Table of Contents

ToggleKey Takeaways:

- Dogecoin price surged over 35% since the beginning of 2023, displaying its potential to go long in the coming days.

- The bullish volume intensified that propelling the price high, however, the spike has also attracted the bears who are attempting to slash the price at regular intervals.

- The price surpassed the crucial resistance and closed the previous day’s close at $0.08975 with a market capitalization of $11.8 billion and a circulating supply of 132.67 billion DOGE.

Dogecoin price has been trading under extreme bearish conditions and remained unaffected by any positive market sentiments for over 20 months. The narrow trend of the token compelled the crypto-verse to have a thought- is Dogecoin dead? However, the token geared up significantly and rose with a notable margin, displaying its potential to reclaim the lost levels in the coming days.

Additional Read: Cardano Vs Dogeoin

The price rise is assumed to be triggered by a whale, who moved a huge volume of DOGE in the past few days. As per some reports, the Dogecoin Whales moved over 500 million DOGE. The largest DOGE whale also moved over 165 million DOGE in the past 2 to 3 days which may have triggered a decent upswing.

These transfers were followed by a popular exchange & a zero-trading platform, Robinhood extended the Dogecoin support for its recently released wallet. Moreover, the market sentiments have also turned bullish which may keep up the bullish momentum for the upcoming days.

Dogecoin Token Technical Overview

- The DOGE price soon after marking the lows at the end of 2022, bounced off but continues to trade within a rising wedge, which is largely considered bearish.

- However, the bullish momentum continues to pile up due to which the price may test the upper resistance at $0.091 in the next few hours.

- These can be considered crucial levels, as if the bulls strengthened their grip here, the price may rise high significantly, invalidating the bearish thesis.

- Else, following a rejection from the resistance, the DOGE price may head back toward the lower support and may also pierce through the levels to test the lower support around $0.079.

