Table of Contents

ToggleKey Takeaways:

- The Polygon price is withstanding immense selling pressure as it dropped more than 12% in the past few days.

- The bulls appear to be calm at the moment, so the possibility of a rebound does not appear at this time.

- Traders prepare to liquidate the token as the development activity wanes, and hence the price may receive an inverse impact

Polygon’s price has been manifesting its strength in times when market conditions were pretty uncertain. Now that the markets are forecasting some strength, the popular token appears to be stuck under a huge bearish influence. MATIC drops below $1 and is struggling very hard to reclaim its position. What triggered the plunge? How long will MATIC’s price remain stuck within the consolidation?

It was not too long before the MATIC supply on the exchanges was at its lowest point in the past 4 years. The trend quickly flipped when massive whale transfers were recorded. Nearly 60 million MATIC were transferred back to the exchanges, which circulated a sense of fear among the market participants. Moreover, some tokens among them were transferred from a self-custody Polygon address to an exchange, which impacted the overall health of the network.

Polygon (MATIC) Technical Overview

Source: Tradingview

- Polygon has just slipped after being rejected from the interim highs at $1.2 and is currently attempting very hard to sustain above $1.

- The volume maintains decent levels, which display equal participation by the bulls and the bears.

- Besides, the ADX, or average directional index, is bullish, which indicates the price may rebound from the current consolidation.

- With a rebound, a decent upswing may raise the price beyond the interim resistance at $1.2 initially, and if it sustains above these levels, giant price action may lift the price toward $1.5.

Read more: What is Polygon zkEVM?

Polygon (MATIC) On-Chain Overview

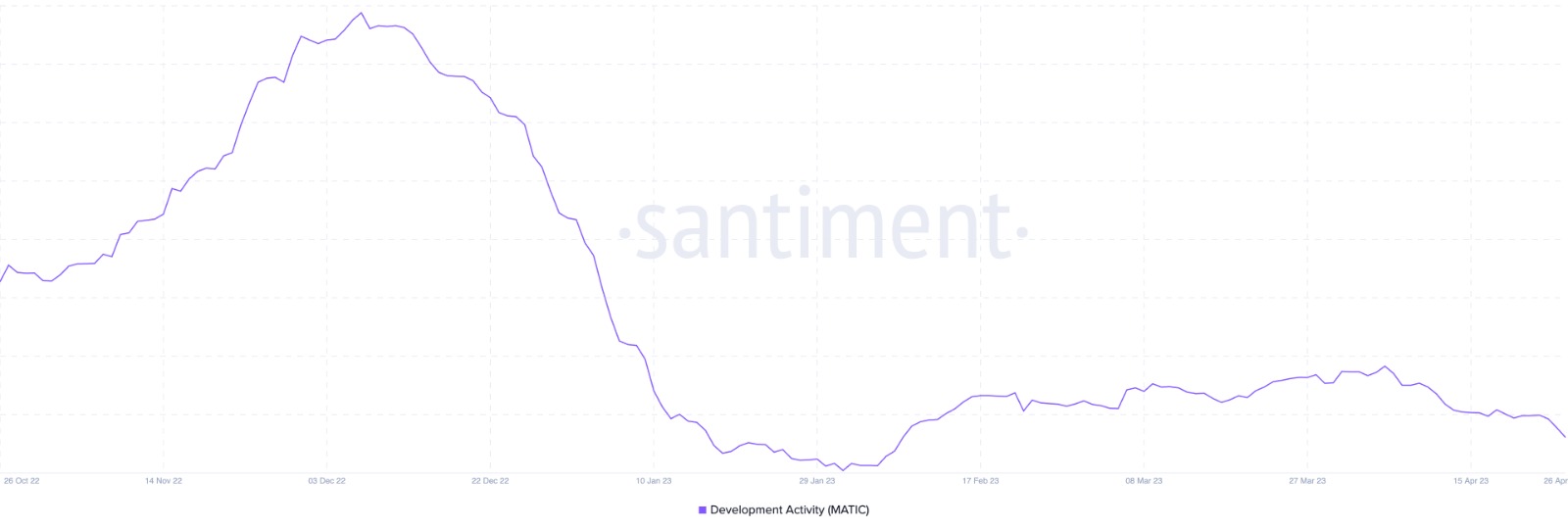

Polygon Development Activity

Source: Santiment

The development activity of a project is recorded in the GitHub repository, which is publicly available. The rise in development activity usually induces bullish momentum among market participants as they become hopeful of receiving new features. Besides, it also suggests that the project is very serious about its business proposition, and may work hard to deliver new upgrades and features.

The development activity that reached the skies in December 2022 has maintained a steep descending trend. The levels have been trading below 70, indicating that development activity has slowed down. Hence, it may impact the value adversely as the traders become pretty uncertain about the price action.

Polygon Social Dominance

Source: Santiment

The social dominance of a token takes account of its social volume, which is nothing but the search count of that token. A rise in social volume indicates that the interest of traders has shifted towards crypto. It mainly compares the social volume of the token to that of the top 100 tokens as per the market cap.

A rise in the levels indicates that the social dominance of the token has surged among the other top 100% assets. Meaning that the traders are searching for and discussing MATIC more than the other tokens within the top 100. This may have a moderate impact on the price as sentiment tends to change over time.

Polygon Supply Held by Exchanges

Source: Santiment

The supply held by the exchanges is nothing but the balance reserves of the token in all the exchanges. Usually, when the trader wishes to liquidate his holdings or swap them for another one, they tend to transfer their holdings onto the exchanges. This is when the supply on the exchanges increases, flashing bearish signals.

Presently, the supply has rebounded after dropping heavily from about $800 million to $700 million. The levels have surged back above $780 million, which is flashing the possibility of a bearish pullback. If the traders continue to sell or swap MATIC, the price may face a decent fallout soon.

Read on: Polygon Price Prediction

Concluding Thought

Polygon price is currently facing extreme bearish pressure which may restrict the price to $1 for a long. Besides, the technicals also suggest a fine descending trend may kick in as the supply on the exchanges has risen with a dropped development activity. Also, the surge in social dominance may keep hopes of a bullish rebound alive.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more