Table of Contents

ToggleKey Takeaways:

- Maker (MKR) price surged notably in the past few hours, leading to a rise beyond $750 displaying a potential to rise to a 4-digit figure soon

- The buying pressure has accumulated which may keep up the price trend elevated, withstanding the bearish actions to reach the desired target soon

- The MKR price rose remarkably and closed the previous day’s trade at $770 with a market capitalization of $723.78 million and a circulating supply of 977,631 MKR

Maker, one of the longest-running DeFi lending protocols, has surged notably during the past few hours in the times when the markets continue to consolidate within narrow regions. The price jumped finely and marked highs beyond $800 at $819 without undergoing any specific bearish pressure. Although the price is consolidating, the upswing is believed to resume shortly, uplifting the price beyond the recent highs.

The platform made huge rounds in recent times, announcing a splendid integration with the blockchain data provider, Chainlink for its stablecoin, DAI. The DeFi giant successfully onboard Chainlink’s smart contract automation into its Keeper system to maintain the stability of DAI. Chainlink’s automation will offer price updates, and liquidity balancing for the DAI deposit module (D3M) by running specific tasks.

The wave of collaboration doesn’t stop here! Maker recently joined hands with Venom Foundation which is the first layer-1 chain to gain a license in Abu Dhabi Global Market (ADGM). This collaboration is to incubate promising Web3 startups focusing on delivering real-world use cases.

Read More: Why Did Compound Price Surged More Than 50%

Maker Token Technical Overview

Source: Tradingview

Maker Token On-Chain Analysis

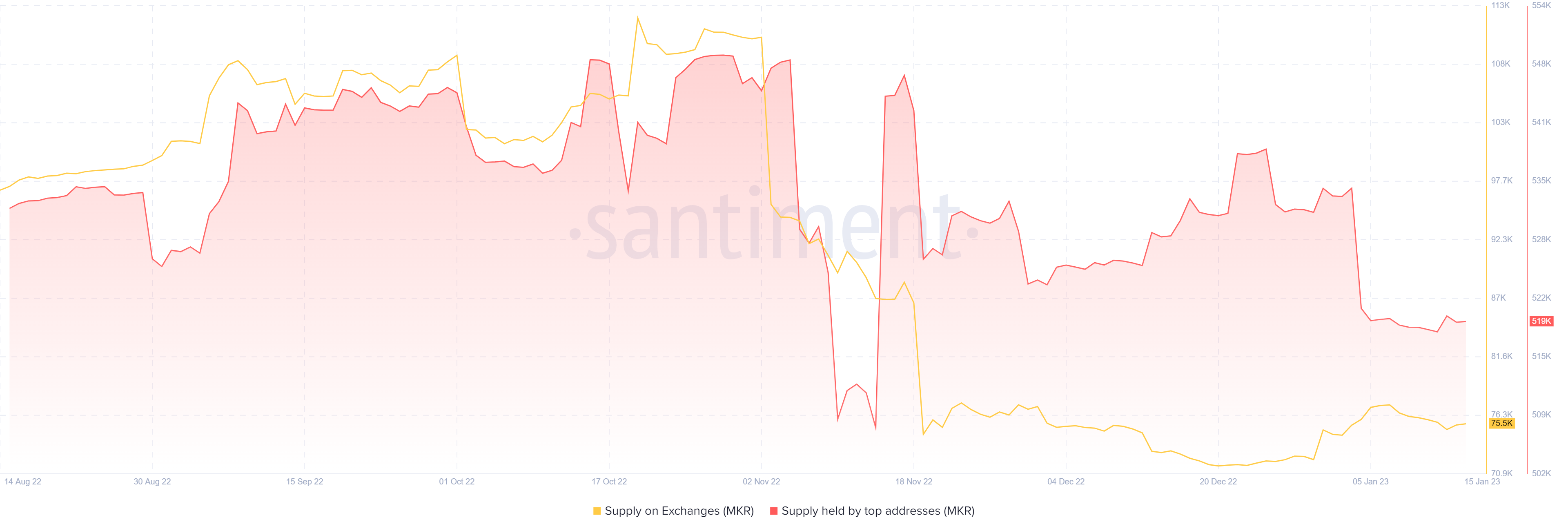

Maker Supply on Exchanges vs Supply on Top Addresses

Source: Santiment

The supply on the exchanges indicates the number of tokens held by them in their wallets. Besides, the supply on top addresses determines the number of tokens held by the address holding a huge number of tokens. They may be referred to as whales who usually hold 1% of the entire supply. An increase in exchange supply indicates the intention of the traders to sell the tokens while it is considered a bullish indicator if supply on top addresses surges.