Read More: Draw & Use Trendlines In Crypto Trading

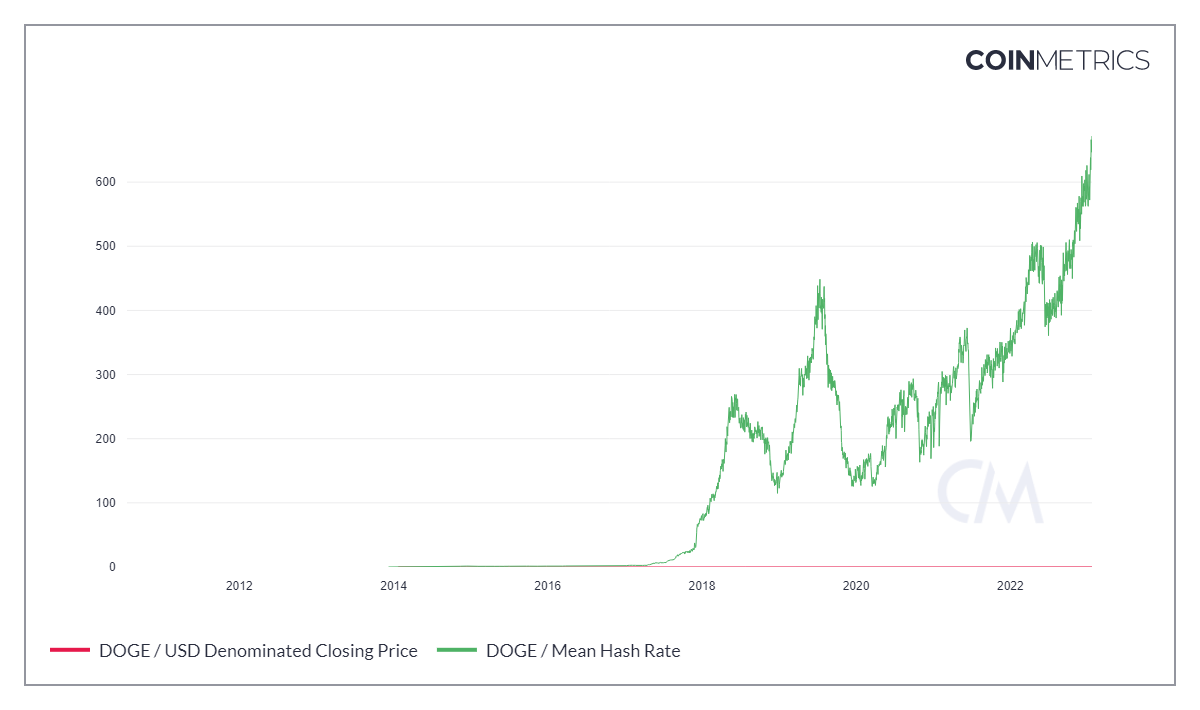

Dogecoin Mean Hashrate at an all-time-high!

Dogecoin’s mean hashrate is a value that specifies the number of hash rates generated per second by the miners in the process of mining new DOGE tokens by solving complex mathematical equations. The mean hash rate is calculated considering the mining difficulty, and average block time and compared with the defined block time. As the activities on the Dogecoin network spike, the hash rate also rises.

The current Dogecoin hash rate is around 671.91 TH/s which is at the highest level since its inception with a mining difficulty of 8.59M.

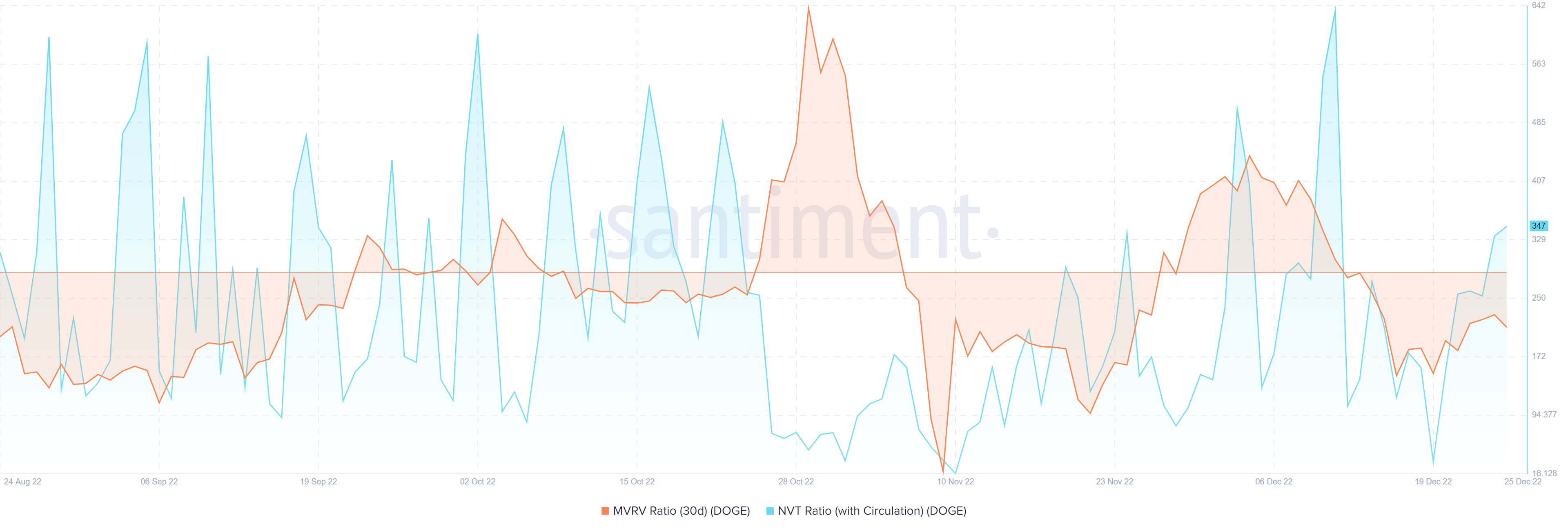

Dogecoin MVRV/NVT Ratio

The MVRV ratio is a comparison between the market value of the token to its realized value. The comparative value determines whether the token is undervalued or overvalued. Besides the NVT ratio compares the transaction volume against the market capitalization. A growing NVT ratio determines the volume has depleted faster than the market cap indicating bearish market sentiments.

