Table of Contents

ToggleKey Takeaways:

- Lido DAO price plunges heavily ahead of the Ethereum Shanghai Upgrade as the bearish pressure accumulates

- The bullish strength continues to prevail while the trend has shifted to bearish after failing to sustain within bullish regions.

- The market participants and the whales both appear to be bearish on LDO but the social dominance remains at the gained levels

Lido DAO, the popular liquid staking solution for the Layer 1 chains like Ethereum, has been draining finely in the past few days. The token gained huge attention and adoption as the Ethereum mainnet was merged with the Proof-of-Stake Beacon chain. The price of the native token LDO also surged equivalently and marked highs above $3 in a very short time frame.

However, now that the withdrawal of the locked ETH is on the horizon, it appears that the dependency on the liquid staking platform has waned to a large extent. Traders staked their ETH which was locked with the ETH 2.0 smart contracts into other protocols using the Lido platform. The platform largely enabled these tokens to be liquefied. However, with the Shanghai upgrades users will not be compelled to use Lido to liquidate their assets.

Read More: Ethereum Shanghai Upgrade

Lido DAO (LDO) (ADA) Technical Overview

Source: Tradingview

- The Lido DAO price has been trading within a rising ascending triangle which suggests the price may maintain a healthy upswing

- The price has been dropping for the past few days and reached the lower support of the triangle

- The RSI of LDO is plunging down, whereas the ADX which indicates the strength of the token displays a bullish divergence

- Hence, the price is expected to remain within the consolidated range for a longer time and may even drop out of the triangle to attract liquidity

Read on: Lido Dao Price Prediction

Lido DAO (LDO) (ADA) On-Chain Overview

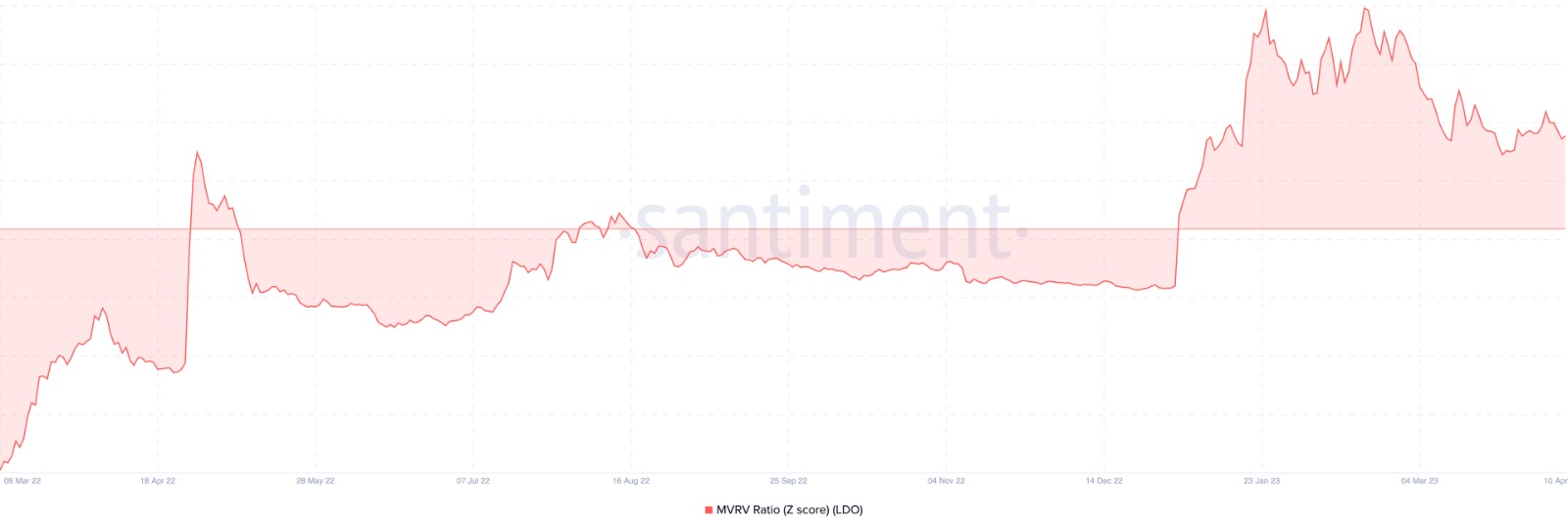

Lido DAO (LDO) MVRV Z-Score

Source: Santiment

The MVRV-Z score is a function of the difference between the total market cap and the realized market cap which is further divided by the standard deviation of the market cap. It evaluates whether the current price of the token is overvalued or undervalued compared to its normal value. It also indicates whether the investors are currently making a profit or whether the probability of the market bleeding could be high.

