Table of Contents

ToggleKey Takeaways:

- Bitcoin price has been trading flat within the same regions, showcasing the possibilities of a bullish breakout in the coming days

- The star crypto appears to have accumulated strength and hence a bullish breakout may be expected any time in the near future

- The on chain metrics have turned bearish and hence a minor pullback could be expected

The Bitcoin price has been in the spotlight ever since the markets began to react drastically to external events. The prices, which once were believed to rise above $25,000, and mark the highs around $30,000, have now stuck below $23,000. The token is frequently subjected to a narrow consolidation that indicates the bulls are experiencing exhaustion every now and then. Although the possibility of a bullish breakout is fewer, the price is believed to maintain a decent upswing ahead.

The upcoming days are expected to be extremely volatile for the Bitcoin price, as multiple events are set to shake up the crypto space. Some of them are mentioned below,

- March 7 – 8: FED chair Jerome Powell will testify on the semi-annual monetary policy report to the House Financial service committee

- March 10: The release of the U.S February 2023 unemployment rate and non-farm payrolls

- March 14: Release of US CPI data and Final Shanghai upgrade expected on Ethereum’s Goreli testnet

- March 22: Fed Meeting on fresh interest rates

- March 27: EOS EVM’s final testnet will go live

The above-mentioned events may have a huge impact on the Bitcoin price. The volatility is set to increase, regardless of the direction of the impending trend. Hence, significant price action may be witnessed throughout the month, where-in the BTC price may either slice through the consolidation and rise high or plunge hard to test the lower support levels.

Read More: Bitcoin Price Prediction

Bitcoin Token Technical Overview

Source: Tradingview

- The Bitcoin price appears to be following a similar pattern of consolidating within a parallel channel after a gigantic drop

- If the pattern repeats, then a massive price drop may be expected that may drag the BTC price toward the local support zone around $21,447

- Besides, the RSI is plunging down, while the Average Directional Index (ADX) has plunged hard and reached lower support, indicating a huge slash in the strength of the rally

- Therefore, the price is believed to maintain a descending consolidation for the rest of the month and may even reach new lows

