Table of Contents

ToggleKey Takeaways:

- The Litecoin price dropped by more than 33% in the first few days of March but ignited a fine rebound to surge by more than 36% in the last couple of days

- As the platform is about to undergo a halving event, a significant bullish momentum is expected to kick in raising the price beyond $100 very soon

- The rise in the Hash rate and the active address count indicates the active involvement of the investors as well as miners

Litecoin witnessed major price action in the past few days and gained nearly 40%, soaring beyond $90. The technicals flashed massive bullish signals, which indicate that the larger price action could continue for a long time ahead. Moreover, the possibility of reaching a 3-digit figure has also emerged, which may keep up the bullish momentum of the rally. Although the crypto market is pretty green at the moment, a couple of other factors are also contributing to the healthy upswing of the token.

The lighter version of Bitcoin is on the verge of undergoing a massive change in its rewards as the halving event is fast approaching. According to the tracker, the halving event will be held on 02 August 2023, with nearly 133 days to go. After the halving the miners rewards are expected to be slashed from 12.5 LTC to 6.25 LTC. Besides, the platform has also set a milestone of undergoing ‘zero-downtime’ in its history of 11 years.

PSA: #Litecoin has zero downtime in its over 11 years of existence. The longest uninterrupted uptime in #crypto. pic.twitter.com/RpP65RQPFA

— Litecoin (@litecoin) March 22, 2023

Besides, the global hash rate of the platform had marked the highs at 721 TH/s at the block height of 2,439,216 with an average difficulty of 25.2. Moreover, Litecoin transactions on payment processors continue to grow, making LTC the most consistent crypto in terms of transactions. These bullish indicators do indicate that the LTC price has just taken-off and may reach new highs in the coming days

Read More: Bitcoin Price Prediction 2023

Litecoin Token Technical Overview

Source: Tradingview

- The LTC price is trading between the crucial resistance and support levels at the 50-day & 200-day MA levels within a rising parallel channel

- The price has just surged beyond the average levels of the channel and is closer to test the crucial resistance at 50-day MA at $90.40

- A successful raise above these levels may ignite a fine upswing towards the upper resistance of the channel at around $107.91

- Surpassing these levels may pave way to secure the levels above the major resistance at $110

- On the contrary, if the price fails to surpass the 50-day MA and fails to hold the lower support at 200-day MA at $72.64, the bullish thesis ma be invalidated and the bears may take over the rally ahead

