Table of Contents

ToggleKey Takeaways:

- The PancakeSwap price dropped by nearly 28% in the past few days dragging the price close to the significant support at $2.5

- The bulls appear to have lost their grip over the rally and hence a notable drop may be fast approaching

- The technicals turn bearish, hence the descending trend may prevail for some time

The bears appear to have completely monitored the PancakeSwap (CAKE) price movements as they have failed to flow along the market sentiments. Although the crypto markets are witnessing a sigh of relief, the CAKE price is stuck under a huge bearish well. It may certainly not bounce off from the descending trend as the bearish pressure has mounted due to massive selling volume.

Besides, the hyped PancakeSwap V3 also failed miserably to lift the CAKE prices up. Moreover, a huge number of CAKE tokens were also burnt, slashing the circulating supply to 193.09 million.

🔥 7,176,570 $CAKE just burned – that’s $23M!

💰 Trading fees (Swap and Perpetual): 157k CAKE ($505k) +26%

🔮 Prediction: 65k CAKE ($210k) -3%

🎟️ Lottery: 23k CAKE ($73k) -36%

🔒 NFT Market, Profile & Factory: 441 CAKE ($1k) +6%*% change from last week is in CAKE

🔥🔥🔥 Proof… pic.twitter.com/jQ2c2Y46Zp

— PancakeSwap🥞Ev3ryone's Favourite D3X (@PancakeSwap) April 24, 2023

Despite the platform burning nearly 3.7% of the total circulating supply, the CAKE price maintained a steep descending trend and plummeted more than 16% in the past 24 hours. The drop is speculated to be the result of the fixed-term staking program which was launched a year ago that required the CAKE holders to lock their tokens to get rewards.

The maximum staking period was one year, beyond which they may un-stake the token. The current situation appears to be fueled by un-staking the tokens that dropped the TVL by 6% in the past few hours.

PancakeSwap (CAKE) Technical Overview

Source: Tradingview

- The CAKE price underwent a massive drop in the past few days, which landed the token at the last point of defense.

- The price is currently testing the June 2022 lows at around $2.5, which are the lowest levels to defend.

- The selling volume has accumulated heavily, and hence, the price may maintain a descending trend for some time ahead.

- Meanwhile, if the price breaks down the lower support, then it may remain consolidated below $2.5, and only a huge bullish event may raise the price above $3