Bitcoin Token On-Chain Analysis

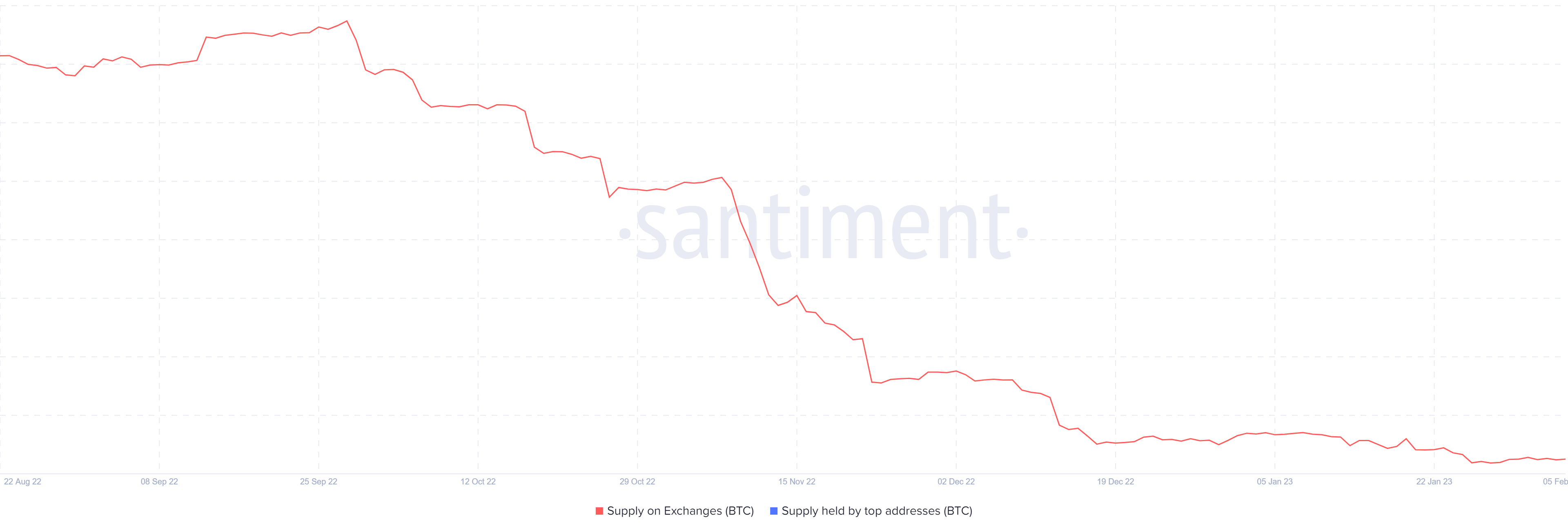

Bitcoin Supply on Exchanges

Source: Santiment

The supply on exchanges is basically the number of tokens present in the reserves or the wallets of the exchanges. These indicate the liquidity levels of the platform, as a rise in the supply also increases the liquidity but drops the demand for the token. It also points out the bearish mindset of the market participants as they bring back their tokens on the exchanges with the intention to sell.

Presently, the supply has dropped heavily, indicating that traders are currently bullish on Bitcoin and hence are holding on to their wallets for a longer time frame.

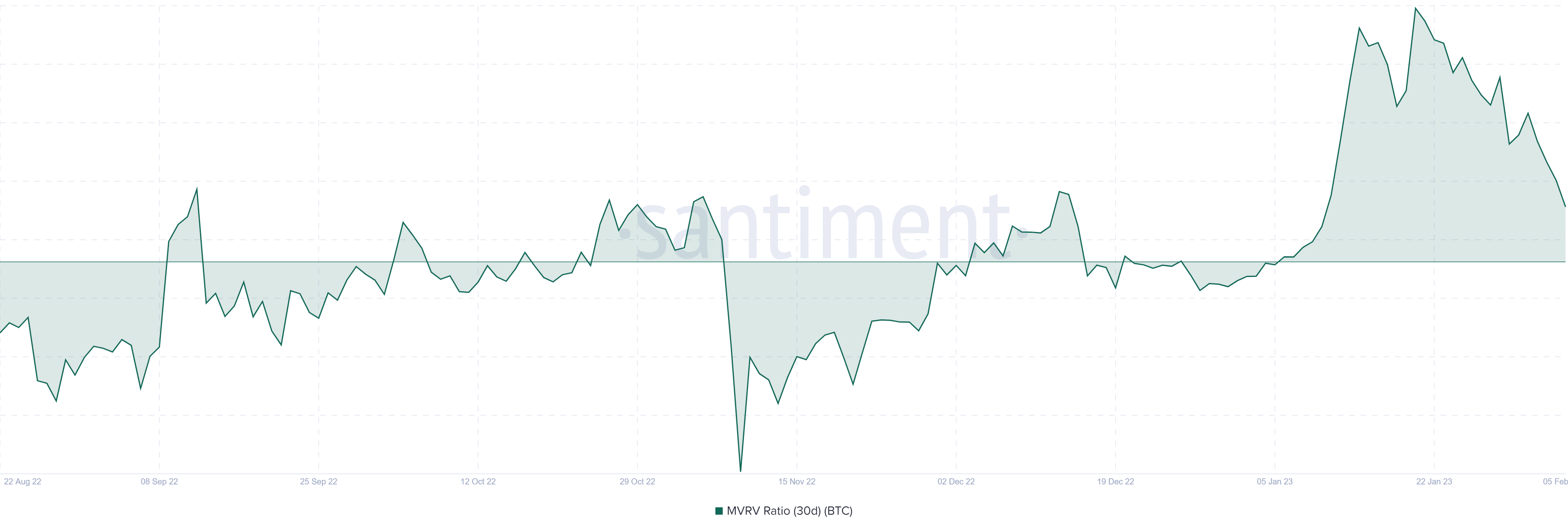

Bitcoin MVRV Ratio (30D)

Source: Santiment

The MVRV ratio is the comparison between the market value to its realized value in order to get a fair value. Fair values help determine whether the current price is undervalued or overvalued. If the price is overvalued, it indicates that the price may undergo a notable plunge as the traders may soon extract their profit.