Litecoin Token On-Chain Analysis

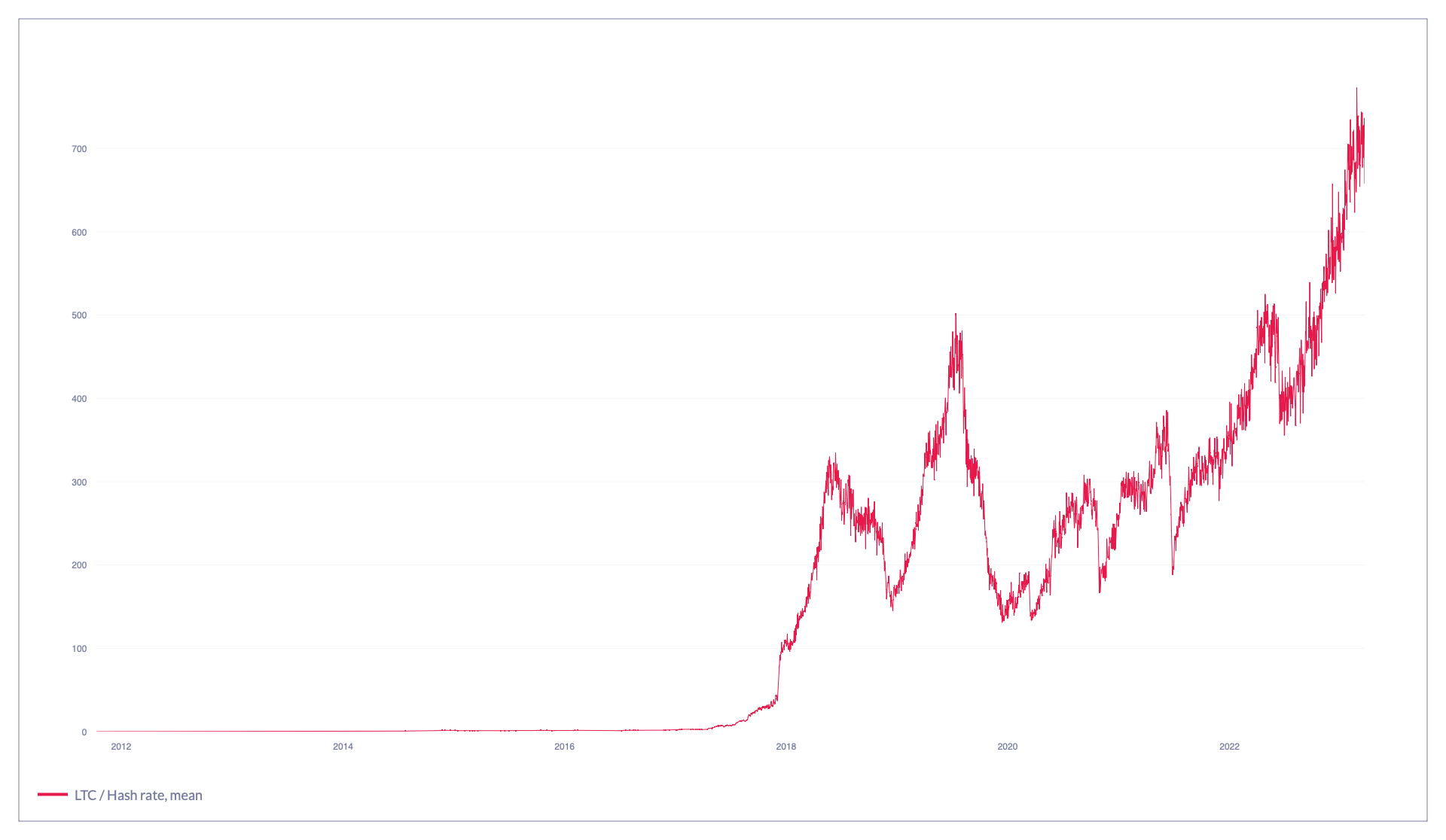

Litecoin Hash Rate

Source: Coinmetrics.io

The hash rate is nothing but the count of the number of hashes being generated by the miners per second. It further shows the computational power required for the miners to validate a transaction and add the block to the chain. The global Litecoin network hashrate is measured in hashes per second (H/s). It uses the current mining difficulty and the average block time between the blocks versus the defined block time.

The hash rate of Litecoin has been increasing incrementally since the price rebounded from the lows in the middle of 2022. The hash rate marked an ATH, a few days ago after reaching the highs at around 763.04 TH/s. Presently, a minor drop is witnessed as the hash rate has dropped to 676.32 TH/s at the moment.