PancakeSwap (CAKE) On-Chain Overview

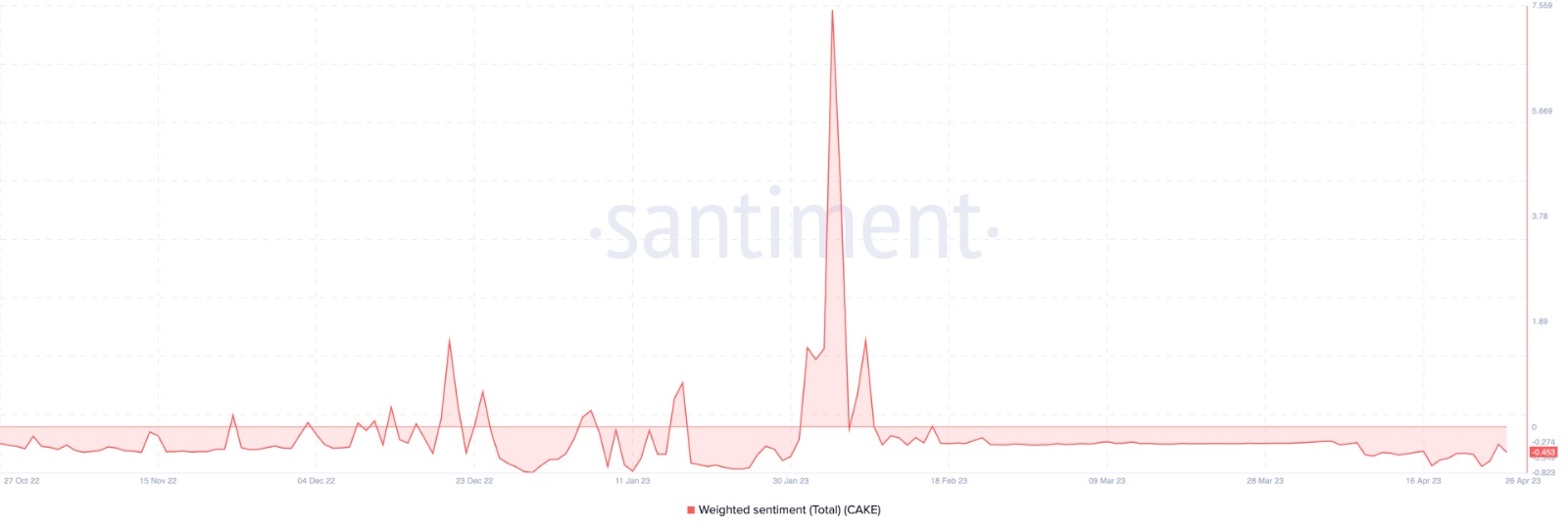

PancakeSwap Weighted Sentiment

Source: Santiment

The weighted sentiment combines the positive and negative mentions, posts, etc, and multiples by the social volume. Whenever the sentiments surge high, the price tends to soar. Besides, in case of a plunge, the price also drops notably. The sentiments do not directly impact the price levels but encapsulate the mindset of the market participants.

Presently, the levels are trading below the average levels for quite a long time, indicating the mounted bearish sentiments. The levels in the recent past had spiked beyond 7.4 as traders were extremely bullish but now have dropped below -0.29. Alongside, the price is also experiencing a steep downfall which may not be good for a healthy rally.

Read more: Pancakeswap Price Prediction

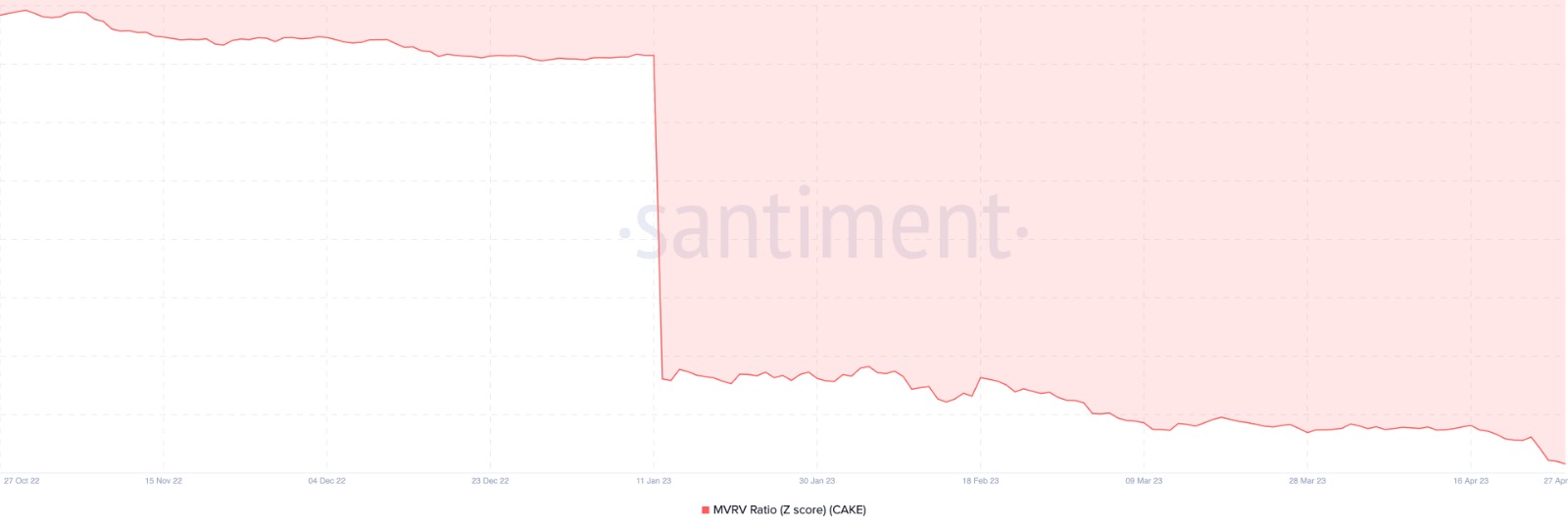

PancakeSwap MVRV-Z Ratio

Source: Santiment

The MVRV-Z score compares the market value and realized value of a token to determine whether the price is undervalued or overvalued. Whenever the market is significantly higher than the realized value, then the token is believed to be overvalued else a drop below these levels indicates the price is undervalued.

The MVRV-Z score trades within a negative range for more than 8 months, indicating the price is constantly undervalued. The price in undervalued levels usually attracts huge liquidity that further lifts the price. Unfortunately, CAKE’s price has failed to do so and continues to find new lows.

Concluding Thought

PancakeSwap (CAKE) price, currently, appears to be under extreme bearish influence as the prices have dropped miserably. The negative weighted sentiments and MVRV-Z score indicate the price to be undervalued and they are prone to maintain the current trend until it finds a strong base to rebound.

Additional Read: Pancakeswap vs Uniswap

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more