Table of Contents

ToggleKey Takeaways:

- Tezos price underwent a fine upswing in the past week recording a jump of more than 25% and 11% in the past few hours

- The XTZ price has ceased the bearish interference to a large extent and hence the bulls are believed to uplift the price toward the higher targets

- The funding rate turns positive as the sentiments also rise above the average levels that appear to be in favor of the bulls

Read More: AAVE Price Prediction

Tezos started the year with a “V-shape recovery” and has since increased by more than 110%. It has increased by more than 25% in the last few days due to high volatility, which has impacted the price heavily. Although bullish market sentiment drove the rally to the north, other factors also played a role.

The XTZ price rise was followed by a significant announcement of Google cloud partnering with the Tezos blockchain. The Google cloud aims to become a validator on the network, offering customers access to the Tezos chain and deploying nodes, building Web3 applications, etc. the collaboration also intends to host and deploy RPC(Remote Procedure Call) by the company and developers using Tezos chain and Google cloud infrastructure.

With this, the XTZ bulls jumped into action and raised the price by more than 13% to reach levels close to $1.43 at the moment. The trading volume also spiked by more than 150%, while the market capitalization is heading toward $1.5 trillion. With continued bullish momentum, the price is believed to maintain a strong upswing for a longer timeframe.

Tezos Token Technical Overview

Source: Tradingview

- The Tezos price has been trading within a rising and expanding wedge and facing rejection after testing the upper resistance of the wedge

- As the expanding wedge is bearish, the impact appears to have begun and is believed to reach the lower support at $1.3

- The MACD is about to undergo a bearish crossover that could substantiate the claim of the impending pullback

- Moreover, the volume also has been slashed hard and dominated by the bears. While the possibility of a bullish reversal may be expected after testing the interim support at $1.3

Tezos Token On-Chain Analysis

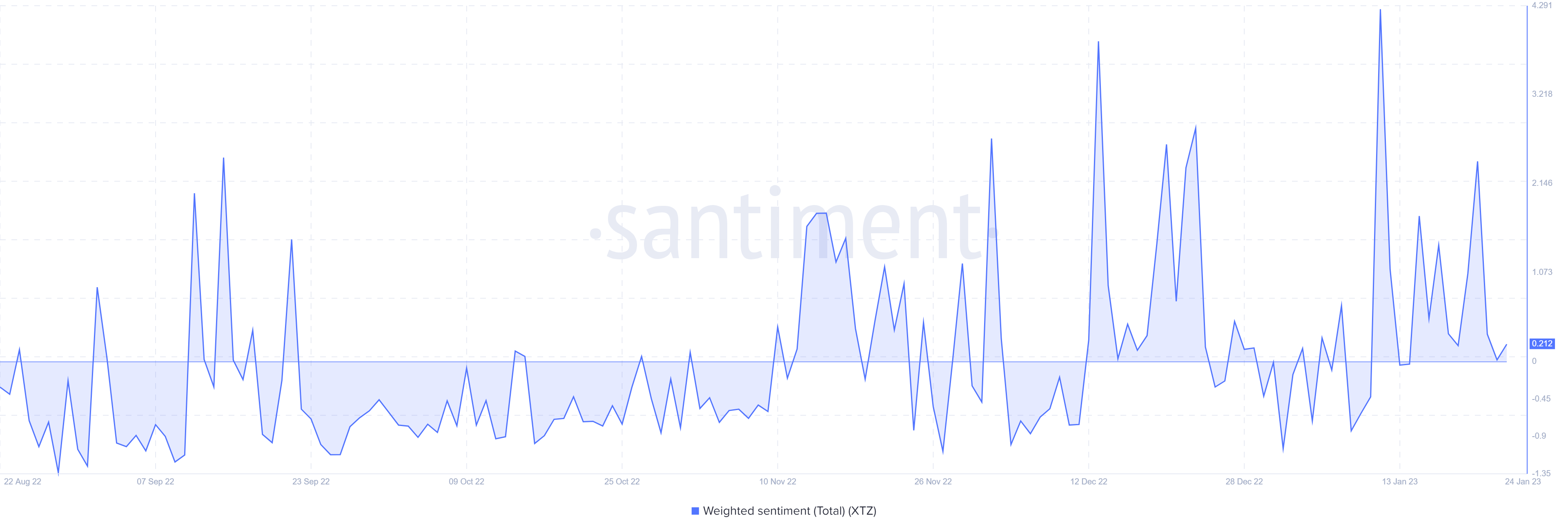

Tezos Weighted Sentiment

Source: Santiment

The demand for the platform is gauged by the popularity of the project. The mentions, engagements, predictions, posts, etc. fuel the popularity of the platform. Total weighted sentiments consider all such posts or mentions, regardless of whether they are positive or negative, and compare them with the frequency of their occurrence. If the calculated figures are above the average then the sentiments towards the token are positive else negative.