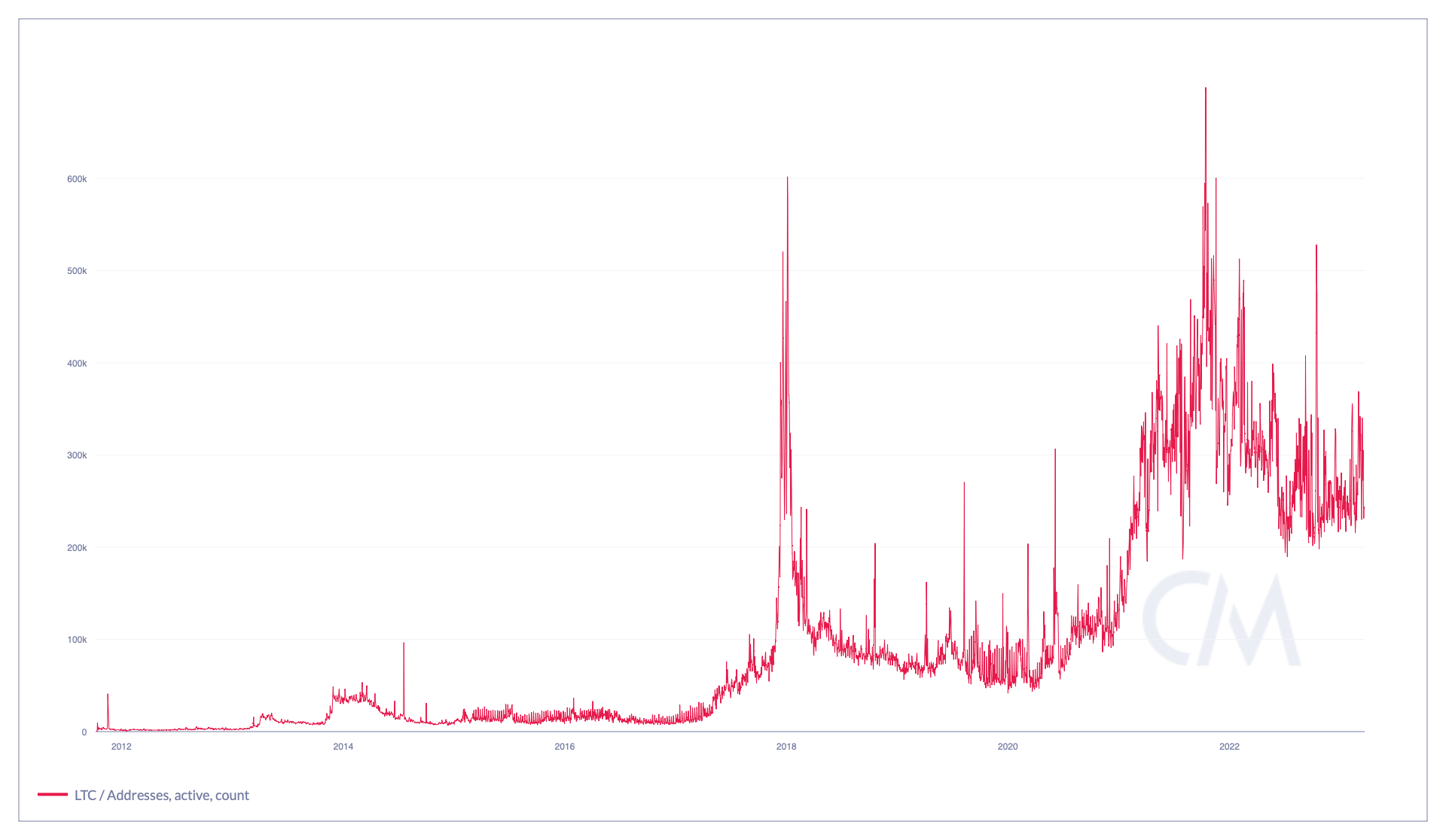

Litecoin Active Address Count

Source: Coinmetrics.io

The platform’s popularity and demand are typically determined by user activities on the platform. The active address count is a metric that measures user activity by counting the number of active addresses. They are nothing but the number of addresses interacting with the platform to perform a trade. All the addresses are counted regardless of whether they are buy addresses or sell addresses or swap addresses

A rise in the active address count indicates a rise in user activity, which in turn indicates rising demand for the token over the specified period. This intensifies the volatility, which further impacts the price, usually on a positive note.