Unfortunately, both metrics show a significant drop and have been flat for several days. It indicates that the traders are not willing to sell the token, hence may have held them in their personal wallets. On the other hand, the drop in whale accumulation could signify the growing activity of the retail traders who may keep up the volatility, impacting the prices positively.

Maker Network Growth

Source: Santiment

The network growth is determined by considering the total number of addresses interacting with the platform to initiate a trade, but only for the first time. The growth indicates the adoption levels of the token and is also used to determine whether the project is gaining traction or fading its popularity.

The levels have dropped notably, including a couple of minor spikes, indicating a few new addresses performed a buy/ sell or a swap trade in recent times. Hence, the adoption of the project remains restricted. Although, this may indicate the popularity of the token among the market participants but may certainly not impact the price directly.

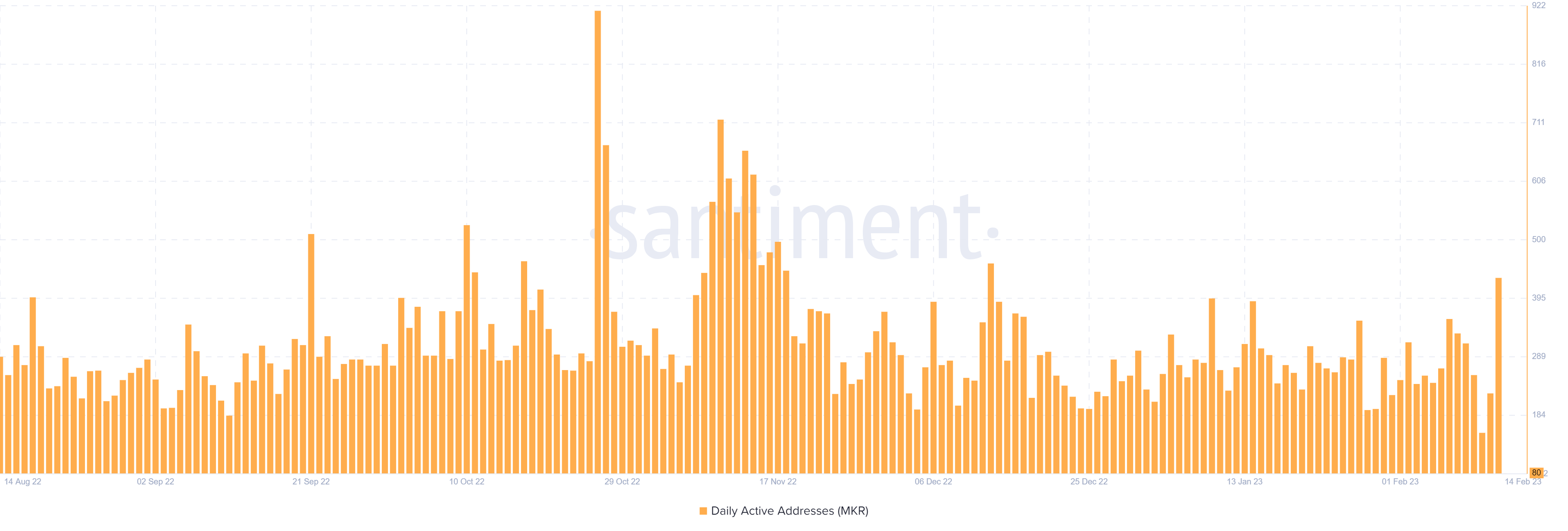

Maker Daily Active Address

Source: Santiment

The Daily active address is much similar to the Network growth, but here all the addresses are considered. Regardless of whether the address is new or old or they are placing a buy order or a sell order or a swap order, each address is counted only once per day. The metric indicates the interest of the market participants in the token.

The metric is considered one of the important indicators to determine further price action as it directly indicates the sentiments of the traders. The levels tend to drop if the traders limit buying or selling MKR and swell otherwise. In the present case, the levels spiked iconically indicating the growing interest of the market participants.

Additional Read: Top Must-have Crypto Research Tools

Concluding Thought!

Maker is one of the pioneers in the DeFi space, intending to strengthen the space along with Web3 adoption. The recent price hike had attracted many onto the platform, due to which the value of MKR also swelled notably. However, the bullish sentiments are coiling up which may keep up the elevated trend for a long time.

As the network growth is trying to surge and a jump in DAA indicates the traders intensifying their activity over the platform. Therefore, the Maker price is believed to maintain a fine upswing to mark the desired target beyond a 4-digit figure soon.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more