Why did the Maker(MKR) Price surged by 40% in February?

Why did the Maker price surge by 40% in February? There are a number of potential reasons, including new partnerships, announcements, and speculation. We explore some of the most likely reasons and what it means for the future of Maker. Read more here.

Table of Contents

ToggleKey Takeaways:

- Maker prices surged by over 30% in the past month and recorded a collective surge of nearly 90% since the beginning of the year

- Amid the sluggish market behavior, MKR bulls appear to be pre-determined to uplift the price beyond a 4-digit figure very soon

- Traders and whales appear to be bullish on Maker price and hence a sizable impact could be imminent

Maker, the governance token of the most popular Decentralized Autonomous Organization (DAO), Maker DAO. The price had slipped from extreme highs throughout 2022 and began with a firm upswing since the beginning of the year. The price ignited a fresh bullish wave during the previous trading day and marked a jump of more than 20% to surge beyond $900. The bullish activity has intensified heavily and hence a jump beyond these levels could be on the edge.

The prices shot up as the platform announced allowing its users to borrow DAI stablecoin against its MKR governance token. However, this has raised concern among many influencers and investors as it may replicate the Terra-UST ecosystem. Besides, the MakerDAO, the largest DeFi platform blockchain data provider Chainlink’s smart contract automation into its Keeper system maintains the stability of Maker’s DAI stablecoin.

Read More: Top 5 Crypto DAO Projects in 2023

Maker Token Technical Overview

Source: Tradingview

- The Maker price is following a parabolic recovery after it rebounded from the 2022 bottom and sparked a significant upswing since the beginning of 2023

- The RSI has surged high after rising beyond overbought levels and hence a minor pullback to $870 may be possible that may not impact the upswing ahead

- The price may reach the neckline at $1100, slicing through $1000, and may face a bearish action that may slash the price harder back below $990

- However, the volume is constantly varying, but the bulls maintain their dominance that could keep up the momentum of the rally

Maker Token On-Chain Analysis

Maker Supply on Exchanges vs Supply Held by Top Addresses

Source: Santiment

The market sentiments of the tokens are completely based on the trades carried out by the market participants. If they are bullish on the crypto, they may continue to hold it in their wallets, and hence the supply on balance decreases. Besides, the supply held by the top address indicates the whale balances; when it increases, the positive sentiments rise, and they become negative when they liquidate.

In the case of MKR, the supply on exchanges has depleted heavily which indicates the traders are bullish on MKR price. Along with this, the supply held by top addresses also has surged massively which signals the whales accumulating the token constantly. Hence, this may impact the MKR price positively in the coming days.

Maker Network Growth

Source: Santiment

The growth of any project is determined by the number of new people who join the platform and also perform activities. The network growth considers the number of new addresses created in a day and places a buy or sell order. The rise in the metrics indicates the adoption of the platform and also helps to determine whether the project is gaining traction or losing its popularity.

The network growth of Maker has slipped, maintaining a steep descending trend. Hence, it can be determined that the number of new addresses on the platform has been declining over time. Therefore, the traders may have shifted their focus to other projects.

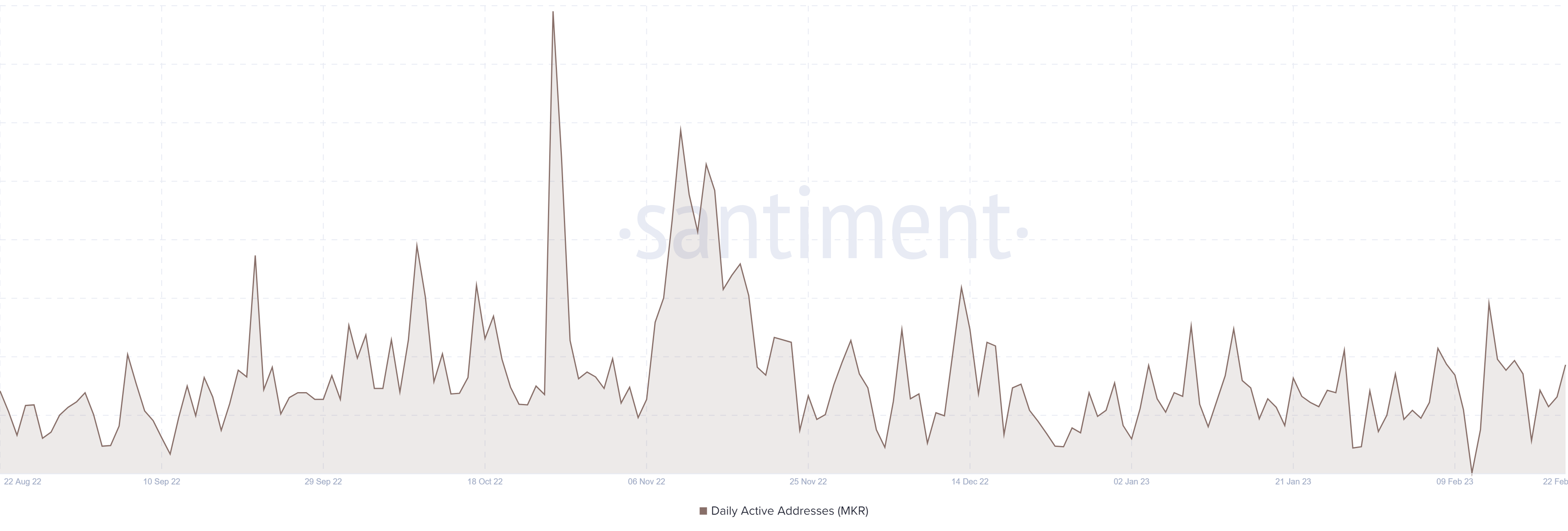

Maker Daily Active Address

Source: Santiment

The daily active address is the number of addresses contacting the platform intending to place a buy order, a sell order, or a swap order. The rise in the DAA levels indicates the platform is gaining traction as more traders are willing to trade MKR tokens. This may keep up the volatility of the token that in turn impacts its value, positively.

Woefully, the DAA of Maker continues to remain consolidated and fails to attract traders onto its platform. Now that the platform has announced significant upgrades which followed by a price rise, a decent rise in the DAA levels may be expected soon.

Read More: Lido DAO Price Predictions

Concluding Thought!

Maker price has been inflated ever since the start of 2023 and displays the huge potential to maintain a firm upswing ahead. The network upgrades are also believed to fuel the price rally that may be intensified once the bearish action depletes. However, the lower address count could be a matter of concern while the drop in the supply points toward the bullish market sentiments among the traders.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more