Table of Contents

ToggleKey Takeaways:

- The Ethereum Classic price surged by nearly 40% since the beginning of 2023 marking a bullish start for the year.

- After consolidating for over a month, the price rose beyond $21, and regardless of the current pullback, it remains under a bullish influence.

- Woefully, the ETC price recorded a bearish close by trading at $20.12 after reaching highs at $21.82 yesterday with a market capitalization of $2.9 billion and a circulating supply of 138.88 million.

Ethereum Classic price after an extended consolidation has risen significantly in the past few days. Despite a consolidated beginning of 2023, the price geared up heavily and spiked by 38% from its interim bottoms. The crypto markets are somewhat bullish as the Bitcoin price rose above $17,000 after trying to do so for a long time. Therefore, the ETC price may have been influenced by the bullish market sentiments to record a fine upswing.

Meanwhile, the rounds of bearish action do also prevail but the bulls presently appear to be in a good position. Moreover, the correlation with its competitor Ethereum, is making huge rounds and hence a rise in ETH prices may also uplift the ETC price, withstanding bearish actions.

Additiona Read: Ethereum Shanghai Upgrade

Ethereum Classic Token Technical Overview

- The ETC price has been trading within a descending parallel channel for more than 6 months and the fresh surge enabled the price to rise above the bearish trade setup.

- After rising above the channel, the price is consolidating within minor ranges and may also drop slightly to test the upper resistance of the channel.

- However, after experiencing a notable pullback, the price may rebound and rise high to reach the pivotal resistance at $27.

- Meanwhile, the price is believed to remain heavily consolidated below $30 and may not easily rise above these levels without bullish interference.

ETH vs ETC Correlation going strong!

The Ethereum and Ethereum Classic correlation has been the highest in recent times as both prices have been plunging heavily. Ethereum was badly impacted by the market collapse in May 2022 while the Ethereum Classic price dropped merely. Moreover, the shift of the miners from ETH to ETC heavily impacted the ETC price which gained immense strength. Since then, the price maintain an equal trend, forming lower highs and lows collectively.

Additional Read : Ethereum Vs Ethereum Classic

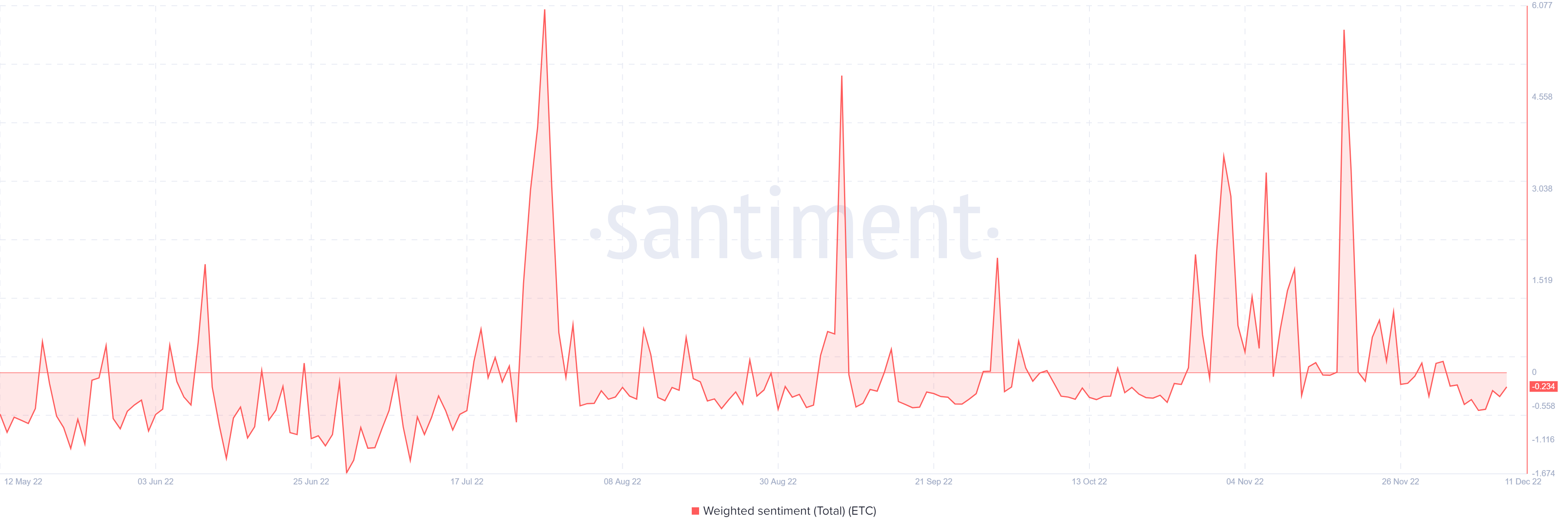

ETC’s Weighted Sentiment in the negative zone

The total weighted sentiment is a metric that measures the market sentiments of the token. It combines all the positive and negative mentions and compares them with the frequency over time. If the sentiment rises above the average levels within the positive range, it indicates the swelling of positive sentiments for the token mounting. However, it also carries the possibility of a significant pullback too. Here in the case of ETC, the levels continue to be within the negative range, signaling the prevailing negative sentiments for the token. Nevertheless, the sentiments tend to change with the revival of bullish trends.

Conclusion

The Ethereum Classic price has risen significantly displaying its capability to maintain a huge upswing for the rest of the year. However, a drop in the on-chain metrics like weighted sentiments or development activity may hinder the progress of the rally but if the bulls jump back in action, the trend may be reversed attracting many strong hands onto the platform.

Prices as on 10 January, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more