Table of Contents

ToggleKey Takeaways:

- The Synthetix price has surged significantly since the beginning of the year and rose over 100%

- The momentum appears to be bullish and hence the price may continue to rise high in the coming days

- The activities over the suggest a bullish breakout may be imminent

The Synthetix network price has been bullish in recent times as the initial push received by the token in the first few days of 2023 kept up the momentum. The price jumped in action in the last few days of February as the network upgraded its platform with additional features. The platform deployed Version 3 on Ethereum following security audits.

The V3 is designed to allow creation of products that offer liquidity for the developers to build. It also offers simplified staking and differentiated debt protocols. The protocol holds over $450 million in tokens which are locked over the Ethereum and optimism chains.

Read on: AAVE Price Prediction

Synthetix Token Technical Overview

Source: Tradingview

- The SNX price is soaring high within a rising wedge pattern and may face a notable price plunge to test the lower support

- The price may further trigger a rebound and test the upper resistance of the wedge and hold at these levels for some time

- The token is required to slice through the resistance and rise high else, a notable pullback may compel the price to reach the lowermost support around $2.7

- However, the ADX or the Average Directional Index is rising and hence the trend may rebound and maintain a significant upswing ahead

Synthetix Token On-Chain Analysis

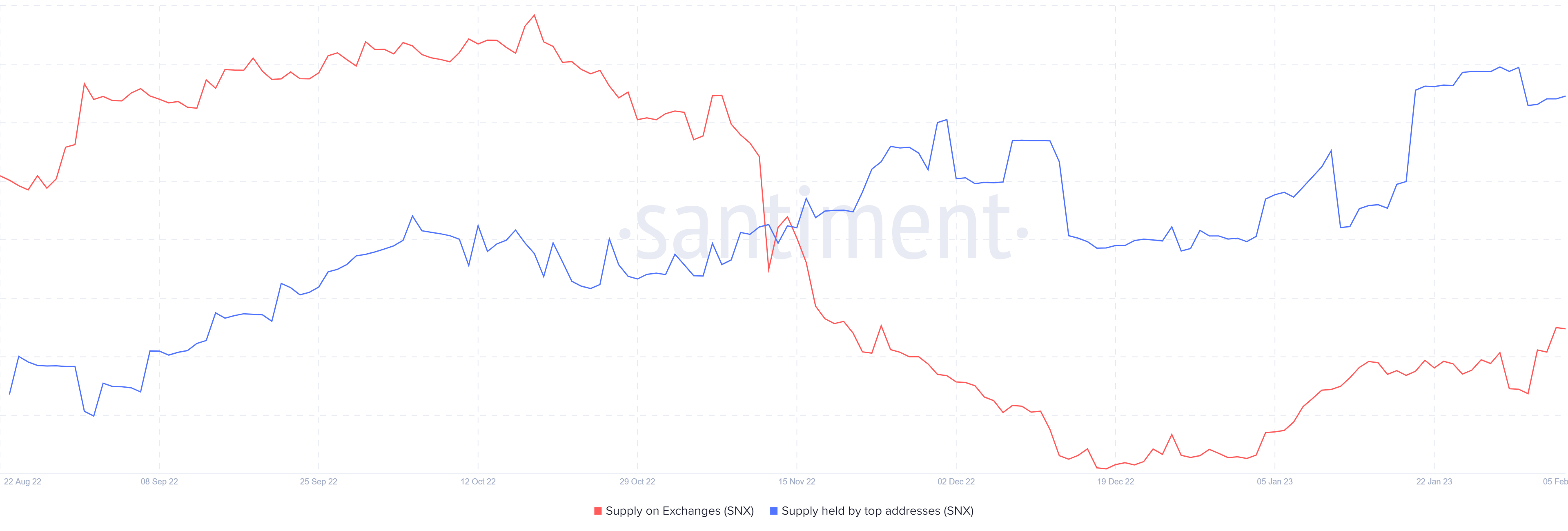

Synthetix Supply on Exchanges

Source: Santiment

The demand for any token depends on the sentiments of the inventors and the top holders, who can also be called whales. If the investors keep on accumulating, the supply on exchanges drops while the supply held by the top addresses surges if the whales accumulate constantly. This indicates the bullish sentiments among the investors and the whales.