After remaining within the bearish regions for a pretty long time, the MVRV-Z score has risen within the positive ranges. A steep jump indicates the price has gained enough value and is prone to withstand a significant drop.

Lido DAO (LDO) Supply on Exchanges vs Supply Held By Top Addresses

Source: Santiment

The supply in the exchanges determines the balance reserves of all the collective exchanges which indicate the liquidity over the platform. The drop in the levels signals that the traders are bullish on the crypto and hence have stored their crypto in their wallets away from the exchanges. Woefully, the levels have surged to a large extent which indicates the traders have transferred their tokens back to the exchange with the intention to sell or swap the token.

Besides, the supply on the top addresses indicates the balance reserves held by the whales who usually hold more than 1% of the circulating supply. The rise in the levels occurs when the whales accumulate heavily and drop when they either stop accumulating or begin liquidating.

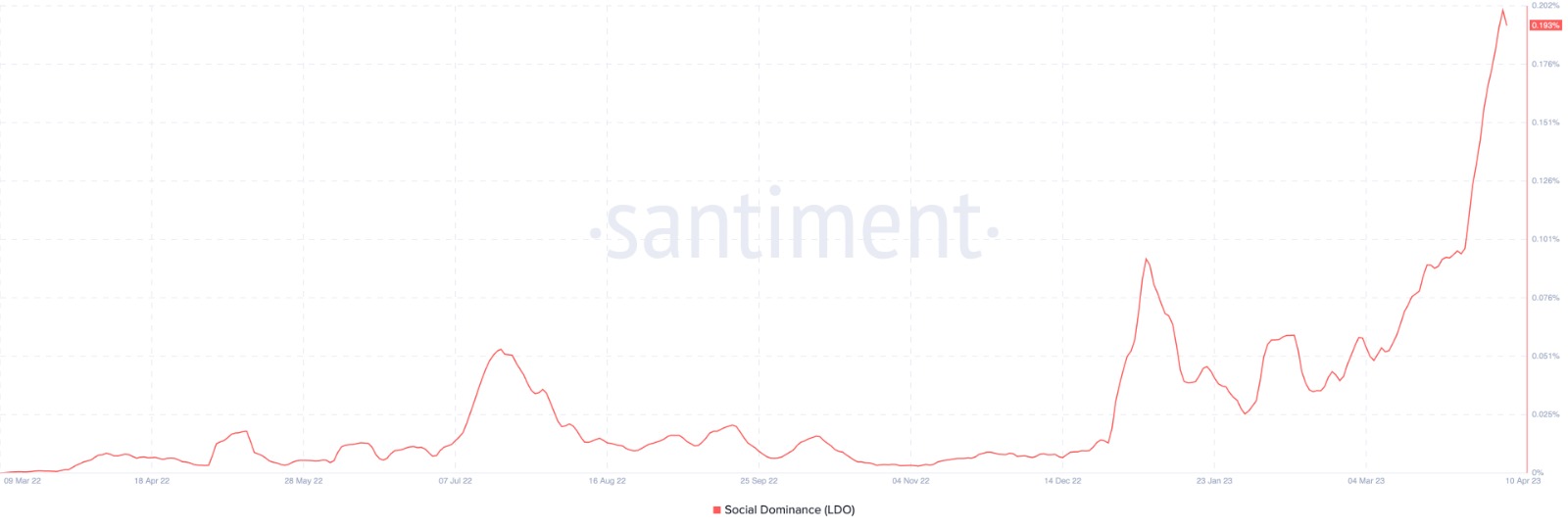

Lido DAO (LDO) Social Dominance

Source: Santiment

The social dominance of a token displays the share of the discussions in crypto media with regard to the token. It compares the social volume which includes the posts, mentions, discussion, etc of the token to the combined social volume of the 100 largest tokens by the market cap.

Currently, the social dominance of LDO has surged massively which means that the number of messages/posts that discuss LDO has jumped compared to the messages/posts that discuss the top 100 assets.

Concluding Thought

Although the Lido DAO token price has dropped fairly, the social dominance continues to remain high indicating the market participants are still bullish on the tokens. Besides the MVRV-Z score which is in the positive range signals a bullish trend to prevail. However, the supply on the exchanges has surged while whale accumulation has decreased which may soon flutter bearish flags for the crypto.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more