Table of Contents

ToggleKey Takeaways:

- Bitcoin price has been exhibiting recent weakness, falling below the crucial level of $29,000.

- Short-term correction below moving averages raises bearish signals for the king coin.

- However, the long-term technical structures remain positive, indicating potential recovery aided by positive newsflows.

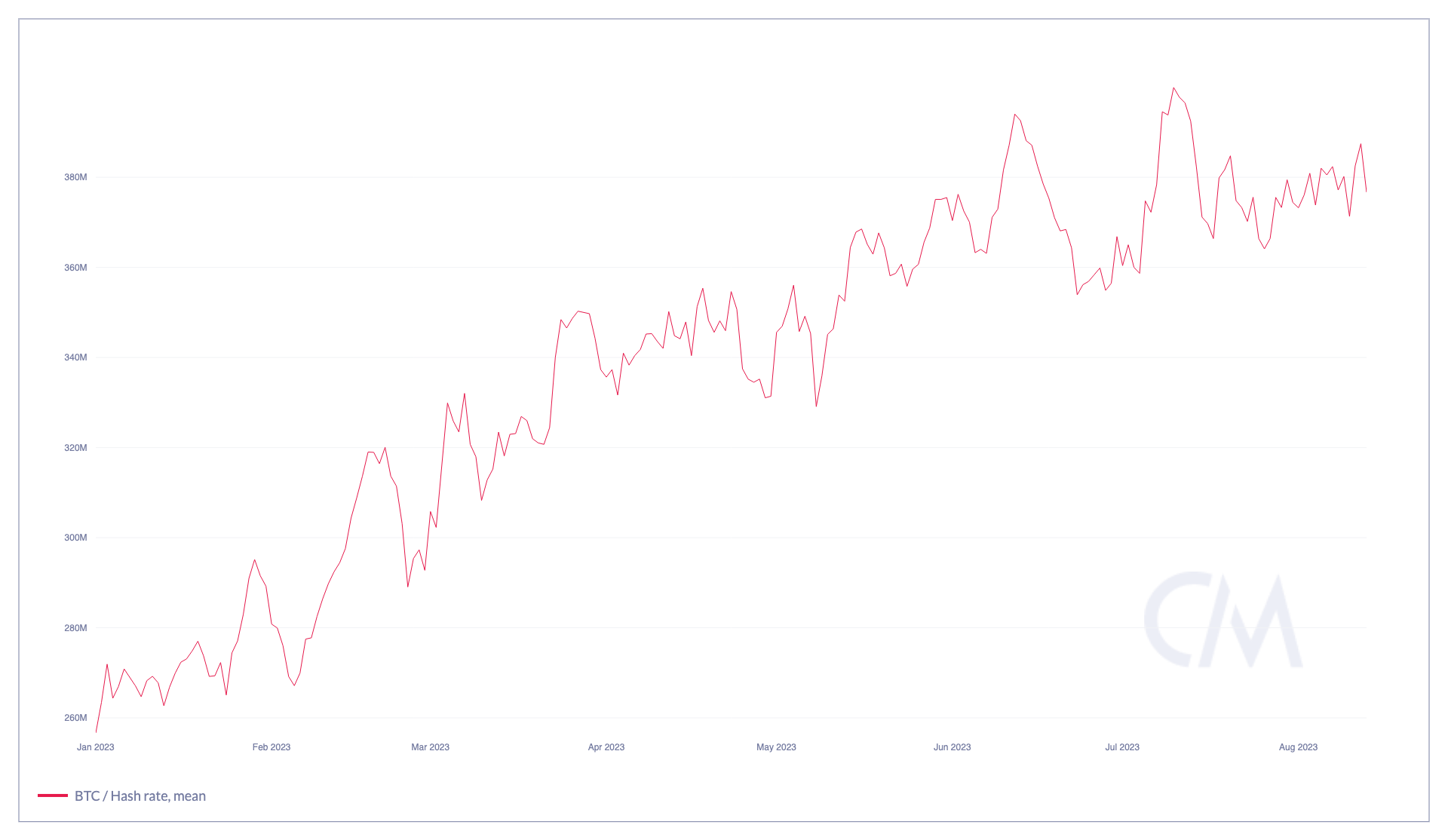

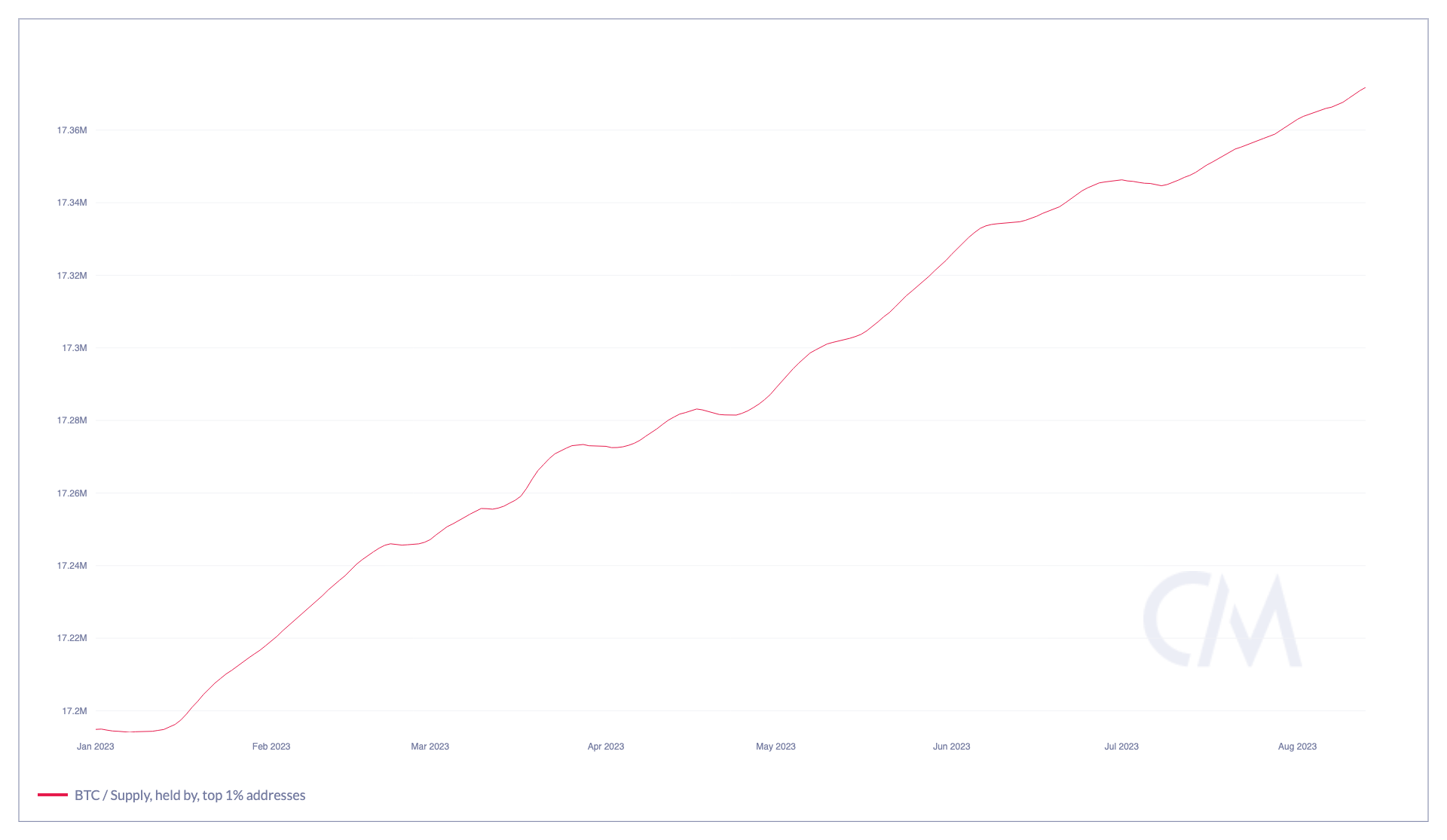

- BTC’s hash rate and whale accumulation also suggest sustained confidence.

What is happening to Bitcoin price?

Over the past week, Bitcoin price has exhibited some weakness in its price, amid the broader consolidation zone it has been stuck in over the past seven weeks. Since mid-June, the BTC price is stuck in a very narrow range, roughly between $29,000 to $31,000. However, in the past week, Bitcoin price has dropped nearly 3.5% and about 2% in the past 24 hours, according to data from CoinMarketCap – thus falling below the $29,000 area. Even over the past 30 days, the BTC price has dropped over 5.5%.

| BTC Price | $28,800 |

| 24-Hour Price Change | -2% |

| 7D Price Change | -3.5% |

| Market Capitalization | $555 billion |

| Circulating Supply | 19.45 million |

| Trading Volume | $16.4 billion |

| All-Time High (ATH) | $68,789.63 |

| YTD Low | ~$16,500 |

| Fear-Greed Index | 50 (Neutral) |

| Sentiment | Bullish |

| Volatility (7D) | 2.3% |

| Green Days | 16/30(53%) |

Bitcoin Technical Analysis

- As the chart above shows, Bitcoin price has been on a strong upward trajectory since the beginning of the year, creating a consistent higher high, higher low price action pattern (as indicated by the diagonal blue trendline).