Currently, both levels are rising slightly, indicating that investors are bearish on the token as they are moving their tokens back to the exchanges. Besides, the rising supply held by top addresses indicates that whales are bullish in the longer term.

Read More: Top DAO Projects in 2023

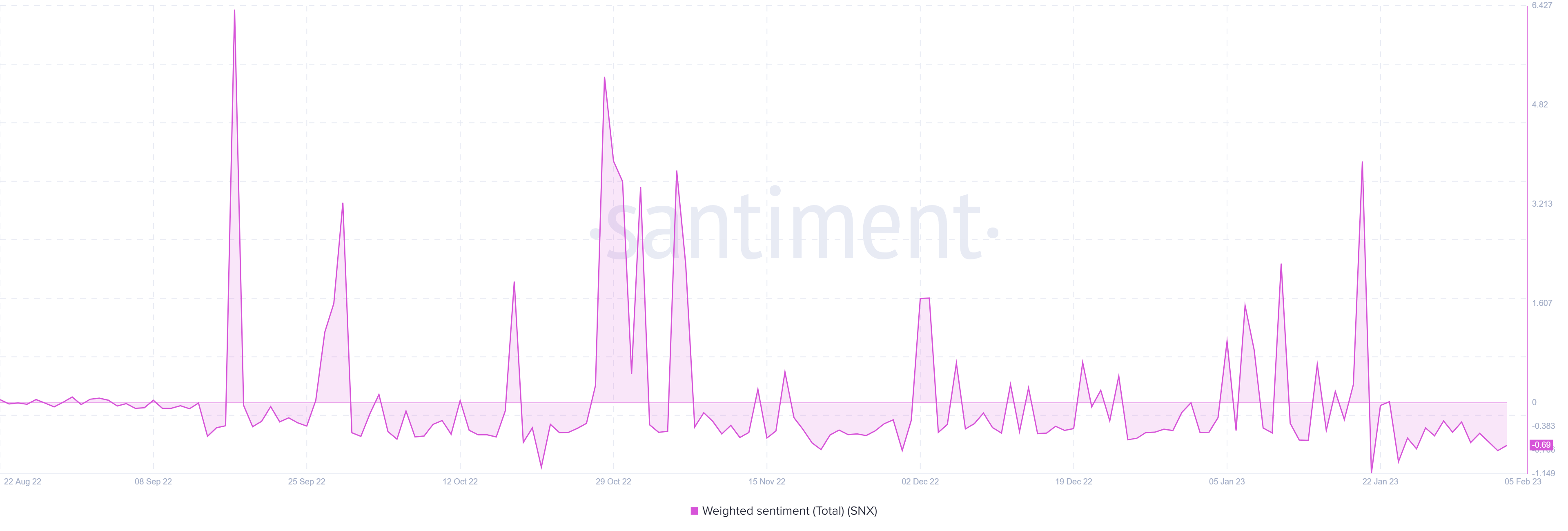

Synthetix Weighted Sentiment

Source: Santiment

The weighted sentiment is calculated by considering all the sentiments, regardless of whether it is positive or negative and comparing them with the frequency of their occurrence. These calculated levels indicate whether the price is overvalued or undervalued.

After trading within the positive levels for quite a longtime, the sentiment has dropped towards the negative levels. Therefore signaling the price being undervalued, carrying the possibility of a bullish reversal at the earliest

Concluding Thought!

Collectively, the sentiment for the Synthetix token is being bearish as the on-chain metrics are pretty misty. Both the exchange reserve and whale reserve are increasing, which may indicate the strong hands accumulating while the panic sellers may be falling prey. Therefore, the price may face a minor outback, post to which a giant price action may be imminent.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more