Table of Contents

ToggleKey Takeaways:

- Neo price has been rising finely in the past few days indicating the resurgence of the bullish trend as the bears remain passive

- The bullish breakout is believed to keep up the price elevated for the next few weeks, as the token is determined to reach its higher target at $15 soon

- The top addresses are accumulating NEO heavily indicating the impending bullish trend at the edge

Neo price has been breaking above the higher targets for the past few days after marking the lows around $11.2. The trend remained elevated while a notable spike in the trading volume was also recorded. However, the volume has dropped notably, but the price has still maintained a fine upswing, adding to the value that has surged by more than 100% since the beginning of the year. The bullish market sentiments that followed with the Bitcoin price soaring above $25,000 induced the required momentum within the space.

Read More: Bitcoin Price Prediction

Apart from the market sentiments, the launch of the NEO Global Program triggered the price spike. Recently, the platform announced its collaboration with FindTruman which is a Web3 game offering a first-person immersion style story format.

“We Welcome FindTruman with open arms as a project that can bring valued and innovative new tools to the Neo ecosystem,” said John Wang, Director of EcoGrowth at NEO. “We are confident that this new partnership will serve as the inspiration for more users to learn AIGC and use AIGC.”

NeoToken Technical Overview

Source: Tradingview

- The NEO price after marking the 2023 highs was trading within a descending channel to mark the interim lows around $11.22

- However, the flip that triggered at these levels uplifted the price within a rising wedge that is heading toward the apex of the consolidation

- Therefore, the price is believed to remain elevated until the month’s end post after which the bears may slash the price toward the lower support at $12.56

- However, a rebound could be imminent from these levels that may rise the price back above $13.5 to hit $14 in the first few days of March

NeoToken On-Chain Analysis

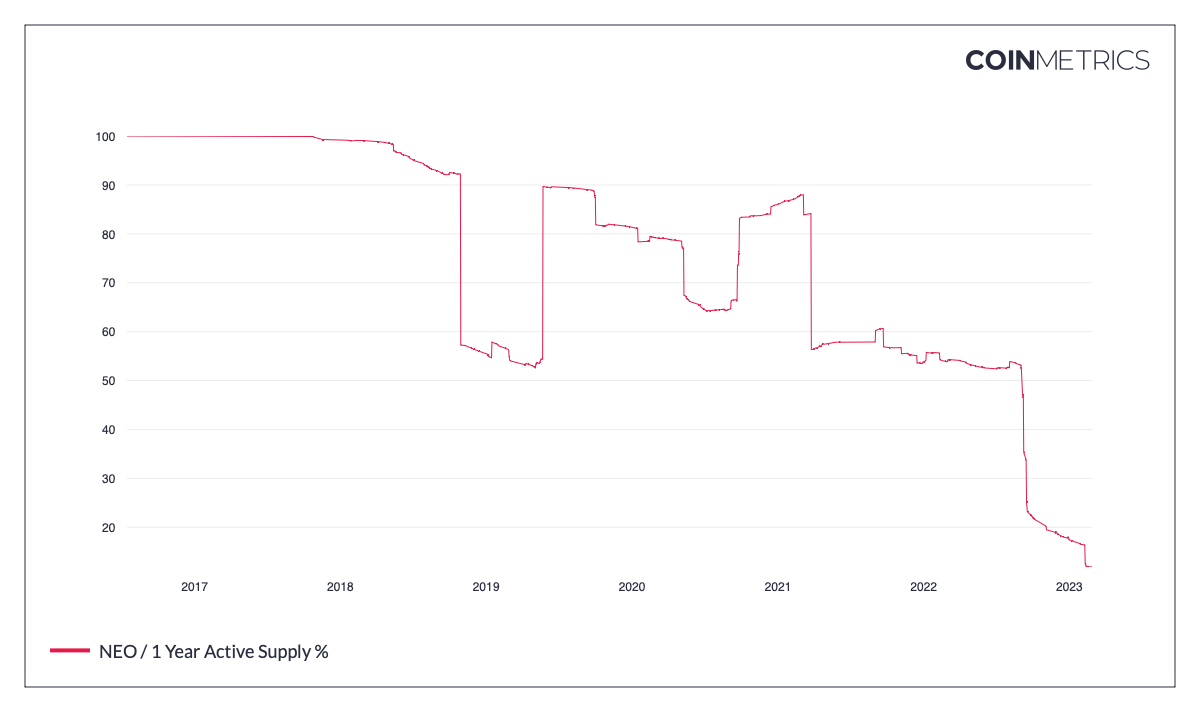

Neo 1 Year Active Supply in %

Source: Coinmetrics

The confidence in the project is determined by the traders holding the token for a longer time instead of liquidating them or swapping them for other tokens. If the tokens are being traded then it remains active for quite a long time, indicating the mounting distrust of the market participants. This is not a good sign of a healthy project as it could severely impact the token’s value.

