Table of Contents

ToggleKey Takeaways

- The LTC price underwent a massive price action by surging close to 40% which appears to have been drained in the past few days

- Although the price is witnessing significant bearish pressure, the momentum continues to remain bullish that may revamp the upswing in a short while

- While the bears are trying to slash the price, technical suggest a revival of the bullish trend soon

Litecoin price began a notable upswing some days ago as the hype around the halving surrounded the token. Meanwhile, the token surged magnificently to reach beyond $90 from a low of around $67, while the Bitcoin price underwent a massive price action at the same time. BTC price managed to rise by more than 45% since the recent price drop, LTC price surged with nearly the same momentum but also recorded a plunge of over 11%.

Therefore, will LTC price revamp with the bullish trend and follow the star crypto, Bitcoin?

Presently, the regulatory clouds are circulating over the crypto space and Litecoin does not seem to be disturbed by it. In a fresh update, the United States Commodity Futures Trading Commission (CFTC) has classified Litecoin as a commodity in the official lawsuit filed by the regulators against the Binance exchange. Interestingly, LTC was specified along with the other cryptos like BTC, ETH, USDT, etc

Certain digital assets, including LTC as alleged herein, are “commodities,” As defined under Section 1a(9) of the Act, 7 U.S.C. § 1a(9.

Litecoin is a Commodity. Nice to know we all agree on that now. pic.twitter.com/l1D0TDDnxK

— Litecoin (@litecoin) March 27, 2023

This clarity was much required for the entire crypto community as the US regulators have been constantly cracking down on crypto companies. The Litecoin community believes that the status of ‘commodity’ may further boost the forthcoming halving event which is less than 130 days away.

Read More: Litecoin Price surged over 12%

Litecoin Token Technical Overview

Source: Tradingview

- Litecoin price is trading within a rising parallel channel ever since the crypto market collapsed due to the fallout of the Terra ecosystem way back in May 2022

- The recent upswing compelled the price to rebound from the lower support and reach the resistance with a v-shape recovery

- The price has formed a strong base at the 50-day which is acting as a strong support level, to begin with, a fine upswing

- The price is required to secure the levels above $100 which may further begin a fine ascending trend ahead