The MVRV ratio has just surpassed the average levels to hover within the positive ranges, hence indicating the price could be overvalued and prone to a minor pullback. However, the NVT ratio is dropping which indicates the transaction volume is growing faster than market capitalization signaling the bullish market sentiments.

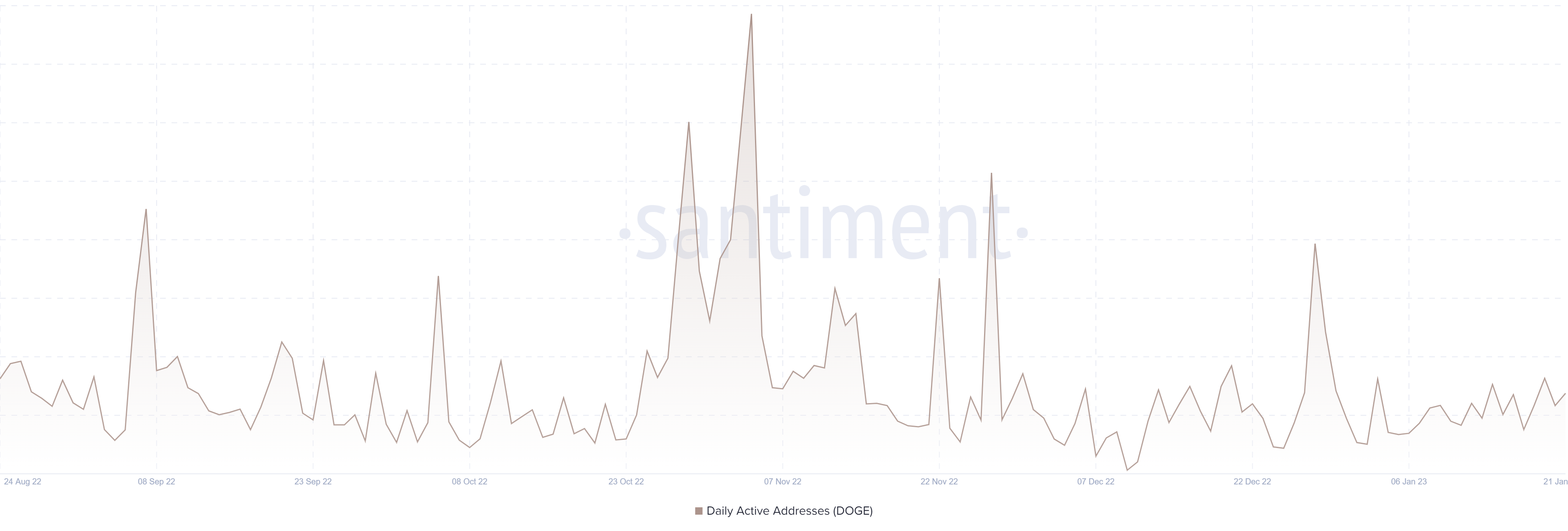

Dogecoin Daily Active Address

The daily active address is the total number of addresses that interact with the platform in a day. Each address is counted once, regardless of whether the trader is carrying out a buy trade, a sell trade, or swapping of the tokens. The rise in the DAA indicates the growing market sentiments among the market participants.

The active address count had dropped significantly during the end of the year 2022, but the levels rebounded at the start of 2023 and have remained incremental since then. Presently, the DAA is around 55,000 and rising.

Conclusion

Dogecoin prices display their potential to pull a massive leg up in the coming days, as the active addresses are increasing signifying the increased interest of the market participants. Moreover, the hash rate has also peaked due to which the mining difficulty could have increased, making the platform more secure to transact. Therefore, the Dogecoin price rally is expected to continue until the price does not settle above $0.1 by the end of January 2023.

Prices as on 24 January, 2023.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more