Additional Read: Ripple Price Prediction

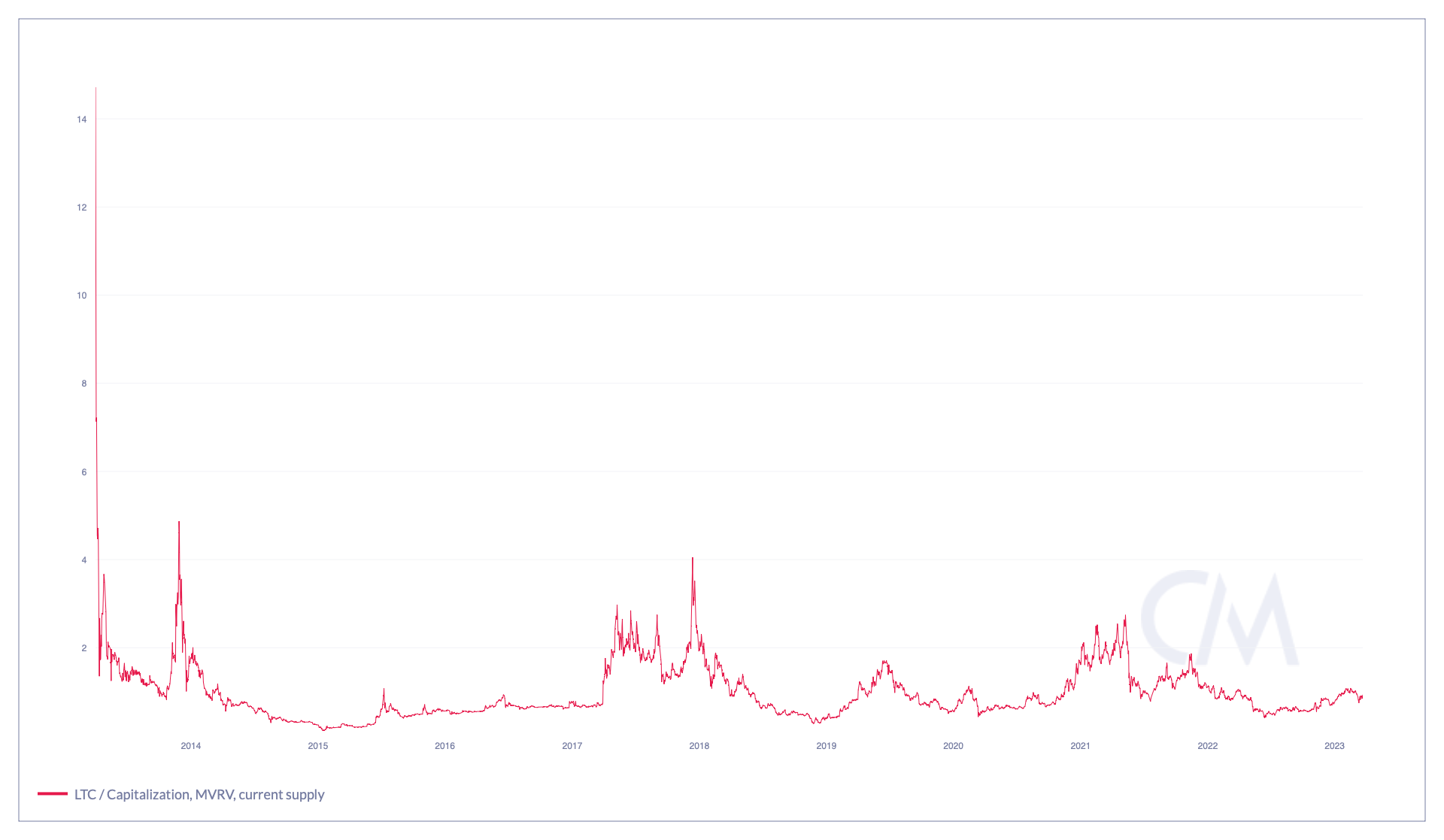

Litecoin MVRV Ratio

Source: Coinmetrics.io

The MVRV ratio is measured by comparing the market capitalization of a token to its realised market capitalization to get the fair value of the token. The fair value of the token indicates whether the current price is overvalued or undervalued. If the current price is above the fair value, it is considered overvalued which also carries the possibility of a minor pullback, while the levels below the fair value is undervalued which attracts liquidity to the platform.

The MVRV ratio depleted heavily in the first few days of March but soon rebounded to mark the levels at 1. Hence the price is slowly gaining value, but still cannot be called as overvalued. Therefore, may continue to attract liquidity that may uplift the price close to the desired target.

Concluding Thought!

The Litecoin price, which has ignited a fine upswing, is expected to continue to do so as bullish flags flutter for the crypto. The massive rise in the hash rate indicates the acute participation of the miners, who aim to accumulate maximum tokens before the rewards get halved during the upcoming halving event. Meanwhile, the rise in the number of active addresses indicates the increased interest of the retail traders who are keeping up with the volatility of the token.

Related posts

Bitcoin Price Hits New All-Time High Following Fed’s 25-Basis-Point Rate Cut

Fed’s interest rate cut spurs crypto momentum, boosting Bitcoin and Ethereum prices.

Read more

Blum Secures Major Investment from TOP to Strengthen DeFi Presence in TON Ecosystem

TOP’s backing aims to accelerate Blum’s multi-blockchain expansion.

Read more