- However, in the immediate short term, BTC price has been facing some weakness and corrected below the 50-day exponential moving average and the diagonal trendline marginally.

- As long as Bitcoin price can sustain above the 200-day exponential moving average, the longer-term trend will remain intact for the king coin.

- Presently the RSI for the king coin is under 40, which can also bring about some bearishness in the token, in addition to the abovementioned points.

Additional Read: Bitcoin Price Prediction

Will Bitcoin price recover?

In the current situation, it is relatively easier for Bitcoin price to recover because the broader technical structures remain positive for the token despite some short-term bearishness creeping into the charts. As long as those long-term technical levels are not breached, we can expect BTC price to recover quickly and strongly. BTC price has been trading within a broad accumulation zone for quite some time now and is still within that, and so long it stays within that, a negative surprise seems unlikely at the moment.

Read More: Can Bitcoin Halving Event in 2024 initiate a Bull Run?

Bitcoin On Chain Metric Overview

BTC Hash Rate Continues its Rally

The Bitcoin hash rate functions as a measure of computational power essential for validating transactions and appending blocks to the blockchain. Fluctuations in this metric reflect miner engagement in transaction validation through puzzle-solving. Escalating levels denote heightened miner participation, enhancing network decentralization and deterring potential 51% attacks resulting from network monopolies. Currently, the mean hashrate stands at approximately 376M TH/s.

Bitcoin Whales Also Continue to Accumulate

As one can observe from the chart above, the BTC supply with the top 1% addresses has been increasing steadily since the beginning of the year. This adds weight to the argument that Bitcoin whales have been accumulating BTC tokens steadily all through 2023, indicating strong confidence in the king coin in the near future.

Should you invest in Bitcoin today?

As the pioneer token in the crypto realm, Bitcoin often sets the trend for other tokens. With almost half of the total crypto market share, it stands as the most reliable and trusted crypto asset out there. Enduring both bullish and bearish market phases has solidified its stability. Notably, the price has recently experienced a significant upward trajectory and is anticipated to sustain its heightened position throughout 2023.

Thus, Bitcoin is definitely a token long-term investor in the crypto market must keep an eye out for.

Read On: How to Buy Bitcoin in India?

Conclusion

In the ever-fluctuating landscape of crypto, Bitcoin continues to command attention. Recent price weakness and short-term corrections have prompted cautious sentiment, yet the broader technical foundations remain positive. Bitcoin’s hash rate surge and sustained accumulation by top addresses hint at ongoing confidence from both miners and whales. As a pioneer of the crypto realm, Bitcoin’s stability and market dominance, comprising nearly half the total market share, positions it as a reliable asset. Its recent upward trajectory and anticipated sustained growth in 2023 further bolster its appeal. While market fluctuations are inevitable, Bitcoin’s enduring legacy and potential for recovery make it an enticing choice for long-term investors seeking stability in the volatile crypto market.

Values as on August 17, 2023.

FAQs

Why has Bitcoin's price experienced recent weakness?

Bitcoin's price has exhibited recent weakness due to a narrow trading range between $29,000 and $31,000, with a drop of approximately 3.5% over the past week. Short-term corrections and fluctuations in the broader crypto market have contributed to this downward trend.

What factors contribute to Bitcoin's potential for recovery?

Despite short-term bearishness, Bitcoin's long-term technical structures remain positive. Sustained trading above the 200-day exponential moving average and ongoing accumulation by top addresses suggest a strong foundation. As long as these key levels are maintained, a potential recovery is anticipated.

Why should investors consider Bitcoin as a long-term investment?

Bitcoin's historical resilience, as evidenced by enduring bullish and bearish market phases, positions it as a stable and trusted asset. With a market share of nearly 50%, Bitcoin sets trends for other tokens and is likely to remain a reliable choice in the crypto market. Its recent upward momentum and projected sustained growth throughout 2023 contribute to its appeal for long-term investors seeking stability.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more