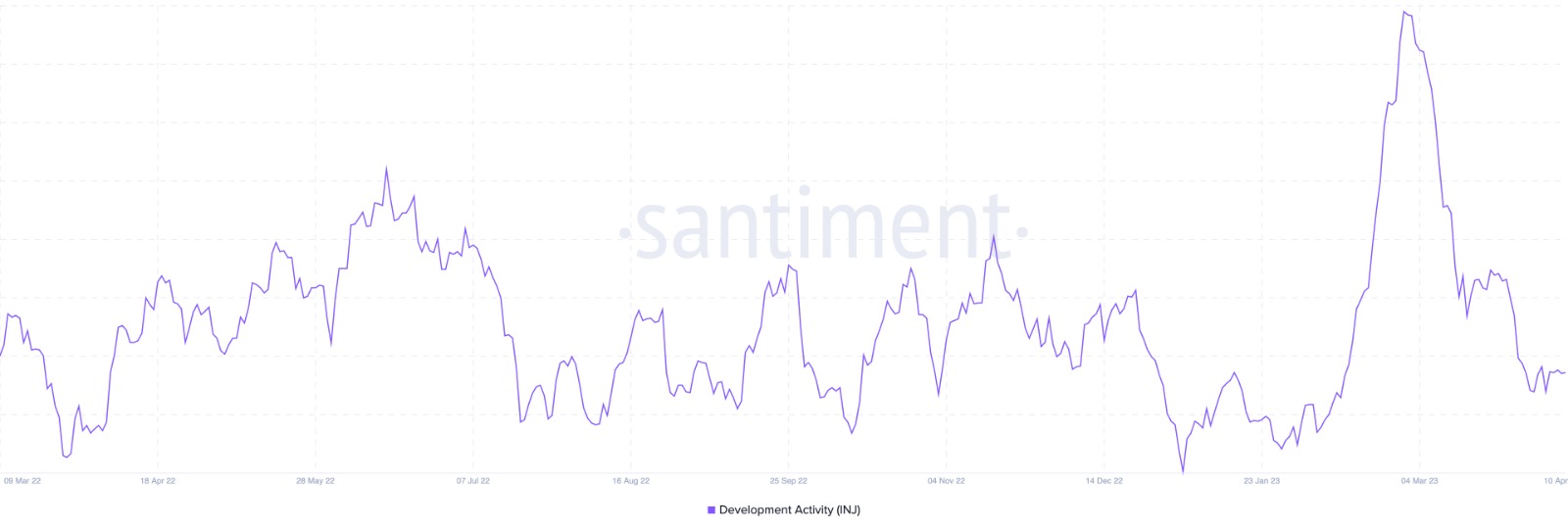

Injective Development Activity

Source: Santiment

The development activity of a project suggests whether the platform is serious about the business proposition or not. Alongside this, it also indicates whether the platform will be able to deliver new features in the future or not be less likely to be an exit scam. The levels can also be used to know how determined the developers are to create a working product and constantly keep polishing and upgrading the features.

The development activity had surged gigantically a few days before, but presently, is dropping hard. While this may indicate the pace of the development activity has slashed considerably. This may induce a sense of fear among the market participants which may create notable bearish pressure.

Additional read: Uniswap Price Prediction

Concluding Thought

The Injective price has flown high driving the entire crypto space in the past few days. While the price pattern indicates a minor pullback before igniting a fine recovery. However, the technicals continue to remain bullish as huge user activity is recorded which is expected to keep having a bullish momentum in the coming days.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more