Litecoin On-Chain Overview

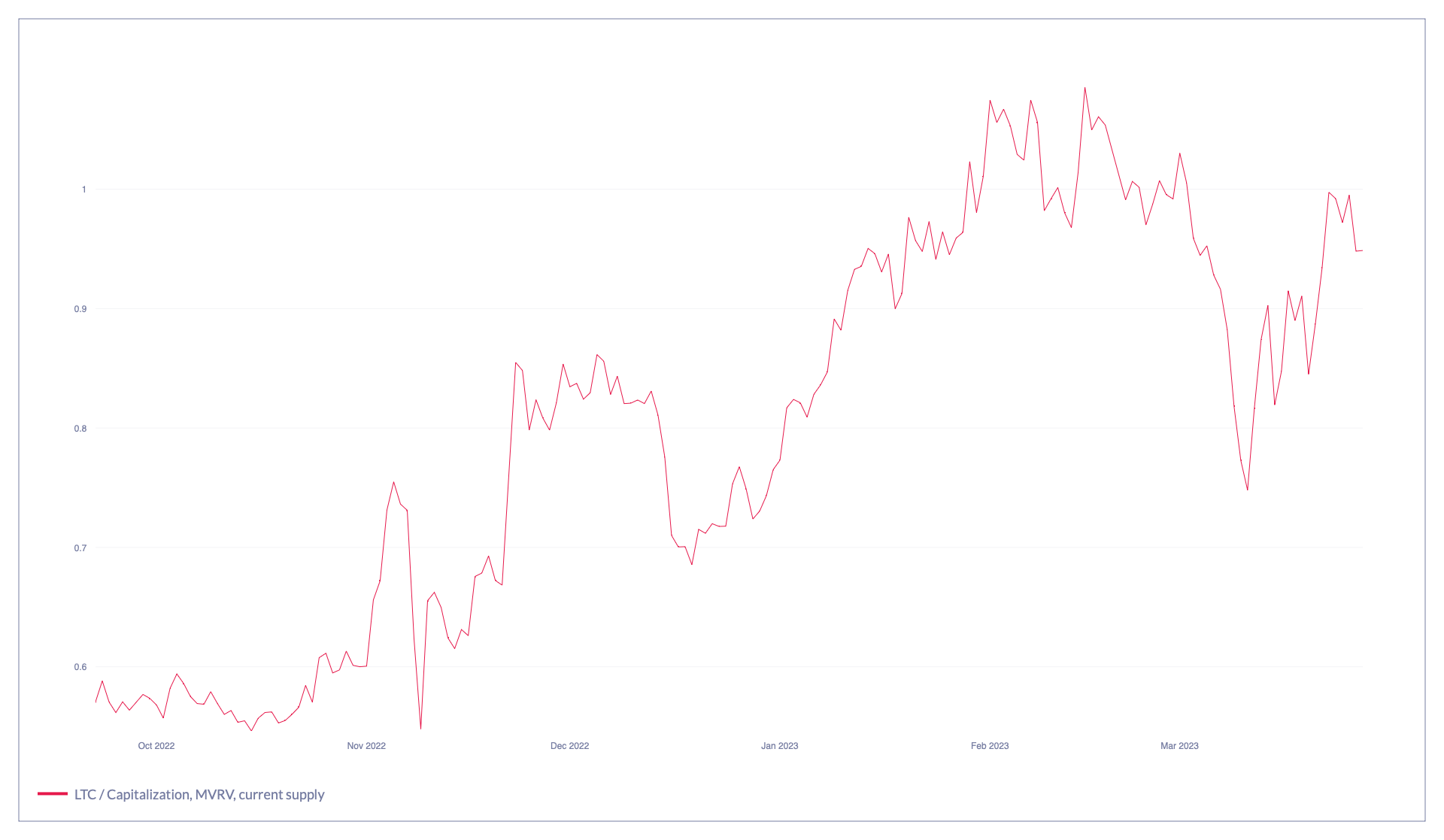

Litecoin MVRV Ratio

Source: Coinmetrics.io

The MVRV ratio is the comparison between the token’s market capitalization with its realised capitalization to get a fair value. The fair value determines whether the token’s price is undervalued or overvalued. If the price is trading above the fair value, then it is considered as overvalued and carries the possibility of a retracement as the traders tend to extract profits.

Besides, if the price is trading below the fair value of the token, then it is said to be undervalued which may attract more liquidity. The MVRV ratio of LTC had plunged down but as the liquidity kicked in the ratio surged high. However, the ratio is again plunging as the traders may be extracting some profits.

