Table of Contents

ToggleKey Takeaways:

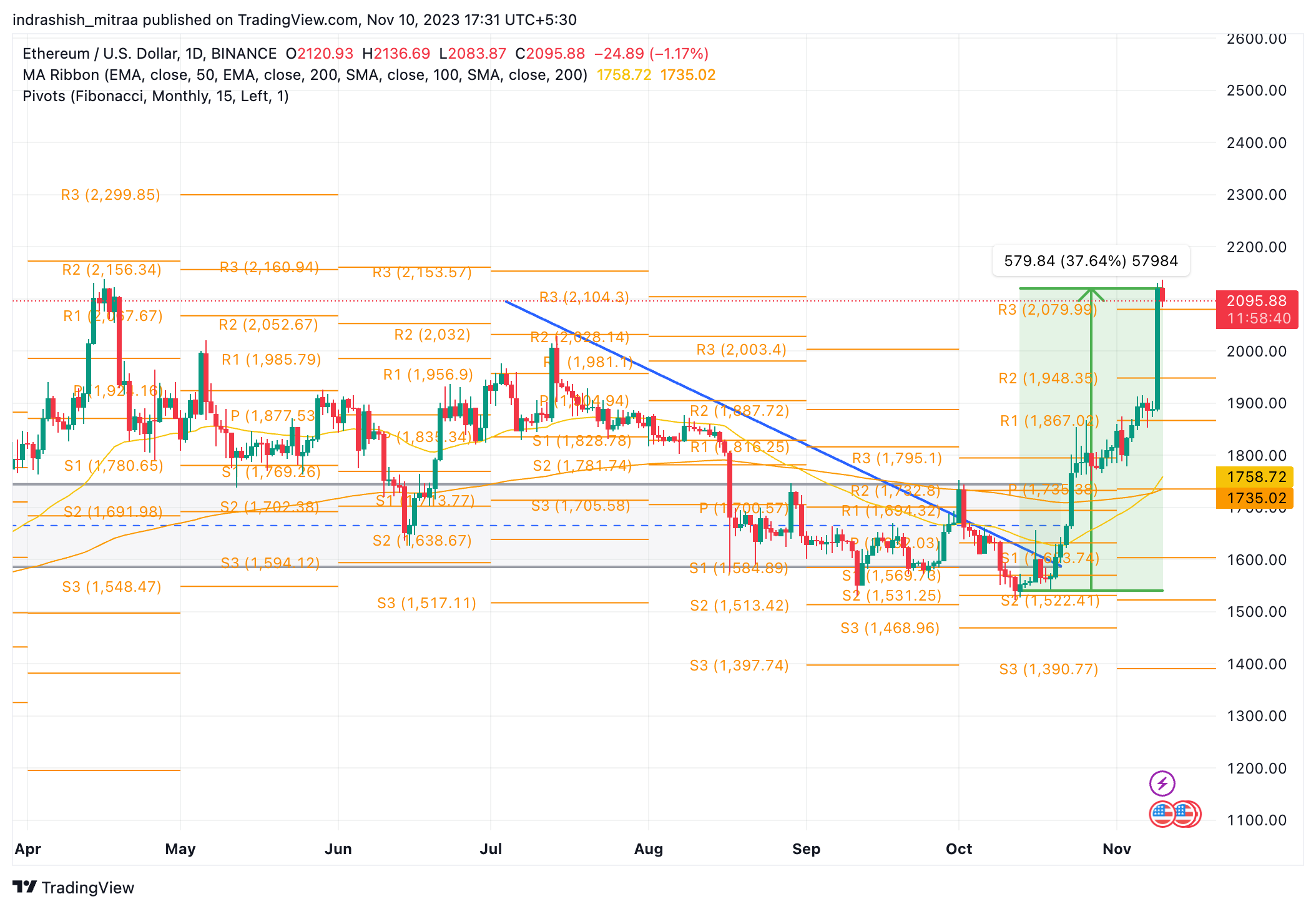

- Milestone Surge: Ethereum hits a 52-week high, exceeding $2,000, showing a remarkable 10% surge in 24 hours and a YTD increase of just over 75%.

- BlackRock’s Impact: BlackRock filing for an iShares Ethereum Trust in Delaware drives optimism for a potential Ethereum ETF, contributing significantly to the recent price surge.

- Market Anticipation: The crypto market eagerly awaits the SEC’s decision on BlackRock’s Bitcoin ETF proposal, with positive sentiment surrounding potential approval for a total of 12 Bitcoin ETFs.