Interestingly, the current MVRV levels have raised and sustained above the gains. Hence indicating that the traders appear to be bullish on the token. However, they may still carry the possibility of a massive plunge.

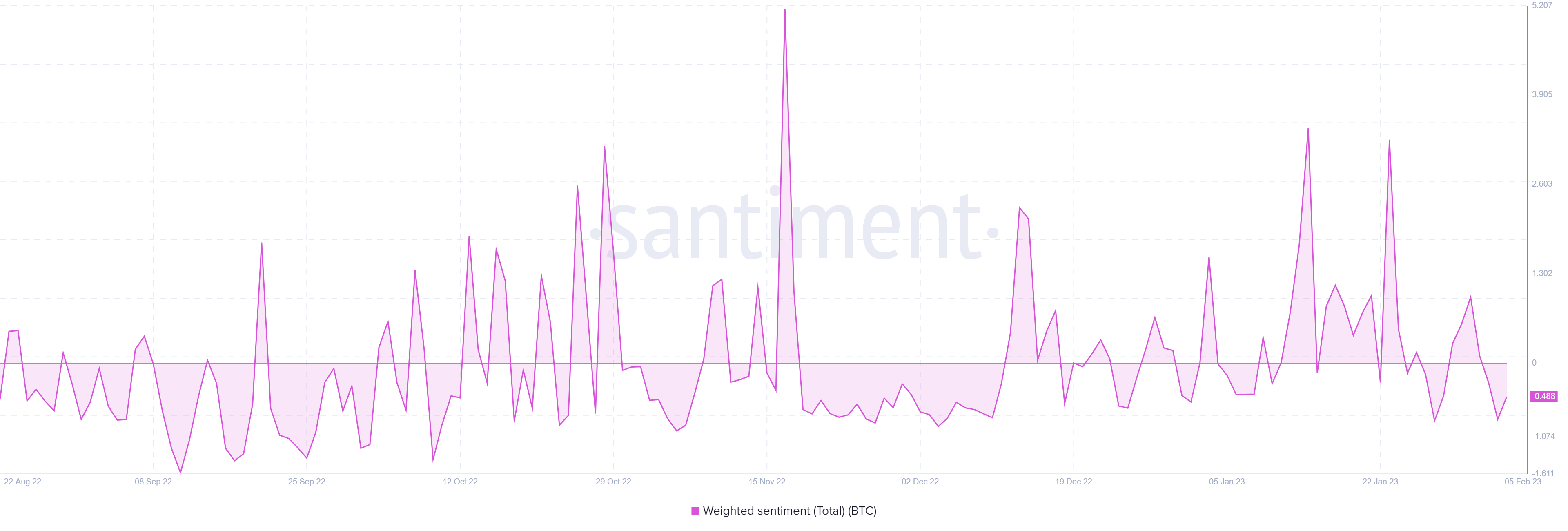

Bitcoin Weighted Sentiment

Source: Santiment

The popularity of a token depends on the sentiments of the market participants, regardless of whether they are positive or negative. A significant rise in the weighted sentiments indicates a rise in positive mentions, while a drop in the level suggests a surge in negative sentiments. The levels are calculated by considering all the positive and negative sentiments and comparing the frequency over time.

The sentiment has dropped significantly, indicating that the market participants have just become bearish. The levels have dropped after hovering within the positive ranges for a long time.

Additional Read: Ethereum Price Prediction

Concluding Thought!

The market sentiments for Bitcoin have become slightly bearish as the price is heading to test one of the crucial support levels. The sentiment has turned bearish, but the decrease in supply on exchanges provides a ray of hope for a notable upswing. Therefore, the upcoming monthly close may be extremely crucial that may set the path for the months ahead.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more