Besides, the 1 year active supply of Neo has plunged hard and reached the bottom at the moment. It indicates that the tokens are held and not sold or swapped. The traders with a hope for a healthy upswing in the coming days have held the token for a longer time frame.

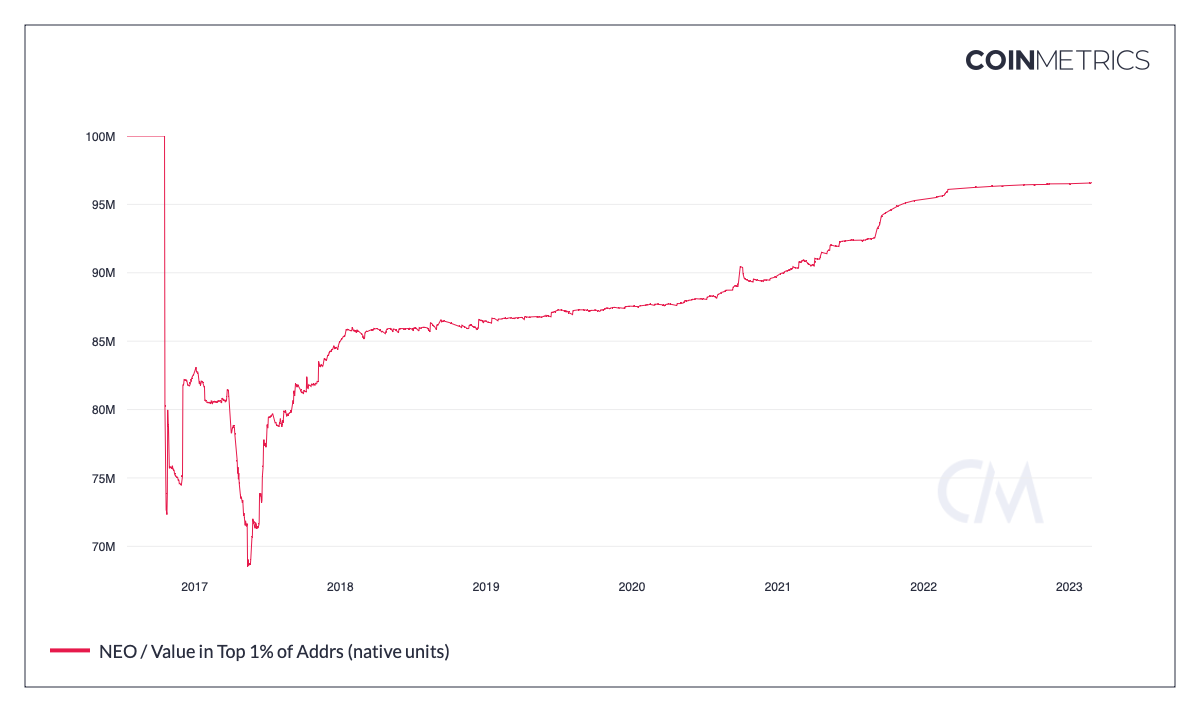

Neo Supply in Top 1% Addresses

Source: Coinmetrics

The supply on the top 1% of addresses can be normally called the supply held by the whales. Whales accumulate whenever the market is around its bottoms and holds them tight as the rally progress towards the north. However, if in case the Whales liquidate a huge amount of tokens, then acute selling pressure may drag the market down along with inducing a huge amount of FUD within the space.

Besides, the NEO’s supply in the top 1% address has been elevated and reached highs. It substantiates the claim of the holders holding the token for a longer time. Therefore, this may have a great impact on the market participants who may follow the whales and accumulate at lower prices.

Read More Why did Tezos Price rise by 25%?

Concluding Thought!

The market sentiments are bullish nowadays, although the bears are trying hard to reclaim their dominance. The popular tokens have rebounded and withstood the bearish pressure, intending to pursue a strong ascending rally. Therefore, NEO price could also maintain a notable upswing, regardless of the fact that it may still face hindrances by the bears. The rising supply in the top addresses indicates the mounting confidence of the whales while the depleting activeness of the token supply signals the positive sentiments.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more