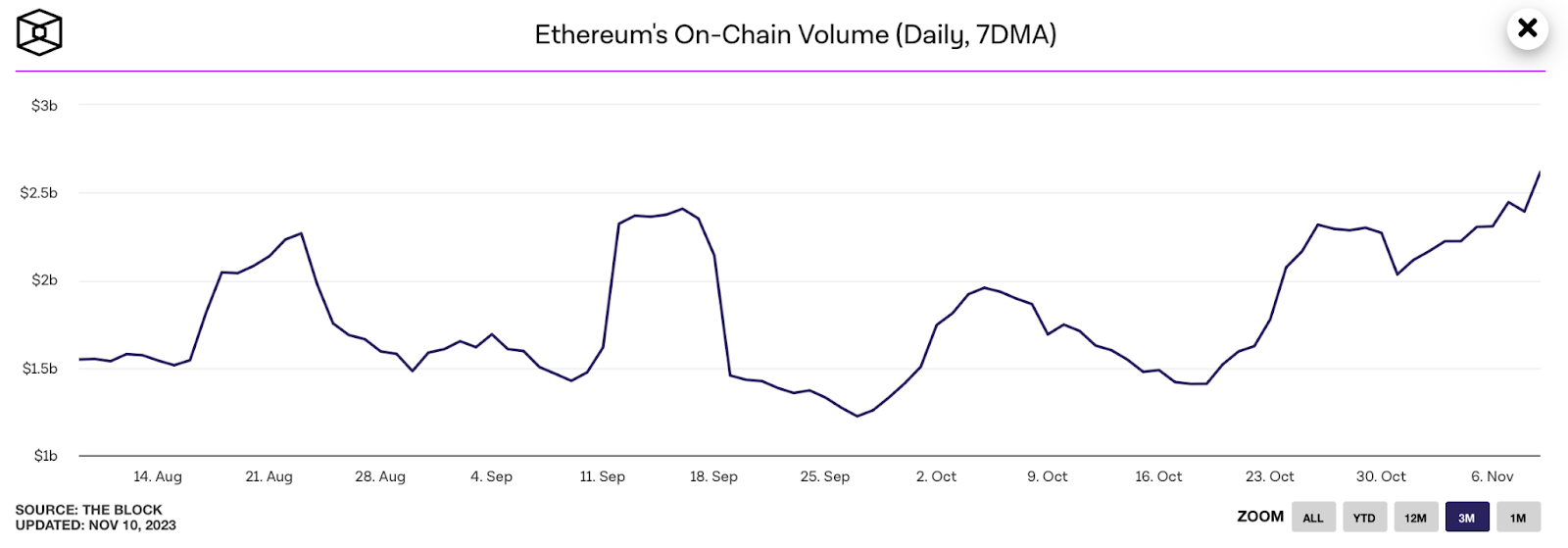

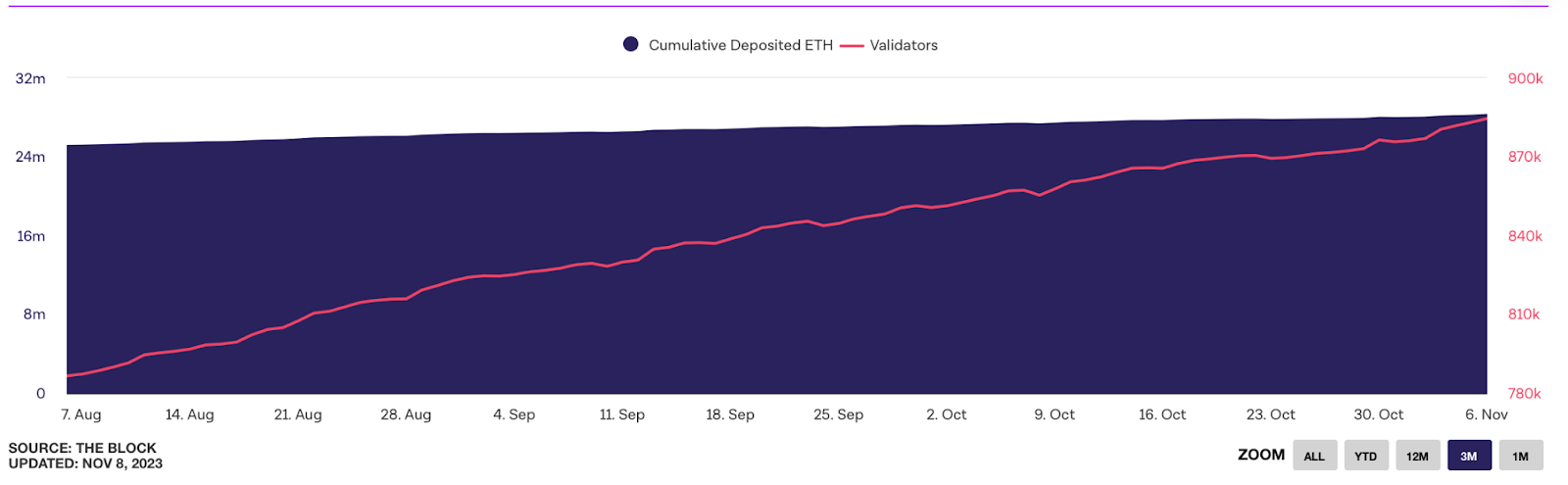

- On-Chain Metrics Boost: Ethereum’s on-chain volume rises from 1.5 billion to 2.62 billion, indicating increased network activity. Staked ETH in the Beacon Chain grows, enhancing network security and decentralization.

- Price Predictions and Caution: Short-term projections target $2,199.93 by November 25, cautioning investors about market uncertainties. Long-term projections aim for $6,809.84 by 2025, emphasizing the risks associated with crypto investments.

Ethereum Achieves 52-Week High Surpassing $2,000 Mark

The recent surge in Ethereum price to a 52-week high, surpassing $2,000, has set the market abuzz with bullish sentiments. As of now, Ethereum is trading at approximately $2,098, reflecting an impressive nearly 10% surge within a 24-hour period. The overall year-to-date (YTD) increase for Ethereum stands at over 75%, showcasing its robust performance since the beginning of the year. Despite these gains, Ethereum still trails its all-time high of $4,891 in November 2021.

BlackRock’s Role in the Surge: iShares Ethereum Trust

One of the major catalysts behind the recent Ethereum price surge is BlackRock’s strategic move in filing for an iShares Ethereum Trust in Delaware. This move is seen as a precursor to a potential Ethereum exchange-traded fund (ETF) following BlackRock’s previous pattern before filing for a Bitcoin spot ETF. This news has fueled speculation and optimism in the market, contributing significantly to Ethereum’s upward trajectory.

Industry observers are closely watching BlackRock’s actions, especially considering its earlier application for a spot Bitcoin ETF on June 15, 2023. The market is now eagerly awaiting the decision of the US Securities and Exchange Commission (SEC) on this Bitcoin ETF proposal. The anticipation of possible approval, not just for BlackRock but for a total of 12 Bitcoin ETFs filed by major Wall Street firms, has injected a bullish sentiment into the crypto market.

ETH On-Chain Metrics Driving Momentum