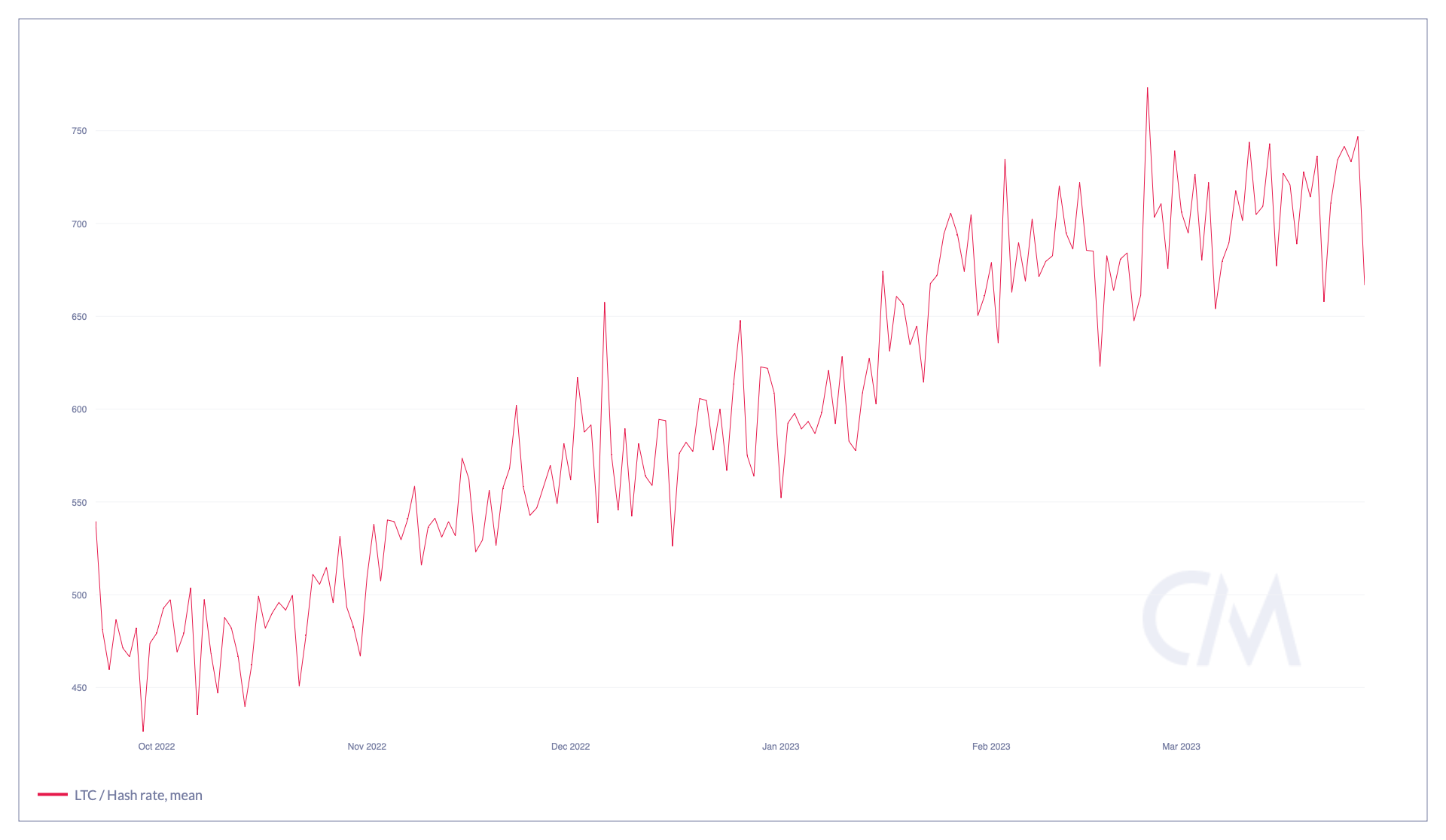

Litecoin Hashrate

Source: Coinmetrics.io

The hash rate is nothing but the computational power required in a Proof-of-Work(PoW) network to validate a transaction and add the block to the chain. It is used to measure the health, security and mining difficulty of a blockchain and is measured by the number of hashes per second. When networking encounters a low hash rate, then the property of being decentralized comes to risk as fewer miners may be participating increasing the possibility of a 51% attack.

However, the hash rate of LTC is soaring high to mark new ATH, indicating that more miners are competing within themselves to validate the transactions. A rising hash rate also substantiates the network to be more decentralized and secure.

Additional Read: BTC Price at $28K Despite Liquidity Drop

Litecoin Mean Difficulty

Source: Coinmetrics.io

The mining difficulty determines how difficult it is for the miners to mine a certain block. To mine a block, the miner is required to solve complex mathematical problems and find a valid hash. As the process advances, the network adjusts the rate so that the miners can find valid hashes. The mining difficulty maintains the security of the network and offers a steady mining rate.

Presently, the mining difficulty has surged heavily and is at its highest point since its inception. Hence indicating that it may be pretty tough for the miners to validate the transactions. Therefore, maintaining the authenticity and security of the network.

Concluding Thought

Litecoin price is witnessing a minor bearish action but countries are to trade under the bullish influence. The price may still revamp a fine upswing in the coming days, as the technicals point towards a notable upswing. The rise in the MVRV ratio, hash rate and mean difficulty indicates the strength of the rally which continues to remain bullish.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more