The weighted sentiment of Tezos has been largely bullish, as the levels have been fluttering within the positive ranges for quite a long time. The surged levels also indicate that the market participants may also be willing to sell their tokens to extract profits. Hence the possibility of a bearish pullback looms over the token.

Read More: Top Crypto Staking Coins In 2023

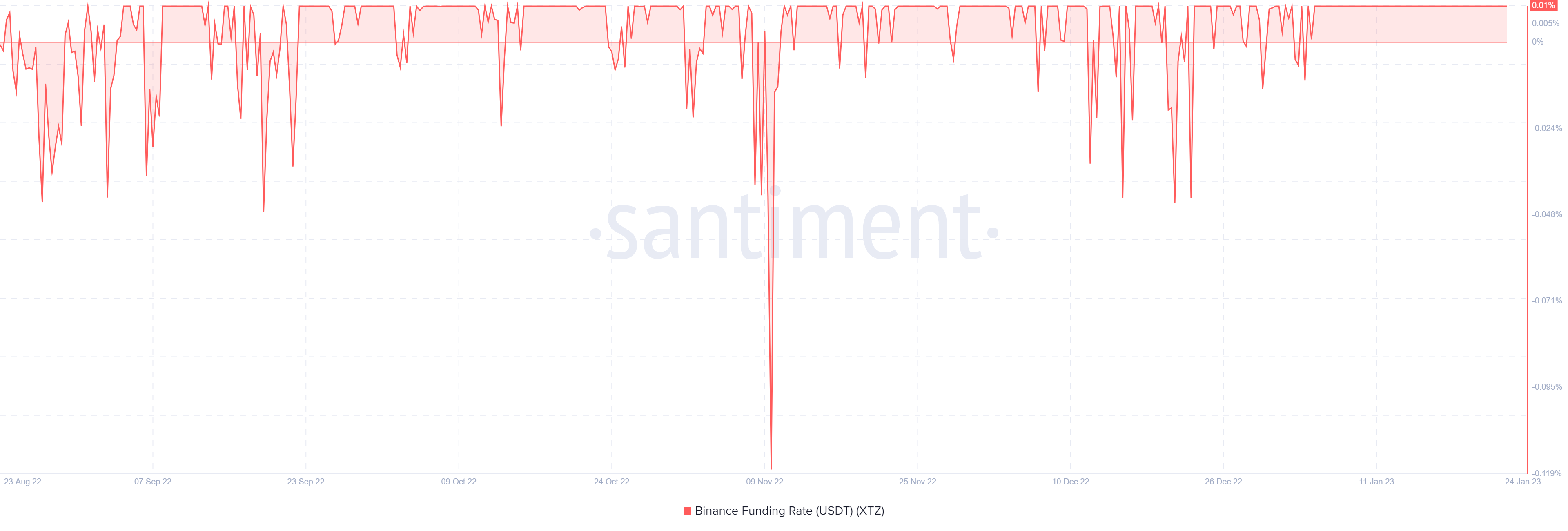

Tezos Binance Funding Rate

Source: Santiment

Funding rates are the difference between the values of the perpetual contracts and the spot markets. These are the periodic payments allotted to either the long or short traders, depending on the difference between the futures and spot prices. Binance, on the other hand, recalculates these rates every 8 hours based on the interest rate and the premium.

A positive funding rate indicates the price of a perpetual contract is higher than the marked price, whereas a negative rate indicates the price is below the marked price. Currently, the funding rates are positive, which indicates that long-term traders have the upper hand and are willing to pay funding to the short traders.

Concluding Thought!

The Tezos price has marked a significant upswing in the past few days that has piled up the bullish momentum to a large extent. However, the possibility of a trend reversal flashes as the price has shown a bearish divergence along with the sentiment flipping to some extent. Therefore, the traders could extract their profits, slashing the price close to its interim support soon.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more