Examining Ethereum’s on-chain metrics provides additional insights into the current surge. On-chain volume, representing the total value of transactions on the Ethereum blockchain, has experienced a notable increase from 1.5 billion in September 2023 to 2.62 billion as of November 10. This surge in on-chain volume indicates heightened activity and usage of the Ethereum network, suggesting increased adoption and utilization for transactions.

Furthermore, the amount of ETH deposited into the Beacon Chain for staking in Ethereum 2.0 has witnessed an uptick from 786,000 in August 2023 to 885,000 on November 10. This growth in staked ETH and validators participating in the network contributes to the security and decentralization of the Ethereum 2.0 network, signaling long-term stability and commitment from stakeholders.

Ethereum Price Predictions and Cautionary Notes

While the recent rally in Ethereum price has sparked optimism, it’s essential to approach price predictions with caution due to the inherent uncertainties and volatility in the crypto market. Short-term predictions suggest an ETH price of $2,199.93 by November 25, projecting a 5.17% increase. Long-term projections are more ambitious, with predictions reaching $4,487.64 in 2023 and potentially $6,809.84 by 2025.

Investors are reminded that crypto investments involve risks, and market predictions can be subject to inaccuracies. Professional financial advice is recommended, and cautious decision-making is crucial, especially in the volatile crypto market. This article serves for educational purposes and does not constitute investment advice.

Read More: Ethereum Price Prediction

Ethereum Price Journey Towards $2500

The recent surge in ETH price beyond the $2000 mark and going on to near $2100 level has resulted in a new 52-week high for the altcoin king. After a long, sustained period of bearishness, the ETH price has finally begun to show some strong signs of bullishness and looks like it will continue. And things look even more optimistic with the positive news around the Ethereum ETF coming out from BlackRock.

Additional Read: Will Ethereum Price Ever Reach $10,000?

Source: crypto.news/CoinMarketCap

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more